SURVEY: Middle-Income Americans Prepare for Possible Recession in 2023

January 12 2023 - 12:00AM

Business Wire

Families look to decrease debt and become

financially secure amid rocky economic outlook

Primerica, Inc. (NYSE: PRI), a leading provider of financial

services in the United States and Canada, released its

Middle-Income Financial Security Monitor for the fourth quarter of

2022. The survey, in its third year, measures changes in the

sentiments of middle-income families in the U.S. about their

finances.

During the fourth quarter of 2022, 81% of middle-income

households reported they are bracing for a possible recession in

2023, with 62% either planning or already taking steps to prepare.

Many middle-income families are aiming to rein in debt to become

financially secure.

Overall, Americans are pessimistic about the current economy and

the year ahead. Nearly three-in-four (72%) say their income is

falling behind the cost of living, and just 15% believe that either

their personal finances or the American economy will be better off

a year from now.

“As middle-income families prepare for a possible recession this

year, it’s more vital than ever that they take control of their

personal finances by addressing debt, setting a budget and keeping

spending in check,” said Glenn J. Williams, CEO of Primerica. “This

quarter’s Financial Security Monitor highlights the challenges

facing Americans in the year ahead and the need for personal

financial guidance to help lead the way through these rocky

economic times.”

“Three-quarters (74%) of middle-income families report not being

able to save for their future, up from 66% a year ago,” said Amy

Crews Cutts, PhD, an economic consultant to Primerica. “Inflation

over the past year, especially in non-discretionary items like food

and gasoline, has hurt the financial security of families as it was

impossible to avoid.”

Key Findings from Primerica’s U.S. Middle-Income Financial

Security Monitor

- Inflation continues to strain household finances. About

three-quarters (76%) of families report they are continuing to cut

back on non-essential purchases to cope with the high cost of

living, and about half (51%) report having to tap into their

emergency funds in the past year. In addition, about one-third

report spending more money in the past year (33%) and/or dipping

into their personal or retirement savings (36%).

- Confidence in personal finances, ability to save

declines. While a majority (53%) still feel positive about

their personal finances, that percentage has dropped 11 percentage

points in the past year from 64%. In addition, just a quarter (24%)

believe in their ability to save for the future, down 13 percentage

points from December 2021.

- Taking control of debt. Of those making financial

New Year’s resolutions, the top two goals are paying off consumer

debt (39%) and keeping debt load manageable (37%). In addition,

about a quarter plan to create an emergency fund (25%) or stick to

a budget (24%).

- Credit card use remains high. Middle-income families are

increasingly relying on credit cards to keep up with the high cost

of living. More than a third (36%) report using their credit cards

more often in the past year, up 9 percentage points from December

2021. Additionally, more than a third (37%) say their credit card

debt has increased in the past three months, up 8 percentage points

from December 2021.

Topline Trends Data

Dec. 2022

Sep. 2022

Jun.

2022

Mar. 2022

Dec.

2021

Aug.

2021

Apr.

2021

How would you rate

the condition of your personal finances? (Reporting “Excellent” and

“Good” responses.)

Q4 2022

Survey: Respondents’ rating about the

condition of their personal finances remained steady.

53%

53%

54%

60%

64%

65%

67%

Overall, would you

say your income is…? (Reporting “Falling behind the cost of living”

responses.)

Q4 2022

Survey: Concern about meeting

increased cost of living is down slightly.

72%

75%

75%

67%

68%

65%

56%

Do you have an

emergency fund that would cover an expense of $1,000 or more (for

example, if your car broke down or you had a large medical bill)?

(Reporting “Yes” responses.)

Q4 2022

Survey: About the same percentage have

an emergency fund that would cover an expense of $1,000 or

more.

59%

60%

61%

62%

60%

65%

66%

How would you rate

the economic health of your community? (Reporting “Not so good” and

“Poor” responses.)

Q4 2022

Survey: The economic health of

communities is up slightly.

53%

55%

58%

52%

50%

54%

52%

How would you rate

your ability to save for the future? (Reporting “Not so good” and

“Poor” responses.)

Q4 2022

Survey: Over 70% feel it will be

difficult to save for the future, an increase from previous

surveys.

74%

73%

72%

66%

62%

63%

58%

In the past three

months, has your credit card debt…? (Reporting “Increased”

responses.)

Q4 2022

Survey: Credit card debt is at the

highest point in Monitor history as it continues to increase

quarter to quarter.

39%

37%

29%

25%

28%

21%

18%

For more information on Primerica’s Middle-Income Financial

Security Monitor, visit

https://www.primerica.com/public/financial-security-monitor.html.

About Primerica’s Middle-Income Financial Security

Monitor

The Monitor is a quarterly national survey to monitor the

financial health of those with annual household incomes of

$30,000-$100,000. Change Research conducted online polling from

Dec. 7 - 12, 2022. Using Dynamic Online Sampling, Change Research

polled 1,263 adults nationwide with incomes between $30,000 and

$100,000. Post-stratification weights were made on gender, age,

race, education and Census region to reflect the population of

these adults based on the five year averages in the 2019 American

Community Survey, published by the U.S. Census. The margin of error

is 3.0%.

About Primerica, Inc.

Primerica is a leading provider of financial services to

middle-income households in the United States and Canada. Licensed

financial representatives educate Primerica clients about how to

prepare for a more secure financial future by assessing their needs

and providing appropriate products like term life insurance, mutual

funds, annuities, and other financial products. Primerica, through

its subsidiaries, insured over 5.7 million lives and had over 2.7

million client investment accounts as of December 31, 2021.

Primerica was the #2 issuer of Term Life insurance coverage in the

United States and Canada in 2021 through its insurance company

subsidiaries. Primerica stock is included in the S&P MidCap 400

and the Russell 1000 stock indices and is traded on The New York

Stock Exchange under the symbol “PRI”.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230111005755/en/

Media: Gana Ahn, 678-431-9266 gana.ahn@primerica.com

Investor Relations: Nicole Russell, 470-564-6663

nicole.russell@primerica.com

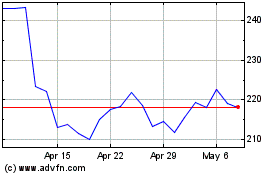

Primerica (NYSE:PRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Primerica (NYSE:PRI)

Historical Stock Chart

From Apr 2023 to Apr 2024