Amended Securities Registration (foreign Private Issuer) (f-4/a)

July 28 2020 - 5:16PM

Edgar (US Regulatory)

As filed with the Securities and Exchange

Commission on July 28, 2020

Registration Nos. 333-239714 and 333-239714-01

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

PRE-EFFECTIVE

AMENDMENT NO. 1

TO

FORM

F-4

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

|

Petróleo Brasileiro S.A. – Petrobras

|

Petrobras Global Finance B.V.

|

(Exact name of each registrant as specified

in its charter)

|

Brazilian Petroleum Corporation – Petrobras

|

Not Applicable

|

(Translation of registrant’s name

into English)

|

The Federative Republic of Brazil

|

The Netherlands

|

(Jurisdiction of incorporation or organization)

(Primary Standard Industrial Classification

Code Number)

|

Not Applicable

|

Not Applicable

|

(I.R.S. employer identification number)

Avenida República do Chile, 65

20031-912 – Rio de Janeiro – RJ, Brazil

+55 (21) 3224-4477

|

Weena 762

3014 DA – Rotterdam - The Netherlands

+31 (0) 10 206-7000

|

(Address and telephone number of registrant’s

principal executive offices)

|

Petrobras America Inc.

10350 Richmond Ave., Suite 1400

Houston, Texas 77042

+1 (713) 808-2000

|

(Name, address and

telephone number of agent for service)

With a copy to:

|

Francesca L. Odell, Esq.

Cleary Gottlieb Steen & Hamilton

LLP

One Liberty Plaza

New York, New York 10006

+1 (212) 225-2000

|

Approximate

date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes

effective.

If this Form is filed to register additional

securities of an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment

filed pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If applicable, place an X in the box to

designate the appropriate rule provision relied upon in conducting this transaction:

|

Exchange Act Rule 13e-4(i)

(Cross-Border Issuer Tender Offer)

|

¨

|

|

Exchange Act Rule 14d-1(d) (Cross-Border

Third-Party Tender Offer)

|

¨

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

|

Emerging growth company

|

¨

|

If an emerging growth company that prepares

its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B)

of the Securities Act. ¨

† The term “new or revised

financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting

Standards Codification after April 5, 2012.

CALCULATION

OF REGISTRATION FEE

Title of

Securities to be Registered

|

Amount to be

Registered

|

Proposed Maximum

Offering Price

Per Unit(1)

|

Proposed Maximum

Aggregate Offering

Price(1)

|

Amount of

Registration

Fee(2)

|

|

5.093% Global Notes Due 2030

|

U.S.$4,115,281,000

|

100%

|

U.S.$4,115,281,000

|

U.S.$534,163.47

|

|

Guaranty of 5.093% Global Notes Due 2030

|

(3)

|

(3)

|

(3)

|

(3)

|

|

(1)

|

The securities being registered hereby are offered (i) in exchange for the securities described in this prospectus,

previously sold in transactions exempt from registration under the Securities Act of 1933, as amended, or the

“Securities Act” and (ii) upon certain resales of the securities by broker-dealers. The registration

fee has been computed based on the face value of the securities solely for the purpose of calculating the amount of the

registration fee pursuant to Rule 457 under the Securities Act .

|

|

|

|

|

(2)

|

Calculated pursuant to Rule 457 under the Securities Act. The registration fee has already been paid.

|

|

|

|

|

(3)

|

Pursuant to Rule 457(n), no separate fee is payable with respect to the guaranty.

|

The

Registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until

the Registrants shall file a further amendment which specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

This Amendment

No. 1 to the Registration Statement on Form F-4 is being filed solely for the purpose of filing Exhibit

3.2 to such Registration Statement as indicated in Item 21 of Part II. No change is made to the preliminary prospectus constituting

Part I of this Registration Statement or Items 20 or 22 of Part II of this Registration Statement. Accordingly, the preliminary

prospectus constituting Part I of this Registration Statement has not been included herein.

PART

II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 20.

|

Indemnification of Directors and Officers

|

Article 23, Section

1 of Petrobras’s by-laws requires it to defend its senior management in administrative and legal proceedings and maintain

insurance coverage to protect senior management from liability arising from the performance of the senior manager’s functions.

Petrobras maintains an insurance policy covering losses and expenses arising from management actions taken by the directors and

officers of Petrobras and its subsidiaries, including PGF, in their capacity as such.

Neither PGF’s

Articles of Association nor the laws of the Netherlands provide for indemnification of directors or officers.

|

Item 21.

|

Exhibits and Financial Statement Schedules

|

(a) Exhibits

|

3.1

|

Amended Bylaws of Petróleo Brasileiro S.A.-Petrobras, dated as of March 4, 2020 (incorporated by reference to Exhibit 1.1 to the Annual Report on Form 20-F of Petrobras, filed with the Securities and Exchange Commission on March 23, 2020 (File No. 001-15106).

|

|

3.2**

|

Articles of Association of Petrobras Global Finance B.V., dated August 2, 2012.

|

|

4.1

|

Indenture, dated as of December 15, 2006, between Petrobras International Finance Company and The Bank of New York, as Trustee (incorporated by reference to Exhibit 4.9 to the Registration Statement of Petrobras and Petrobras International Finance Company on Form F-3, filed with the Securities and Exchange Commission on December 18, 2006 (File Nos. 333-139459 and 333-139459-01)).

|

|

4.2

|

Fourth Supplemental Indenture, dated as of October 30, 2009, among Petrobras International Finance Company, Petrobras and The Bank of New York Mellon, as Trustee, relating to the 6.875% Global Notes due 2040 (incorporated by reference to Exhibit 2.36 to the Annual Report on Form 20-F of Petrobras and Petrobras International Finance Company, filed with the Securities and Exchange Commission on May 20, 2010 (File Nos. 001-15106 and 001-33121)).

|

|

4.3

|

Guaranty for the 6.875% Global Notes due 2040, dated as of October 30, 2009, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 2.38 to the Annual Report on Form 20-F of Petrobras and Petrobras International Finance Company, filed with the Securities and Exchange Commission on May 20, 2010 (File Nos. 001-15106 and 001-33121)).

|

|

4.5

|

Transfer of Rights Agreement, dated as of September 3, 2010, among Petrobras, the Brazilian Federal Government and the National Petroleum, Natural Gas and Biofuels Agency (incorporated by reference to Exhibit 2.47 to the Annual Report on Form 20-F of Petrobras and Petrobras International Finance Company, filed with the Securities and Exchange Commission on May 26, 2011 (File Nos. 001-15106 and 001-33121)).

|

|

4.6

|

Ninth Supplemental Indenture, dated as of December 9, 2011, among Petrobras International Finance Company, Petrobras, The Bank of New York Mellon, as Trustee, The Bank of New York Mellon, London Branch, as Principal Paying Agent and The Bank of New York Mellon (Luxembourg) S.A., as Luxembourg Paying Agent, relating to the 5.875% Global Notes due 2022 (incorporated by reference to Exhibit 4.5 to Form 6-K of Petrobras and Petrobras International Finance Company, furnished to the Securities and Exchange Commission on December 9, 2011 (File Nos. 001-15106 and 001-33121)).

|

|

4.7

|

Guaranty for the 5.875% Global Notes due 2022, dated as of December 9, 2011, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.4 to Form 6-K of Petrobras and Petrobras International Finance Company, furnished to the Securities and Exchange Commission on December 9, 2011 (File Nos. 001-15106 and 001-33121)).

|

|

4.8

|

Tenth Supplemental Indenture, dated as of December 12, 2011, among Petrobras International Finance Company, Petrobras, The Bank of New York Mellon, as Trustee, The Bank of New York Mellon, London Branch, as Principal Paying Agent and The Bank of New York Mellon (Luxembourg) S.A., as Luxembourg Paying Agent, relating to the 6.250% Global Notes due 2026 (incorporated by reference to Exhibit 4.2 to Form 6-K of Petrobras and Petrobras International Finance Company, furnished to the Securities and Exchange Commission on December 12, 2011 (File Nos. 001-15106 and 001-33121)).

|

|

4.9

|

Guaranty for the 6.250% Global Notes due 2026, dated as of December 12, 2011, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.1 to Form 6-K of Petrobras and Petrobras International Finance Company, furnished to the Securities and Exchange Commission on December 12, 2011 (File Nos. 001-15106 and 001-33121)).

|

|

4.10

|

Further Amended and Restated Deposit Agreement, dated as of January 2, 2020, among Petrobras, JPMorgan Chase Bank, N.A., as depositary, and registered holders and beneficial owners from time to time of the ADSs, representing the common shares of Petrobras, and Form of ADR evidencing ADSs representing the common shares of Petrobras.

|

|

4.11

|

Further Amended and Restated Deposit Agreement, dated as of January 2, 2020, among Petrobras, JPMorgan Chase Bank, N.A., as depositary, and registered holders and beneficial owners from time to time of the ADSs, representing the preferred shares of Petrobras, and Form of ADR evidencing ADSs representing the preferred shares of Petrobras.

|

|

4.12

|

Amended and Restated Sixth Supplemental Indenture, dated as of February 6, 2012, among Petrobras International Finance Company, Petrobras and The Bank of New York Mellon, as Trustee, relating to the 5.375% Global Notes due 2021 (incorporated by reference to Exhibit 4.2 to Form 6-K of Petrobras and Petrobras International Finance Company, furnished to the Securities and Exchange Commission on February 6, 2012 (File Nos. 001-15106 and 001-33121)).

|

|

4.13

|

Amended and Restated Seventh Supplemental Indenture, dated as of February 6, 2012, among Petrobras International Finance Company, Petrobras and The Bank of New York Mellon, as Trustee, relating to the 6.750% Global Notes due 2041 (incorporated by reference to Exhibit 4.5 to Form 6-K of Petrobras and Petrobras International Finance Company, furnished to the Securities and Exchange Commission on February 6, 2012 (File Nos. 001-15106 and 001-33121)).

|

|

4.14

|

Amended and Restated Guaranty for the 5.375% Global Notes due 2021, dated as of February 6, 2012, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.1 to Form 6-K of Petrobras and Petrobras International Finance Company, furnished to the Securities and Exchange Commission on February 6, 2012 (File Nos. 001-15106 and 001-33121)).

|

|

4.15

|

Amended and Restated Guaranty for the 6.750% Global Notes due 2041, dated as of February 6, 2012, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.4 to Form 6-K of Petrobras and Petrobras International Finance Company, furnished to the Securities and Exchange Commission on February 6, 2012 (File Nos. 001-15106 and 001-33121)).

|

|

4.16

|

Sixth Supplemental Indenture, dated as of February 10, 2012, among Petrobras International Finance Company, Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 2.11 to the Annual Report on Form 20-F of Petrobras and Petrobras International Finance Company, filed with the Securities and Exchange Commission on April 2, 2012 (File Nos. 001-15106 and 001-33121)).

|

|

4.17

|

Thirteenth Supplemental Indenture, dated as of February 10, 2012, among Petrobras International Finance Company, Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 2.60 to the Annual Report on Form 20-F of Petrobras and Petrobras International Finance Company, filed with the Securities and Exchange Commission on April 2, 2012 (File Nos. 001-15106 and 001-33121)).

|

|

4.18

|

Indenture, dated as of August 29, 2012, between Petrobras Global Finance B.V. and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.5 to the Registration Statement on Form F-3 of Petrobras, Petrobras International Finance Company and Petrobras Global Finance B.V., filed with the Securities and Exchange Commission on August 29, 2012 (File Nos. 333-183618, 333-183618-01 and 333-183618-02)).

|

|

4.19

|

Second Supplemental Indenture, dated as of October 1, 2012, among Petrobras Global Finance B.V., Petrobras, The Bank of New York Mellon, as Trustee, The Bank of New York Mellon, London Branch, as principal paying agent, and The Bank of New York Mellon (Luxembourg) S.A., as Luxembourg paying agent, relating to the 4.25% Global Notes due 2023 (incorporated by reference to Exhibit 4.5 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on October 1, 2012 (File No. 001-15106)).

|

|

4.20

|

Third Supplemental Indenture, dated as of October 1, 2012, among Petrobras Global Finance B.V., Petrobras, The Bank of New York Mellon, as Trustee, The Bank of New York Mellon, London Branch, as principal paying agent, and The Bank of New York Mellon (Luxembourg) S.A., as Luxembourg paying agent, relating to the 5.375% Global Notes due 2029 (incorporated by reference to Exhibit 4.8 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on October 1, 2012 (File No. 001-15106)).

|

|

4.21

|

Guaranty for the 4.25% Global Notes due 2023, dated as of October 1, 2012, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.4 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on October 1, 2012 (File No. 001-15106)).

|

|

4.22

|

Guaranty for the 5.375% Global Notes due 2029, dated as of October 1, 2012, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.7 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on October 1, 2012 (File No. 001-15106)).

|

|

4.23

|

Sixth Supplemental Indenture, dated as of May 20, 2013, between Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as Trustee, relating to the 4.375% Global Notes due 2023 (incorporated by reference to Exhibit 4.8 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 20, 2013 (File No. 001-15106)).

|

|

4.24

|

Seventh Supplemental Indenture, dated as of May 20, 2013, between Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as Trustee, relating to the 5.625% Global Notes due 2043 (incorporated by reference to Exhibit 4.11 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 20, 2013 (File No. 001-15106)).

|

|

4.25

|

Guaranty for the 4.375% Global Notes due 2023, dated as of May 20, 2013, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.7 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 20, 2013 (File No. 001-15106)).

|

|

4.26

|

Guaranty for the 5.625% Global Notes due 2043, dated as of May 20, 2013, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.10 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 20, 2013 (File No. 001-15106)).

|

|

4.27

|

Production Sharing Agreement, dated as of December 2, 2013, among Petrobras, Shell Brasil Petróleo Ltda., Total E&P do Brasil Ltda., CNODC Brasil Petróleo e Gás Ltda. and CNOOC Petroleum Brasil Ltda., the Brazilian Federal Government, Pré-Sal Petróleo S.A.—PPSA and the National Petroleum, Natural Gas and Biofuels Agency (incorporated by reference to the Annual Report on Form 20-F of Petrobras, filed with the Securities and Exchange Commission on April 30, 2014 (File No. 001-15106)).

|

|

4.28

|

Eleventh Supplemental Indenture, dated as of January 14, 2014, among Petrobras Global Finance B.V., Petrobras, The Bank of New York Mellon, as Trustee, The Bank of New York Mellon, London Branch, as principal paying agent, and The Bank of New York Mellon (Luxembourg) S.A., as Luxembourg paying agent, relating to the 3.750% Global Notes due 2021 (incorporated by reference to Exhibit 4.5 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on January 14, 2014 (File No. 001-15106)).

|

|

4.29

|

Twelfth Supplemental Indenture, dated as of January 14, 2014, among Petrobras Global Finance B.V., Petrobras, The Bank of New York Mellon, as Trustee, The Bank of New York Mellon, London Branch, as principal paying agent, and The Bank of New York Mellon (Luxembourg) S.A., as Luxembourg paying agent, relating to the 4.750% Global Notes due 2025 (incorporated by reference to Exhibit 4.8 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on January 14, 2014 (File No. 001-15106)).

|

|

4.30

|

Thirteenth Supplemental Indenture, dated as of January 14, 2014, among Petrobras Global Finance B.V., Petrobras, The Bank of New York Mellon, as Trustee, The Bank of New York Mellon, London Branch, as principal paying agent, and The Bank of New York Mellon (Luxembourg) S.A., as Luxembourg paying agent, relating to the 6.625% Global Notes due 2034 (incorporated by reference to Exhibit 4.11 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on January 14, 2014 (File No. 001-15106)).

|

|

4.31

|

Guaranty for the 3.750% Global Notes due 2021, dated as of January 14, 2014, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.4 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on January 14, 2014 (File No. 001-15106)).

|

|

4.32

|

Guaranty for the 4.750% Global Notes due 2025, dated as of January 14, 2014, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.7 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on January 14, 2014 (File No. 001-15106)).

|

|

4.33

|

Guaranty for the 6.625% Global Notes due 2034, dated as of January 14, 2014, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.10 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on January 14, 2014 (File No. 001-15106)).

|

|

4.34

|

Sixteenth Supplemental Indenture, dated as of March 17, 2014, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as Trustee, relating to the 6.250% Global Notes due 2024 (incorporated by reference to Exhibit 4.8 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on March 17, 2014 (File No. 001-15106)).

|

|

4.35

|

Seventeenth Supplemental Indenture, dated as of March 17, 2014, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as Trustee, relating to the 7.250% Global Notes due 2044 (incorporated by reference to Exhibit 4.11 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on March 17, 2014 (File No. 001-15106)).

|

|

4.36

|

Nineteenth Supplemental Indenture, dated as of March 17, 2014, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as Trustee, relating to the Floating Rate Global Notes due 2020 (incorporated by reference to Exhibit 4.17 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on March 17, 2014 (File No. 001-15106)).

|

|

4.37

|

Guaranty for the 6.250% Global Notes due 2024, dated as of March 17, 2014, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.7 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on March 17, 2014 (File No. 001-15106)).

|

|

4.38

|

Guaranty for the 7.250% Global Notes due 2044, dated as of March 17, 2014, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.10 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on March 17, 2014 (File No. 001-15106)).

|

|

4.39

|

Guaranty for the Floating Rate Global Notes due 2020, dated as of March 17, 2014, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.16 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on March 17, 2014 (File No. 001-15106)).

|

|

4.40

|

Seventh Supplemental Indenture, dated as of December 28, 2014, among Petrobras International Finance Company S.A., Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.1 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on January 15, 2015 (File No. 001-15106)).

|

|

4.41

|

Fourteenth Supplemental Indenture, dated as of December 28, 2014, among Petrobras International Finance Company S.A., Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.2 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on January 15, 2015 (File No. 001-15106)).

|

|

4.42

|

First Amendment to the Guaranties, dated as of December 28, 2014, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.3 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on January 15, 2015 (File No. 001-15106)).

|

|

4.43

|

Twentieth Supplemental Indenture, dated as of June 5, 2015, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as Trustee, relating to the 6.850% Global Notes due 2115 (incorporated by reference to Exhibit 4.2 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on June 5, 2015 (File No. 001-15106)).

|

|

4.44

|

Guaranty for the 6.850% Global Notes due 2115, dated as of June 5, 2015, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.1 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on June 5, 2015 (File No. 001-15106)).

|

|

4.45

|

Twenty-First Supplemental Indenture, dated as of May 23, 2016, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, relating to the 8.375% Global Notes due 2021 (incorporated by reference to Exhibit 4.2 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 23, 2016 (File No. 01-15106)).

|

|

4.46

|

Amended and Restated Twenty-First Supplemental Indenture, dated as of July 13, 2016, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, relating to the 8.375% Global Notes due 2021 (incorporated by reference to Exhibit 4.2 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on July 13, 2016 (File No. 01-15106)).

|

|

4.47

|

Twenty-Second Supplemental Indenture, dated as of May 23, 2016, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, relating to the 8.750% Global Notes due 2026 (incorporated by reference to Exhibit 4.5 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 23, 2016 (File No. 01-15106)).

|

|

4.48

|

Amended and Restated Twenty-Second Supplemental Indenture, dated as of July 13, 2016, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, relating to the 8.750% Global Notes due 2026 (incorporated by reference to Exhibit 4.5 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on July 13, 2016 (File No. 01-15106)).

|

|

4.49

|

Twenty-Third Supplemental Indenture, dated as of January 17, 2017, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, relating to the 6.125% Global Notes due 2022 (incorporated by reference to Exhibit 4.2 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on January 17, 2017 (File No. 01-15106)).

|

|

4.50

|

Twenty-Fourth Supplemental Indenture, dated as of January 17, 2017, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, relating to the 7.375% Global Notes due 2027 (incorporated by reference to Exhibit 4.5 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on January 17, 2017 (File No. 01-15106)).

|

|

4.51

|

Guaranty for the 8.375% Global Notes due 2021, dated as of May 23, 2016, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.1 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 23, 2016 (File No. 01-15106)).

|

|

4.52

|

Amended and Restated Guaranty for the 8.375% Global Notes due 2021, dated as of July 13, 2016, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.1 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on July 13, 2016 (File No. 01-15106)).

|

|

4.53

|

Guaranty for the 8.750% Global Notes due 2026, dated as of May 23, 2016, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.4 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 23, 2016 (File No. 01-15106)).

|

|

4.54

|

Amended and Restated Guaranty for the 8.750% Global Notes due 2026, dated as of July 13, 2016, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.4 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on July 13, 2016 (File No. 01-15106)).

|

|

4.55

|

Amended and Restated Guaranty for the 6.125% Global Notes due 2022, dated as of May 22, 2017, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.1 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 22, 2017 (File No. 01-15106)).

|

|

4.56

|

Amended and Restated Guaranty for the 7.375% Global Notes due 2027, dated as of May 22, 2017, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.4 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 22, 2017 (File No. 01-15106)).

|

|

4.57

|

Amended and Restated Twenty-Third Supplemental Indenture, dated as of January 17, 2017, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, relating to the 6.125% Global Notes due 202 (incorporated by reference to Exhibit 4.2 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 22, 2017 (File No. 01-15106)).

|

|

4.58

|

Amended and Restated Twenty-Fourth Supplemental Indenture, dated as of May 22, 2017, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, relating to the 7.375% Global Notes due 2027 (incorporated by reference to Exhibit 4.5 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 22, 2017 (File No. 01-15106)).

|

|

4.59

|

Amended and Restated Seventeenth Supplemental Indenture, dated as of May 22, 2017, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as Trustee, relating to the 7.250% Global Notes due 2044 (incorporated by reference to Exhibit 4.8 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 22, 2017 (File No. 01-15106)).

|

|

4.60

|

Indenture, dated as of September 27, 2017, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as trustee, relating to the 5.299% Global Notes due 2025.

|

|

4.61

|

Indenture, dated as of September 27, 2017, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as trustee, relating to the 5.999% Global Notes due 2028.

|

|

4.62

|

Guaranty for the 5.299% Global Notes due 2025, dated as of September 27, 2017, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.96 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on July 27, 2018 (File No. 333-226375)).

|

|

4.63

|

Guaranty for the 5.999% Global Notes due 2028, dated as of September 27, 2017, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.97 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on July 27, 2018 (File No. 333-226375)).

|

|

4.64

|

Twenty-Fifth Supplemental Indenture, dated as of February 1, 2018, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, relating to the 5.750% Global Notes due 2029 (incorporated by reference to Exhibit 4.2 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on February 1, 2018 (File No. 001-15106)).

|

|

4.65

|

Guaranty for the 5.750% Global Notes due 2029, dated as of February 1, 2018, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.1 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on February 1, 2018 (File No. 001-15106)).

|

|

4.66

|

Indenture, dated as of August 28, 2018 between Petrobras and The Bank of New York, as Trustee (incorporated by reference to Exhibit 4.3 to the Registration Statement of Petrobras and Petrobras Global Finance on Form F-3, filed with the Securities and Exchange Commission on August 28, 2018 (File Nos. 333-227087 and 333-227087-01)).

|

|

4.67

|

Indenture, dated as of August 28, 2018 between Petrobras Global Finance B.V. and The Bank of New York, as Trustee (incorporated by reference to Exhibit 4.4 to the Registration Statement of Petrobras and Petrobras Global Finance B.V. on Form F-3, filed with the Securities and Exchange Commission on August 28, 2018 (File Nos. 333-227087 and 333-227087-01)).

|

|

4.68

|

Amended And Restated Guaranty for the 5.750% Global Notes due 2029, dated as of March 19, 2019, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.1 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on March 19, 2019 (File No. 001-15106).

|

|

4.69

|

Amended And Restated Twenty-Fifth Supplemental Indenture for the 5.750% Global Notes due 2029, dated as of March 19, 2019, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.2 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on March 19, 2019 (File No. 001-15106).

|

|

4.70

|

Guaranty for the 6.90% Global Notes due 2049, dated as of March 19, 2019, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.5 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on March 19, 2019 (File No. 001-15106).

|

|

4.71

|

First Supplemental Indenture for the 6.90% Global Notes due 2049, dated as of March 19, 2019, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.6 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on March 19, 2019 (File No. 001-15106).

|

|

4.72

|

Amended and Restated Guaranty of the Amended and Restated Guaranty of the 7.250% Global Notes due 2044, dated as of March 17, 2014, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.7 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on May 22, 2017 (File No. 001-15106)).

|

|

4.73*

|

Guaranty for the 5.093% Global Notes Due 2030, dated as of September 18, 2019, between Petrobras and The Bank of New York Mellon, as Trustee.

|

|

4.74*

|

Form of 5.093% Global Notes due 2030.

|

|

4.75*

|

Indenture, dated September 18, 2019, by and among PGF, Petrobras, the Trustee and The Bank of New York Mellon SA/NV, Luxembourg Branch.

|

|

4.76*

|

Exchange and Registration Rights Agreement, dated as of September 18, 2019, among Petrobras Global Finance B.V., Petrobras, Citigroup Global Markets Inc., Credit Agricole Securities (USA) Inc., HSBC Securities (USA) Inc., Mizuho Securities USA LLC, Morgan Stanley & Co. LLC and Santander Investment Securities Inc.

|

|

4.77

|

Second Supplemental Indenture for the 5.600% Global Notes due 2031, dated as of June 3, 2020, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.2 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on June 3, 2020 (File No. 001-15106).

|

|

4.78

|

Guaranty

for the 5.600% Global Notes Due 2031, dated as of June 3, 2020, between Petrobras and The Bank of New York Mellon, as

Trustee (incorporated by reference to Exhibit 4.1 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on

June 3, 2020 (File No. 001-15106).

|

|

4.79

|

Third Supplemental Indenture for the 6.750% Global Notes due 2050, dated as of June 3, 2020, among Petrobras Global Finance B.V., Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.5 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on June 3, 2020 (File No. 001-15106).

|

|

4.80

|

Guaranty for the 6.750% Global Notes Due 2050, dated as of June 3, 2020, between Petrobras and The Bank of New York Mellon, as Trustee (incorporated by reference to Exhibit 4.4 to Form 6-K of Petrobras, furnished to the Securities and Exchange Commission on June 3, 2020 (File No. 001-15106).

|

|

5.1*

|

Opinion of Cleary Gottlieb Steen & Hamilton LLP, special New York counsel to Petrobras Global Finance B.V. and Petrobras.

|

|

5.2*

|

Opinion of Ms. Taísa Oliveira Maciel, General Counsel of Petrobras.

|

|

5.3*

|

Opinion of NautaDutilh N.V., special Dutch counsel to Petrobras Global Finance B.V.

|

|

10.1 P

|

Form of Concession Agreement for Exploration, Development and

Production of crude oil and natural gas executed between Petrobras and the ANP (incorporated by reference to Exhibit 10.1 of Petrobras’

Registration Statement on Form F-1 filed with the Securities and Exchange Commission on July 14, 2000 (File No. 333-12298)).

This was a paper filing, and is

not available on the SEC website.

|

|

10.2 P

|

Purchase and Sale Agreement of natural gas, executed between

Petrobras and Yacimientos Petroliferous Fiscales Bolivianos-YPFB (together with and English version) (incorporated by reference

to Exhibit 10.2 to Petrobras’ Registration Statement on Form F-1 filed with the Securities and Exchange Commission on July 14,

2000 (File No. 333-12298)). This was a paper filing, and is not available on the SEC website.

Until the moment seven GSA Additives

have been concluded since its celebration on August 16, 1996, so the GSA remains in force.

|

* Previously filed.

** Filed herewith.

(b) Financial Statement Schedules

All schedules have

been omitted because they are not required or are not applicable, or the information is included in the financial statements or

notes thereto.

(c) Not applicable.

(a) The undersigned registrants hereby

undertake:

|

1.

|

To file, during any period in which offers or sales are being made, a post-effective amendment

to this registration statement:

|

|

|

(i)

|

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933 (the “Securities

Act”);

|

|

|

|

|

|

|

(ii)

|

To reflect in the prospectus any facts arising after the effective date of the registration statement

(or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in

the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the

low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and

Exchange Commission (the “Commission”) pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price

represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement; and

|

|

|

|

|

|

|

(iii)

|

To include any material information with respect to the plan of distribution not previously disclosed

in the registration statement or any material change to such information set forth in the registration statement.

|

provided,

however, that the undertakings set forth in paragraphs (i), (ii) and (iii) above do not apply if the information required

to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission

by Petrobras pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

that are incorporated by reference in this registration statement or is contained in a form of prospectus filed pursuant to Rule

424(b) that is part of this registration statement.

|

2.

|

That, for the purpose of determining any liability under the Securities Act, each such post-effective

amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

|

|

3.

|

To remove from registration by means of a post-effective amendment any of the securities being

registered which remain unsold at the termination of the offering.

|

|

|

|

|

4.

|

In the case of Petrobras, to file a post-effective amendment to this registration statement to

include any financial statements required by Item 8.A. of Form 20-F at the start of any delayed offering or throughout a continuous

offering. Financial statements and information otherwise required by Section 10(a)(3) of the Securities Act need not be furnished;

provided that Petrobras includes in the prospectus, by means of a post-effective amendment, financial statements required pursuant

to this paragraph (a)(4) and other information necessary to ensure that all other information in the prospectus is at least current

as the date of those financial statements. Notwithstanding the foregoing, a post-effective amendment need not be filed to include

financial statements and information required by Section 10(a)(3) of the Securities Act of 1933 or Item 8.A. of Form 20-F if such

financial statements and information are contained in periodic reports filed with or furnished to the Commission by Petrobras pursuant

to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this registration statement.

|

|

|

|

|

5.

|

That, for the purpose of determining liability under the Securities Act to any purchaser

|

|

|

(i)

|

Each prospectus filed by the registrants pursuant to Rule 424(b)(3) shall be deemed to be part

of the registration statement as of the date

the filed prospectus was deemed part of and included in the registration statement; and

|

|

|

|

|

|

|

(ii)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of the

registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the

purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and included

in this registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date

of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability

purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date

of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof; provided, however, that

no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated

or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will,

as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made

in the registration statement or prospectus that was part of the registration statement or made in any such document immediately

prior to such effective date.

|

|

6.

|

That, for the purpose of determining liability of the registrants under the Securities Act to any

purchaser in the initial distribution of the securities, the undersigned registrants undertake that in a primary offering of securities

of the undersigned registrants pursuant to this registration statement, regardless of the underwriting method used to sell the

securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications,

the undersigned registrants will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

|

|

|

(i)

|

Any preliminary prospectus or prospectus of the undersigned registrants relating to the offering

required to be filed pursuant to Rule 424;

|

|

|

|

|

|

|

(ii)

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned

registrants or used or referred to by the undersigned registrants;

|

|

|

(iii)

|

The portion of any other free writing prospectus relating to the offering containing material information

about the undersigned registrants or their securities provided by or on behalf of the undersigned registrants; and

|

|

|

|

|

|

|

(iv)

|

Any other communication that is an offer in the offering made by the undersigned registrants to

the purchaser.

|

|

7.

|

That, for purposes of determining any liability under the Securities Act, each filing of Petrobras’s

annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit

plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration

statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

|

|

8.

|

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to

directors, officers and controlling persons of the registrants pursuant to the foregoing provisions, or otherwise, the registrants

have been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities

Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment

by the registrants of expenses incurred or paid by a director, officer or controlling person of the registrants in the successful

defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities

being registered, the registrants will, unless in the opinion of their counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification is against public policy as expressed in

the Securities Act and will be governed by the final adjudication of such issue.

|

|

|

|

|

9.

|

(i) To respond to requests for information that is incorporated by reference into the prospectus

pursuant to Items 4, 10(b), 11 or 13 of this Form, within one business day of receipt of such request, and to send the incorporated

documents by first class mail or other equally prompt means, and (ii) to arrange or provide for a facility in the United States

for the purpose of responding to such requests. The undertaking in subparagraph (i) above includes information contained in

documents filed subsequent to the effective date of this registration statement through the date of responding to the request.

|

|

|

|

|

10.

|

To supply by means of a post-effective amendment all information concerning a transaction and the

company being acquired involved therein, that was not the subject of and included in the registration statement when it became

effective.

|

SIGNATURE

PAGE OF PETROBRAS GLOBAL FINANCE B.V.

Pursuant to the requirements

of the Securities Act of 1933, the registrant has duly caused this Amendment no. 1 to the Registration Statement to be signed on

its behalf by the undersigned, thereunto duly authorized, in Rio de Janeiro, Brazil on July 28, 2020.

|

|

PETROBRAS GLOBAL FINANCE B.V.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Guilherme Rajime Takhashi Saraiva

|

|

|

Name:

|

Guilherme Rajime Takhashi Saraiva

|

|

|

Title:

|

Managing Director A

|

|

|

PETROBRAS GLOBAL FINANCE B.V.

|

|

|

|

|

|

|

|

|

By:

|

/s/ João Lossio Pereira

dos Reis

|

|

|

Name:

|

Joao Lossio Pereira dos Reis

|

|

|

Title:

|

Managing Director B

|

Pursuant to the requirements

of the Securities Act of 1933, this Amendment no.1 to the Registration Statement has been signed by the following persons in the

indicated capacities as indicated below on July 28, 2020, in respect of Petrobras Global Finance B.V.

|

Signature

|

|

Title

|

|

|

|

|

|

/s/ Guilherme Rajime Takhashi Saraiva

|

|

|

|

Guilherme Rajime Takahashi

Saraiva

|

|

Managing Director A

|

|

|

|

|

|

/s/ João Lossio Pereira dos Reis

|

|

|

|

João Lossio

Pereira dos Reis

|

|

Managing Director B

|

|

|

|

|

|

/s/ Donald

J. Puglisi

|

|

|

|

PUGLISI & ASSOCIATES

|

|

Authorized Representative in the United States

|

SIGNATURE PAGE OF PETRÓLEO BRASILEIRO

S.A. — PETROBRAS

Pursuant to the requirements

of the Securities Act of 1933, the registrant has duly caused this Amendment no. 1 to the Registration Statement to be signed on

its behalf by the undersigned, thereunto duly authorized, in Rio de Janeiro, Brazil on July 28, 2020.

|

|

PETRÓLEO BRASILEIRO S.A. — PETROBRAS

|

|

|

|

|

|

By:

|

*

|

|

|

|

Roberto da Cunha Castello-Branco

|

|

|

|

Chief Executive Officer

|

|

|

|

|

|

PETRÓLEO BRASILEIRO S.A.

— PETROBRAS

|

|

|

|

|

|

By:

|

*

|

|

|

|

Andrea Marques de Almeida

|

|

|

|

Chief Financial Officer and Chief Investor Relations Officer

|

|

*By:

|

/s/ Larry Carris Cardoso

|

|

|

|

Name:

|

Larry Carris Cardoso

|

|

|

|

Title:

|

Attorney-in-Fact

|

|

|

|

|

Pursuant to powers of attorney previously filed

|

|

Pursuant to the requirements

of the Securities Act of 1933, this Amendment no. 1 to the Registration Statement has been signed by the following persons in the

capacities indicated below on July 28, 2020, in respect of Petróleo Brasileiro S.A.—Petrobras.

|

Signature

|

|

Title

|

|

|

|

|

|

*

|

|

|

|

Roberto da Cunha Castello Branco

|

|

Chief Executive Officer and

Member of the Board of Directors

|

|

|

|

|

|

*

|

|

|

|

Andrea Marques de Almeida

|

|

Chief Financial Officer and

Chief Investor Relations Officer

|

|

|

|

|

|

*

|

|

|

|

Rodrigo

Araújo Alves

|

|

Chief Accounting and Tax Officer

|

|

|

|

|

|

*

|

|

|

|

Eduardo Bacellar Leal Ferreira

|

|

Chairman of the Board of Directors

|

|

|

|

|

|

*

|

|

|

|

Danilo Ferreira da Silva

|

|

Member of the Board of Directors

|

|

|

|

|

|

*

|

|

|

|

JOÃO

COX

NETO

|

|

Member of the Board of Directors

|

|

|

|

|

|

|

|

|

|

Nivio Ziviani

|

|

Member of the Board of Directors

|

|

|

|

|

|

|

|

|

|

Marcelo Mesquita de

Siqueira Filho

|

|

Member of the Board of Directors

|

|

|

|

|

|

*

|

|

|

|

Sônia Júlia Sulzbeck Villalobos

|

|

Member of the Board of Directors

|

|

|

|

|

|

*

|

|

|

|

Walter

Mendes de Oliveira Filho

|

|

Member of the Board of Directors

|

|

|

|

|

|

|

|

|

|

Maria

Cláudia Mello Guimarães

|

|

Member of the Board of Directors

|

|

|

|

|

|

/s/ Donald J. Puglisi

|

|

|

|

PUGLISI & ASSOCIATES

|

|

Authorized Representative in the United States

|

|

*By:

|

/s/ Larry Carris Cardoso

|

|

|

|

Name:

|

Larry Carris Cardoso

|

|

|

|

Title:

|

Attorney-in-Fact

|

|

|

|

|

Pursuant to powers of attorney previously filed

|

|

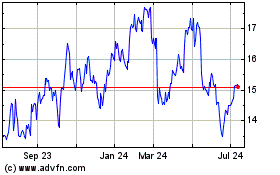

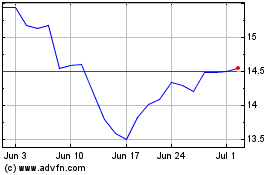

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024