Report of Foreign Issuer (6-k)

July 06 2020 - 6:32AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2020

Commission File Number 1-15106

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

(Exact name of registrant as specified in its charter)

Brazilian Petroleum Corporation – PETROBRAS

(Translation of Registrant's name into English)

Avenida República do Chile, 65

20031-912 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras on Severance Programs

—

Rio de Janeiro, July 2, 2020 –Petróleo Brasileiro S.A. – Petrobras, following up on the release disclosed on April 8, 2020, hereby updates the market on the Voluntary Severance Programs (PDVs) and Incentive Retirement Program (PAI) implemented by the company as part of its resilience actions aimed at maximizing value generation for shareholders.

In addition to the PAI, a severance program aimed at employees eligible for retirement effective until 12/31/2023, the company also implemented three other PDVs: (i) PDV 2019 for employees that retired under the INSS (Brazilian Social Security) according to the PEC 133 of 2019; (ii) PDV specific to employees allocated to assets/units under divestment process; (iii) PDV exclusive for employees working in the company's corporate segment.

PDV 2019, the program with the highest number of eligible employees, was the first to end the employee enrollment cycle on June 30 this year. To date, the package of programs has met a great employees adhesion and is being considered a success by Petrobras' CEO, Roberto Castello Branco. “The Voluntary Severance Programs were designed to respect the free choice our employees. The result of PDV 2019 was extremely positive with 94% adhesion, from the 10,053 eligible employees, we had 9,405 registered. Consolidating the other programs, we reached 10,082 registrations, which represents 22% of the current workforce. So, we are contributing to the permanent reduction of the company's cost structure, which will help us to successfully face a scenario of lower oil prices in the long term”

Petrobras estimates a reduction in personnel costs by 2025 of R$ 4 billion per year with the withdrawal of the 10,082 enrolled in the programs. The additional return (avoided personnel cost of R$ 22 billion minus the disbursement with the compensations of R$ 4 billion) will be approximately R$ 18 billion by 2025.

It should be noted that the expected impact of the indemnities on the company's cash flow will not be immediate in 2020, but rather diluted over the next three years. This is because at PDV 2019, there are categories with an expected outflow of up to 24 months, which will dilute the outflow over time. In addition, the company has chosen to defer the payment of the indemnities in two installments, one at the time of withdrawal and the other in July 2021 or one year after withdrawal, whichever is greater.

Petrobras reaffirms its commitment to transparency and respect for all its employees. These measures seek to maximize shareholder value and are aligned with the company's five strategic pillars: (a) maximizing return on capital employed; (b) reduction of the cost of capital; (c) relentless search for low costs; (d) meritocracy; (e) respect for people and the environment and focus on the safety of its operations.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS | Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. República do Chile, 65 – 1803 – 20031-912 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes", "expects", "predicts", "intends", "plans", "projects", "aims", "should," and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore, future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: July 2, 2020

PETRÓLEO BRASILEIRO S.A—PETROBRAS

By: /s/ Andrea Marques de Almeida

______________________________

Andrea Marques de Almeida

Chief Financial Officer and Investor Relations Officer

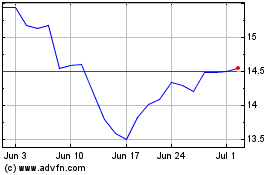

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

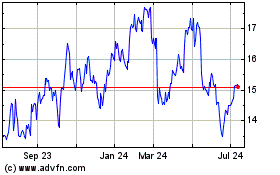

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024