PG&E Comes Out Against Elliott's $30 Billion Restructuring Pitch

July 19 2019 - 5:04PM

Dow Jones News

By Soma Biswas

PG&E Corp. and certain shareholders are fighting back

against a restructuring strategy by Elliott Management Corp. and

other bondholders that would hand them nearly full control of the

utility when it exits bankruptcy.

PG&E's lawyers argued in court papers Thursday that the

bondholders' chapter 11 proposal can't be confirmed because it

gives them a vote and a voice in the bankruptcy proceeding they

don't deserve. Elliott and the other bondholders aren't at risk of

being paid less than they are owed and therefore can't vote on or

propose a restructuring plan, the company said.

The bondholder group which includes Elliott and Pacific

Investment Management Co. have outlined a proposal to raise $30

billion in equity, including $18 billion that would go to victims

of the California wildfires caused by PG&E equipment, while

asking the bankruptcy court supervising PG&E's restructuring to

end the company's exclusive right to propose exit terms.

The Elliott group's plan would result in the bondholders

recovering more than 100% of the face value of their bonds, a group

of PG&E shareholders said in court papers that also opposed the

Elliott plan. Creditors are entitled to recover no more than 100%

of the money owed to them under the bankruptcy code.

Under the code, only creditors who haven't been paid back in

full or who are impaired can vote on or propose a company's

reorganization plan in bankruptcy.

PG&E said the bondholders are trying to improve their rank

in the company's capital structure. Under Elliott's proposed plan,

the company would swap their unsecured notes for new secured debt.

Instead, the company said it could simply reinstate the unsecured

notes, making the bondholders whole.

The company also took issue with the bondholders' request for a

$650 million backstop fee for purchasing equity and the interest

rate on the debt they would receive.

The group of PG&E shareholders weighing in against the

Elliott restructuring plan on Thursday argued the company is

"solvent by billions of dollars," and that the bondholder group is

simply trying to take over PG&E at a "fire sale price."

PG&E's unsecured notes are all trading close to or over par,

while the company's market capitalization is roughly $9

billion.

PG&E said it is in the process of "refining" a different

restructuring plan that includes a new cash equity infusion and the

issuance of securitized debt, funded by future cash flows from

PG&E, which will enable the company to meet California

lawmakers' June 2020 deadline to leave bankruptcy.

Last week California Gov. Gavin Newsom signed legislation

creating a multibillion-dollar fund that would pay for damage from

any future wildfires caused by the state's largest utilities,

including PG&E, Southern California Edison Co. and San Diego

Gas & Electric Co., but doesn't pay victims of the 2017 and

2018 fires linked to PG&E equipment.

The PG&E bondholder group includes some of the biggest debt

investors in the world, including Apollo Global Management LLC,

Citadel Advisors LLC and Capital Research and Management Co., court

filings show.

They have been at odds with a group of equity holders including

Abrams Capital Management LP, Knighthead Capital Management LLC and

Redwood Capital Management LLC that worked with PG&E to install

a new chief executive earlier this year.

San Francisco-based PG&E has been under pressure to produce

a chapter 11 exit plan quickly, with Governor Newsom and others

complaining about a lack of action from a company blamed for years

of fires that took lives and homes.

The Jan. 29 bankruptcy filing gave PG&E a limited period of

exclusive chapter 11 plan rights, but that time runs out on Sept.

26.

Write to Soma Biswas at soma.biswas@wsj.com

(END) Dow Jones Newswires

July 19, 2019 16:49 ET (20:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

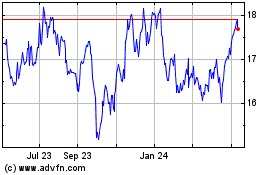

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

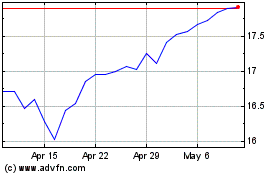

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024