As filed with the Securities and Exchange Commission on August 27, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PBF Energy Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Delaware

|

|

45-3763855

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

One Sylvan Way, Second Floor

Parsippany, New Jersey 07054

Telephone: (973) 455-7500

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Trecia M. Canty, Esq.

Senior Vice President, General Counsel and Secretary

PBF Energy Inc.

One Sylvan Way, Second Floor

Parsippany, New Jersey 07054

Telephone: (973) 455-7500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Todd E. Lenson, Esq.

Jordan M. Rosenbaum, Esq.

Kramer Levin Naftalis & Frankel LLP

1177 Avenue of the Americas

New York, New York 10036

Telephone: (212) 715-9100

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this registration statement as determined by the Registrant.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☑

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a

post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a

post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☑

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☑

|

|

Accelerated filer

|

|

☐

|

|

|

|

|

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the

extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

CALCULATION

OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

of Securities to be Registered

|

|

Amount to be

Registered/Proposed

Maximum Offer Price

Per Share/Proposed

Maximum Aggregate

Offering Price

|

|

Amount of

Registration Fee

|

|

Class A common stock, par value $0.001 per share

|

|

(1)

|

|

(2)

|

|

|

|

|

|

(1)

|

|

An unspecified aggregate initial offering price and number of shares of Class A common stock is being registered hereunder, as may from time to time be offered at

indeterminate prices, and as may be issued upon conversion, repurchase or exchange thereof.

|

|

(2)

|

|

In accordance with Rules 456(b) and 457(r) of the Securities Act of 1933, as amended, the registrant is deferring payment of the entire registration fee.

|

Prospectus

Class A Common Stock

We may, in one or more offerings, offer and sell Class A common stock of PBF

Energy Inc. Our Class A common stock is listed for trading on The New York Stock Exchange under the symbol “PBF.”

We may offer and sell these securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed

basis. This prospectus describes the general terms of the shares of Class A common stock and the general manner in which we will offer the shares of Class A common stock. If necessary, the specific terms of any shares of Class A common stock we

offer will be included in a supplement to this prospectus. The prospectus supplement will also describe the specific manner in which we will offer the shares of Class A common stock. The names of any underwriters will be stated in a supplement to

this prospectus.

Investing in our Class A common stock involves risks.

See “Risk Factors” beginning on page 2 of this prospectus and all other information included or incorporated by reference in this prospectus in its entirety before you decide whether to buy our Class A

common stock.

Neither the Securities and Exchange Commission nor any

state securities commission has approved or disapproved of these securities nor passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated August 27, 2021

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of an automatic shelf registration

statement on Form S-3 that we filed with the Securities and Exchange Commission, or SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act. Under the automatic shelf process, we may offer and sell, from time

to time, shares of our Class A common stock. This prospectus provides you with a general description of our Class A common stock that may be offered by us. Each time we sell Class A common stock with this prospectus, we will be required to provide a

prospectus supplement containing specific information about the terms on which our Class A common stock is being offered and sold. We may also add, update or change in a prospectus supplement information contained in this prospectus. If there is any

inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information provided in the prospectus supplement.

You should rely only on the information contained in this

prospectus and the accompanying prospectus supplement, including the information incorporated by reference herein as described under “Where You Can Find More Information; Incorporation of Certain Documents by Reference,” and any free

writing prospectus that we prepare and distribute.

We have not authorized anyone to provide you with information different from that contained in or incorporated by reference into this

prospectus, the accompanying prospectus supplement or any such free writing prospectus. If given or made, any such other information or representation should not be relied upon as having been authorized by us. We may only offer to sell, and seek

offers to buy, shares of our Class A common stock in jurisdictions where offers and sales are permitted.

This prospectus and any accompanying prospectus supplement or other offering materials do not contain all of the information included in

the registration statement as permitted by the rules and regulations of the SEC. For further information, we refer you to the registration statement on Form S-3, including its exhibits. We are subject to the informational requirements of the

Securities Exchange Act of 1934, as amended, or the Exchange Act, and, therefore, file reports and other information with the SEC. Statements contained in this prospectus and any accompanying prospectus supplement or other offering materials about

the provisions or contents of any agreement or other document are only summaries. If SEC rules require that any agreement or document be filed as an exhibit to the registration statement, you should refer to that agreement or document for its

complete contents.

You should not assume that

the information in this prospectus, any prospectus supplement or any other offering materials is accurate as of any date other than the date on the front of each document. Our business, financial condition, results of operations and prospects may

have changed since then.

i

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION OF CERTAIN

DOCUMENTS BY REFERENCE

We file annual,

quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public from the SEC’s website at http://www.sec.gov, and at our website at http://www.pbfenergy.com.

Information on or accessible through our website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus unless we specifically so designate and file such information with the SEC.

The SEC allows us to “incorporate by reference”

information into this prospectus, which means that we can disclose important information about us by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be a part of this

prospectus. This prospectus incorporates by reference the documents and reports listed below:

|

|

•

|

|

Our Annual Report on Form 10-K for the year ended December

31, 2020, filed with the SEC on February 18, 2021;

|

|

|

•

|

|

Our quarterly reports on Form 10-Q for the quarters ended March

31, 2021 and June 30, 2021, filed with the SEC on April 29, 2021 and July 29, 2021, respectively;

|

|

|

•

|

|

Our current reports on Form 8-K (excluding those furnished under Item 2.02 and Item 7.01), filed with the SEC on June

1, 2021 and August 19, 2021;

|

|

|

•

|

|

The description of our Class A common stock, which is contained in Item 1 of our registration statement on Form

8-A filed with the SEC on December 13, 2012; and

|

|

|

•

|

|

Our definitive proxy statement on Schedule 14A for

our 2021 annual meeting of stockholders, filed with the SEC on April 9, 2021.

|

We also incorporate by reference the information contained in all other documents we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than portions of these

documents that are deemed to have been furnished and not filed in accordance with SEC rules, including current reports on Form 8-K furnished under Item 2.02 and Item 7.01 (including any financial statements or exhibits relating thereto

furnished pursuant to Item 9.01)) after the date of this prospectus. The information contained in any such document will be considered part of this prospectus from the date the document is filed with the SEC.

Any statement contained in a document incorporated or deemed

to be incorporated by reference in this prospectus will be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference in

this prospectus modifies or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We undertake to provide without charge to any person, including any beneficial owner, to whom a copy of this

prospectus is delivered, upon oral or written request of such person, a copy of any or all of the documents that have been incorporated by reference in this prospectus, excluding any exhibits to those documents unless the exhibit is specifically

incorporated by reference as an exhibit in this prospectus. You should direct requests for documents to us at the following address: PBF Energy Inc., One Sylvan Way, Second Floor, Parsippany, New Jersey 07054, Attn: Secretary, or telephoning us

at (973) 455-7500.

ii

FORWARD-LOOKING STATEMENTS

This prospectus, any accompanying prospectus supplement, any

related free writing prospectus and the documents incorporated by reference into this prospectus contain “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995 (“PSLRA”)) of expected

future developments that involve risks and uncertainties. You can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “should,” “seeks,”

“approximately,” “intends,” “plans,” “estimates” or “anticipates” or similar expressions that relate to our strategy, plans or intentions. All statements we make in this prospectus or the documents

incorporated herein by reference relating to our estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results or to our strategies, objectives, resources and expectations regarding future industry

trends and the information referred to under “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” in this prospectus and/or the documents

incorporated by reference into this prospectus are forward-looking statements made under the safe harbor provisions of the PSLRA except to the extent such statements relate to the operations of a partnership or limited liability company. In

addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. These forward-looking statements are subject to risks and

uncertainties that may change at any time, and, therefore, our actual results may differ materially from those that we expected. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many

detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual

results.

Important factors that could cause

actual results to differ materially from our expectations, which we refer to as “cautionary statements,” are disclosed under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations” in this prospectus and/or the documents incorporated by reference into this prospectus. All such forward-looking statements and subsequent written and oral forward-looking statements attributable to us, or persons acting on our

behalf, are expressly qualified in their entirety by the cautionary statements.

We caution you that the foregoing list of important factors may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters

referred to in such forward-looking statements may not in fact occur. Accordingly, investors should not place undue reliance on those statements.

Our forward-looking statements in this prospectus, any accompanying prospectus supplement, any related free writing prospectus or the

documents incorporated herein by reference speak only as of the date on which they are made. Except as required by applicable law, including the securities laws of the United States, we do not intend to update or revise any forward-looking

statements. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing. See “Where You Can Find More Information; Incorporation of

Certain Documents by Reference.”

iii

THE COMPANY

In this prospectus, unless the context otherwise

requires, references to the “Company,” “we,” “our,” “us” or “PBF” refer to PBF Energy Inc., or PBF Energy, and, in each case, unless the context otherwise requires, its consolidated subsidiaries,

including PBF Energy Company LLC, or PBF LLC, PBF Holding Company LLC and its subsidiaries, or PBF Holding, and PBF Logistics L.P. and its subsidiaries, or PBF Logistics, the Partnership or PBFX.

We are one of the largest independent petroleum refiners and

suppliers of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other petroleum products in the United States. We sell our products throughout the Northeast, Midwest, Gulf Coast and West Coast of the United States,

as well as in other regions of the United States, Canada and Mexico, and are able to ship products to other international destinations. As of the date hereof, we own and operate six domestic oil refineries and related assets. We operate in two

reportable business segments: Refining and Logistics.

We are a holding company and our primary asset is an equity interest in PBF LLC. We are the sole managing member of PBF LLC and operate and control all of the business and affairs and consolidate the

financial results of PBF LLC and its subsidiaries. PBF LLC is a holding company for the companies that directly or indirectly own and operate our business.

We are a Delaware corporation incorporated on November 7, 2011 with our principal executive offices located at One Sylvan Way, Second

Floor, Parsippany, NJ 07054 and our telephone number is (973) 455-7500. Our website address is http://www.pbfenergy.com. The information contained on our website or that is or becomes accessible through our website neither constitutes part of this

prospectus nor is incorporated by reference into this prospectus.

1

RISK FACTORS

You should consider the specific risks described in our most

recent Annual Report on Form 10-K filed with the SEC, the risk factors described under the caption “Risk Factors” in any applicable prospectus supplement and any risk factors set forth in our other filings with the SEC, pursuant to

Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, before making an investment decision. See “Where You Can Find More Information; Incorporation of Certain Documents by Reference.” Each of the risks described in these documents could

materially and adversely affect our business, financial condition, results of operations and prospects, and could result in a partial or complete loss of your investment. The risks and uncertainties are not limited to those set forth in the risk

factors described in these documents. Additional risks and uncertainties not presently known to us or that we currently believe to be less significant than the risk factors incorporated by reference herein may also adversely affect our business.

When we offer and sell any securities pursuant to a prospectus supplement, we may include additional risk factors relevant to such securities in the applicable prospectus supplement. In addition, past financial performance may not be a reliable

indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.

2

USE OF PROCEEDS

Unless otherwise indicated to the contrary in an accompanying

prospectus supplement, we will use the net proceeds from any sale of securities covered by this prospectus for general corporate purposes, which may include repayment of indebtedness, acquisitions, capital expenditures and additions to working

capital.

Any specific allocation of the net

proceeds of an offering of securities to a specific purpose will be determined at the time of the offering and, if necessary, will be described in a prospectus supplement.

3

DESCRIPTION OF CAPITAL STOCK

The following is a description of the material terms of

our amended and restated certificate of incorporation and amended and restated bylaws. For more information on how you can obtain our amended and restated certificate of incorporation and our amended and restated bylaws, see

“Where You Can Find More Information; Incorporation of Certain Documents by Reference.” We urge you to read our amended and restated certificate of incorporation and our amended and restated bylaws in their entirety.

Authorized Capitalization

Our authorized capital stock consists of 1,000,000,000

shares of our Class A common stock, par value $0.001 per share, 1,000,000 shares of Class B common stock, par value $0.001 per share, and 100,000,000 shares of preferred stock, par value $0.001 per share.

Class A Common Stock

Voting Rights. Holders of shares of our Class A

common stock are entitled to one vote per share on all matters to be voted upon by the stockholders. The holders of our Class A common stock do not have cumulative voting rights in the election of directors.

Dividend Rights. Subject to the rights of the holders

of any preferred stock that may be outstanding and any contractual or statutory restrictions, holders of our Class A common stock are entitled to receive equally and ratably, share for share dividends as may be declared by our board of

directors out of funds legally available to pay dividends. Dividends upon our Class A common stock may be declared by the board of directors at any regular or special meeting, and may be paid in cash, in property, or in shares of capital stock.

Before payment of any dividend, there may be set aside out of any of our funds available for dividends, such sums as the board of directors deems proper as reserves to meet contingencies, or for equalizing dividends, or for repairing or maintaining

any of our property, or for any proper purpose, and the board of directors may modify or abolish any such reserve.

Liquidation Rights. Upon liquidation, dissolution, distribution of assets or other winding up, the holders of our Class A

common stock are entitled to receive ratably the assets available for distribution to the stockholders after payment of liabilities and the liquidation preference of any of our outstanding shares of preferred stock.

Other Matters. The shares of our Class A common

stock have no preemptive or conversion rights and are not subject to further calls or assessment by us. There are no redemption or sinking fund provisions applicable to our Class A common stock. All outstanding shares of our Class A common

stock are fully paid and non-assessable.

Class B Common Stock

Voting Rights. Holders of shares of Class B common stock are entitled, without regard to the number of shares of Class B common stock held by such holder, to one vote for each PBF LLC Series A Unit

beneficially owned by such holder. Accordingly, the members of PBF LLC other than PBF Energy collectively have a number of votes in PBF Energy that is equal to the aggregate number of PBF LLC Series A Units that they hold. Holders of shares of our

Class A common stock and Class B common stock vote together as a single class on all matters presented to our stockholders for their vote or approval, except as otherwise required by applicable law.

Dividend and Liquidation Rights. Holders of our Class

B common stock do not have any right to receive dividends or to receive a distribution upon a liquidation or winding up of PBF Energy.

4

Preferred Stock

Our certificate of incorporation authorizes our board of

directors to establish one or more series of preferred stock and to determine, with respect to any series of preferred stock, the terms and rights of that series, including:

|

|

•

|

|

the designation of the series;

|

|

|

•

|

|

the number of shares of the series which our board may, except where otherwise provided in the preferred stock designation, increase or decrease, but

not below the number of shares then outstanding;

|

|

|

•

|

|

whether dividends, if any, will be cumulative or non-cumulative and the dividend rate of the series;

|

|

|

•

|

|

the dates at which dividends, if any, will be payable;

|

|

|

•

|

|

the redemption rights and price or prices, if any, for shares of the series;

|

|

|

•

|

|

the terms and amounts of any sinking fund provided for the purchase or redemption of shares of the series;

|

|

|

•

|

|

the amounts payable on shares of the series in the event of any voluntary or involuntary liquidation, dissolution or

winding-up of the affairs of our company, or upon any distribution of assets of our company;

|

|

|

•

|

|

whether the shares of the series will be convertible into shares of any other class or series, or any other security, of our company or any other

corporation, and, if so, the specification of the other class or series or other security, the conversion price or prices or rate or rates, any rate adjustments, the date or dates as of which the shares will be convertible and all other terms and

conditions upon which the conversion may be made;

|

|

|

•

|

|

the preferences and special rights, if any, of the series and the qualifications and restrictions, if any, of the series;

|

|

|

•

|

|

the voting rights, if any, of the holders of the series; and

|

|

|

•

|

|

such other rights, powers and preferences with respect to the series as our board of directors may deem advisable.

|

Authorized but Unissued Capital Stock

Delaware law does not require stockholder approval for any

issuance of authorized shares. However, the listing requirements of the NYSE, which would apply so long as our Class A common stock is listed on the NYSE, require stockholder approval of certain issuances (other than a public offering) equal to

or exceeding 20% of the then outstanding voting power or then outstanding number of shares of our Class A common stock, as well as for certain issuances of stock in compensatory transactions. These additional shares may be used for a variety of

corporate purposes, including future public offerings, to raise additional capital or to facilitate acquisitions. One of the effects of the existence of unissued and unreserved Class A common stock may be to enable our board of directors to

issue shares to persons friendly to current management, which issuance could render more difficult or discourage an attempt to obtain control of our company by means of a merger, tender offer, proxy contest or otherwise, and thereby protect the

continuity of our management and possibly deprive the stockholders of opportunities to sell their shares of our Class A common stock at prices higher than prevailing market prices.

Anti-Takeover Effects of Certain Provisions of Delaware Law and our Certificate of Incorporation and Bylaws

Certain provisions of our certificate of incorporation and

bylaws, which are summarized in the following paragraphs, may have an anti-takeover effect and may delay, defer or prevent a tender offer or takeover attempt that a stockholder might consider in its best interest, including those attempts that might

result in a premium over the market price for the shares held by stockholders.

5

Undesignated Preferred Stock

The ability to authorize undesignated preferred stock will

make it possible for our board of directors to issue preferred stock with super voting, special approval, dividend or other rights or preferences on a discriminatory basis that could impede the success of any attempt to acquire us or otherwise

effect a change in control of us. These and other provisions may have the effect of deferring, delaying or discouraging hostile takeovers, or changes in control or management of our company.

No Cumulative Voting

The Delaware General Corporation Law, or DGCL, provides that

stockholders are not entitled to the right to cumulate votes in the election of directors unless our certificate of incorporation provides otherwise. Our certificate of incorporation prohibits cumulative voting.

Calling of Special Meetings of Stockholders

Our bylaws currently provide that

special meetings of our stockholders may be called at any time only by the chairman of the board of directors, the chief executive officer or the board of directors.

Stockholder Action by Written Consent

The DGCL permits stockholder action by

written consent unless otherwise provided by our certificate of incorporation. Our certificate of incorporation currently precludes stockholder action by written consent.

Advance Notice Requirements for Stockholder Proposals

and Director Nominations

Our bylaws

currently establish advance notice procedures with respect to stockholder proposals and the nomination of candidates for election as directors, other than nominations made by or at the direction of the board of directors (or a committee of the board

of directors). In order for any matter to be “properly brought” before a meeting, a stockholder will have to comply with advance notice requirements and provide us with certain information. Our bylaws allow the presiding officer at a

meeting of the stockholders to adopt rules and regulations for the conduct of meetings which may have the effect of precluding the conduct of certain business at a meeting if the rules and regulations are not followed.

These provisions may defer, delay or discourage a potential

acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our company.

Removal of Directors; Vacancies

Our certificate of incorporation provides that directors may be removed with or without cause upon the affirmative vote of holders of at

least a majority of the voting power of all the then outstanding shares of stock entitled to vote generally in the election of directors. In addition, our bylaws provide that any newly-created directorship on the board of directors that results from

an increase in the number of directors and any vacancy occurring on the board of directors shall be filled only by a majority of the directors then in office, although less than a quorum, or by a sole remaining director (but subject to the terms of

the stockholders agreement).

Delaware

Anti-takeover Statute

We are currently

subject to Section 203 of the DGCL, which, subject to specified exceptions, prohibits a publicly held Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three

years after the date of the transaction in which the person became an interested stockholder. “Business combinations” include mergers, asset sales and other transactions resulting in a financial benefit to the

6

“interested stockholder.” Subject to various exceptions, an “interested stockholder” is a person who together with his or her affiliates and associates, owns, or within three

years did own, 15% or more of the corporation’s outstanding voting stock. These restrictions generally prohibit or delay the accomplishment of mergers or other takeover or change in control attempts.

Supermajority Provisions

Our certificate of incorporation currently grants our board

of directors the authority to amend and repeal our bylaws without a stockholder vote in any manner not inconsistent with the laws of the State of Delaware or our certificate of incorporation and requires a 75% supermajority vote for the stockholders

to amend any provision of our bylaws.

Limitations on Liability and Indemnification of Officers and Directors

The DGCL authorizes corporations to limit or eliminate the

personal liability of directors to corporations and their stockholders for monetary damages for breaches of directors’ fiduciary duties. Our certificate of incorporation includes a provision that eliminates the personal liability of directors

for monetary damages for breach of fiduciary duty as a director, except:

|

|

•

|

|

for breach of duty of loyalty;

|

|

|

•

|

|

for acts or omissions not in good faith or involving intentional misconduct or knowing violation of law;

|

|

|

•

|

|

under Section 174 of the DGCL (unlawful dividends); or

|

|

|

•

|

|

for transactions from which the director derived improper personal benefit.

|

Our certificate of incorporation and bylaws provide that we must indemnify our directors and officers to the

fullest extent authorized by the DGCL. We are also expressly authorized to, and do, carry directors’ and officers’ insurance providing coverage for our directors, officers and certain employees for some liabilities. We believe that these

indemnification provisions and insurance are useful to attract and retain qualified directors and executive officers.

The limitation of liability and indemnification provisions in our certificate of incorporation and bylaws may discourage stockholders from

bringing a lawsuit against directors for breach of their fiduciary duty. These provisions may also have the effect of reducing the likelihood of derivative litigation against directors and officers, even though such an action, if successful, might

otherwise benefit us and our stockholders. In addition, your investment may be adversely affected to the extent we pay the costs of settlement and damage awards against directors and officers pursuant to these indemnification provisions.

We have entered into indemnification agreements with each of

our directors and officers providing for additional indemnification protection beyond that provided by the directors’ and officers’ liability insurance policy. In the indemnification agreements, we have agreed, subject to certain

exceptions, to indemnify and hold harmless the director or officer to the maximum extent then authorized or permitted by the provisions of the certificate of incorporation, the DGCL, or by any amendment(s) thereto.

There is currently no pending litigation or proceeding

involving any of our directors, officers or employees for which indemnification is sought.

Choice of Forum

Our certificate of incorporation provides that, unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware will be the exclusive forum for:

(a) any derivative action or proceeding brought on our behalf; (b) any action asserting a breach of fiduciary duty; (c) any action asserting a

7

claim against us arising pursuant to the DGCL, our certificate of incorporation or our bylaws; or (d) any action asserting a claim against us that is governed by the internal affairs

doctrine. However, several lawsuits involving other companies have challenged the validity of choice of forum provisions in certificates of incorporation, and it is possible that a court could rule that such provision is inapplicable or

unenforceable.

Transfer Agent and Registrar

The transfer agent and registrar for our Class A common

stock is American Stock Transfer & Trust Company, LLC.

New

York Stock Exchange Listing

Our Class A

common stock is traded on the NYSE under the symbol “PBF.”

8

PLAN OF DISTRIBUTION

We may sell the shares of Class A common stock covered by

this prospectus from time to time in one or more offerings. Registration of the shares of Class A common stock covered by this prospectus does not mean, however, that such shares will necessarily be offered or sold.

The securities offered pursuant to this prospectus and any

accompanying prospectus supplement, if required, may be sold by us in any of the following ways:

|

|

•

|

|

directly to one or more purchasers;

|

|

|

•

|

|

to or through underwriters or brokers-dealers; or

|

|

|

•

|

|

through a combination of any of these methods of sale.

|

We will prepare a prospectus supplement, if required, for

each offering that will disclose the terms of the offering, including the name or names of any underwriters, dealers or agents and the amounts of securities underwritten or purchased by them (if any), the purchase price of the securities and the

proceeds to us from the sale, any delayed delivery arrangements, any underwriting discounts and other items constituting compensation to underwriters, dealers or agents.

In addition, we may use any one or more of the following

methods when selling securities:

|

|

•

|

|

underwritten transactions;

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

•

|

|

“at the market offerings” within the meaning of Rule 415(a)(4) under the Securities Act, to or through a market maker or into an existing

trading market, on an exchange or otherwise;

|

|

|

•

|

|

exchange distributions and/or secondary distributions;

|

|

|

•

|

|

sales in the over-the-counter market;

|

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker solicits purchasers;

|

|

|

•

|

|

a block trade (which may involve crosses) in which the broker-dealer so engaged will attempt to sell the securities as agent but may position and

resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus;

|

|

|

•

|

|

short sales and delivery of shares of Class A common stock to close out short positions;

|

|

|

•

|

|

sales by broker-dealers of shares of Class A common stock that are loaned or pledged to such broker-dealers;

|

|

|

•

|

|

transactions in options, swaps or other derivatives that may or may not be listed on an exchange;

|

|

|

•

|

|

a combination of any such methods of sale; and

|

|

|

•

|

|

any other method permitted pursuant to applicable law.

|

We may distribute the securities covered by this prospectus

from time to time in one or more transactions at:

|

|

•

|

|

a fixed price or prices, which may be changed;

|

|

|

•

|

|

market prices prevailing at the time of sale;

|

|

|

•

|

|

prices related to market prices; or

|

We may change the price of the securities offered from time to time.

We or agents designated by us, may directly solicit, from

time to time, offers to purchase the securities. Any such agent may be deemed to be an underwriter as that term is defined in the Securities Act. We will name any agents involved in the offer or sale of the securities and describe any commissions

payable by us to these agents in the applicable prospectus supplement, if required. The agents may also be our customers or may engage in transactions with or perform services for us in the ordinary course of business.

9

If we utilize any underwriters in the sale of the securities in respect of which this

prospectus is delivered, we will enter into an underwriting agreement with those underwriters at the time of sale to them. We will set forth the names of these underwriters and the terms of the transaction in the applicable prospectus supplement, if

required, which will be used by the underwriters to make resales of the securities in respect of which this prospectus is delivered to the public. We may use underwriters with whom we have a material relationship. As applicable, we will describe in

each accompanying prospectus supplement the name of the underwriter(s) and the nature of any such relationship(s).

If we utilize a dealer in the sale of the securities in respect of which this prospectus is delivered, we will sell those securities to

the dealer, as principal. The dealer may then resell those securities to the public at varying prices to be determined by the dealer at the time of resale. The dealers may also be our customers or may engage in transactions with, or perform services

for us in the ordinary course of business.

Offers

to purchase securities may be solicited directly by us and the sale thereof may be made by us directly to institutional investors or others, who may be deemed to be underwriters within the meaning of the Securities Act with respect to any resale

thereof. The terms of any such sales will be described in the prospectus supplement, if required, relating thereto. We may use electronic media, including the Internet, to sell offered securities directly.

We may offer our shares of Class A common stock into an

existing trading market on the terms described in a prospectus supplement relating thereto. Underwriters, dealers and agents who participate in any at-the-market offerings will be described in the prospectus supplement relating thereto.

We may agree to indemnify underwriters, dealers and agents

who participate in the distribution of securities against certain liabilities to which they may become subject in connection with the sale of the securities, including liabilities arising under the Securities Act.

A prospectus and accompanying prospectus supplement, if

required, in electronic form may be made available on the web sites maintained by the underwriters. The underwriters may agree to allocate a number of securities for sale to their online brokerage account holders. Such allocations of securities for

internet distributions will be made on the same basis as other allocations. In addition, securities may be sold by the underwriters to securities dealers who resell securities to online brokerage account holders.

Underwriters, dealers or agents may receive compensation in

the form of discounts, concessions or commissions from us or our purchasers, as their agents in connection with the sale of securities. These underwriters, dealers or agents may be considered to be underwriters under the Securities Act. As a result,

discounts, commissions or profits on resale received by the underwriters, dealers or agents may be treated as underwriting discounts and commissions. Each accompanying prospectus supplement will identify any such underwriter, dealer or agent and

describe any compensation received by them from us. Any initial public offering price and any discounts or concessions allowed or re-allowed or paid to dealers may be changed from time to time.

To the extent required, this prospectus may be amended or

supplemented from time to time to describe a specific plan of distribution.

In connection with offerings of securities under the registration statement of which this prospectus forms a part and in compliance with applicable law, underwriters or broker-dealers may engage in

transactions that stabilize or maintain the market price of the securities at levels above those that might otherwise prevail in the open market. Specifically, underwriters or broker-dealers may over-allot in connection with offerings, creating a

short position in the securities for their own accounts. For the purpose of covering a syndicate short position or stabilizing the price of the securities, the underwriters or broker-dealers may place bids for the securities or effect purchases of

the securities in the open market. Finally, the underwriters may impose a penalty whereby selling

10

concessions allowed to syndicate members or other broker-dealers for distribution of the securities in offerings may be reclaimed by the syndicate if the syndicate repurchases previously

distributed securities in transactions to cover short positions, in stabilization transactions or otherwise. These activities may stabilize, maintain or otherwise affect the market price of the securities, which may be higher than the price that

might otherwise prevail in the open market, and, if commenced, may be discontinued at any time.

Underwriters, broker-dealers or agents who may become involved in the sale of shares of Class A common stock may engage in transactions with, and perform other services for, us in the ordinary course of

their business for which they receive compensation.

LEGAL MATTERS

The validity of the shares of Class A common stock offered by this prospectus will be passed upon for us by Kramer Levin Naftalis

& Frankel LLP, New York, New York.

EXPERTS

The financial statements of PBF Energy Inc., incorporated in

this Prospectus by reference from PBF Energy Inc.’s Annual Report on Form 10-K, and the effectiveness of PBF Energy Inc.’s internal control over financial reporting, have been audited by Deloitte & Touche LLP, an independent

registered public accounting firm, as stated in their reports, which are incorporated herein by reference. Such financial statements have been so incorporated in reliance upon the reports of such firm given upon their authority as experts in

accounting and auditing.

11

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth all expenses (other than

underwriting discounts and commissions) expected to be incurred in connection with the issuance and distribution of the securities registered hereby:

|

|

|

|

|

|

|

Securities and Exchange Commission Registration Fee

|

|

$

|

*

|

|

|

Accounting Fees and Expenses

|

|

$

|

**

|

|

|

Printing and Engraving

|

|

$

|

**

|

|

|

Legal Fees and Expenses

|

|

$

|

**

|

|

|

Transfer Agent and Registrar fees

|

|

$

|

**

|

|

|

Miscellaneous

|

|

$

|

**

|

|

|

|

|

|

|

|

|

Total

|

|

$

|

**

|

|

|

|

|

|

|

|

|

|

*

|

|

Deferred in accordance with Rule 456(b) and Rule 457(r) of the Securities Act.

|

|

|

**

|

|

Since an indeterminate amount of securities is covered by this registration statement, the expenses in connection with the issuance and distribution of the securities

are not currently determinable. An estimate of the aggregate expenses in connection with the issuance and distribution of the securities being offered will be included in the applicable prospectus supplement, if required.

|

Item 15. Indemnification of Directors and Officers

Section 102 of the DGCL allows a corporation to

eliminate the personal liability of directors to a corporation or its stockholders for monetary damages for a breach of a fiduciary duty as a director, except where the director breached his duty of loyalty, failed to act in good faith, engaged in

intentional misconduct or knowingly violated a law, authorized the payment of a dividend or approved a stock repurchase or redemption in violation of Delaware corporate law or obtained an improper personal benefit.

Section 145 of the DGCL empowers a Delaware corporation

to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right

of such corporation) by reason of the fact that such person is or was a director, officer, employee or agent of such corporation, or is or was serving at the request of such corporation as a director, officer, employee or agent of another

corporation, partnership, joint venture, trust or other enterprise. The indemnity may include expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection

with such action, suit or proceeding, provided that such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal action or

proceeding, had no reasonable cause to believe such person’s conduct was unlawful. A Delaware corporation may indemnify directors, officers, employees and other agents of such corporation in an action by or in the right of a corporation under

the same conditions against expenses (including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense and settlement of such action or suit, except that no indemnification is permitted without judicial

approval if the person to be indemnified has been adjudged to be liable to the corporation. Where a present or former director or officer of the corporation is successful on the merits or otherwise in the defense of any action, suit or proceeding

referred to above or in defense of any claim, issue or matter therein, the corporation must indemnify such person against the expenses (including attorneys’ fees) which he or she actually and reasonably incurred in connection therewith.

Section 174 of the DGCL provides, among

other things, that a director who willfully or negligently approves of an unlawful payment of dividends or an unlawful stock purchase or redemption, may be held liable

II-1

for such actions. A director who was either absent when the unlawful actions were approved or dissented at the time, may avoid liability by causing his or her dissent to such actions to be

entered into the books containing the minutes of the meetings of the board of directors at the time such action occurred or immediately after such absent director receives notice of the unlawful acts.

The Registrant’s certificate of incorporation and bylaws

contains provisions that provide for indemnification of officers and directors and their heirs and representatives to the full extent permitted by, and in the manner permissible under, the DGCL.

As permitted by Section 102(b)(7) of the DGCL, the

Registrant’s certificate of incorporation contains a provision eliminating the personal liability of a director to the Registrant or its stockholders for monetary damages for breach of fiduciary duty as a director, subject to some exceptions.

The Registrant maintains, at its expense, a

policy of insurance which insures its directors and officers, subject to exclusions and deductions as are usual in these kinds of insurance policies, against specified liabilities which may be incurred in those capacities.

The Registrant has entered into an indemnification agreement

with each of its directors and executive officers. The indemnification agreements supplement existing indemnification provisions in the Registrant’s bylaws and in it the Registrant agrees, subject to certain exceptions, to the fullest extent

then permitted by the DGCL, (1) to indemnify the director or executive officer and (2) to pay expenses incurred by the director or executive officer in any proceeding in advance of the final disposition of such proceeding, with the primary

purpose of the agreements being to provide specific contractual assurances to the Registrant’s directors and executive officers in respect of these indemnification protections which could not be altered by future changes to the

Registrant’s current bylaw indemnification provisions.

Any underwriting agreement that the Registrant may enter into in connection with the sale of any securities registered hereunder will provide for indemnification by the underwriters of us and our officers

and directors, and by us of the underwriters, for certain liabilities arising under the Securities Act or otherwise in connection with any offerings.

Item 16. Exhibits.

The following exhibits are filed as part of this registration statement.

|

|

**

|

|

To be filed, if applicable, by amendment to this registration statement or incorporated by reference from documents filed or to be filed with the SEC under the Exchange

Act.

|

II-2

Item 17. Undertakings.

The undersigned registrant hereby undertakes:

|

|

(1)

|

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

|

(i)

|

|

To include any prospectus required by section 10(a)(3) of the Securities Act;

|

|

|

(ii)

|

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof)

which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of

securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the

aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

|

|

|

(iii)

|

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such

information in the registration statement;

|

provided, however, that paragraphs (i), (ii) and (iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports

filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to

Rule 424(b) that is part of the registration statement.

|

|

(2)

|

|

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(3)

|

|

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(4)

|

|

That, for the purpose of determining liability under the Securities Act to any purchaser:

|

|

|

(A)

|

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was

deemed part of and included in the registration statement; and

|

|

|

(B)

|

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B

relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as

of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer

and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of

such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document

incorporated or deemed incorporated by reference

|

II-3

|

|

into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify

any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

|

|

|

(5)

|

|

That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the securities, the

undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities

are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

|

|

|

(i)

|

|

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

|

|

|

(ii)

|

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

|

|

|

(iii)

|

|

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by

or on behalf of the undersigned registrant; and

|

|

|

(iv)

|

|

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

The undersigned registrant hereby undertakes that, for

purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit

plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that, in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of

any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

The undersigned registrant hereby undertakes that:

|

|

(a)

|

|

For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part of this registration statement in

reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b) (1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared

effective.

|

|

|

(b)

|

|

For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

II-4

The undersigned registrant hereby undertakes to deliver or cause to be delivered with the

prospectus, to each person to whom the prospectus is sent or given, the latest annual report to security holders that is incorporated by reference in the prospectus and furnished pursuant to and meeting the requirements of Rule 14a-3 or Rule 14c-3

under the Securities Exchange Act; and, where interim financial information required to be presented by Article 3 of Regulation S-X are not set forth in the prospectus, to deliver, or cause to be delivered to each person to whom the prospectus is

sent or given, the latest quarterly report that is specifically incorporated by reference in the prospectus to provide such interim financial information.

II-5

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933,

as amended, the registrant certifies that it has reasonable grounds to believe that it meets all the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly

authorized, in the Township of Parsippany-Troy Hills, State of New Jersey, on the 27th day of August, 2021.

|

|

|

|

|

PBF ENERGY INC.

|

|

|

|

|

By:

|

|

/S/ TRECIA M. CANTY

|

|

Name:

|

|

Trecia M. Canty

|

|

Title:

|

|

Senior Vice President, General Counsel and Corporate Secretary

|

POWER OF ATTORNEY

Each person whose signature to this registration statement appears below hereby constitutes and appoints Matthew C. Lucey, Erik Young and

Trecia M. Canty, and each of them singly (with full power to each of them to act alone), his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for such person and in his name, place and stead, in

any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement, and to file the same, with all exhibits thereto and other documents in connection therewith, with the Securities and

Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite or necessary to be done in and about the premises, as fully to all intents and

purposes as he might or could do in person, hereby ratifying and confirming that any such attorney-in-fact and agent, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933

this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/S/ THOMAS J. NIMBLEY

Thomas J. Nimbley

|

|

Chief Executive Officer and Chairman of the Board of Directors (Principal Executive Officer)

|

|

August 27, 2021

|

|

|

|

|

|

/S/ ERIK YOUNG

Erik Young

|

|

Senior Vice President, Chief Financial Officer (Principal Financial Officer)

|

|

August 27, 2021

|

|

|

|

|

|

/S/ JOHN BARONE

John Barone

|

|

Chief Accounting Officer (Principal Accounting Officer)

|

|

August 27, 2021

|

|

|

|

|

|

Spencer Abraham

|

|

Director

|

|

|

|

|

|

|

|

/S/ WAYNE A. BUDD

Wayne A. Budd

|

|

Director

|

|

August 27, 2021

|

|

|

|

|

|

/S/ KAREN B. DAVIS

Karen B. Davis

|

|

Director

|

|

August 27, 2021

|

|

|

|

|

|

/S/ GENE EDWARDS

Gene Edwards

|

|

Director

|

|

August 27, 2021

|

II-6

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/S/ WILLIAM HANTKE

William Hantke

|

|

Director

|

|

August 27, 2021

|

|

|

|

|

|

/S/ ROBERT J. LAVINIA

Robert J. Lavinia

|

|

Director

|

|

August 27, 2021

|

|

|

|

|

|

/S/ KIMBERLY LUBEL

Kimberly Lubel

|

|

Director

|

|

August 27, 2021

|

|

|

|

|

|

/S/ GEORGE OGDEN

George Ogden

|

|

Director

|

|

August 27, 2021

|

II-7

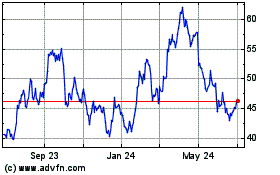

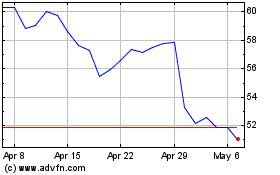

PBF Energy (NYSE:PBF)

Historical Stock Chart

From Mar 2024 to Apr 2024

PBF Energy (NYSE:PBF)

Historical Stock Chart

From Apr 2023 to Apr 2024