Report of Foreign Issuer (6-k)

July 29 2020 - 6:08AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2020

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation – PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on news article published in the media

—

Rio de Janeiro, July 28,

2020 - Petróleo Brasileiro SA - Petrobras, clarifies that, in relation to a news article published in the media today regarding

the divestment of the Baúna field, the expected reduction of US$380 million in the transaction's firm value is a price adjustment

to exclude the amounts already received by Petrobras.

Price adjustments are a common

practice in acquisition and divestment transactions since the base date of the offer is different than the actual date the transaction

is completed. The firm value of US$380 million announced for transaction was calculated for the January 1, 2019 base date and,

therefore, will be adjusted according to the asset's cash flow incorporated by Petrobras from January 1,2019 until the actual transaction

closing date. The result obtained during this period must be reverted to Karoon due to the sale of 100% of the field and in compliance

with the contractual terms since the economic evaluation and purchase proposal for the asset were based on the transaction's announcement

date, which was January 1, 2019.

As this is an active production

field that generates a positive cash flow, the adjustment and the deposit must be discounted from the agreed firm amount. As disclosed

in the Material Fact released on July 24, 2020, Petrobras already received a deposit of US$49.9 million on on July 24, 2019, the

date the transaction was signed, and will receive US$150 million on transaction closing date. It is also estimated that, after

excluding the deposit, the amount to be paid at the closing of the transactions and the adjustments as explained above, there will

still be an outstanding portion due 18 months after the transaction has been concluded.

Additionally, the parties

agreed that a contingent portion of the price, in the amount of US$285 million, is to be received by 2026.

Finally, Petrobras reinforces

its commitment to being fully transparent with its divestment projects and portfolio management, and informs that the transaction's

conclusion will be disclosed to the market in accordance with the Company's Divestment Systematic.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investor Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803

– 20031-912 – Rio de Janeiro, RJ.

Phone: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section

21E of the Securities Exchange Act of 1934, as amended (Exchange Act) that merely reflect the expectations of the Company’s

management. Such terms as “anticipate”, “believe”, “expect”, “forecast”, “intend”,

“plan”, “project”, “seek”, “should”, along with similar or analogous expressions,

are used to identify such forward-looking statements. These predictions evidently involve risks and uncertainties, whether foreseen

or not by the Company. Therefore, the future results of operations may differ from current expectations, and readers must not base

their expectations exclusively on the information presented herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July

28, 2020

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea Marques de Almeida

Chief Financial Officer and Investor Relations Officer

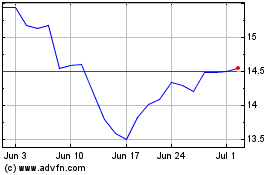

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

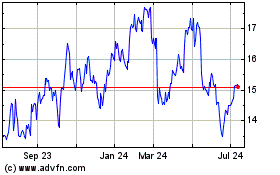

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024