UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

July, 2022

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20231-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on remuneration to shareholders

—

Rio de Janeiro, July 28, 2022 – Petróleo

Brasileiro S.A. – Petrobras informs that its Board of Directors, at a meeting held today, approved the payment of dividends in the

amount of R$ 6.732003 per outstanding preferred and common share.

The proposed dividend is in line with the Shareholder

Remuneration Policy, which provides that in case of gross debt below US$ 65 billion, Petrobras may distribute to its shareholders 60%

of the difference between operating cash flow and acquisitions of fixed and intangible assets (investments). In addition, the Policy also

foresees the possibility of paying extraordinary dividends, provided that the financial sustainability of the Company is preserved.

The approval of the proposed dividend is compatible

with the company's financial sustainability and is aligned with the commitment of value generation for the society and for the shareholders,

as well as with the best practices in the oil and gas industry.

It is worth noting that in the Strategic Plan

2022-26 the investment projects requested by the business areas were met because they presented good resilience and are supported by operating

cash generation and the flow of divestments, with no adverse effects on leverage. Therefore, there are no investments held back by financial

or budgetary constraints and the decision to use the surplus resources to remunerate shareholders presents itself as the most efficient

one for optimizing the allocation of cash.

The dividends will be paid in two equal installments

in August and September, as follows:

Amount to be paid: R$ 6.732003 per common

and preferred share outstanding, whereby:

(i) the first installment, in the amount

of R$ 3.366002 per outstanding preferred and common share, will be paid on August 31, 2022.

(ii) the second installment, in the amount

of R$ 3.366001 per outstanding preferred and common share, will be paid on September 20, 2022.

Record date: August 11, 2022 for holders

of Petrobras shares traded on B3 and August 15, 2022 for ADR holders traded on New York Stock Exchange (NYSE). Petrobras shares will be

traded ex-dividends on B3 and NYSE as of August 12, 2022.

Payment date: For holders of Petrobras

shares traded on B3, first payment will be made on August 31, 2022 and second payment will be made on September 20, 2022. ADR holders

will receive payments starting on September 08, 2022 and September 27, 2022, respectively.

Form of distribution: The first installment

of payment will be made as follows: (a) dividends, of R$ 2.938861 per outstanding preferred and common share; and (b) interest on equity

of R$ 0.427141 per outstanding preferred and common share. The second installment will be paid in full as dividends.

It is important to point out that these proceeds

will be deducted from the dividends to be approved at the 2023 Annual Shareholders' Meeting for the year 2022, and their amounts will

be adjusted by the Selic rate from the date of payment of each installment until the end of the current fiscal year for purposes of calculating

the deduction.

Petrobras' Shareholder Remuneration Policy

can be accessed on the company's website (https://www.investidorpetrobras.com.br/en/).

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 19th Floor

– 20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 28, 2022

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Rodrigo Araujo Alves

______________________________

Rodrigo Araujo Alves

Chief Financial Officer and Investor Relations

Officer

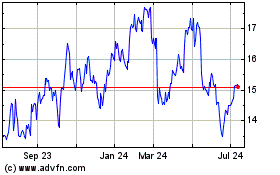

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

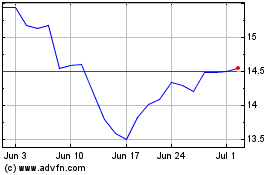

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024