PG&E Investor Opposes Bankruptcy Move -- WSJ

January 18 2019 - 3:02AM

Dow Jones News

By Peg Brickley

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 18, 2019).

BlueMountain Capital Management LLC, a hedge fund with a

significant stake in PG&E Corp., has challenged the utility's

board over a plan to resort to bankruptcy to tackle wildfire

damages that PG&E estimates could run as high as $30

billion.

The California utility announced Monday it would file for

bankruptcy, jolting BlueMountain and other investors that bought up

the stock in 2018 before the state's deadly Camp Fire, which killed

86 people. The utility's equipment is suspected of having triggered

some wildfires.

The announcement slammed the already depressed price of

PG&E's shares and bonds. The shares, which were selling for

$48.80 just before the Camp Fire broke out in November, fell 9.5%

to $6.36 on Thursday, marking a three-month drop of 87%.

BlueMountain, which reported owning 4.3 million shares as of

Sept. 30, now owns about 11 million shares, according to a person

familiar with the firm's holdings. The hedge fund contends the

utility's board is moving too quickly toward a chapter 11

bankruptcy, destroying value unnecessarily.

"The company has ample liquidity to operate its business; the

amount of liabilities remains uncertain and contestable; there are

meaningful probabilities of offsets from settlements and cost

recovery; and any potential liabilities are payable in the future,"

BlueMountain wrote in a letter to PG&E's board of directors on

Thursday.

In the wake of California's devastating wildfires, bankruptcy is

the only workable option for the utility, said PG&E spokeswoman

Lynsey Paulo.

"Following a comprehensive review with the assistance of outside

experts and at management's recommendation, the PG&E board

unanimously determined that initiating a chapter 11 reorganization

for both the utility and the corporation is the only viable option

for PG&E and will maximize the value of the enterprise for the

benefit of all stakeholders, " Ms. Paulo said Thursday.

It isn't clear what effect BlueMountain's objection might have

on the push toward bankruptcy court. Law firm Weil Gotshal &

Manges LLP, a chapter 11 heavyweight, is already on board, and the

utility said it would be filing before the end of the month.

Shareholders generally fare poorly in bankruptcy, their holdings

often wiped out because creditors are paid before equity owners.

BlueMountain also cited the likelihood that bankruptcy will boost

PG&E's financing costs.

In PG&E's case, creditors will include victims of a series

of wildfires that are believed to be linked to the utility's

equipment or practices. Without a final court determination that

PG&E is to blame for the fires, and with no trial record to

establish the range of verdicts the utility could face, the damage

estimates are guesses and not a basis for bankruptcy, according to

the hedge fund.

BlueMountain urged PG&E's board to take another look at the

numbers, weigh other options and draw on its borrowing power and

insurance coverage before admitting insolvency. Until recently,

PG&E had investment-grade credit ratings, BlueMountain said,

and regulators and lawmakers were open to working with the utility

to overcome its problems. Bankruptcy will bring hopes of a state

rescue to an end, the hedge fund said.

Some lawyers who have sued PG&E for wildfire damages also

maintain that bankruptcy isn't the best way out of trouble.

The utility needs to be taken apart and recreated, but

regulators, not a bankruptcy court, should be in charge of reform,

said Amanda Riddle, one of the plaintiffs' lawyers.

A PG&E bankruptcy would keep most of management in place,

delaying a shake-up of the utility by regulators, Ms. Riddle said

in an email earlier this month. "It would allow existing

management, which has proven beyond all doubt that it is either

safety-incompetent or driven entirely by greed, to stay at their

current jobs that much longer," she said.

PG&E said Sunday, before announcing its intention to file

for bankruptcy, that Chief Executive Geisha Williams was stepping

down and John Simon, the company's general counsel since 2017,

would serve as interim CEO as the utility's board of directors

conducts a search for a new chief.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

January 18, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

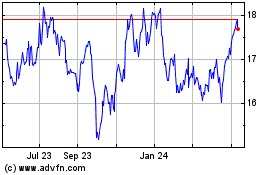

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

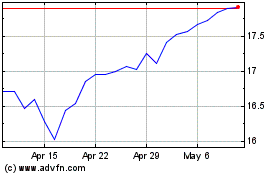

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024