Phillips 66 Becomes Joint Venture Partner with Energy Transfer to Build Bakken Crude Oil Pipelines

October 28 2014 - 8:30AM

Business Wire

Energy Transfer Equity, L.P. (NYSE:ETE), Energy Transfer

Partners, L.P. (NYSE:ETP) (ETE and ETP collectively, “Energy

Transfer”) and Phillips 66 (NYSE:PSX) announced that they have

formed two joint ventures to develop the previously announced

Dakota Access Pipeline (DAPL) and Energy Transfer Crude Oil

Pipeline (ETCOP) projects. Energy Transfer holds a 75 percent

interest in each joint venture and will operate both pipeline

systems. Phillips 66 owns the remaining 25 percent interests and

will fund its proportionate share of the construction costs. The

DAPL and ETCOP projects are expected to begin commercial operations

in the fourth quarter of 2016.

“We look forward to working with Phillips 66 to build this

much-needed pipeline infrastructure to link rapidly growing

supplies of domestically produced light crude oil in the

Bakken/Three Forks play to refineries throughout the country,” said

Kelcy Warren, chairman of ETE and chairman and CEO of ETP.

“Energy Transfer is a valued partner with a proven track record

of developing major interstate pipelines,” said Greg Garland,

chairman and CEO of Phillips 66. “These joint-venture projects will

allow Phillips 66 to increase its access to advantaged North

American crude oil and add to the momentum we are building in our

Midstream business.”

Based on contractual commitments to date, DAPL is expected to

deliver in excess of 450,000 barrels per day of crude oil from the

Bakken/Three Forks production area in North Dakota to market

centers in the Midwest. DAPL will provide shippers with access to

Midwestern refineries, unit-train rail loading facilities to

facilitate deliveries to East Coast refineries, and the Gulf Coast

market through an interconnection in Patoka, Illinois, with ETCOP.

ETCOP will provide crude oil transportation service from the

Midwest to the Sunoco Logistics Partners and Phillips 66 storage

terminals located in Nederland, Texas.

In September, Energy Transfer announced the launch of a binding

Expansion Open Season to assess additional interest in

transportation service on DAPL and ETCOP above those levels

previously announced. Subject to the terms and conditions of the

Expansion Open Season, potential shippers will also have the

opportunity to secure expansion transportation service from the

Bakken/Three Forks production area to the Midwest and Gulf Coast,

as well as to the Cushing hub in Oklahoma. More information about

the binding Expansion Open Season is available on the ETP web site

by accessing www.energytransfer.com/ops_copp.aspx, or via e-mail at

dlDA_ETCO@energytransfer.com.

About Energy Transfer Partners

Energy Transfer Partners, L.P. (NYSE: ETP) is a master limited

partnership owning and operating one of the largest and most

diversified portfolios of energy assets in the United States. ETP

currently owns and operates approximately 35,000 miles of natural

gas and natural gas liquids pipelines. ETP also owns 100% of

Panhandle Eastern Pipe Line Company, LP (the successor of Southern

Union Company) and a 70% interest in Lone Star NGL LLC, a joint

venture that owns and operates natural gas liquids storage,

fractionation and transportation assets. ETP also owns the general

partner, 100% of the incentive distribution rights, and

approximately 67.1 million common units in Sunoco Logistics

Partners L.P. (NYSE: SXL), which operates a geographically diverse

portfolio of crude oil and refined products pipelines, terminalling

and crude oil acquisition and marketing assets. ETP owns 100% of

Sunoco, Inc. and 100% of Susser Holdings Corporation. Additionally

ETP owns the general partner, 100% of the incentive distribution

rights and approximately 44% of the limited partnership interests

in Sunoco LP (formerly Susser Petroleum Partners LP) (NYSE: SUN), a

wholesale fuel distributor. ETP’s general partner is owned by ETE.

For more information, visit the Energy Transfer Partners, L.P. web

site at www.energytransfer.com.

About Energy Transfer Equity

Energy Transfer Equity, L.P. (NYSE:ETE) is a master limited

partnership which owns the general partner and 100% of the

incentive distribution rights (IDRs) of Energy Transfer Partners,

L.P. (NYSE: ETP), approximately 30.8 million ETP common units, and

approximately 50.2 million ETP Class H Units, which track 50% of

the underlying economics of the general partner interest and IDRs

of Sunoco Logistics Partners L.P. (NYSE: SXL). ETE also owns the

general partner and 100% of the IDRs of Regency Energy Partners LP

(NYSE: RGP) and approximately 57.2 million RGP common units. On a

consolidated basis, ETE’s family of companies owns and operates

approximately 71,000 miles of natural gas, natural gas liquids,

refined products, and crude oil pipelines. For more information,

visit the Energy Transfer Equity, L.P. web site at www.energytransfer.com.

About Phillips 66

Built on more than 130 years of experience, Phillips 66 is a

growing energy manufacturing and logistics company with

high-performing Midstream, Chemicals, Refining, and Marketing and

Specialties businesses. This integrated portfolio enables Phillips

66 to capture opportunities in a changing energy landscape.

Headquartered in Houston, the company has 13,500 employees who are

committed to operating excellence and safety. Phillips 66 had $51

billion of assets as of June 30, 2014. For more information, visit

www.phillips66.com or follow us on Twitter @Phillips66Co.

Forward-Looking Statements

This press release may include certain statements concerning

expectations for the future that are forward-looking statements as

defined by federal law. Such forward-looking statements are subject

to a variety of known and unknown risks, uncertainties, and other

factors that are difficult to predict and many of which are beyond

management’s control. An extensive list of factors that can affect

future results are discussed in the Annual Reports on Form 10-K and

other documents filed by Energy Transfer and Phillips 66 from time

to time with the Securities and Exchange Commission. Energy

Transfer and Phillips 66 undertake no obligation to update or

revise any forward-looking statement to reflect new information or

events.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/multimedia/home/20141028005255/en/

Energy TransferInvestor Relations:Brent Ratliff,

214-981-0700orMedia Relations:Granado Communications

GroupVicki Granado, 214-599-8785214-498-9272 (cell)orPhillips

66Investor Relations:Rosy Zuklic,

832-765-2297rosy.zuklic@p66.comorMedia Relations:Michael

Barnes, 832-765-1028michael.c.barnes@p66.com

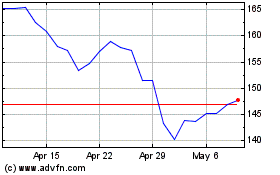

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Jan 2025 to Feb 2025

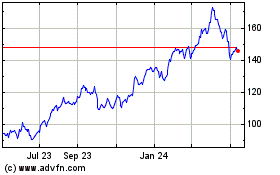

Phillips 66 (NYSE:PSX)

Historical Stock Chart

From Feb 2024 to Feb 2025