Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

April 28 2023 - 11:13AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April

2023

PEARSON plc

(Exact

name of registrant as specified in its charter)

N/A

(Translation

of registrant's name into English)

80 Strand

London, England WC2R 0RL

44-20-7010-2000

(Address

of principal executive office)

Indicate

by check mark whether the Registrant files or will file annual

reports

under

cover of Form 20-F or Form 40-F:

Form

20-F

X

Form 40-F

Indicate

by check mark whether the Registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934

Yes

No X

Pearson 2023 Q1 Trading Update (Unaudited)

|

28th April

2023

|

Pearson delivered another quarter of strong performance,

reinforcing business momentum and strategic progress

|

Highlights

|

●

|

Underlying sales growth excluding

OPM1 and

Strategic Review2 of

6%.

|

|

●

|

Performance in each of Pearson's divisions in line with or ahead of

our expectations.

|

|

●

|

Strong progress executing our strategic priorities, including

further portfolio reshaping with the sale of OPM and completion of

PDRI acquisition.

|

|

●

|

On track for delivery of £120m of cost efficiencies this

year.

|

|

●

|

Remain on track to achieve our 2023 guidance.

|

|

●

|

Intention to commence a buyback to repurchase £300m of shares

in the second half of 2023.

|

|

Andy Bird, Pearson's Chief

Executive, said:

"Pearson has had a strong start to the year with results ahead of

our expectations. This ongoing momentum is testament to our

increasingly interconnected, consumer-focused, and innovative

approach alongside relentless commercial execution. We delivered

double-digit sales growth in our enterprise facing businesses,

reflecting our strategy to address the upskilling and reskilling

opportunity around the world. With our new talent investment

platform on track to be launched later this year, this progress

reinforces our belief that partnerships with enterprises will be a

strong driver of future growth. Our continuing outperformance and

the proven resilience of our business underpins our confidence of

delivering on our financial expectations for the full year and over

the medium term."

|

Underlying sales growth of 6%,

excluding OPM1 and

Strategic Review2;

2% in aggregate

|

●

|

Assessment & Qualifications sales grew 6% driven by strong

growth in Pearson VUE. This was due to the strength of Pearson VUE

volumes, particularly in the nursing and IT certification sectors.

Our extensive breadth of testing options, strong market position,

and high quality delivery of licensure and certification exams,

will continue to be a key driver of our performance going

forward.

|

|

●

|

Virtual Learning sales decreased 14%, driven by an expected 35%

decrease in OPM1.

Virtual Schools declined 2%, supported by good retention rates and

the return of a school that had previously left, offset by

enrolment declines for the 2022/23 academic year and lower district

partnership renewals.

|

|

●

|

English Language Learning sales increased 66%. As expected, the

strong growth is primarily due to an outstanding contribution

from Pearson Test of English due to an improvement in global

mobility versus the same period last year as well as increased

market share in India and a temporary increase in skilled visa

allocations in Australia. We also saw a strong performance in

our Institutional business.

|

|

●

|

Workforce Skills sales grew 8%, driven by double-digit growth in

Workforce Solutions, and continued growth in Vocational

Qualifications. Sales are expected to build throughout the year,

supported by the launch of the talent investment platform later

this year.

|

|

●

|

Higher Education sales were down 5%, as expected, including the

anticipated deferral of Pearson+ sales into Q2 this year due to a

revenue recognition shift.

|

|

●

|

Sales in businesses under Strategic Review2 decreased

50% as expected.

|

Strong execution across strategic initiatives

|

●

|

Completed acquisition of PDRI, significantly expanding Pearson's

services to U.S. federal government. This acquisition unlocks

synergies between Pearson and PDRI, whilst also expanding Pearson

VUE's reach in a key strategic area.

|

|

●

|

Agreement to dispose of OPM business, further focusing Pearson's

portfolio towards future growth opportunities.

|

|

●

|

On track to deliver £120m of cost efficiencies in

2023.

|

|

●

|

In February, Pearson's PTE language test received approval for

Canadian Economic Immigration.

|

|

●

|

Pearson+ continues to show strong performance of paid subscriptions

this Spring semester, growing threefold versus Spring

2022.

|

|

●

|

After the successful beta test of our Channels service in Pearson+,

we began a targeted pricing test in April. We now have 18 academic

channels and we recently introduced tech and soft skills classes,

further enhancing Pearson's focus on learning for

work.

|

Strong financial position

|

●

|

Pearson's financial position remains robust, with low net debt and

strong liquidity.

|

Share buyback

|

●

|

Intention to commence a buyback to repurchase £300m of shares

in the second half of 2023.

|

Financial summary

|

|

Underlying growth

|

|

Sales

|

|

|

Assessment & Qualifications

|

6%

|

|

Virtual Learning1

|

(14%)

|

|

English Language Learning

|

66%

|

|

Workforce Skills

|

8%

|

|

Higher Education

|

(5)%

|

|

Strategic Review2

|

(50)%

|

|

Total

|

2%

|

|

Total, excluding OPM and Strategic Review

|

6%

|

Throughout this announcement growth rates are stated on an

underlying basis unless otherwise stated. Underlying growth rates

exclude currency movements and portfolio changes.

1.

We

have entered into an agreement to sell the OPM business. As is

usual practice, it will continue to be reported as part of Virtual

Learning until the sale has been completed.

2.

Strategic

Review is revenues in international courseware local publishing

businesses being wound down, which will continue to be reported

separately until dissipated.

Executive Appointments

|

●

|

Pearson today announced the appointment of Tony Prentice as Chief

Product Officer and Co-President of Direct to Consumer. Tony brings

to the role more than 25 years of experience in consumer-led

product management including at companies such as SEMA4, American

Express, GE, Starbucks and McKinsey.

|

This announcement contains inside information.

Contacts

|

Investor Relations

|

Jo Russell

James Caddy

Gemma Terry

Brennan Matthews

|

+44 (0) 7785 451 266

+44 (0) 7825 948 218

+44 (0) 7841 363 216

+1 (332) 238-8785

|

|

|

|

|

|

Teneo

|

Charles Armitstead

|

+44 (0) 7703 330 269

|

Notes

|

Forward looking statements: Except

for the historical information contained herein, the matters

discussed in this statement include forward-looking statements. In

particular, all statements that express forecasts, expectations and

projections with respect to future matters, including trends in

results of operations, margins, growth rates, overall market

trends, the impact of interest or exchange rates, the availability

of financing, anticipated cost savings and synergies and the

execution of Pearson's strategy, are forward-looking statements. By

their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that will occur in future. They are based on numerous

assumptions regarding Pearson's present and future business

strategies and the environment in which it will operate in the

future. There are a number of factors which could cause actual

results and developments to differ materially from those expressed

or implied by these forward-looking statements, including a number

of factors outside Pearson's control. These include international,

national and local conditions, as well as competition. They also

include other risks detailed from time to time in Pearson's

publicly-filed documents and you are advised to read, in

particular, the risk factors set out in Pearson's latest annual

report and accounts, which can be found on its website

(www.pearsonplc.com). Any forward-looking statements speak only as

of the date they are made, and Pearson gives no undertaking to

update forward-looking statements to reflect any changes in its

expectations with regard thereto or any changes to events,

conditions or circumstances on which any such statement is based.

Readers are cautioned not to place undue reliance on such

forward-looking statements.

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

PEARSON

plc

|

|

|

|

|

Date: 28

April 2023

|

|

|

|

By: /s/

NATALIE WHITE

|

|

|

|

|

|

------------------------------------

|

|

|

Natalie

White

|

|

|

Deputy

Company Secretary

|

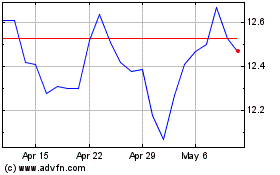

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

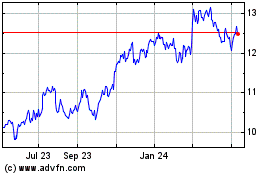

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024