|

2150 Kittredge St. Suite 450

|

www.asyousow.org

|

|

Berkeley, CA 94704

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992

|

Notice of Exempt Solicitation

Pursuant to Rule 14a-103

Name of the Registrant: Phillips

66 (PSX)

Name of persons relying on exemption: As You Sow

Address of persons relying on exemption: 2150 Kittredge St. Suite 450, Berkeley, CA 94704

Written materials are submitted

pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934. Submission is not required of this filer

under the terms of the Rule, but is made voluntarily in the interest of public disclosure and consideration of these important

issues.

Phillips

66 (PSX)

Vote Yes: Item #4 – Petrochemical Risk Proposal

Annual

Meeting: May 6, 2020

CONTACT: Lila Holzman | lholzman@asyousow.org

THE

PROPOSAL

Shareholders request that Phillips

66, with board oversight, publish a report, omitting proprietary information and prepared at reasonable cost, assessing the public

health risks of expanding petrochemical operations and investments in areas increasingly prone to climate change-induced storms,

flooding, and sea level rise.

SUMMARY

Due to the COVID-19 pandemic,

2020 has seen unprecedented economic disruption. With lives at stake, government action has been insufficient to avert massive

loss of life and economic devastation. This shock demonstrates just how critical early action and planning is to mitigate known

and likely global catastrophes. Even as the energy sector grapples with the impacts of COVID-19, it must not put aside preparation

and action to stem the risks presented by the climate crisis.

Physical risks associated with

climate change are increasing faster than previously predicted, as demonstrated by heightened storm intensity and frequency, as

well as rising sea levels in regions like the Gulf Coast. Chevron Phillips Chemical Company (CPChem), jointly owned by Phillips

66 and Chevron, has announced plans to significantly expand new petrochemical infrastructure in Gulf Coast areas that are already

being affected by such climate impacts.

Investors are concerned about

the financial, health, environmental, and reputational risks associated with operating and building-out new chemical plants and

related infrastructure in Gulf Coast locations that are increasingly prone to catastrophic storms and flooding associated with

climate change. Given the highly toxic chemicals involved in petrochemical operations (including benzene, volatile organic compounds,

and sulfur dioxide), the location of these investments in the Gulf Coast poses significant risks to the company, local communities,

and the environment. Disruptions in plant operations, such as those experienced by CPChem during Hurricane Harvey, frequently

result in upsets and equipment malfunctions and release of toxic chemicals beyond permitted levels. CPChem was noted as being

the source of some of the largest pollution leaks during Hurricane Harvey.

|

2020 Proxy Memo

|

|

|

Phillip’s 66 | Petrochemical Risk Proposal

|

While the Company rapidly expands

its petrochemical assets in climate-impacted areas, investors seek specific information to assess whether Phillips 66 is sufficiently

prepared to mitigate public health risks associated with climate-related impacts and the dangerous chemicals it uses.

RATIONALE

FOR A YES VOTE

|

|

1)

|

Phillips 66’s increasing

investments in petrochemical infrastructure projects expose the company to growing climate

risks. These risks could lead to harms to human health and the environment and associated

litigation, financial penalties, regulatory action, reputational damage, loss of social

license to operate, and significant repair and clean-up costs that adversely impact shareholder

value.

|

|

|

2)

|

Phillips 66 does not provide

shareholders with sufficient analysis and disclosure on managing growing risk to its

petrochemical operations. The Company states it is aware of climate change and its

risks, but it has not adequately described plans to address the increasing risks its

operations face in sensitive areas. The Company’s references to high-level and

generalized risk management protocols are insufficient to assess if and how CPChem is

preparing to adequately mitigate and prevent the growing risks that climate change poses

to its current and planned petrochemical investments.

|

DISCUSSION

|

|

1)

|

Phillips 66’s increasing

investments in petrochemical infrastructure projects expose the company to growing climate

risks.

|

Phillips

66 has announced major billion-dollar investments for Gulf Coast-based projects over the next few years including the development

of a major petrochemical plant with an ethylene cracker and two high-density polyethylene units.1 Existing and proposed

petrochemical projects have the potential to create major liability during extreme weather events. In fact, Phillips 66 and CPChem

were noted as being the source of some of the largest pollution leaks during Hurricane Harvey, indicating that the Company may

be ill-prepared to manage the risks posed by climate change.2 Hurricane Harvey’s impacts also contributed to

a $123 million decrease in pre-tax income from Phillips 66’s Chemicals segment in 2017, which could burgeon if facilities

are hit by worse and more frequent events in the future.3

_____________________________

1 http://www.cpchem.com/en-us/news/Pages/Chevron-Phillips-Chemical-and-Qatar-Petroleum-announce-plans-to-jointly-develop-U-S--Gulf-Coast-petrochemical-project.aspx

2 https://www.environmentalintegrity.org/wp-content/uploads/2018/08/Hurricane-Harvey-Report-8.16.18-final.pdf,

p.12

3 https://s22.q4cdn.com/128149789/files/doc_financials/annual_report/2018/PSX_2018_AnnualReport.pdf

|

2020 Proxy Memo

|

|

|

Phillip’s 66 | Petrochemical Risk Proposal

|

Growing

storms and the costs they bring our company are predicted to increase in frequency and intensity as global warming escalates.

Flood-related damage is projected to be highest in Texas, where many of CPChem’s petrochemical plants are concentrated,

and Houston alone has seen three 500-year floods in a three-year span. Hazardous chemical releases, such as those experienced

by CPChem’s petrochemical facilities during Hurricane Harvey, put surrounding communities at risk and have eroded the Company’s

social license to operate. The Center for International Environmental Law (CIEL) published a report in 2019 noting the extent

to which petrochemical refining operations use and produce hazardous pollutants that cause health impacts, including cancer, reproductive

and birth defects, etc. The report emphasized that fenceline communities are especially vulnerable, and that the risk is exacerbated

by extreme weather events. During Hurricane Harvey roughly one million pounds of dangerous air pollutants like benzene, 1,3-butadiene,

sulfur dioxide, and toluene were released by local refineries and plants.4

Outside of more extreme events, leaks are an ongoing danger and liability for Phillips 66 that can compound vulnerabilities

and impacts. Its facilities have been listed as the 2nd and the 6th largest emitters in the Houston region.5,6

Peer companies are already facing civil legal action regarding the emerging issue of climate resiliency. In 2019, a judge

in a Boston federal court allowed a lawsuit to move forward seeking $110 million for Exxon’s failure to fortify an oil storage

facility to withstand the physical impacts of climate change.7

The financial sector, including insurance companies, are also becoming more acutely aware of climate-specific risks, especially

in areas subject to greater climate impacts such as hurricanes and flooding. Swiss Re has published a report on the rapidly growing

costs of natural disasters, which reached $337 billion in 2017; Lloyd’s of London cited natural disasters for its first

loss in six years; and AXA has spoken out saying that major global warming would make the world uninsurable this century.8

BlackRock, the world’s largest asset manager, with $6 trillion in assets under management, released a report in April

of 2019 on its assessment of physical climate risks, noting: “Our early findings suggest investors must rethink their assessment

of vulnerabilities. Weather events such as hurricanes and wildfires are underpriced in financial assets.”9 Potential

lack of insurance coverage may be a growing concern for the Company.

|

|

2)

|

Phillips

66 does not provide shareholders with sufficient analysis and disclosure on managing

growing risk to its petrochemical operations.

|

Despite

clear risks, Phillips 66 provides investors with minimal discussion of how it is responding to growing physical risks from climate

change. In Phillips 66’s “Energy: Policy Risks and Disclosures” report, the Company states that “the possible

physical effects of climate change on coastal assets are incorporated into planning, investment, and risk management decision

making.”10 Similarly vague and non-descriptive language is offered by Phillips 66 in its 10-K, as the Company

states “[t]he potential physical effects of climate change on our operations are highly uncertain and depend upon the unique

geographic and environmental factors present… [w]e have systems in place to manage potential acute physical risks...”11

_____________________________

4 https://www.ciel.org/wp-content/uploads/2019/02/Plastic-and-Health-The-Hidden-Costs-of-a-Plastic-Planet-February-2019.pdf,

p.17-22

5 https://environmentalintegrity.org/wp-content/uploads/2020/02/Benzene-Report-2.6.20.pdf

6 https://www.environmentalintegrity.org/wp-content/uploads/2019/09/Plastics-Pollution-on-the-Rise-report-final.pdf,

p.21

7 https://www.wbur.org/news/2019/03/13/exxonmobil-conservation-law-foundation-lawsuit-moves-forward

8 https://www.ft.com/content/0f530242-02c1-11e9-9d01-cd4d49afbbe3

9 https://www.blackrock.com/us/individual/literature/whitepaper/bii-physical-climate-risks-april-2019.pdf

10 https://www.phillips66.com/Sustainability-site/Documents/energy-policy-risks-disclosures-2018.pdf,

p.8

11 https://d18rn0p25nwr6d.cloudfront.net/CIK-0001534701/2c2b7a68-e8de-45fc-9871-9b1b2bf16e22.pdf,

p.21

|

2020 Proxy Memo

|

|

|

Phillip’s 66 | Petrochemical Risk Proposal

|

This

lack of transparency is especially worrisome considering Phillips 66’s large pollution leaks and loss of earnings during

Hurricane Harvey, which underscore that its current risk management strategy is inadequate.12 For instance, the company

does not: identify which of its current and planned facilities are in areas at high risk of experiencing climate-related severe

weather events; provide assumptions made and describe measures used to evaluate how climate change will affect its Gulf Coast

facilities and respond to increasing risk; report estimated emissions from unplanned upsets such as those that occur during hurricanes;

outline strategies to communicate with key local stakeholders during emergency situations; or describe measures taken to minimize

health impacts of associated chemical releases.

While some information on major spills must be reported to state and federal governments, companies are not required to

report this to counties.13 Current reporting requirements can leave communities in the dark about the health risks

they face; companies should therefore improve disclosures beyond what is required by law to retain and improve the goodwill and

trust of local communities and governments and to demonstrate to shareholders the type of best management practices in place.

As the risks of climate change become more apparent and urgent, shareholders require robust analysis and transparent disclosure

of risks and company mitigation strategies in order to make appropriately informed investment decisions.

RESPONSE TO

PHILLIP’S 66 BOARD OF DIRECTORS’ STATEMENT IN OPPOSITION

Phillips 66’s Board of

Directors (“the Board”) argues against this shareholder proposal on the basis that current “practices are designed

to ensure that any potential public health risk…can be managed to safe and acceptable levels” and that it discloses

enough information on its “performance and efforts.” It also states, “operational and economic advantages of

investments are weighed against any potential for environmental, socioeconomic, and health risks…” and that “identification

of risks in the project development phase allows CPChem to develop measures to avoid, mitigate, or remedy them before making new

investments.” However, the Company provides no insight into how it analyzes, weighs, and mitigates the risks raised

in the Proposal. The Company does not explain how it determines what is or is not considered to be a “safe and acceptable”

level of risk to public health, and past events indicate that such risk was not sufficiently considered. Furthermore, climate

science makes clear that future weather patterns will be different from the past - moving into a paradigm that is more extreme

and destructive, erratic and unpredictable. New weather paradigms necessitate new methods of analysis and approaches to minimize

risks to companies’ assets. The Board’s Statement does not indicate it is factoring future climate change impacts

into its analysis or processes to protect community health.

While the Board’s Statement

claims that Phillips 66’s “Operation Excellence” Policy takes into consideration “physical risks such

as flooding and storms” among the many risks the Company might face, recent events call this assumption into question, and

there is no mention of how climate change factors into such consideration. As noted, alarming chemical releases that occurred

during Hurricane Harvey demonstrate that Phillips 66’s current risk management systems are not sufficient to responsibly

manage extreme weather events, especially as these intensify in the future. The Company does state that it has implemented “lessons

learned” from Hurricane Harvey at “existing facilities and newly completed facilities.” However, the Company

does not explain what these lessons learned are or provide support that resulting changes are sufficient to withstand the heightened

future risks climate change is bringing for vulnerable coastal infrastructure.

_____________________________

12 https://s22.q4cdn.com/128149789/files/doc_financials/annual_report/2018/PSX_2018_AnnualReport.pdf,

p.41

13 https://apnews.com/e0ceae76d5894734b0041210a902218d

|

2020 Proxy Memo

|

|

|

Phillip’s 66 | Petrochemical Risk Proposal

|

Climate-related risks are of

significant concern to investors and require comprehensive disclosures to fully inform shareholders about Company management of

these evolving risks. The high-level references in the Board’s Statement are insufficient to assure investors that risks

raised in the Proposal are being appropriately managed. In fact, “climate change” is not mentioned anywhere in

its Statement. As such, investors desire more clarity on Phillips 66’s management of the new risks that climate change

poses to local community safety.

CONCLUSION

Vote “Yes” on

this Shareholder Proposal regarding the Company’s efforts to limit public health and environmental impacts of building out

hazardous petrochemical infrastructure in high-risk climate-affected areas.

Phillips 66 is investing billions

in the construction and expansion of petrochemical infrastructure projects in regions that are exposed to increasing climate risk

such as destructive weather and flooding. Shareholders urge strong support for this proposal, which will bring increased transparency

to shareholders on a significant and emerging business risk facing the company.

--

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL

MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. THE COST

OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY ONE OR MORE OF THE CO-FILERS. PROXY CARDS

WILL NOT BE ACCEPTED BY ANY CO-FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY CO-FILER. TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS

ON YOUR PROXY CARD.

5

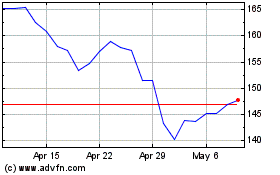

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Mar 2024 to Apr 2024

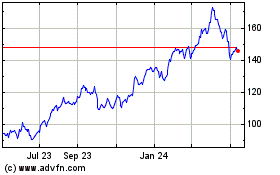

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Apr 2023 to Apr 2024