UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities

Exchange Act of 1934

For

the month of July, 2020

Commission

File Number 1-15106

PETRÓLEO

BRASILEIRO S.A. – PETROBRAS

(Exact

name of registrant as specified in its charter)

Brazilian

Petroleum Corporation – PETROBRAS

(Translation

of Registrant's name into English)

Avenida

República do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

_______ No___X____

Highlights on production and sales

in 2Q20

Rio de Janeiro, July 21st, 2020

– In a challenging context, we presented solid operational performance in 2Q20. The preventive measures against COVID-19

demanded a reduction in the number of shifts in our operations, in which we have been working with 50% of the regular staff.

In view of this new scenario for the

oil and gas industry, we decided to mothball 62 platforms that operate in shallow waters, as prices do not cover variable costs.

Despite the sharp drop in demand at

the end of March and in April, the average production of oil, NGL and natural gas in 2Q20 was 2.802 MMboed, 6.4% higher than in

2Q19 and only 3.7% below 1Q20. This result was made possible by the company's quick reaction to the challenges imposed by the global

recession caused by the pandemic.

In April, integrated logistics and marketing

initiatives allowed exports to grow, offsetting the reduction in domestic fuel demand. We reached a record for oil exports of 1

million barrels per day.

Reinforcing our commitment to the health

of our employees and our service providers, we operate with a restricted number of people on board, prioritizing only essential

services in order to keep our operational activities safe. Due to these restrictions, there was a postponement in the interconnection

of new wells, commissioning of new units and maintenance stoppages, which will resume in September this year, following expectations

of regularization of activities, whose impacts for 2020 are projected in our Strategic Plan released in December 2019. Therefore,

we keep our production target for 2020 of 2.7 MMboed, with a variation of 2.5% up or down.

Another important achievement was starting

up the P-70 platform in the midst of the pandemic, with the first oil from the Atapu Field, in the eastern portion of the Santos

Basin pre-salt, close to the Búzios field, being extracted on June 25. The reservoir comprises the fields of Oeste de Atapu,

Atapu and a portion of the Government's non-contracted area, and we hold an 89% stake. P-70 will contribute to increase the growth

in the production of oil equivalent in the pre-salt, whose participation grew from 63% in 1Q20 to 66% in 2Q20, becoming increasingly

relevant for Petrobras and Brazil. The FPSO has the capacity to process up to 150 thousand barrels of oil a day and treat up to

6 million m³ of natural gas.

The platforms installed in Búzios

field (P-74, P-75, P-76 and P-77), in the Santos Basin pre-salt, reached new production records on July 13, with daily production

of 674 kbpd of oil and 844 kboed of oil and gas. By maximizing the use of the units' installed capacity and interconnecting only

four to five wells per platform, supported by the high production potential of the wells and the reservoir, we managed to increase

the oil production capacity in the four units, reaching average production 168 kbpd per platform. The Búzios field, discovered

in 2010 and whose rights to explore and produce the Transfer of Rights surplus were acquired by Petrobras in November 2019, is

the largest deepwater oil field in the world. It is a world-class asset, with substantial reserves, low risk, low lifting cost

and resilient to challenging scenarios.

We also reached the mark of 1 billion

barrels of oil produced in the Parque das Baleias area, which adds to the list of fields that have already reached this level of

accumulated production (Marlim, Marlim Sul, Roncador and Tupi Area). The Parque das

Baleias area, comprising the fields

of Jubarte, Baleia Anã, Cachalote, Caxaréu and Pirambú, in the Campos Basin, on the coast of Espírito

Santo, had its first oil in 2002 and was the area in which the 1st well in Brazilian pre- salt started production in 2008.

Still in 2Q20, we continued to prioritize

production in deep and ultra-deep waters, concluding the divestment of the Macau cluster and, in line with our commitment to the

Low Carbon and Sustainability Agenda, we reached a new monthly record for the use of natural gas, with the 97.7% threshold reached

in April, against an average of 97% in 2019.

In the refining business, production

was significantly impacted by the reduction in demand, mainly in April, when the utilization factor of our refineries reached 59%.

Optimizations were carried out at our refineries in order to adapt the output of oil by-products to variations in demand, seeking

to maximize profitability in the refining system. As a result, we prioritized the production of bunker and fuel oil, which enabled

us to achieve records in fuel oil exports in May and, as domestic consumption recovered, we were readjusting the mix, allowing

the refining utilization to return to pre-pandemic levels, reaching 74% and 78%, in May and June, respectively.

In this context, the Digital Twins Project

stands out, with the implementation of digital technology in refineries to support decision-making, which increased efficiency,

optimizing processes. Digital Twins is already implemented in eleven refineries: REFAP, REPAR, RECAP, RPBC, REVAP, REPLAN, REDUC,

REGAP, RNEST, LUBNOR and REMAN. In 2019 we had a gain of US$ 66 million and the forecast for 2020 is up to US$ 154 million.

In April Petrobras exported the equivalent

of 30.4 million barrels (more than 1 million barrels per day), thus establishing the new monthly record for the volume of oil exported.

The previous record had been set in December 2019, with an average of 771,000 barrels per day. In the quarter, physical exports

totaled 74 million barrels. The export of these representative volumes enabled us to act quickly in the management of oil inventories,

and, as a consequence, in the resumption of oil production earlier than expected, completely removing restrictions on oil production

due to demand issues in the last days of April.

Oil by-products exports rose 22% compared

to 1Q20, especially in May, when we exported 290 kbpd, mainly of low sulfur fuel oil streams. This performance demonstrates Petrobras'

strong presence in the international market.

In June, REPLAN reached a production

record of 31 kbpd of low sulfur fuel oil, 24% higher than the previous record of 25 kbpd. June was also marked by the resumption

of operations of a distillation unit (U-200A) and a catalytic cracking unit (U-220), to meet the increased market demand for oil

by-products. With the return of these units, REPLAN resumed its capacity to process 434 thousand barrels of oil per day, the largest

in our refining system. In addition, there was a record of S10 diesel production, a high value-added product, in June 2020.

Following up on our commitments, we

have successfully completed tests for coprocessing diesel with refined soybean oil at REPAR. Based on the test results, the technical

feasibility of the technology is confirmed, establishing an easier-to-implement alternative for capturing opportunities in the

renewable diesel market with businesses integrated with Petrobras' refining system, whether in existing units, taking advantage

of the current capacity in co-processing, or in units that may be designed for specific production of green diesel. Unlike biodiesel,

green diesel does not have double bonds, oxygen and contaminants such as glycerins and metallic compounds. Thus, the use of green

diesel is more environmentally friendly and meets the limits of vehicle

emissions that will be adopted

from 2022/2023. We emphasize that the economic viability of this initiative depends on the recognition of green diesel for the

purpose of meeting biodiesel mandates.

In relation to sales, demand for diesel

and gasoline recovered in May and June compared to the previous two months, which were impacted by social distancing measures.

As a result, we had an increase in sales and market share in these products in the period.

REDUC reached 16.8 thousand tons of

asphalt sold in June 2020, an increase of 42.5% in relation to May and 120.8% in relation to the same month of the previous year.

This is the refinery's best mark in selling this product since 2013.

Regarding the new gasoline specification,

our refining system is already prepared to produce it, in compliance with the regulations of the National Petroleum, Natural Gas

and Biofuels Agency (ANP), which will come into force in August 2020. The new specification will bring the quality of the fuel

sold in Brazil closer to that of the American and European markets. The intrinsic quality of this gasoline will increase in terms

of octanes and specific mass, resulting in a more efficient fuel and better protection for vehicle engines. This will allow a reduction

in gasoline consumption per kilometer traveled.

In the Gas and Power segment, June had

a recovery in the volume of domestic gas made available to the market, with a 10% growth compared to May. As to total volumes,

the growth in June was 14% in relation to May. Total supply was 61.5 MM m³ / day in June against 53.9 MM m³ / day in

the previous month.

The expansion in demand was felt mainly

in sales to the non-thermoelectric sector, with volume growing from 28.1 MM m³ / day in May to 31.2 MM m³ / day in June,

representing a 21% growth compared to April, the worst month since 2005.

Also due to the pandemic, Petrobras

triggered fortuitous cases or force majeure clauses in contracts for the purchase of natural gas, both imported and domestic, guaranteeing

a minimum volume of gas to supply the market in the period of reduced demand.

Additionally, with the objective of

preserving the integrity of the value chain, there were negotiations between Petrobras and natural gas distributors and carriers

in order to minimize the impacts of the pandemic for the parties.

1 - Exploration & Production

|

|

|

|

|

|

|

Variation (%)

|

|

Thousand barrels of oil equivalent per day (kboed)

|

2Q20

|

1Q20

|

2Q19

|

6M20

|

6M19

|

2Q20 / 1Q20

|

2Q20 / 2Q19

|

6M20 / 6M19

|

|

Crude oil, NGL and natural gas - Brazil

|

2.757

|

2.856

|

2.553

|

2.806

|

2.507

|

(3,5)

|

8,0

|

11,9

|

|

Crude oil and NGLs (Kbpd)

|

2.245

|

2.320

|

2.052

|

2.282

|

2.012

|

(3,2)

|

9,4

|

13,4

|

|

Onshore

|

108

|

114

|

122

|

111

|

126

|

(5,3)

|

(11,5)

|

(11,9)

|

|

Shallow water

|

37

|

43

|

62

|

40

|

69

|

(14,0)

|

(40,3)

|

(42,0)

|

|

Post-salt - deep and ultra deep

|

573

|

620

|

700

|

596

|

715

|

(7,6)

|

(18,1)

|

(16,6)

|

|

Pre-salt

|

1.527

|

1.543

|

1.168

|

1.535

|

1.102

|

(1,0)

|

30,7

|

39,3

|

|

Natural gas (Kboed)

|

512

|

536

|

500

|

524

|

495

|

(4,5)

|

2,4

|

5,9

|

|

Crude oil, NGL and natural gas - Abroad

|

45

|

54

|

81

|

49

|

79

|

(16,7)

|

(44,4)

|

(38,0)

|

|

Total (Kboed)

|

2.802

|

2.909

|

2.633

|

2.856

|

2.586

|

(3,7)

|

6,4

|

10,4

|

|

Total - commercial (Kboed)

|

2.474

|

2.606

|

2.377

|

2.540

|

2.339

|

(5,1)

|

4,1

|

8,6

|

Average production of oil, NGL and natural

gas in 2Q20 was 2,802 kboed, which corresponds to a commercial production of 2,474 kboed. Thus, in comparison with 1Q20, we had

a reduction of 3.7% and 5.1%, respectively, mainly due to the impacts arising from the COVID-19 pandemic, which resulted in: (a)

mothballing of platforms that operate in shallow waters and are not resilient to low oil prices, (b) temporary interruption of

production in the FPSOs Cidade de Santos, Cidade de Angra dos Reis and Cidade de Mangaratiba, in Santos Basin and FPSO Capixaba,

in Campos Basin and (c) drop in demand, more pronounced in April, with recovery in May and June. Despite the difficulties faced,

we managed to keep oil production in Brazil at the planned level.

In 2Q20, production in the pre-salt

fields was 1% lower than the previous quarter, which reflects the impacts of reduced production, especially in May, with the stoppage

of production in the Tupi area, for disinfection in the FPSOs Cidade Angra dos Reis, from May 5 to 17, and Cidade de Mangaratiba,

from April 30 to May 10, and the delay in solving operational problems whose maintenance lasted longer than expected due to the

people on board restrictions resulting from COVID -19, mainly on P-67 and P-74. These events were partially offset by lower scheduled

maintenance stoppages in 2Q20 compared to 1Q20.

We also highlight important milestones

reached in the pre-salt in 2Q20, with the start-up of production of the P-70 platform, in Atapu field and the growth of production

in Búzios field, which reached a new record on July 13, with a daily production of 674 kbpd and 844 kboed.

The production in deep and ultra-deep

waters in the post-salt in 2Q20 was 7.6% lower than the previous quarter. We had temporary production stoppages at FPSO Cidade

de Santos, between April 8 and 17, and FPSO Capixaba, which started on April 9, both for disinfecting the units, with a combined

impact on the average production of 55 kboed. The latter, accounting for 35 kboed, remains with the wells closed after we successfully

negotiated the temporary suspension of the contract with the chartering company, the result of one of the initiatives of the resilience

plan that we adopted to face the pandemic. The platform will start operating already in 3Q20 and the contract suspension period

is being used by the charterer to carry out works on the platform in order to increase operational efficiency.

Onshore oil production totaled 108

kbpd in 2Q20, a reduction of 6 kbpd in relation to the previous quarter. This reduction was due to the sale of assets at Macau

Cluster, restrictions on gas processing plants for health reasons, due to the COVID-19 pandemic, and the natural decline in production,

leading to a reduction in oil and gas production.

Oil production in shallow water, non-core

assets and the object of divestment, was 37 kbpd in 2Q20, a reduction of 6 kbpd when compared to 1Q20, due to the mothballing of

62 platforms, as disclosed in March 2020, offset by the resumption of production in the PCE-1 and PPM-1 platforms, after scheduled

maintenance stoppages in 1Q20.

2 - Refining

|

|

|

|

|

|

|

Variation (%)

|

|

Operational (kbpd)

|

2Q20

|

1Q20

|

2Q19

|

6M20

|

6M19

|

2Q20 / 1Q20

|

2Q20 / 2Q19

|

6M20 / 6M19

|

|

Total production volume

|

1.642

|

1.836

|

1.765

|

1.739

|

1.753

|

(10,6)

|

(7,0)

|

(0,8)

|

|

Total sales volume

|

1.497

|

1.630

|

1.745

|

1.563

|

1.741

|

(8,2)

|

(14,2)

|

(10,2)

|

|

Reference feedstock

|

2.176

|

2.176

|

2.176

|

2.176

|

2.176

|

−

|

−

|

−

|

|

Refining plants utilization factor (%)

|

70%

|

79%

|

76%

|

75%

|

76%

|

(9,0)

|

(6,0)

|

(1,0)

|

|

Processed feedstock (excluding LNG)

|

1.529

|

1.715

|

1.665

|

1.622

|

1.651

|

(10,8)

|

(8,2)

|

(1,8)

|

|

Processed feedstock

|

1.575

|

1.763

|

1.707

|

1.669

|

1.690

|

(10,7)

|

(7,7)

|

(1,2)

|

|

Domestic crude oil as % of total

processed feedstock

|

94%

|

91%

|

89%

|

93%

|

90%

|

3,0

|

5,0

|

3,0

|

Processed feedstock in 2Q20 was 1,575 kbpd, with

a utilization factor of 70% and total production of oil by-products of 1,642 kbpd, representing, respectively, a reduction of 10.7%

in the processed feedstock and 10.6% in total production of oil by-products, compared to 1Q20. Although the average utilization

factor for the quarter was 70%, at the end of June we had already returned to 78%, a level equivalent to 1Q20.

Virtually all oil by-products had their production

reduced in 2Q20, when compared to 1Q20, due to the drop in demand due to the effects of COVID-19, especially jet fuel (-81.5%),

gasoline (-19.4%) and diesel (-2,4%). The month of April was the most affected, reflecting the actions of containment and social

isolation due to the pandemic.

At the end of 1Q20, we carried out stoppages in

some units in order to adjust the refining system to the sales scenario. Throughout 2Q20, we had a gradual return from the main

distillation and conversion units, with the feedstock adjusted to the most recent sales scenario.

2.1- Diesel

|

|

|

|

|

|

|

Variation (%)

|

|

thousand barrels per day (kbpd)

|

2Q20

|

1Q20

|

2Q19

|

6M20

|

6M19

|

2Q20 / 1Q20

|

2Q20 / 2Q19

|

6M20 / 6M19

|

|

Production volume

|

650

|

666

|

720

|

658

|

700

|

(2,4)

|

(9,7)

|

(6,0)

|

|

Sales volume for the Brazilian market

|

633

|

610

|

732

|

621

|

715

|

3,8

|

(13,5)

|

(13,1)

|

Diesel production

in 2Q20 was 2.4% lower than 1Q20, despite the impacts of COVID-19, in view of the increased demand from distributors, which had

reduced inventories in March, in addition to seasonal factors. The greatest decrease in production occurred in April, when refineries

operated at 59% of their capacity, with diesel production reduced to 542 kbpd. As of May, sales recovered.

In June, we

reached a record production of 335 kbpd in S-10 diesel, especially in REPLAN and REPAR. In May, REFAP also achieved record production

of S-10 diesel.

2.2 - Gasoline

|

|

|

|

|

|

|

Variation (%)

|

|

thousand barrels per day (kbpd)

|

2Q20

|

1Q20

|

2Q19

|

6M20

|

6M19

|

2Q20 / 1Q20

|

2Q20 / 2Q19

|

6M20 / 6M19

|

|

Production volume

|

290

|

360

|

388

|

325

|

389

|

(19,4)

|

(25,3)

|

(16,5)

|

|

Sales volume for the Brazilian market

|

282

|

330

|

367

|

306

|

376

|

(14,5)

|

(23,2)

|

(18,6)

|

The volume

of gasoline production decreased by 19.4% in 2Q20 compared to 1Q20, mainly due to lower sales in the domestic market, driven by

the effects of COVID-19 on the consumption of this fuel. Lower sales caused a reduction in the operational activities of catalytic

cracking units (FCC) throughout the refining system, including FCC unit stops at REPLAN and REGAP, in April and May, and REMAN

throughout the period (return is expected in January 2021).

2.3 – Fuel Oil

|

|

|

|

|

|

|

Variation (%)

|

|

thousand barrels per day (kbpd)

|

2Q20

|

1Q20

|

2Q19

|

6M20

|

6M19

|

2Q20 / 1Q20

|

2Q20 / 2Q19

|

6M20 / 6M19

|

|

Production volume

|

286

|

295

|

176

|

290

|

187

|

(3,1)

|

62,5

|

55,1

|

|

Sales volume for the Brazilian market

|

36

|

41

|

38

|

38

|

42

|

(12,2)

|

(5,3)

|

(9,5)

|

Fuel oil production decreased 3.1% in

2Q20 when compared to 1Q20, reflecting the lower oil processed in our refineries due to the lower consumption of fuels in the domestic

market due to COVID-19. However, production in 2Q20 was 62.5% higher than 2Q19, due to the capture of opportunities in the foreign

market, arising from the new quality specifications for bunker by IMO.

In June, there was a monthly record

of bunker production, fuel oil with low sulfur content used in ships, for the second consecutive month at REPLAN. The refinery

reached 31 kbpd, 24% higher than the previous record recorded in May, of 25 kbpd.

Sales of fuel oil in the domestic market

in 2Q20 decreased by 12.2% compared to 1Q20, mainly due to the reduction in bunker demand as a result of COVID-19 in foreign trade.

2.4- Naphta

|

|

|

|

|

|

|

Variation (%)

|

|

thousand barrels per day (kbpd)

|

2Q20

|

1Q20

|

2Q19

|

6M20

|

6M19

|

2Q20 / 1Q20

|

2Q20 / 2Q19

|

6M20 / 6M19

|

|

Production volume

|

120

|

116

|

82

|

118

|

76

|

3,4

|

46,3

|

55,3

|

|

Sales volume for the Brazilian market

|

129

|

136

|

85

|

132

|

88

|

(5,1)

|

51,8

|

50,0

|

Naphtha production

increased 3.4% in 2Q20 compared to 1Q20, mainly due to the lower use of naphtha streams for gasoline production. Although they

have fallen due to the impacts of COVID-19, sales continue to be much higher than last year due to increased demand by Braskem

in 2020.

2.5- Liquefied Petroleum Gas (LPG)

|

|

|

|

|

|

|

Variation (%)

|

|

thousand barrels per day (kbpd)

|

2Q20

|

1Q20

|

2Q19

|

6M20

|

6M19

|

2Q20 / 1Q20

|

2Q20 / 2Q19

|

6M20 / 6M19

|

|

Production volume

|

124

|

124

|

122

|

124

|

120

|

−

|

1,6

|

3,3

|

|

Sales volume for the Brazilian market

|

242

|

220

|

232

|

231

|

224

|

10,0

|

4,3

|

3,1

|

In 2Q20, LPG production remained stable when compared

to 1Q20 and 2Q19. Despite the reduction in activities at the catalytic cracking units in the refining, LPG production was not impacted,

due to the reduction in gasoline production caused by the drop in demand.

Sales in 2Q20 were higher than in 1Q20 due to the

increased consumption of this oil by-product in the residential segment, caused by social isolation measures. The supply of the

LPG market was guaranteed based on operational measures at refineries and gas treatment units, complemented by imports.

2.6- Jet Fuel

|

|

|

|

|

|

|

Variation (%)

|

|

thousand barrels per day (kbpd)

|

2Q20

|

1Q20

|

2Q19

|

6M20

|

6M19

|

2Q20 / 1Q20

|

2Q20 / 2Q19

|

6M20 / 6M19

|

|

Production volume

|

20

|

108

|

105

|

64

|

109

|

(81,5)

|

(81,0)

|

(41,3)

|

|

Sales volume for the Brazilian market

|

21

|

112

|

114

|

66

|

120

|

(81,3)

|

(81,6)

|

(45,0)

|

Jet fuel production

was the most impacted by the effects of COVID-19 in 2Q20, being 81.5% lower when compared to 1Q20, due to the significant drop

in the air transport market caused by the restrictions imposed by the pandemic, with strong retraction in the international and

domestic segments.

3 - Gas & Power

|

|

|

|

|

|

|

Variation (%)

|

|

Operational

|

2Q20

|

1Q20

|

2Q19

|

6M20

|

6M19

|

2Q20 / 1Q20

|

2Q20 / 2Q19

|

6M20 / 6M19

|

|

Sales in Regulated Contracting Environment - Average MW

|

2.404

|

2.404

|

2.788

|

2.404

|

2.788

|

−

|

(13,8)

|

(13,8)

|

|

Sales in Free Contracting Environment and internal consumption - Average MW

|

678

|

758

|

1.194

|

718

|

1.173

|

(10,6)

|

(43,2)

|

(38,8)

|

|

Generation of electricity - average MW

|

1.074

|

1.679

|

975

|

1.377

|

1.686

|

(36,0)

|

10,2

|

(18,3)

|

|

Spot prices SE / CO - R$/MWh

|

75

|

189

|

131

|

132

|

208

|

(60,3)

|

(42,7)

|

(36,5)

|

|

National gas delivery (MM m³/day)

|

44

|

47

|

49

|

45

|

50

|

(6,4)

|

(10,2)

|

(10,0)

|

|

Regasification of liquefied natural gas (MM m³/day)

|

−

|

7

|

8

|

3

|

8

|

(98,0)

|

(98,3)

|

(62,5)

|

|

Import of natural gas (MM m³/day)

|

12

|

20

|

13

|

16

|

15

|

(40,0)

|

(7,7)

|

6,7

|

|

Sales volume of natural gas - MM m³/day

|

56

|

72

|

69

|

64

|

72

|

(22,2)

|

(18,8)

|

(11,1)

|

Electricity

generation was 1,074 average MW in 2Q20, a 36% reduction compared to 1Q20. This reduction can be explained, mainly, by the decrease

in spot prices, due to the improvement of hydrological conditions and decrease in energy consumption.

Sales in the

Free Contracting Environment fell between 2Q20 and 1Q20 mainly due to the lower internal energy consumption in our units. It is

worth mentioning that the drop in the volume of Sales in the Regulated Contracting Environment and in the Free Contracting Environment

between 2020 and 2019 was due to the end of the terms of energy commercialization contracts at the end of 2019.

The volume

of of natural gas sales was 56.0 MM m³/day in 2Q20, representing a drop of 22.2% compared to 1Q20 (72 MM m³/day). These

reductions are explained by the lower demands of the thermoelectric and non-thermoelectric segments. The drop in natural gas thermoelectric

dispatch was 36.3%, with the volume going from 22.6 MM m³/day, in 1Q20, to 14.4 MM m³/day, in 2Q20. The drop in the volume

of natural gas supplied to the non-thermoelectric segment in 2Q20, compared to 1Q20, was 20.9%, going from 35.9 MM m³/day

to 28.4 MM m³/day.

The effects

of the COVID-19 pandemic were felt in March, with a more marked reduction in the volumes of natural gas traded in April and May

and signs of recovery in June. Due to this drop in demand, there was a need to reduce the production of natural gas in some E&P

units and there was virtually no LNG imports in 2Q20.

The drop in

demand in 2Q20 also reduced the imports of Bolivian natural gas, made possible by the transition agreement under the natural gas

supply contract with YPFB (Yacimientos Petrolíferos Fiscales Bolivianos), signed on 3/6/2020, with a reduction in the total

contracted volume from 30 MM m³/day to 20 MM m³/day and a minimum withdrawal commitment (take or pay) of 14 MM m³/day.

There was also a declaration of force majeure by Petrobras due to the COVID-19 pandemic, allowing the withdrawal volume to be reduced

to 12 MM m³/day in 2Q20.

Exhibit I: Consolidated Sales Volume

|

|

|

|

|

|

|

Variation %

|

|

Sales volume (kbpd)

|

2Q20

|

1Q20

|

2Q19

|

6M20

|

6M19

|

2Q20 / 1Q20

|

2Q20 / 2Q19

|

6M20 / 6M19

|

|

Diesel

|

633

|

610

|

732

|

621

|

715

|

3,8

|

(13,5)

|

(13,1)

|

|

Gasoline

|

282

|

330

|

367

|

306

|

376

|

(14,5)

|

(23,2)

|

(18,6)

|

|

Fuel oil

|

36

|

41

|

38

|

38

|

42

|

(12,2)

|

(5,3)

|

(9,5)

|

|

Naphtha

|

129

|

136

|

85

|

132

|

88

|

(5,1)

|

51,8

|

50,0

|

|

LPG

|

240

|

220

|

232

|

231

|

223

|

9,1

|

3,4

|

3,6

|

|

Jet Fuel

|

21

|

112

|

114

|

66

|

120

|

(81,3)

|

(81,6)

|

(45,0)

|

|

Others

|

154

|

181

|

156

|

168

|

156

|

(14,9)

|

(1,3)

|

7,7

|

|

Total oil products

|

1.495

|

1.630

|

1.724

|

1.562

|

1.720

|

(8,3)

|

(13,3)

|

(9,2)

|

|

Alcohols, nitrogenous, renewable and others

|

7

|

8

|

7

|

7

|

11

|

(12,5)

|

−

|

(36,4)

|

|

Natural gas

|

236

|

316

|

323

|

276

|

330

|

(25,3)

|

(26,9)

|

(16,4)

|

|

Total domestic market

|

1.738

|

1.954

|

2.054

|

1.845

|

2.061

|

(11,1)

|

(15,4)

|

(10,5)

|

|

Exports of petroleum, oil products and other

|

962

|

1.031

|

606

|

996

|

635

|

(6,8)

|

58,6

|

56,9

|

|

Sales of international units

|

127

|

88

|

67

|

108

|

118

|

44,3

|

89,6

|

(8,5)

|

|

Total external market

|

1.088

|

1.119

|

673

|

1.104

|

753

|

(2,8)

|

61,7

|

46,6

|

|

Grand total

|

2.826

|

3.073

|

2.727

|

2.949

|

2.814

|

(8,0)

|

3,6

|

4,8

|

Exhibit II: Net imports and exports

|

|

|

|

|

|

|

Variation (%)

|

|

Thousand barrels per day (kbpd)

|

2Q20

|

1Q20

|

2Q19

|

6M20

|

6M19

|

2Q20 / 1Q20

|

2Q20 / 2Q19

|

6M20 / 6M19

|

|

Net export (import)

|

823

|

747

|

217

|

785

|

267

|

10,2

|

279,3

|

194,0

|

|

Import

|

139

|

284

|

389

|

211

|

366

|

(51,1)

|

(64,3)

|

(42,4)

|

|

Petroleum

|

22

|

168

|

189

|

95

|

184

|

(86,9)

|

(88,4)

|

(48,4)

|

|

Diesel

|

−

|

9

|

51

|

4

|

60

|

−

|

−

|

(93,3)

|

|

Gasoline

|

3

|

26

|

36

|

15

|

31

|

(88,5)

|

(91,7)

|

(51,6)

|

|

Naphtha

|

14

|

24

|

14

|

19

|

14

|

(41,7)

|

−

|

35,7

|

|

GLP

|

99

|

49

|

85

|

74

|

65

|

102,0

|

16,5

|

13,9

|

|

Other oil products

|

1

|

8

|

14

|

4

|

12

|

(87,5)

|

(92,9)

|

(66,7)

|

|

Export

|

962

|

1031

|

606

|

996

|

633

|

(6,7)

|

58,7

|

57,4

|

|

Petroleum

|

688

|

806

|

416

|

747

|

455

|

(14,6)

|

65,4

|

64,2

|

|

Fuel oil

|

195

|

174

|

129

|

185

|

122

|

12,1

|

51,2

|

51,6

|

|

Other oil products

|

79

|

51

|

61

|

64

|

56

|

54,9

|

29,5

|

14,3

|

In 2Q20, net

exports increased by 76 kbpd compared to 1Q20 (due to the 145 kbpd drop in imports of oil and oil by-products), driven by the reduction

in demand from the domestic market. In addition, we strongly focused our efforts to export oil and oil by-products, due to the

drop in demand in the domestic market, caused by the effects of COVID-19. We reached a monthly oil export record of 1,025 kbpd

in June, as a result of the April physical export record. The time difference is explained by the fact that the main destination

of our exports is the Asian market, taking around 60 days for the product to reach its destination and to be recorded in the results.

Disclaimer

This release includes forward-looking

that are subject to risks and uncertainties. The forward-looking statements, which address the Company’s expected business

and financial performance, among other matters, contain words such as “believe,” “expect,” “estimate,”

“anticipate,” “optimistic,” “intend,” “plan,” “aim,” “will,”

“may,” “should,” “could,” “would,” “likely,” and similar expressions.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which

they are made. There is no assurance that the expected events, trends or results will actually occur. We undertake no obligation

to publicly update or revise any forward-looking statements, whether as a result of new information or future events or for any

other reason. The amounts informed for 3Q19 on are estimates. The operational data contained in this release is not audited by

the independent auditor.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: July 21, 2020

PETRÓLEO BRASILEIRO

S.A—PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea

Marques de Almeida

Chief Financial Officer

and Investor Relations Officer

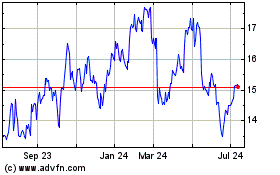

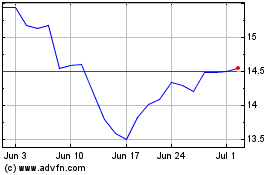

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024