Pediatrix Medical Group, Inc. (NYSE: MD), the nation’s leading

provider of highly specialized health care for women, children and

babies, today reported earnings from continuing operations of $0.35

per share for the three months ended September 30, 2022. On a

non-GAAP basis, Pediatrix reported Adjusted EPS from continuing

operations of $0.40.

For the 2022 third quarter, Pediatrix reported the following

results from continuing operations:

- Net revenue of $490 million;

- Income from continuing operations of $29 million; and

- Adjusted EBITDA of $58 million.

“We are disappointed in our third-quarter operating results,

which reflected operational challenges in billing and collections

and modest headwinds in volumes and payor mix,” said Mark S. Ordan,

Chief Executive Officer of Pediatrix Medical Group. “We have taken

significant steps to address what we have identified as priority

areas for enhanced resources and processes in revenue cycle

management. We have also executed internal plans that will benefit

our corporate cost structure beginning in the fourth quarter.

Combined, we intend for these steps to position us for improving

revenue and bottom-line performance. To assist our efforts, R1, as

our revenue cycle partner, is providing enhanced support in a

variety of ways to help effectuate our expected improvement, which

is incorporated in our updated outlook for 2022 Adjusted

EBITDA.”

Operating Results from Continuing Operations – Three Months

Ended September 30, 2022

Pediatrix’s net revenue for the three months ended September 30,

2022 was $489.9 million, compared to $492.9 million for the

prior-year period. Pediatrix’s overall same-unit revenue decreased

by 3.2 percent, partially offset by revenue growth driven by net

acquisition activity.

Same-unit revenue from net reimbursement-related factors

declined by 3.5 percent for the 2022 third quarter as compared to

the prior-year period. This net decrease primarily reflects the

impact of certain revenue cycle management transition activities

and a modest decline in the percentage of services reimbursed by

commercial and other non-government payors compared to the

prior-year period, partially offset by increases in contract and

administrative fees. The percentage of services reimbursed by

commercial and other non-government payors declined by

approximately 120 basis points compared to the prior-year

period.

Same-unit revenue attributable to patient volume increased by

0.3 percent for the 2022 third quarter as compared to the

prior-year period, with growth in other pediatric services,

primarily newborn nursery, maternal-fetal medicine, pediatric

cardiology and other pediatric services partially offset by

declines in neonatology services. Shown below are year-over-year

percentage changes in certain same-unit volume statistics for the

three and nine months ended September 30, 2022. (Note: figures in

the below table reflect contributions only to net patient service

revenue and exclude other contributions to total same-unit revenue,

including contract and administrative fees.)

Three Months Ended September

30, 2022

Nine Months Ended September

30, 2022

Hospital-based patient services

(0.6)%

0.8%

Office-based patient services

3.5%

2.8%

Neonatology services (within

hospital-based services):

Total births

(0.8)%

0.9%

Neonatal intensive care unit (NICU)

days

(1.4)%

0.2%

For the 2022 third quarter, practice salaries and benefits

expense was $342.9 million, compared to $328.8 million for the

prior-year period. This increase primarily reflects same-unit

clinical compensation increases, as well as salary increases

related to acquisitions completed over the past year, partially

offset by decreases in incentive compensation expense.

For the 2022 third quarter, general and administrative expenses

were $57.9 million, as compared to $66.9 million for the prior-year

period. The net decrease of $9.0 million is primarily related to

cost reductions from net staffing reductions, lower incentive

compensation expense based on operating results and a net savings

in revenue cycle management expenses.

For the third quarter of 2022, transformational and

restructuring related expenses totaled $1.0 million, compared to

$4.2 million for the third quarter of 2021. The expense recorded

during the third quarter of 2022 related predominantly to contract

terminations and modest consulting fees.

Adjusted EBITDA from continuing operations, which is defined as

earnings from continuing operations before interest, taxes,

depreciation and amortization, and transformational and

restructuring related expenses, was $58.3 million for the 2022

third quarter, compared to $73.4 million for the prior-year

period.

Depreciation and amortization expense was $9.0 million for the

third quarter of 2022 compared to $8.2 million for the third

quarter of 2021.

Investment and other income was $0.6 million for the third

quarter of 2022, compared to $1.7 million for the third quarter of

2021. This decrease primarily reflects the reimbursement received

in the prior year period related to the transition services

provided to the buyer of one of the Company’s divested medical

groups.

Interest expense was $9.5 million for the third quarter of 2022

compared to $17.6 million for the third quarter of 2021. This

decrease reflects lower total debt and lower interest rates from

the Company’s previously-disclosed refinancing transactions

completed during the first quarter of 2022.

Pediatrix generated income from continuing operations of $28.8

million, or $0.35 per diluted share, for the 2022 third quarter,

based on a weighted average 82.8 million shares outstanding. This

compares with income from continuing operations of $31.8 million,

or $0.37 per diluted share, for the 2021 third quarter, based on a

weighted average 86.1 million shares outstanding. The decrease in

weighted average shares outstanding is related to the share

repurchases completed during 2022.

For the third quarter of 2022, Pediatrix reported Adjusted EPS

from continuing operations of $0.40, compared to $0.46 for the

third quarter of 2021. For these periods, Adjusted EPS from

continuing operations is defined as diluted income from continuing

operations per common and common equivalent share excluding

non-cash amortization expense, stock-based compensation expense,

transformational and restructuring related expenses, and discrete

tax events.

Operating Results from Continuing Operations – Nine Months Ended

September 30, 2022

For the nine months ended September 30, 2022, Pediatrix

generated revenue from continuing operations of $1.46 billion,

compared to $1.41 billion for the prior-year period. Adjusted

EBITDA from continuing operations for the nine months ended

September 30, 2022 was $174.5 million, compared to $184.4 million

for the prior year. Pediatrix generated income from continuing

operations of $38.6 million, or $0.45 per share, for the nine

months ended September 30, 2022, based on a weighted average 84.8

million shares outstanding, which compares to income from

continuing operations of $67.7 million, or $0.79 per share, based

on a weighted average 85.8 million shares outstanding for the first

nine months of 2021. For the nine months ended September 30, 2022,

Pediatrix reported Adjusted EPS from continuing operations of

$1.20, compared to $1.11 in the same period of 2021.

Financial Position and Cash Flow – Continuing Operations

Pediatrix had cash and cash equivalents of $8.7 million at

September 30, 2022, compared to $387.4 million on December 31,

2021, and net accounts receivable were $294.4 million. As

previously disclosed, during the first quarter of 2022 the Company

used cash on hand, together with proceeds from the new issuance of

debt, to redeem its $1.0 billion in outstanding principal amount of

6.25% Senior Notes due 2027 and pay related fees and expenses.

For the third quarter of 2022, Pediatrix generated cash from

continuing operations of $88.4 million, compared to $67.2 million

for the third quarter of 2021. During the third quarter of 2022,

the Company used $21.5 million to fund the repurchase of 1.1

million shares under the Company’s previously announced repurchase

program and $6.9 million to fund capital expenditures.

At September 30, 2022, Pediatrix had total debt outstanding of

$739 million, consisting of its $400 million in 5.375% Senior Notes

due 2030; $244 million in borrowings under its Term A Loan; and $95

million in borrowings under its revolving line of credit.

Non-GAAP Measures

A reconciliation of Adjusted EBITDA from continuing operations

and Adjusted EPS from continuing operations to the most directly

comparable GAAP measures for the three and nine months ended

September 30, 2022 and 2021 is provided in the financial tables of

this press release.

2022 Outlook

Pediatrix anticipates that its 2022 Adjusted EBITDA, as defined

above, will be in a range of $240 million to $245 million. This

outlook reflects Adjusted EBITDA for the first nine months of 2022

of $174.5 million.

Earnings Conference Call

Pediatrix will host an investor conference call to discuss the

quarterly results at 9 a.m., ET today. The conference call Webcast

may be accessed from the Company’s Website, www.pediatrix.com. A

telephone replay of the conference call will be available from

12:45 p.m. ET today through midnight ET November 18, 2022 by

dialing 866.207.1041, access Code 5783034. The replay will also be

available at www.pediatrix.com.

ABOUT PEDIATRIX MEDICAL GROUP

Pediatrix® Medical Group, Inc. (NYSE:MD) is the nation’s leading

provider of physician services. Pediatrix-affiliated clinicians are

committed to providing coordinated, compassionate and clinically

excellent services to women, babies and children across the

continuum of care, both in hospital settings and office-based

practices. Specialties include obstetrics, maternal-fetal medicine

and neonatology complemented by more than 20 pediatric

subspecialties, as well as a newly expanded area of pediatric

primary and urgent care clinics. The group’s high-quality,

evidence-based care is bolstered by significant investments in

research, education, quality-improvement and safety initiatives.

The physician-led company was founded in 1979 as a single

neonatology practice and today provides its highly specialized and

often critical care services through more than 4,800 affiliated

physicians and other clinicians in 37 states and Puerto Rico. To

learn more about Pediatrix, visit www.pediatrix.com or follow us on

Facebook, Instagram, LinkedIn, Twitter and the Pediatrix blog.

Investment information can be found at

www.pediatrix.com/investors.

Certain statements and information in this press release may be

deemed to contain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995, Section 27A

of the Securities Act of 1933, as amended (the “Securities Act”),

and Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements may include, but are not limited to,

statements relating to the Company’s objectives, plans and

strategies, and all statements, other than statements of historical

facts, that address activities, events or developments that we

intend, expect, project, believe or anticipate will or may occur in

the future. These statements are often characterized by terminology

such as “believe,” “hope,” “may,” “anticipate,” “should,” “intend,”

“plan,” “will,” “expect,” “estimate,” “project,” “positioned,”

“strategy” and similar expressions, and are based on assumptions

and assessments made by the Company’s management in light of their

experience and their perception of historical trends, current

conditions, expected future developments and other factors they

believe to be appropriate. Any forward-looking statements in this

press release are made as of the date hereof, and the Company

undertakes no duty to update or revise any such statements, whether

as a result of new information, future events or otherwise.

Forward-looking statements are not guarantees of future performance

and are subject to risks and uncertainties. Important factors that

could cause actual results, developments, and business decisions to

differ materially from forward-looking statements are described in

the Company’s most recent Annual Report on Form 10-K and its

Quarterly Reports on Form 10-Q, including the sections entitled

“Risk Factors”, as well the Company’s current reports on Form 8-K,

filed with the Securities and Exchange Commission, and include the

impact of the Company’s name change; the impact of the COVID-19

pandemic on the Company and its financial condition and results of

operations; the effects of economic conditions on the Company’s

business; the effects of the Affordable Care Act and potential

changes thereto or a repeal thereof; the Company’s relationships

with government-sponsored or funded healthcare programs, including

Medicare and Medicaid, and with managed care organizations and

commercial health insurance payors; the impact of surprise billing

legislation and its implementation; the Company’s ability to comply

with the terms of its debt financing arrangements; the Company’s

transition to a third-party revenue cycle management provider; the

impact of the divestiture of the Company’s anesthesiology and

radiology medical groups; the impact of management transitions; the

timing and contribution of future acquisitions; the effects of

share repurchases; and the effects of the Company’s transformation

initiatives, including its reorientation on, and growth strategy

for, its pediatrics and obstetrics business.

Pediatrix Medical Group,

Inc.

Consolidated Statements of

Income

(in thousands, except per

share data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

Net revenue

$

489,915

$

492,949

$

1,458,177

$

1,412,661

Operating expenses:

Practice salaries and benefits

342,850

328,759

1,016,762

964,806

Practice supplies and other operating

expenses

31,857

26,122

90,189

72,516

General and administrative expenses

57,888

66,892

180,340

204,376

Gain on sale of building

—

—

—

(7,280

)

Depreciation and amortization

8,956

8,151

26,500

24,288

Transformational and restructuring related

expenses

977

4,232

7,736

19,042

Total operating expenses

442,528

434,156

1,321,527

1,277,748

Income from operations

47,387

58,793

136,650

134,913

Investment and other income

617

1,686

2,336

11,829

Interest expense

(9,516

)

(17,595

)

(29,743

)

(52,119

)

Loss on early extinguishment of debt

—

—

(57,016

)

(14,532

)

Equity in earnings of unconsolidated

affiliate

371

550

1,319

1,622

Total non-operating expenses

(8,528

)

(15,359

)

(83,104

)

(53,200

)

Income from continuing operations before

income taxes

38,859

43,434

53,546

81,713

Income tax provision

(10,051

)

(11,594

)

(14,982

)

(14,002

)

Income from continuing operations

28,808

31,840

38,564

67,711

Income (loss) from discontinued

operations, net of tax

1,920

(1,052

)

(1,892

)

15,716

Net income

30,728

30,788

36,672

83,427

Net loss attributable to noncontrolling

interest

—

7

4

21

Net income attributable to Pediatrix

Medical Group, Inc.

$

30,728

$

30,795

$

36,676

$

83,448

Per common and common equivalent share

data (diluted):

Income from continuing operations

$

0.35

$

0.37

$

0.45

$

0.79

Income (loss) from discontinued

operations

$

0.02

$

(0.01

)

$

(0.02

)

$

0.18

Net income attributable to Pediatrix

Medical Group, Inc.

$

0.37

$

0.36

$

0.43

$

0.97

Weighted average common shares

82,776

86,096

84,821

85,759

Pediatrix Medical Group,

Inc.

Reconciliation of Income from

Continuing Operations

to Adjusted EBITDA from

Continuing Operations Attributable to Pediatrix Medical Group,

Inc.

(in thousands)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2022

2021

2022

2021

Income from continuing operations

attributable to Pediatrix

$

28,808

$

31,847

$

38,568

$

67,732

Medical Group, Inc.

Interest expense

9,516

17,595

29,743

52,119

Gain on sale of building

—

—

—

(7,280

)

Loss on early extinguishment of debt

—

—

57,016

14,532

Income tax provision

10,051

11,594

14,982

14,002

Depreciation and amortization expense

8,956

8,151

26,500

24,288

Transformational and restructuring related

expenses

977

4,232

7,736

19,042

Adjusted EBITDA from continuing operations

attributable to

$

58,308

$

73,419

$

174,545

$

184,435

Pediatrix Medical Group, Inc.

Pediatrix Medical Group,

Inc.

Reconciliation of Diluted

Income from Continuing Operations per Share

to Adjusted Income from

Continuing Operations per Diluted Share (“Adjusted EPS”)

(in thousands, except per

share data)

(Unaudited)

Three Months Ended September

30,

2022

2021

Weighted average diluted shares

outstanding

82,776

86,096

Income from continuing operations and

diluted income from continuing operations per share attributable to

Pediatrix Medical Group, Inc.

$

28,808

$

0.35

$

31,847

$

0.37

Adjustments (1):

Amortization (net of tax of $554 and

$583)

1,662

0.02

1,749

0.02

Stock-based compensation (net of tax of

$1,030 and $1,374)

3,090

0.03

4,121

0.05

Transformational and restructuring

expenses (net of tax of $244 and $1,058)

733

0.01

3,174

0.03

Net impact from discrete tax events

(1,083

)

(0.01

)

(901

)

(0.01

)

Adjusted income and diluted EPS from

continuing operations attributable to Pediatrix Medical Group,

Inc.

$

33,210

$

0.40

$

39,990

$

0.46

(1) A blended tax rate of 25% was

used to calculate the tax effects of the adjustments for the three

months ended September 30, 2022 and 2021.

Nine Months Ended September

30,

2022

2021

Weighted average diluted shares

outstanding

84,821

85,759

Income from continuing operations and

diluted income from continuing operations per share attributable to

Pediatrix Medical Group, Inc.

$

38,568

$

0.45

$

67,732

$

0.79

Adjustments (1):

Amortization (net of tax of $1,635 and

$2,049)

4,907

0.06

6,149

0.07

Stock-based compensation (net of tax of

$3,223 and $3,737)

9,668

0.12

11,210

0.13

Transformational and restructuring

expenses (net of tax of $1,934 and $4,760)

5,802

0.07

14,282

0.16

Gain on sale of building (net of tax of

$1,820)

—

—

(5,460

)

(0.06

)

Loss on early extinguishment of debt (net

of tax of $14,254 and $3,633)

42,762

0.50

10,899

0.13

Net impact from discrete tax events

(297

)

—

(9,484

)

(0.11

)

Adjusted income and diluted EPS from

continuing operations attributable to Pediatrix Medical Group,

Inc.

$

101,410

$

1.20

$

95,328

$

1.11

- A blended tax rate of 25% was used to calculate the tax effects

of the adjustments for the three months ended September 30, 2022

and 2021.

Pediatrix Medical Group,

Inc.

Balance Sheet

Highlights

(in thousands)

(Unaudited)

As of September 30,

2022

As of December 31,

2021

Assets:

Cash and cash equivalents

$

8,668

$

387,391

Investments

91,396

99,715

Accounts receivable, net

294,351

301,775

Income taxes receivable

9,729

14,249

Other current assets

19,563

37,434

Intangible assets, net

19,534

21,565

Operating and finance lease right-of-use

assets

69,346

65,461

Goodwill, other assets, property and

equipment

1,819,370

1,794,956

Total assets

$

2,331,957

$

2,722,546

Liabilities and equity:

Accounts payable and accrued expenses

$

306,460

$

394,118

Total debt, including finance leases,

net

745,923

1,004,748

Operating lease liabilities

68,213

61,080

Other liabilities

352,694

365,908

Total liabilities

1,473,290

1,825,854

Total equity

858,667

896,692

Total liabilities and equity

$

2,331,957

$

2,722,546

Pediatrix Medical Group,

Inc.

Reconciliation of Income from

Continuing Operations

to Forward-Looking Adjusted

EBITDA from Continuing Operations Attributable to Pediatrix Medical

Group, Inc.

(in thousands)

(Unaudited)

Year Ended December 31,

2022

Income from continuing operations

attributable to Pediatrix Medical Group, Inc.

$

70,000

$

74,000

Interest expense

39,000

38,500

Loss on early extinguishment of debt

57,000

57,000

Income tax provision

28,700

30,200

Depreciation and amortization expense

35,000

35,000

Transformational and restructuring related

expenses

10,300

10,300

Adjusted EBITDA from continuing operations

attributable to Pediatrix Medical Group, Inc.

$

240,000

$

245,000

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221103005417/en/

Charles Lynch Senior Vice President, Finance and Strategy

954-384-0175, x 5692 charles.lynch@pediatrix.com

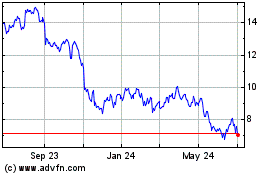

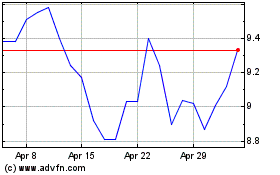

Pediatrix Medical (NYSE:MD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pediatrix Medical (NYSE:MD)

Historical Stock Chart

From Apr 2023 to Apr 2024