By Katherine Blunt and Rebecca Smith

Already paying some of the highest electricity prices in the

country, customers of California's largest utility, PG&E Corp.,

could soon face large rate increases due to the state's

catastrophic wildfires.

PG&E asked state regulators on Thursday to approve a plan to

sharply increase revenues it seeks from customers over a three-year

period, with a hike of 12%, or more than $1 billion, in 2020,

growing to 24% by 2022. The company is currently authorized to seek

$8.5 billion next year.

The company said the request reflected expected additional

spending on wildfire mitigation and insurance costs, but didn't

include the largest potential expenses it faces -- liability from

lawsuits alleging it is to blame for sparking wildfires in recent

years.

If regulators approve its plan, PG&E estimates that an

average residential customer would pay an additional $10.57 a month

for gas and electricity in 2020. It hasn't released estimates for

increases in 2021 and 2022.

"As California experiences more frequent and intense wildfires

and other extreme weather events, we must take...steps to protect

our customers," Steve Malnight, PG&E's senior vice president of

energy supply and policy, said in a statement.

PG&E declined to comment on any potential liability or on

the prospect of wildfire-liability-related rate increases.

While the exact scope of PG&E's fire-related liability

remains uncertain, the utility potentially faces tens of billions

of dollars in claims. That alone would amount to an average

power-bill increase of as much as 17% if the full total were passed

on to ratepayers, according to one analyst's estimate.

The liability burden is more likely to be spread between

shareholders and ratepayers, but it could weigh on the economy of a

state that already has high living costs. Under a state law passed

this year, PG&E can seek permission to turn much of the

obligation for fire expenses into securitized debt, which

businesses and homeowners would then pay off over several years

through higher power prices.

PG&E customers already pay power prices almost twice the

national average. Of the 10 largest investor-owned utilities,

PG&E has the second-highest rates, averaging 20.06 cents a

kilowatt-hour, according to the U.S. Energy Information

Administration.

"There is no real scenario where customers are not staring down

the barrel of some pretty significant securitization costs," said

Height Securities analyst Katie Bays.

California authorities haven't determined whether PG&E

equipment helped start last month's Camp Fire, which killed at

least 86 people and destroyed about 14,000 homes, making it the

state's deadliest fire ever. They also have yet to determine

whether PG&E helped cause last year's Tubbs Fire, the second

worst in state history, which killed 22 people.

But the state's fire investigator, Cal Fire, has found PG&E

responsible for 17 major fires in 2017 that scorched 193,743 acres

in eight counties, destroyed 3,256 structures and killed 22 people.

Eleven of those cases have been referred to county district

attorneys for possible criminal charges against PG&E.

The utility released new information this week indicating that

one of its power lines near where the Camp Fire started Nov. 8 came

apart immediately beforehand, and fell from the metal tower that

held it aloft. Investigators removed some utility equipment from it

and from another line with broken power poles for closer

analysis.

The company faces a mountain of lawsuits seeking to make it pay

fire-related costs and damages. California's legal framework makes

PG&E financially responsible for damage from fires started by

its equipment, even if the utility wasn't negligent.

Under state law, shareholders could be asked to shoulder some of

those costs, but not so much that the burden would drive up the

company's capital costs and threaten its financial health. PG&E

is currently one to two notches above junk-bond levels.

Some analysts have estimated that PG&E's shareholders could

bear $3 billion to $6 billion in costs before the company would

have to seek assistance from its customers. The rest of the costs

could potentially be securitized as bonds and paid off by

customers.

Hugh Wynne, an analyst at Sector & Sovereign Research,

estimated that PG&E could face as much as $26.5 billion in

liability costs from 2017 and 2018 fires. Fully securitized, he

estimates this could raise the utility's average power rate by 17%.

He expects customers will likely bear at least half of those

costs.

PG&E's system-average cost of electricity service rose more

than 4% a year from 2013 to 2017, far faster than inflation, as the

utility passed on the cost of California's ambitious

renewable-energy expansion and other expenses to customers.

The utility's customers are already having difficulty paying

their bills. PG&E electricity-service disconnections for

nonpayment jumped 32% from 2013 to 2017, according to the

commission.

In a statement, PG&E said it was committed to working with

customers who have trouble managing their energy bills.

After the 2017 fires, the California Legislature passed a law in

August that allows utilities to securitize fire-related losses as

bonds to be paid off by customers.

Assemblyman Chris Holden, a Democrat from the Los Angeles area,

is planning to introduce legislation next year to expand the

recently passed securitization law to include 2018 fires, a move

that could substantially increase the amount of liability costs

eligible for recovery from customers.

The companies have to get permission from the California Public

Utilities Commission, however, to issue bonds. The commission could

rule that some costs are ineligible for recovery, particularly if

they resulted from fires caused by utility negligence.

Not all consumers would be on the hook for any wildfire bonds.

The legislature exempted roughly 1.2 million low-income residential

accounts at PG&E, leaving the remaining four million accounts

responsible for paying whatever sum is assigned to residential

customers.

Still, consumer advocates are concerned the costs may be

unbearable for some ratepayers. "Where's the stress test for the

utility customer?" said Mark Toney, executive director of The

Utility Reform Network, an advocacy group in San Francisco.

Big energy consumers are bracing for a rate fight with PG&E,

arguing that they shouldn't be saddled with too much of the

bill.

Lance Hastings, president of the California Manufacturers &

Technology Association, said that however the costs are divided,

the result needs to support "our state's manufacturing

competitiveness and economic stability."

California has spread out massive energy costs to power

customers before. Following the electricity crisis of 2000-2001,

when power prices surged after the state passed a flawed

electricity-deregulation law, leading to blackouts and the eventual

bankruptcy of PG&E, the state sold billions of dollars in bonds

that utility customers continue to repay.

Patrick McCallum, a Californian whose home was destroyed in the

October 2017 Tubbs fire, said he accepts that consumers will end up

bearing some wildfire costs but is more worried about having a

utility that is starved for capital and can't make needed safety

improvements.

Finding solutions to the fire problem, he added, may be even

more expensive than the liability tab. "Hardening the grid will be

more costly than wildfires," he said.

Write to Katherine Blunt at Katherine.Blunt@wsj.com and Rebecca

Smith at rebecca.smith@wsj.com

(END) Dow Jones Newswires

December 13, 2018 22:21 ET (03:21 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

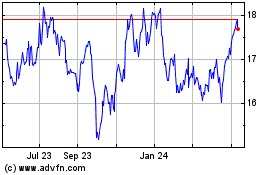

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

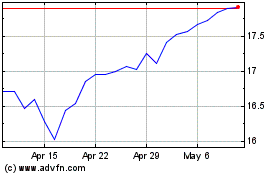

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024