Special Report: Middle-Income Families Resilient Amid High Inflation, Economic Uncertainty

February 03 2023 - 12:00AM

Business Wire

Cost of food, gas and utilities greatly impact

household budgets

Primerica, Inc. (NYSE: PRI), a leading provider of financial

services in the United States and Canada, released a special report

titled, “The Financial Condition of Middle-Income American Families

Heading Into 2023.”

Researched and written by Amy Crews Cutts, Ph.D., CBE®, economic

consultant to Primerica, the report combines data from the monthly

Consumer Price Index (CPI), the Federal Reserve Bank of Atlanta,

and Primerica’s Financial Security Monitor — a national survey that

measures changes in the sentiments of middle-income families in the

U.S. about their finances — to present a clear picture of the

pressures these households face.

As many economists continue to predict a recession this year,

middle-income families are already taking an economic hit that is

threatening their long-term financial security. A focused analysis

of the CPI for just the cost of food, gas and utilities —

necessities that greatly impact middle-income households’ budgets —

shows prices on those items rose significantly higher than

benchmark inflation in 2022.

“High inflation stings for everyone, but it’s especially painful

for middle-income American families,” said Dr. Cutts. “With prices

increasing at the fastest rate in a generation, the middle-market

is now spending their savings to make ends meet. Even so, most

middle-income households are optimistic about their future and show

a remarkable resilience in the face of economic headwinds.”

Primerica’s quarterly survey also highlights a disconnect

between what middle-income families say they will do and what they

actually do. Respondents frequently overestimated their ability to

save and limit spending, as well as their ability to pay all their

bills. Still, the Financial Security Monitor has consistently found

that most middle-income households rate their financial situation

positively, and they remain optimistic about the year ahead with

many adjusting their spending or savings to cope.

“Our report illustrates not only the economic burden facing

middle-income Americans but also their resilience in these tough

financial times,” said Peter W. Schneider, President of Primerica.

“Families are well aware of the potential economic risks in the

year ahead and are proactively taking steps to reduce the impact on

their financial future.”

Key Findings

- Savings take a hit. A large majority (82%) of

respondents to Primerica’s survey either curtailed or stopped

saving for the future or tapped into existing savings to make ends

meet as their income fell behind the cost of living.

- Inflation’s disproportionate impact. In 2022, food, gas

and utilities prices remained elevated, peaking in the second

quarter at 18.2% higher than the previous year. The full CPI peaked

at 8.6% in the second quarter.

- Increase in missed payments. Primerica’s survey found 5%

of respondents thought they would likely miss a debt payment in the

fourth quarter, yet a significantly higher percentage of 18%

reported being delinquent when the quarter ended.

- Spending higher than anticipated. Only 15% of survey

respondents in Primerica’s third quarter survey planned to spend

more money overall in the fourth quarter. However, more than double

that share — 33% — ended up spending more than planned.

- Most rank personal finances positively. When asked about

the condition of their personal finances in Primerica’s survey, 53%

of respondents in the fourth quarter of 2022 reported they were in

good or excellent shape; however, this is down from 60% a year

earlier.

About Primerica’s Financial Security Monitor

The Financial Security Monitor is a quarterly national survey to

monitor the financial health of those with annual household incomes

of $30,000-$100,000. Using Dynamic Online Sampling, Change Research

polls more than 800 adults nationwide with incomes between $30,000

and $100,000. Post-stratification weights were made on gender, age,

race, education, and Census region to reflect the population of

these adults based on the five-year averages in the 2019 American

Community Survey, published by the U.S. Census.

About Primerica, Inc.

Primerica is a leading provider of financial services to

middle-income households in the United States and Canada. Licensed

financial representatives educate Primerica clients about how to

prepare for a more secure financial future by assessing their needs

and providing appropriate products like term life insurance, mutual

funds, annuities, and other financial products. Primerica insured

over 5.7 million lives and had over 2.7 million client investment

accounts as of December 31, 2021. Primerica was the #2 issuer of

Term Life insurance coverage in the United States and Canada in

2021 through its insurance company subsidiaries. Primerica stock is

included in the S&P MidCap 400 and the Russell 1000 stock

indices and is traded on The New York Stock Exchange under the

symbol “PRI”.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230202005903/en/

Media Relations: Gana Ahn, 678-431-9266

gana.ahn@primerica.com

Investor Relations: Nicole Russell, 470-564-6663

nicole.russell@primerica.com

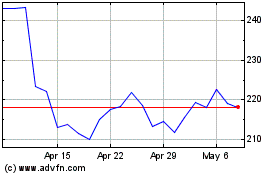

Primerica (NYSE:PRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Primerica (NYSE:PRI)

Historical Stock Chart

From Apr 2023 to Apr 2024