PG&E Stock Rebounds After Selloff -- WSJ

January 17 2019 - 3:02AM

Dow Jones News

By Katherine Blunt and Alejandro Lazo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 17, 2019).

PG&E Corp. shares fell and then recovered Wednesday as

prospects dimmed that California politicians would step in to help

the embattled utility avoid a bankruptcy filing.

After falling more than 8%, PG&E shares rebounded late and

closed up 1.7% or 12 cents, at $7.03. That stopped several days of

declines after PG&E said Monday it would file for chapter 11

protection at the end of the month due to liabilities stemming from

its role in starting California wildfires.

The bankruptcy announcement triggered a selloff that has erased

more than $5 billion from the company's stock market value this

week. Shares have fallen by 60% since Friday's close, and since the

end of October -- when they traded above $46 -- their value has

dropped by about 85%.

Analysts said the recent plunge reflected mounting concerns

among investors that California Gov. Gavin Newsom and state

lawmakers won't offer the company an alternative to bankruptcy in

the near term. Public opposition to PG&E has grown in recent

months, complicating a state rescue.

"Investors are starting to realize this is going to be quite a

protracted process to figure out a solution that works for all

constituents," said Morgan Stanley analyst Stephen Byrd.

PG&E declined to comment.

The company's share price has been falling since mid-November,

when the Camp Fire, the deadliest wildfire in California history,

killed 86 people and destroyed about 14,000 homes in the northern

part of the state. PG&E's market value closed at $3.64 billion

on Wednesday, down from about $24 billion at the end of

October.

State fire investigators haven't yet determined whether PG&E

equipment helped start the Camp Fire, but the company has disclosed

that some of its equipment malfunctioned in the area shortly before

the fire started. Investigators previously tied PG&E equipment

to at least 17 major fires in 2017.

In a securities filing Monday, PG&E called a bankruptcy

filing its "only viable option," citing more than $30 billion in

potential wildfire-related liability costs. It said it faced about

50 lawsuits related to the Camp Fire and more than 700 lawsuits in

connection with 2017 fires.

Rob Rains, an analyst with Washington Analysis LLC, wrote in a

note that the company's intent to file for bankruptcy protection

and subsequent statements from California officials imply "that a

rescue mission by elected leaders may not be forthcoming,

forecasting a potentially contentious bankruptcy proceeding."

California lawmakers last year passed legislation that provides

a path for PG&E to securitize some of its wildfire-related

liabilities from 2017 wildfires and pass those costs on to

customers. But the law didn't explicitly address fires in 2018, and

lawmakers this week indicated there were no efforts under way to

expand the law.

State Assemblyman Chris Holden, who had been expected to

introduce legislation to extend the law to include 2018, has since

paused the effort.

"To the extent that the courts can help them restructure and put

them in a different position, I think that's obviously the choice

they've made," Mr. Holden said.

Mr. Newsom, who took office as governor this month, has stated

his desire to protect the interests of the state as well as fire

victims and PG&E customers as the company heads to bankruptcy

court. But he has stopped short of offering an alternative.

Write to Katherine Blunt at Katherine.Blunt@wsj.com and

Alejandro Lazo at alejandro.lazo@wsj.com

(END) Dow Jones Newswires

January 17, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

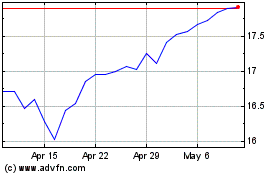

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

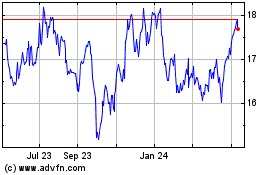

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024