Filed by Pfizer Inc.

Pursuant to Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934, as amended

Subject Company: Pfizer Inc.

(Commission File No. 001-03619)

The following communications are being filed in connection with the proposed business combination between Mylan N.V. and Upjohn, Pfizer Inc.’s off-patent branded and generic established medicines business.

V VI IA AT TR RIIS S: : A A N Ne ew w C Ch ha am mp pi io on n f fo or r G

Gllo ob ba all H He ea allt th h J Ja an nu ua ar ry y 2 20 02 20 0 IIn nv ve es stto or r P Pr re es se en ntta attiio on n 1V VI IA AT TR RIIS S: : A A N Ne ew w C Ch ha am mp pi io on n f fo or r G Gllo ob ba all H He ea allt th h J Ja an nu ua

ar ry y 2 20 02 20 0 IIn nv ve es stto or r P Pr re es se en ntta attiio on n 1

Forward-Looking Statements This communication contains

“forward-looking statements”. Such forward-looking statements may include, without limitation, statements about the proposed combination of Upjohn Inc. (“Newco”) and Mylan N.V. (“Mylan”), which will immediately

follow the proposed separation of the Upjohn business (the “Upjohn Business”) from Pfizer Inc. (“Pfizer”) (the “proposed transaction”), the expected timetable for completing the proposed transaction, the benefits

and synergies of the proposed transaction, future opportunities for the combined company and products and any other statements regarding Pfizer’s, Mylan’s, the Upjohn Business’s or the combined company’s future operations,

financial or operating results, capital allocation, dividend policy, debt ratio, anticipated business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competitions, and other expectations and targets

for future periods. Forward-looking statements may often be identified by the use of words such as “will”, “may”, “could”, “should”, “would”, “project”, “believe”,

“anticipate”, “expect”, “plan”, “estimate”, “forecast”, “potential”, “pipeline”, “intend”, “continue”, “target”,

“seek” and variations of these words or comparable words. Because forward-looking statements inherently involve risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking

statements. Factors that could cause or contribute to such differences include, but are not limited to: the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction;

changes in relevant tax and other laws; the parties’ ability to consummate the proposed transaction; the conditions to the completion of the proposed transaction, including receipt of approval of Mylan’s shareholders, not being satisfied

or waived on the anticipated timeframe or at all; the regulatory approvals required for the proposed transaction not being obtained on the terms expected or on the anticipated schedule or at all; inherent uncertainties involved in the estimates and

judgments used in the preparation of financial statements and the providing of estimates of financial measures, in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and related

standards or on an adjusted basis (“Non-GAAP measures”); the integration of Mylan and Newco being more difficult, time consuming or costly than expected; Mylan’s, the Upjohn Business’s and the combined company’s failure

to achieve expected or targeted future financial and operating performance and results; the possibility that the combined company may be unable to achieve expected benefits, synergies and operating efficiencies in connection with the proposed

transaction within the expected time frames or at all or to successfully integrate Mylan and Newco; customer loss and business disruption being greater than expected following the proposed transaction; the retention of key employees being more

difficult following the proposed transaction; any regulatory, legal or other impediments to Mylan’s, the Upjohn Business’s or the combined company’s ability to bring new products to market, including but not limited to where Mylan,

the Upjohn Business or the combined company uses its business judgment and decides to manufacture, market and/or sell products, directly or through third parties, notwithstanding the fact that allegations of patent infringement(s) have not been

finally resolved by the courts (i.e., an “at-risk launch”); success of clinical trials and Mylan’s, the Upjohn Business’s or the combined company’s ability to execute on new product opportunities; any changes in or

difficulties with Mylan’s, the Upjohn Business’s or the combined company’s manufacturing facilities, including with respect to remediation and restructuring activities, supply chain or inventory or the ability to meet anticipated

demand; the scope, timing and outcome of any ongoing legal proceedings, including government investigations, and the impact of any such proceedings on Mylan’s, the Upjohn Business’s or the combined company’s consolidated financial

condition, results of operations and/or cash flows; Mylan’s, the Upjohn Business’s and the combined company’s ability to protect their respective intellectual property and preserve their respective intellectual property rights; the

effect of any changes in customer and supplier relationships and customer purchasing patterns; the ability to attract and retain key personnel; changes in third-party relationships; actions and decisions of healthcare and pharmaceutical regulators;

the impacts of competition; changes in the economic and financial conditions of the Upjohn Business or the business of Mylan or the combined company; uncertainties regarding future demand, pricing and reimbursement for our, the Upjohn

Business’s or the combined company’s products; and uncertainties and matters beyond the control of management and other factors described under “Risk Factors” in each of Pfizer’s and Mylan’s Annual Reports on Form

10-K, Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission (“SEC”). These risks, as well as other risks associated with Mylan, the Upjohn Business, the combined company and the proposed transaction

are also more fully discussed in the Registration Statement on Form S-4, as amended, which includes a proxy statement/prospectus (the “Form S-4”), and Form 10, as amended, which includes an information statement (the “Form

10”), each of which has been filed by Newco with the SEC on October 25, 2019 and amended on December 13, 2019, and has not yet been declared effective. You can access Pfizer’s, Mylan’s and Newco’s filings with the SEC through

the SEC website at www.sec.gov or through Pfizer’s or Mylan’s website, as applicable, and Pfizer and Mylan strongly encourage you to do so. Except as required by applicable law, Pfizer, Mylan and Newco undertake no obligation to update

any statements herein for revisions or changes after the communications on this website are made. 2Forward-Looking Statements This communication contains “forward-looking statements”. Such forward-looking statements may include, without

limitation, statements about the proposed combination of Upjohn Inc. (“Newco”) and Mylan N.V. (“Mylan”), which will immediately follow the proposed separation of the Upjohn business (the “Upjohn Business”) from

Pfizer Inc. (“Pfizer”) (the “proposed transaction”), the expected timetable for completing the proposed transaction, the benefits and synergies of the proposed transaction, future opportunities for the combined company and

products and any other statements regarding Pfizer’s, Mylan’s, the Upjohn Business’s or the combined company’s future operations, financial or operating results, capital allocation, dividend policy, debt ratio, anticipated

business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competitions, and other expectations and targets for future periods. Forward-looking statements may often be identified by the use of words

such as “will”, “may”, “could”, “should”, “would”, “project”, “believe”, “anticipate”, “expect”, “plan”, “estimate”,

“forecast”, “potential”, “pipeline”, “intend”, “continue”, “target”, “seek” and variations of these words or comparable words. Because forward-looking statements

inherently involve risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to:

the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; changes in relevant tax and other laws; the parties’ ability to consummate the proposed

transaction; the conditions to the completion of the proposed transaction, including receipt of approval of Mylan’s shareholders, not being satisfied or waived on the anticipated timeframe or at all; the regulatory approvals required for the

proposed transaction not being obtained on the terms expected or on the anticipated schedule or at all; inherent uncertainties involved in the estimates and judgments used in the preparation of financial statements and the providing of estimates of

financial measures, in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and related standards or on an adjusted basis (“Non-GAAP measures”); the integration of Mylan and

Newco being more difficult, time consuming or costly than expected; Mylan’s, the Upjohn Business’s and the combined company’s failure to achieve expected or targeted future financial and operating performance and results; the

possibility that the combined company may be unable to achieve expected benefits, synergies and operating efficiencies in connection with the proposed transaction within the expected time frames or at all or to successfully integrate Mylan and

Newco; customer loss and business disruption being greater than expected following the proposed transaction; the retention of key employees being more difficult following the proposed transaction; any regulatory, legal or other impediments to

Mylan’s, the Upjohn Business’s or the combined company’s ability to bring new products to market, including but not limited to where Mylan, the Upjohn Business or the combined company uses its business judgment and decides to

manufacture, market and/or sell products, directly or through third parties, notwithstanding the fact that allegations of patent infringement(s) have not been finally resolved by the courts (i.e., an “at-risk launch”); success of

clinical trials and Mylan’s, the Upjohn Business’s or the combined company’s ability to execute on new product opportunities; any changes in or difficulties with Mylan’s, the Upjohn Business’s or the combined

company’s manufacturing facilities, including with respect to remediation and restructuring activities, supply chain or inventory or the ability to meet anticipated demand; the scope, timing and outcome of any ongoing legal proceedings,

including government investigations, and the impact of any such proceedings on Mylan’s, the Upjohn Business’s or the combined company’s consolidated financial condition, results of operations and/or cash flows; Mylan’s, the

Upjohn Business’s and the combined company’s ability to protect their respective intellectual property and preserve their respective intellectual property rights; the effect of any changes in customer and supplier relationships and

customer purchasing patterns; the ability to attract and retain key personnel; changes in third-party relationships; actions and decisions of healthcare and pharmaceutical regulators; the impacts of competition; changes in the economic and financial

conditions of the Upjohn Business or the business of Mylan or the combined company; uncertainties regarding future demand, pricing and reimbursement for our, the Upjohn Business’s or the combined company’s products; and uncertainties and

matters beyond the control of management and other factors described under “Risk Factors” in each of Pfizer’s and Mylan’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the Securities and

Exchange Commission (“SEC”). These risks, as well as other risks associated with Mylan, the Upjohn Business, the combined company and the proposed transaction are also more fully discussed in the Registration Statement on Form S-4, as

amended, which includes a proxy statement/prospectus (the “Form S-4”), and Form 10, as amended, which includes an information statement (the “Form 10”), each of which has been filed by Newco with the SEC on October 25, 2019

and amended on December 13, 2019, and has not yet been declared effective. You can access Pfizer’s, Mylan’s and Newco’s filings with the SEC through the SEC website at www.sec.gov or through Pfizer’s or Mylan’s website,

as applicable, and Pfizer and Mylan strongly encourage you to do so. Except as required by applicable law, Pfizer, Mylan and Newco undertake no obligation to update any statements herein for revisions or changes after the communications on this

website are made. 2

Additional Information and Where to Find It This communication shall not

constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. In

connection with the proposed transaction, Newco and Mylan have filed certain materials with the SEC, including, among other materials, the Form S-4 and Form 10 filed by Newco. The registration statements have not yet become effective. After the Form

S-4 is effective, a definitive proxy statement/prospectus will be sent to the Mylan shareholders seeking approval of the proposed transaction, and after the Form 10 is effective, a definitive information statement will be made available to the

Pfizer stockholders relating to the proposed transaction. Newco and Mylan intend to file additional relevant materials with the SEC in connection with the proposed transaction, including a proxy statement of Mylan in definitive form. INVESTORS AND

SECURITY HOLDERS ARE URGED TO READ DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MYLAN, NEWCO AND THE PROPOSED TRANSACTION. The documents relating to the proposed transaction (when

they are available) can be obtained free of charge from the SEC’s website at www.sec.gov. These documents (when they are available) can also be obtained free of charge from Mylan, upon written request to Mylan, at (724) 514- 1813 or

investor.relations@mylan.com or from Pfizer on Pfizer’s internet website at https://investors. Pfizer.com/financials/sec-filings/default.aspx or by contacting Pfizer’s Investor Relations Department at (212) 733-2323, as applicable.

Participants in the Solicitation This communication is not a solicitation of a proxy from any investor or security holder. However, Pfizer, Mylan, Newco and certain of their respective directors and executive officers may be deemed to be

participants in the solicitation of proxies in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Pfizer may be found in its Annual Report on Form 10-K filed with the SEC on

February 28, 2019 and its definitive proxy statement and additional proxy statement relating to its 2019 Annual Meeting filed with the SEC on March 14, 2019 and on April 2, 2019, respectively, and Current Report on Form 8-K filed with the SEC on

June 27, 2019. Information about the directors and executive officers of Mylan may be found in its amended Annual Report on Form 10-K filed with the SEC on April 30, 2019, and its definitive proxy statement relating to its 2019 Annual Meeting filed

with the SEC on May 24, 2019. Additional information regarding the interests of these participants can also be found in the Form S-4 and will also be included in the definitive proxy statement of Mylan in connection with the proposed transaction

when it becomes available. These documents (when they are available) can be obtained free of charge from the sources indicated above. Non-GAAP Financial Measures This communication includes the presentation and discussion of certain financial

information that differs from what is reported under U.S. GAAP. These Non-GAAP measures, including, but not limited to, Adjusted EBITDA, Adjusted EBITDA margin and debt to credit agreement Adjusted EBITDA leverage ratio, are presented in order to

supplement investors’ and other readers’ understanding and assessment of the financial performance of Mylan and the expected financial performance of the combined company following the consummation of the proposed transaction. The stated

forward-looking Non-GAAP measure, targeted long-term average debt to credit agreement Adjusted EBITDA leverage ratio, is based on the ratio of (i) targeted long-term average debt, and (ii) targeted long-term credit agreement Adjusted EBITDA.

However, Mylan has not quantified future amounts to develop the target but has stated its goal to manage long-term average debt and adjusted earnings and EBITDA over time in order to generally maintain the target. The target does not reflect Mylan

guidance. Non-GAAP measures should be considered only as supplements to, not as substitutes for or as superior measures to, the measures of financial performance prepared in accordance with U.S. GAAP. 3Additional Information and Where to Find It

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of

1933, as amended. In connection with the proposed transaction, Newco and Mylan have filed certain materials with the SEC, including, among other materials, the Form S-4 and Form 10 filed by Newco. The registration statements have not yet become

effective. After the Form S-4 is effective, a definitive proxy statement/prospectus will be sent to the Mylan shareholders seeking approval of the proposed transaction, and after the Form 10 is effective, a definitive information statement will be

made available to the Pfizer stockholders relating to the proposed transaction. Newco and Mylan intend to file additional relevant materials with the SEC in connection with the proposed transaction, including a proxy statement of Mylan in definitive

form. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MYLAN, NEWCO AND THE PROPOSED TRANSACTION. The documents relating to the

proposed transaction (when they are available) can be obtained free of charge from the SEC’s website at www.sec.gov. These documents (when they are available) can also be obtained free of charge from Mylan, upon written request to Mylan, at

(724) 514- 1813 or investor.relations@mylan.com or from Pfizer on Pfizer’s internet website at https://investors. Pfizer.com/financials/sec-filings/default.aspx or by contacting Pfizer’s Investor Relations Department at (212) 733-2323,

as applicable. Participants in the Solicitation This communication is not a solicitation of a proxy from any investor or security holder. However, Pfizer, Mylan, Newco and certain of their respective directors and executive officers may be deemed to

be participants in the solicitation of proxies in connection with the proposed transaction under the rules of the SEC. Information about the directors and executive officers of Pfizer may be found in its Annual Report on Form 10-K filed with the SEC

on February 28, 2019 and its definitive proxy statement and additional proxy statement relating to its 2019 Annual Meeting filed with the SEC on March 14, 2019 and on April 2, 2019, respectively, and Current Report on Form 8-K filed with the SEC on

June 27, 2019. Information about the directors and executive officers of Mylan may be found in its amended Annual Report on Form 10-K filed with the SEC on April 30, 2019, and its definitive proxy statement relating to its 2019 Annual Meeting filed

with the SEC on May 24, 2019. Additional information regarding the interests of these participants can also be found in the Form S-4 and will also be included in the definitive proxy statement of Mylan in connection with the proposed transaction

when it becomes available. These documents (when they are available) can be obtained free of charge from the sources indicated above. Non-GAAP Financial Measures This communication includes the presentation and discussion of certain financial

information that differs from what is reported under U.S. GAAP. These Non-GAAP measures, including, but not limited to, Adjusted EBITDA, Adjusted EBITDA margin and debt to credit agreement Adjusted EBITDA leverage ratio, are presented in order to

supplement investors’ and other readers’ understanding and assessment of the financial performance of Mylan and the expected financial performance of the combined company following the consummation of the proposed transaction. The stated

forward-looking Non-GAAP measure, targeted long-term average debt to credit agreement Adjusted EBITDA leverage ratio, is based on the ratio of (i) targeted long-term average debt, and (ii) targeted long-term credit agreement Adjusted EBITDA.

However, Mylan has not quantified future amounts to develop the target but has stated its goal to manage long-term average debt and adjusted earnings and EBITDA over time in order to generally maintain the target. The target does not reflect Mylan

guidance. Non-GAAP measures should be considered only as supplements to, not as substitutes for or as superior measures to, the measures of financial performance prepared in accordance with U.S. GAAP. 3

Speakers Robert Coury Michael Goettler Rajiv Malik Executive Chairman Chief

Executive Officer President • As VIATRIS’ Executive Chairman, • As Chief Executive Officer, will lead • As President of VIATRIS, will report will lead the Board and strategic direction VIATRIS and be responsible for the to

the CEO and oversee day-to-day of the Company; oversee the transition execution of the Company’s operations and serve as a and future integration of the new strategy complementary partner to Michael management team; and mentor and •

Seasoned and talented pharma • Unique profile as a scientist, who drive the management team to execute executive with strong leadership also possesses operational and on the Company’s strategy to deliver skills, international expertise

and commercial expertise, along with strong performance and growth deep industry knowledge strong financial acumen • Experienced board chair who has been the principal architect of the • Currently Global President, Upjohn •

Currently President, Mylan N.V. transformation of Mylan through his direction of a series of transformative acquisitions over the last 17 years • Currently Chairman, Mylan N.V. 4Speakers Robert Coury Michael Goettler Rajiv Malik Executive

Chairman Chief Executive Officer President • As VIATRIS’ Executive Chairman, • As Chief Executive Officer, will lead • As President of VIATRIS, will report will lead the Board and strategic direction VIATRIS and be

responsible for the to the CEO and oversee day-to-day of the Company; oversee the transition execution of the Company’s operations and serve as a and future integration of the new strategy complementary partner to Michael management team; and

mentor and • Seasoned and talented pharma • Unique profile as a scientist, who drive the management team to execute executive with strong leadership also possesses operational and on the Company’s strategy to deliver skills,

international expertise and commercial expertise, along with strong performance and growth deep industry knowledge strong financial acumen • Experienced board chair who has been the principal architect of the • Currently Global

President, Upjohn • Currently President, Mylan N.V. transformation of Mylan through his direction of a series of transformative acquisitions over the last 17 years • Currently Chairman, Mylan N.V. 4

ACCESS LEADERSHIP PARTNERSHIP Empowering people worldwide to live healthier,

at every stage of life. 5ACCESS LEADERSHIP PARTNERSHIP Empowering people worldwide to live healthier, at every stage of life. 5

The New Reality… What the World is Facing What the Marketplace Needs

• Greater portion of the World’s population with medical • Broad portfolio across geographies and therapeutic needs (i.e. aging population, growing middle class) areas/diseases and technologies • Growing disease cost burden,

increasing budget • Focused innovation to improve health outcomes pressures and limited access to medicines • Across all disease states Coupled with a need to better understand and access … • Across biology, medicine and

digital/technology • Growing number of innovations and medicines across • Across partners and stakeholders wide array of diseases and modalities • Affordable and sustainable supply of high quality • New

digital/data/technology opportunities to deliver medicines healthcare outcomes at reduced costs 6The New Reality… What the World is Facing What the Marketplace Needs • Greater portion of the World’s population with medical •

Broad portfolio across geographies and therapeutic needs (i.e. aging population, growing middle class) areas/diseases and technologies • Growing disease cost burden, increasing budget • Focused innovation to improve health outcomes

pressures and limited access to medicines • Across all disease states Coupled with a need to better understand and access … • Across biology, medicine and digital/technology • Growing number of innovations and medicines

across • Across partners and stakeholders wide array of diseases and modalities • Affordable and sustainable supply of high quality • New digital/data/technology opportunities to deliver medicines healthcare outcomes at reduced

costs 6

…A New Kind of Global Player ACCESS LEADERSHIP PARTNERSHIP 7…A

New Kind of Global Player ACCESS LEADERSHIP PARTNERSHIP 7

…With a Powerful Foundation In Addition to Presence in Developed

Global Footprint in US, Europe and Enhanced Global Scale and Markets, Uniquely Scaled Footprint Asia Markets Geographic Reach in Asia and the Emerging Markets Diverse Portfolio Across all Key Sustainable, Diverse and Trusted, Iconic Off-Patent

Brands Therapeutic Areas Differentiated Portfolio and Pipeline Powerful Operating Platform / Best-in-Class Global Manufacturing Best-in-Class Global Commercial Capabilities and Ability to and Supply Platform Commercial Capabilities Extend Profitable

Product Life Cycle Enhanced, Sustainable Cash Flows Strong Cash Flow Profile Plus Anticipated, Enabling Shareholder Strong Cash Flow Profile Sustainable Pipeline Engine Friendly Capital Allocation = Creation of A New Global Healthcare Gateway

8…With a Powerful Foundation In Addition to Presence in Developed Global Footprint in US, Europe and Enhanced Global Scale and Markets, Uniquely Scaled Footprint Asia Markets Geographic Reach in Asia and the Emerging Markets Diverse Portfolio

Across all Key Sustainable, Diverse and Trusted, Iconic Off-Patent Brands Therapeutic Areas Differentiated Portfolio and Pipeline Powerful Operating Platform / Best-in-Class Global Manufacturing Best-in-Class Global Commercial Capabilities and

Ability to and Supply Platform Commercial Capabilities Extend Profitable Product Life Cycle Enhanced, Sustainable Cash Flows Strong Cash Flow Profile Plus Anticipated, Enabling Shareholder Strong Cash Flow Profile Sustainable Pipeline Engine

Friendly Capital Allocation = Creation of A New Global Healthcare Gateway 8

VIATRIS Will Offer a Unique Global Healthcare Gateway Broad Global

Commercial Reach Across Channels &TAs Empowering people Global Supply worldwide Network to live healthier, Expansive Technical at every Expertise stage of life Cost Efficient Operating Platform Partner of Choice Creating better value for all

stakeholders 9VIATRIS Will Offer a Unique Global Healthcare Gateway Broad Global Commercial Reach Across Channels &TAs Empowering people Global Supply worldwide Network to live healthier, Expansive Technical at every Expertise stage of life Cost

Efficient Operating Platform Partner of Choice Creating better value for all stakeholders 9

…and Unparalleled Global Reach Enables VIATRIS to Deliver Products

Across Multiple Channels Global Commercial Platform 165+ 1,100+ Countries & Marketing Territories professionals 60,000+ 1,400+ Customers Molecules 13,000+ ~30,000 Sales force SKUs 10…and Unparalleled Global Reach Enables VIATRIS to Deliver

Products Across Multiple Channels Global Commercial Platform 165+ 1,100+ Countries & Marketing Territories professionals 60,000+ 1,400+ Customers Molecules 13,000+ ~30,000 Sales force SKUs 10

…Delivered Through a Unique Global Platform Strong Technical

Resources Truly Global Supply Network R&D, Quality, Medical, PV, with local proximity & Regulatory across the globe Optimized Operating and Medical Capabilities ~50 80B+ Manufacturing sites Doses produced 60+ 2,500+ Distribution Networks

Scientists 35,000+ 1,000+ Marketing Authorizations Regulatory experts 135+ 600+ Annual Health Authorities Medical & Product inspections Safety Professionals Illustrative, not comprehensive 11…Delivered Through a Unique Global Platform

Strong Technical Resources Truly Global Supply Network R&D, Quality, Medical, PV, with local proximity & Regulatory across the globe Optimized Operating and Medical Capabilities ~50 80B+ Manufacturing sites Doses produced 60+ 2,500+

Distribution Networks Scientists 35,000+ 1,000+ Marketing Authorizations Regulatory experts 135+ 600+ Annual Health Authorities Medical & Product inspections Safety Professionals Illustrative, not comprehensive 11

Fueling Our Future Growth A Focus on Actively Expanding Innovative

Partnerships Complex Products Biologics Respiratory Significant partnership track record of leveraging each other’s capabilities and strengths 12Fueling Our Future Growth A Focus on Actively Expanding Innovative Partnerships Complex Products

Biologics Respiratory Significant partnership track record of leveraging each other’s capabilities and strengths 12

A Proven Track Record of Addressing Unmet Needs Through Complex Science DPI

Respiratory Complex Injectable NCE Fluticasone propionate / Glatiramer Acetate Revefenacin Salmeterol (Advair) Injection (Copaxone) (Yupelri) Continuing to Execute Up the Value Continuum Insulin Biosimilars Glargine (Lantus) Pegfilgrastim (Neulasta)

Trastuzumab (Herceptin) Adalimumab (Humira) Targeting ~$3B in New MR-106A-01* Revenue from Products MR-107A-01* 1x/Month Expected to Launch by Year 4 ~2/3 Will be Complex Gx, Biosimilars and Global Key Brands Product examples illustrative, not

exhaustive * Molecules in development, not yet publicly identified 13A Proven Track Record of Addressing Unmet Needs Through Complex Science DPI Respiratory Complex Injectable NCE Fluticasone propionate / Glatiramer Acetate Revefenacin Salmeterol

(Advair) Injection (Copaxone) (Yupelri) Continuing to Execute Up the Value Continuum Insulin Biosimilars Glargine (Lantus) Pegfilgrastim (Neulasta) Trastuzumab (Herceptin) Adalimumab (Humira) Targeting ~$3B in New MR-106A-01* Revenue from Products

MR-107A-01* 1x/Month Expected to Launch by Year 4 ~2/3 Will be Complex Gx, Biosimilars and Global Key Brands Product examples illustrative, not exhaustive * Molecules in development, not yet publicly identified 13

Sustainable, Diverse and Differentiated Portfolio OTC 6% Biologics 4% U.S.

Generic 15% Brand 56% Ex-U.S. Generic 19% Expected Combined Revenue 14Sustainable, Diverse and Differentiated Portfolio OTC 6% Biologics 4% U.S. Generic 15% Brand 56% Ex-U.S. Generic 19% Expected Combined Revenue 14

Synergies Cost Synergies: Expected to Achieve Annually by Year Four ~$1bn

COGS G&A S&M % % % ~40 ~40 ~20 of total of total of total Key Areas Key Areas Key Areas • Transition Services Agreement • Transition Services Agreements • Optimization of Network • Elimination of Duplicate

Infrastructure • Elimination of Duplicate Infrastructure • Manufacturing and Supply Agreements • Cost Avoidance • Procurement • No Standalone / Corporate Build-up • Transition Services Agreements Costs Revenue

Synergies Expected After Year One • Select Product Opportunities Based on Synergistic Portfolio • Launch New Products in Emerging Markets and Asia Pacific • Expand Access and Reach for Global Partners • Cross Pollinate Global

Key Brands Across Portfolios • Enhance Commercial Excellence 15Synergies Cost Synergies: Expected to Achieve Annually by Year Four ~$1bn COGS G&A S&M % % % ~40 ~40 ~20 of total of total of total Key Areas Key Areas Key Areas •

Transition Services Agreement • Transition Services Agreements • Optimization of Network • Elimination of Duplicate Infrastructure • Elimination of Duplicate Infrastructure • Manufacturing and Supply Agreements •

Cost Avoidance • Procurement • No Standalone / Corporate Build-up • Transition Services Agreements Costs Revenue Synergies Expected After Year One • Select Product Opportunities Based on Synergistic Portfolio • Launch

New Products in Emerging Markets and Asia Pacific • Expand Access and Reach for Global Partners • Cross Pollinate Global Key Brands Across Portfolios • Enhance Commercial Excellence 15

Stronger Business Model Transformational combination strengthens balance

sheet, enhances financial flexibility and transitions to a shareholder return focused capital allocation model 1 Financial Flexibility Leverage Target: 3.0x Leverage Target: ≤2.5x Expected dividend ≥ 25% of free cash flow No dividend

beginning first full quarter after close of proposed Dividend transaction (est. to close mid-2020) Return of Capital Prioritizing debt paydown over Significant financial capacity to repurchase shares in Repurchase share repurchases addition to

paying down debt Netherlands Delaware Domicile (Stakeholder-centric model) (Shareholder-centric model) Structural Strong and cohesive current Deep bench strength that combines the Management management team complementary skill sets of Mylan and

Upjohn 1 Reflects Mylan’s targeted long-term average debt to credit agreement Adjusted EBITDA leverage ratio. 16Stronger Business Model Transformational combination strengthens balance sheet, enhances financial flexibility and transitions to a

shareholder return focused capital allocation model 1 Financial Flexibility Leverage Target: 3.0x Leverage Target: ≤2.5x Expected dividend ≥ 25% of free cash flow No dividend beginning first full quarter after close of proposed Dividend

transaction (est. to close mid-2020) Return of Capital Prioritizing debt paydown over Significant financial capacity to repurchase shares in Repurchase share repurchases addition to paying down debt Netherlands Delaware Domicile (Stakeholder-centric

model) (Shareholder-centric model) Structural Strong and cohesive current Deep bench strength that combines the Management management team complementary skill sets of Mylan and Upjohn 1 Reflects Mylan’s targeted long-term average debt to

credit agreement Adjusted EBITDA leverage ratio. 16

Clear Roadmap of Execution to Optimize Total Shareholder Return (TSR) Years

Transaction Close 0 1 2 3 4 5 6 7+ INTEGRATION Operations PRODUCT LAUNCHES ~$3bn Business New Pipeline Execution Launches COST SYNERGIES Synergies REVENUE SYNERGIES Leverage RAPID DELEVERAGING SHARE REPURCHASES Capital Return Capital DIVIDENDS

Allocation New Pipeline Investment Business Development 17Clear Roadmap of Execution to Optimize Total Shareholder Return (TSR) Years Transaction Close 0 1 2 3 4 5 6 7+ INTEGRATION Operations PRODUCT LAUNCHES ~$3bn Business New Pipeline Execution

Launches COST SYNERGIES Synergies REVENUE SYNERGIES Leverage RAPID DELEVERAGING SHARE REPURCHASES Capital Return Capital DIVIDENDS Allocation New Pipeline Investment Business Development 17

Expected Attractive Financial Profile Selected Large Cap Pharma VIATRIS

Selected Spec Pharma / Generics ü More Balanced Risk Profile $227 $216 ü Robust Balance Sheet $143 $132 $119 1 ~$25 $15 $11 $10 $7 $6 $1 2020E EBITDA 2 5 Margin 43% 34% 55% 35% 32% ~40% 23% 30% 28% 20% 27% 24% Avg. Est. Gross ≤ 2.5x

Debt / 2020E ~2x ~4x 3 Sustained leverage target EBITDA Pays Dividend / Dividend 4 6 Yield 3.6% 3.1% 2.4% 1.9% 4.5% 2.7%-3.9% 0.6% 1.6% 1.6% TEV / 2020E What multiple will 8 9 10 ~12x ~14x ~12x ~17x ~11x ~14x ~8x ~10x ~10x ~10x 7 EBITDA VIATRIS

deserve? Creates a Differentiated Industry Leader with a Strong Financial Profile and Opportunities to Deliver Substantial Shareholder Returns Source: Company filings, Capital IQ. Note: Market data as of 01/10/2020. 1 Assumes estimated pro forma

shares of 1.215bn and Mylan price per share as of 01/10/2020; 2 Wall Street consensus 2020E EBITDA margin. Figures adjusted to reflect 2020E calendar year; 3 Gross leverage multiples based on consensus EBITDA estimates and gross debt outstanding as

of the last reported publicly available filings. EBITDA estimates adjusted to reflect 2020E calendar year 4 Dividend per share declared in the last 12 months divided by the company share price dated 01/10/2020; 5 2020E pro forma adjusted EBITDA

margin including phased-in synergies 6 Dividend per share assumes 25% of illustrative $4bn of pro forma 2020E free cash flow paid as dividend, divided by pro forma share count of 1.215bn. 2.7% and 3.9% dividend yield based on illustrative ~$30 and

~$21 VIATRIS share price, respectively; 7 Wall Street consensus 2020E EBITDA. Figures adjusted to reflect 2020E calendar year. Enterprise value calculated as market capitalization dated 01/10/2020 plus debt outstanding less cash and cash equivalents

plus non-controlling interest and less investment in affiliates as reported in the latest public filing. Consensus estimates are not internal estimates; 8 Includes $9.7bn cash impact from acquiring The Medicines Company; 9 Includes $13.4bn cash

impact from acquiring Celgene’s Otezla; 10 Includes $1.1bn cash impact from acquiring Dermira. 18 Market Cap ($bn)Expected Attractive Financial Profile Selected Large Cap Pharma VIATRIS Selected Spec Pharma / Generics ü More Balanced Risk

Profile $227 $216 ü Robust Balance Sheet $143 $132 $119 1 ~$25 $15 $11 $10 $7 $6 $1 2020E EBITDA 2 5 Margin 43% 34% 55% 35% 32% ~40% 23% 30% 28% 20% 27% 24% Avg. Est. Gross ≤ 2.5x Debt / 2020E ~2x ~4x 3 Sustained leverage target EBITDA

Pays Dividend / Dividend 4 6 Yield 3.6% 3.1% 2.4% 1.9% 4.5% 2.7%-3.9% 0.6% 1.6% 1.6% TEV / 2020E What multiple will 8 9 10 ~12x ~14x ~12x ~17x ~11x ~14x ~8x ~10x ~10x ~10x 7 EBITDA VIATRIS deserve? Creates a Differentiated Industry Leader with a

Strong Financial Profile and Opportunities to Deliver Substantial Shareholder Returns Source: Company filings, Capital IQ. Note: Market data as of 01/10/2020. 1 Assumes estimated pro forma shares of 1.215bn and Mylan price per share as of

01/10/2020; 2 Wall Street consensus 2020E EBITDA margin. Figures adjusted to reflect 2020E calendar year; 3 Gross leverage multiples based on consensus EBITDA estimates and gross debt outstanding as of the last reported publicly available filings.

EBITDA estimates adjusted to reflect 2020E calendar year 4 Dividend per share declared in the last 12 months divided by the company share price dated 01/10/2020; 5 2020E pro forma adjusted EBITDA margin including phased-in synergies 6 Dividend per

share assumes 25% of illustrative $4bn of pro forma 2020E free cash flow paid as dividend, divided by pro forma share count of 1.215bn. 2.7% and 3.9% dividend yield based on illustrative ~$30 and ~$21 VIATRIS share price, respectively; 7 Wall Street

consensus 2020E EBITDA. Figures adjusted to reflect 2020E calendar year. Enterprise value calculated as market capitalization dated 01/10/2020 plus debt outstanding less cash and cash equivalents plus non-controlling interest and less investment in

affiliates as reported in the latest public filing. Consensus estimates are not internal estimates; 8 Includes $9.7bn cash impact from acquiring The Medicines Company; 9 Includes $13.4bn cash impact from acquiring Celgene’s Otezla; 10 Includes

$1.1bn cash impact from acquiring Dermira. 18 Market Cap ($bn)

Potential Opportunity to Deliver Significant Shareholder Value In addition

to returning significant capital to shareholders, VIATRIS has the opportunity to unlock shareholder value through multiple expansion 1 Implied VIATRIS Share Price Illustrative VIATRIS EBITDA ($bn) 7.0 7.5 8.0 8.5 $20 $23 $26 $29 7.0x 8.0x $26 $29

$32 $36 $31 $35 $39 $43 9.0x $37 $41 $45 $50 10.0x 11.0x $43 $48 $52 $57 Note: Share price rounded to the nearest dollar. 1 Assumes net debt of $24.8bn including $12bn Upjohn contributed debt, $13bn standalone Mylan debt, $0.4bn standalone Mylan

cash (as of Q3 2019) and pro forma share count of 1.215bn. 19 Illustrative Total Enterprise Value / EBITDAPotential Opportunity to Deliver Significant Shareholder Value In addition to returning significant capital to shareholders, VIATRIS has the

opportunity to unlock shareholder value through multiple expansion 1 Implied VIATRIS Share Price Illustrative VIATRIS EBITDA ($bn) 7.0 7.5 8.0 8.5 $20 $23 $26 $29 7.0x 8.0x $26 $29 $32 $36 $31 $35 $39 $43 9.0x $37 $41 $45 $50 10.0x 11.0x $43 $48 $52

$57 Note: Share price rounded to the nearest dollar. 1 Assumes net debt of $24.8bn including $12bn Upjohn contributed debt, $13bn standalone Mylan debt, $0.4bn standalone Mylan cash (as of Q3 2019) and pro forma share count of 1.215bn. 19

Illustrative Total Enterprise Value / EBITDA

On-Track for Mid-2020 Close ü q Ongoing Integration Planning

qü Announce New Company Name qü Determined that VIATRIS will be Listed on Nasdaq ü q Commenced VIATRIS Director Appointments q Announce VIATRIS Chief Financial Officer q Receive Mylan Shareholder Approval

q Receive Regulatory Approvals Across Jurisdictions, including U.S., EC and China q Complete Other Customary Closing Conditions Transaction Expected to Close Mid-2020 q 20On-Track for Mid-2020 Close ü q Ongoing Integration

Planning qü Announce New Company Name qü Determined that VIATRIS will be Listed on Nasdaq ü q Commenced VIATRIS Director Appointments q Announce VIATRIS Chief Financial Officer q Receive Mylan Shareholder

Approval q Receive Regulatory Approvals Across Jurisdictions, including U.S., EC and China q Complete Other Customary Closing Conditions Transaction Expected to Close Mid-2020 q 20

Viatris Brand Reveal Video—JP Morgan Healthcare Conference

Our world needs us

To come together like never before.

To make good on the belief that the path to better health is achieved through greater access, making it possible to live life better today and tomorrow.

Our world needs us

to lead the way by innovating around the

clock and around the globe, so that the quality medicines we make, supply and deliver

create a path of value for people everywhere.

Our world needs us

to partner with patients, physicians, nurses,

pharmacists, and each other

to untap opportunities and deliver a more hopeful and sustainable healthcare journey that empowers people around the world to

live healthier at every stage of life.

We are Viatris.

ADDITIONAL INFORMATION

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor

shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made

except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. In connection with the proposed combination of Upjohn Inc. (“Newco”), a wholly owned subsidiary of Pfizer Inc.

(“Pfizer”) and Mylan N.V. (“Mylan”), which will immediately follow the proposed separation of the Upjohn business (the “Upjohn Business”) from Pfizer (the “proposed transaction”), Newco and Mylan have filed

certain materials with the Securities and Exchange Commission (the “SEC”), including, among other materials, the Registration Statement on Form S-4 which includes a proxy statement/prospectus (as amended, the “Form S-4”), and

Form 10 which includes an information statement (as amended, the “Form 10”), each of which has been filed by Newco with the SEC on October 25, 2019 and subsequently amended. The registration statements have not yet become effective. After

the Form S-4 is effective, a definitive proxy statement/prospectus will be sent to the Mylan shareholders seeking approval of the proposed transaction, and after the Form 10 is effective, a definitive information statement will be made available to

the Pfizer stockholders relating to the proposed transaction. Newco and Mylan intend to file additional relevant materials with the SEC in connection with the proposed transaction, including a proxy statement of Mylan in definitive form. INVESTORS

AND SECURITY HOLDERS ARE URGED TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MYLAN, NEWCO AND THE PROPOSED TRANSACTION. The documents relating to the proposed

transaction (when they are available) can be obtained free of charge from the SEC’s website at www.sec.gov. These documents (when they are available) can also be obtained free of charge from Mylan, upon written request to Mylan, at

(724) 514-1813 or investor.relations@mylan.com or from Pfizer on Pfizer’s internet website at https://investors.Pfizer.com/financials/sec-filings/default.aspx or by contacting Pfizer’s Investor Relations Department at (212) 733-2323, as

applicable.

FORWARD LOOKING STATEMENTS

This

communication contains “forward-looking statements”. Such forward-looking statements may include, without limitation, statements about the proposed transaction, the expected timetable for completing the proposed transaction, the benefits

and synergies of the proposed transaction, future opportunities for the combined company and products and any other statements regarding Pfizer’s, Mylan’s, the Upjohn Business’s or the combined company’s future operations,

financial or operating results, capital allocation, dividend policy, debt ratio, anticipated business levels, future earnings, planned activities, anticipated growth, market opportunities, strategies, competitions, and other expectations and targets

for future periods. Forward-looking statements may often be identified by the use of words such as “will”, “may”, “could”, “should”, “would”, “project”, “believe”,

“anticipate”, “expect”, “plan”, “estimate”, “forecast”, “potential”, “pipeline”, “intend”, “continue”, “target”, “seek” and variations of

these words or comparable words. Because forward-looking statements inherently involve risks and uncertainties, actual future results may differ materially from those expressed or implied by such forward-looking statements. Factors that could cause

or contribute to such differences include, but are not limited to: the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the proposed transaction; changes in relevant tax and other laws;

the parties’ ability to consummate the proposed transaction; the conditions to the completion of the proposed transaction, including receipt of approval of Mylan’s shareholders, not being satisfied or waived on the anticipated timeframe or

at all; the regulatory approvals required for the proposed transaction not being obtained on the terms expected or on the anticipated schedule or at all; inherent uncertainties involved in the estimates and judgments used in the preparation of

financial statements and the providing of estimates of financial measures, in accordance with accounting principles generally accepted in the United States of America and related standards, or on an adjusted basis; the integration of Mylan and Newco

being more difficult, time consuming or costly than expected; Mylan’s, the Upjohn Business’s and the combined company’s failure to achieve expected or targeted future financial and operating performance and results; the possibility

that the combined company may be unable to achieve expected benefits, synergies and operating efficiencies in connection with the proposed transaction

within the expected time frames or at all or to successfully integrate Mylan and Newco; customer loss and business disruption being greater than expected following the proposed transaction; the

retention of key employees being more difficult following the proposed transaction; any regulatory, legal or other impediments to Mylan’s, the Upjohn Business’s or the combined company’s ability to bring new products to market,

including but not limited to where Mylan, the Upjohn Business or the combined company uses its business judgment and decides to manufacture, market and/or sell products, directly or through third parties, notwithstanding the fact that allegations of

patent infringement(s) have not been finally resolved by the courts (i.e., an “at-risk launch”); success of clinical trials and Mylan’s, the Upjohn Business’s or the combined company’s ability to execute on new product

opportunities; any changes in or difficulties with Mylan’s, the Upjohn Business’s or the combined company’s manufacturing facilities, including with respect to remediation and restructuring activities, supply chain or inventory or the

ability to meet anticipated demand; the scope, timing and outcome of any ongoing legal proceedings, including government investigations, and the impact of any such proceedings on Mylan’s, the Upjohn Business’s or the combined

company’s consolidated financial condition, results of operations and/or cash flows; Mylan’s, the Upjohn Business’s and the combined company’s ability to protect their respective intellectual property and preserve their

respective intellectual property rights; the effect of any changes in customer and supplier relationships and customer purchasing patterns; the ability to attract and retain key personnel; changes in third-party relationships; actions and decisions

of healthcare and pharmaceutical regulators; the impacts of competition; changes in the economic and financial conditions of the Upjohn Business or the business of Mylan or the combined company; uncertainties regarding future demand, pricing and

reimbursement for Mylan’s, the Upjohn Business’s or the combined company’s products; and uncertainties and matters beyond the control of management and other factors described under “Risk Factors” in each of Pfizer’s

and Mylan’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other filings with the SEC. These risks, as well as other risks associated with Mylan, the Upjohn Business, the combined company and the proposed transaction are also

more fully discussed in the Form S-4 and the Form 10. You can access Pfizer’s, Mylan’s or Newco’s filings with the SEC through the SEC website at www.sec.gov or through Pfizer’s or Mylan’s website, as applicable, and Pfizer

and Mylan strongly encourage you to do so. Except as required by applicable law, Pfizer, Mylan and Newco undertake no obligation to update any statements herein for revisions or changes after the date of this communication.

PARTICIPANTS IN THE SOLICITATION

This communication is

not a solicitation of a proxy from any investor or security holder. However, Pfizer, Mylan, Newco and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the

proposed transaction under the rules of the SEC. Information about the directors and executive officers of Pfizer may be found in its Annual Report on Form 10-K filed with the SEC on February 28, 2019, its definitive proxy statement and additional

proxy statement relating to its 2019 Annual Meeting filed with the SEC on March 14, 2019 and on April 2, 2019, respectively, and Current Report on Form 8-K filed with the SEC on June 27, 2019. Information about the directors and executive officers

of Mylan may be found in its amended Annual Report on Form 10-K filed with the SEC on April 30, 2019, and its definitive proxy statement relating to its 2019 Annual Meeting filed with the SEC on May 24, 2019. Additional information regarding the

interests of these participants can also be found in the Form S-4 and will also be included in the definitive proxy statement of Mylan in connection with the proposed transaction when it becomes available. These documents (when they are available)

can be obtained free of charge from the sources indicated above.

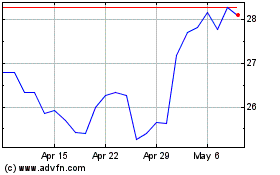

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024