UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities

Exchange Act of 1934

For

the month of September, 2020

Commission

File Number 1-15106

PETRÓLEO

BRASILEIRO S.A. – PETROBRAS

(Exact

name of registrant as specified in its charter)

Brazilian

Petroleum Corporation – PETROBRAS

(Translation

of Registrant's name into English)

Avenida

República do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

_______ No___X____

Petrobras on E&P portfolio revision

—

Rio de Janeiro, September

14, 2020 – Petróleo Brasileiro S.A. – Petrobras reports on the revision of the Exploration & Production

(E&P) segment portfolio in face of the crisis caused by COVID-19. The revision aims to maximize the value of the E&P portfolio,

focusing on world-class assets in deep and ultra-deep waters.

The portfolio revision is

in line with the price assumptions disclosed in the first quarter results. In addition, the following guidelines were considered:

(a) focus on deleveraging, reaching the gross debt target of US$ 60 billion in 2022; (b) focus on resilience, prioritizing projects

with Brent price breakeven of not more than US$ 35/barrel and aligned to the company's strategy and; (c) revision of the entire

investment and divestment portfolios.

As a result of the portfolio

revision, Petrobras estimates a Capex for E&P of approximately US$ 40-50 billion for 2021-2025, as compared to the US$ 64 billion

announced in the 2020-2024 Strategic Plan. In addition to the effect of the devaluation of the Real, the following should be highlighted:

(a) optimization in exploratory investments, keeping the commitments agreed with the National Agency of Petroleum, Natural Gas

and Biofuels, (b) avoided Capex associated with divestments and (c) revision of the investment portfolio, considering optimizations,

postponements and cancellations.

|

E&P estimated investment 2021-2025

US$ billion

|

|

|

1 Impact of new exchange rate assumptions

2 Includes: period change, optimizations, postponements, cancellations,

R&D adjustment, risk factor (probabilistic analysis) and others

|

Búzios and the other

pre-salt assets will become even more important in the company's portfolio, representing 71% of the total E&P investment for

2021-2025, against 59% in the 2020-2024 Strategic Plan. Investments in these world-class assets, in which we are the natural owners,

are in line with our strategic pillars and are resilient to lower oil prices.

|

Estimated investment

E&P 2021-2025

|

|

|

|

As a result of the portfolio

revision, Petrobras has decided to include new assets in its divestment portfolio.

The potential impact on the

production curve, as well as the start-up schedule for the new platforms, will be announced at Petrobras day 2020, scheduled for

the end of November, after the conclusion and approval of the 2021-25 Strategic Plan.

Petrobras reaffirms its strategic

pillars and will continue its execution with the objective of creating sustainable value for its shareholders.

This report on Form 6-K shall be

deemed to be incorporated by reference into (i) the Offer to Purchase dated September 10, 2020, relating to the previously announced

tender offers by Petrobras Global Finance B.V., a wholly-owned subsidiary of Petróleo Brasileiro S.A. – Petrobras,

and (ii) the Registration Statement on Form F-4 No. 333-239714, filed with the Securities and Exchange Commission (“SEC”)

on July 6, 2020, as amended on July 28, 2020, and the related prospectus, filed with the SEC pursuant to Rule 424(b)(3) on August

17, 2020.

www.petrobras.com.br/ri

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities

Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates",

"believes", "expects", "predicts", "intends", "plans", "projects",

"aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties,

predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and

the reader should not rely solely on the information included herein.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: September 14, 2020

PETRÓLEO BRASILEIRO

S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea

Marques de Almeida

Chief Financial Officer and

Investor Relations Officer

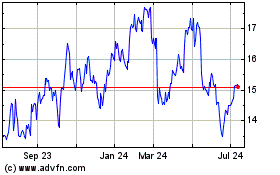

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

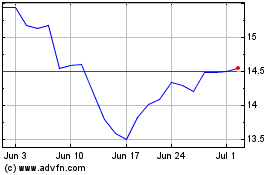

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024