PG&E Shareholder BlueMountain Protests Bankruptcy Decision

January 17 2019 - 7:39AM

Dow Jones News

By Peg Brickley

BlueMountain Capital Management LLC, a hedge fund with a

significant stake in PG&E Corp. stock, has challenged the

utility's board over a plan to resort to bankruptcy to tackle

wildfire damages that the utility estimates could run as high as

$30 billion.

The California utility announced Monday it would file for

bankruptcy, jolting BlueMountain and other investors that bought up

the stock in 2018, before the deadly Camp Fire, which killed 86

people.

The announcement slammed PG&E's share price, and sent bond

prices, already battered, down even more. Shares that were selling

for $48.80 just before the Camp Fire began in November 2018 closed

Wednesday at $7.03 a share, marking a three-month drop of more than

85%.

BlueMountain, which reported owning 4.3 million shares as of

Sept. 30, now owns about 11 million shares, according to a person

familiar with the firm's holdings. The hedge fund contends the

utility's board is moving too quickly toward chapter 11 bankruptcy,

destroying value unnecessarily.

"The company has ample liquidity to operate its business; the

amount of liabilities remains uncertain and contestable; there are

meaningful probabilities of offsets from settlements and cost

recovery; and any potential liabilities are payable in the future,"

BlueMountain wrote in a letter to PG&E's board of directors on

Thursday.

PG&E couldn't immediately be reached to respond, and it

isn't clear whether the shareholder's letter would put the brakes

on the push toward bankruptcy court. Law firm Weil Gotshal &

Manges LLP, a chapter 11 heavyweight, is already on board, and the

utility said it would be filing before the end of the month.

Shareholders fare poorly in bankruptcy, their holdings often

wiped out because creditors are paid before equity owners.

BlueMountain also pointed to the effects bankruptcy will have on

PG&E's financing costs.

In PG&E's case, creditors will include victims of a series

of wildfires that are believed to be linked to the utility's

equipment or practices. Without a final court determination that

PG&E is to blame for the fires, and with no trial record to

establish the range of verdicts the utility could face, the damage

estimates are guesses, and not a basis for bankruptcy, according to

the hedge fund.

BlueMountain urged PG&E's board to take another look at the

numbers, weigh its other options and draw on its borrowing power

and insurance coverage before admitting insolvency. Until recently,

PG&E had investment-grade credit ratings, BlueMountain said,

and regulators and lawmakers were open to working with the utility.

Bankruptcy will bring hopes of a state rescue to an end, the hedge

fund said.

The shareholder's criticism echoes what some lawyers who have

sued PG&E for wildfire damages say: bankruptcy isn't the best

way out of trouble.

The utility needs to be taken apart and recreated, but

regulators, not a bankruptcy court, should be in charge of reform,

said Amanda Riddle, one of the plaintiffs' lawyers.

A PG&E bankruptcy would keep most of management in place,

delaying a shake-up of the utility by regulators, Ms. Riddle said

in an email before the announcement. "It would allow existing

management, which has proven beyond all doubt that it is either

safety-incompetent or driven entirely by greed, to stay at their

current jobs that much longer," she said.

PG&E said Sunday, before announcing its intention to file

for bankruptcy, that Chief Executive Geisha Williams was stepping

down and John Simon, the company's general counsel since 2017,

would serve as interim CEO as the company's board of directors

conducts a search for a new chief.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

January 17, 2019 07:24 ET (12:24 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

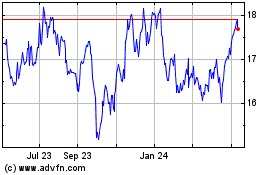

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

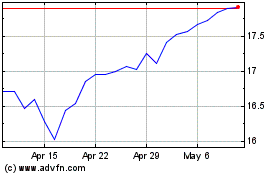

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024