PG&E Reaches Deal With California Governor on Bankruptcy Exit -- Update

March 20 2020 - 7:12PM

Dow Jones News

By Katherine Blunt

California Gov. Gavin Newsom on Friday dropped his opposition to

PG&E Corp.'s plan to emerge from bankruptcy protection after

striking a deal requiring certain concessions from the company.

As part of the deal, PG&E has agreed to put itself up for

sale if it can't exit bankruptcy by June 30, a state-imposed

deadline for its emergence if it wants to qualify for a state

wildfire fund.

PG&E also agreed to use shareholder funding to reduce its

debt load and submit to more stringent regulatory oversight that

could lead to a state takeover of the company if it fails to make

safety improvements.

"Because of these new tools, the state will have the legal

authority to continue demanding total transformation even after the

company emerges from bankruptcy," Mr. Newsom said in a statement.

"We aren't taking our foot off the gas."

The move clears one of the last major remaining hurdles for

PG&E to exit Chapter 11. The company sought bankruptcy

protection last year due to billions in potential liabilities from

wildfires sparked by its equipment. The company disclosed the

details of the agreement in a bankruptcy court filing.

The plan is now subject to approval by the California Public

Utilities Commission, as well as a vote by the company's creditors,

which include wildfire victims as well as shareholders and

bondholders.

"We now look to the California Public Utilities Commission to

approve the Plan through its established regulatory process, so

that we can exit Chapter 11, pay wildfire victims fairly and as

soon as possible, and participate in the State's Wildfire Fund,"

PG&E Chief Executive Bill Johnson said in a statement.

Mr. Newsom, a Democrat, had for months opposed PG&E's

reorganization plan, which proposes raising billions of dollars in

debt and equity to pay damages tied to a series of deadly wildfires

throughout its service territory. He raised concerns that the plan

would leave the company too leveraged to make safety investments in

the electric grid and failed to ensure operational change within

its leadership.

As part of the deal, PG&E has agreed to submit to an

"operational observer" selected by the state to monitor its safety

compliance. The company earlier this year agreed to replace many of

its current directors and expand safety positions and performance

metrics after it emerged from bankruptcy protection.

The company will now be subject to stricter regulatory oversight

from the California Public Utilities Commission to ensure its

compliance with state regulations. Marybel Batjer, the agency's

president, last month proposed a series of escalating sanctions for

continual violations, culminating with a process to revoke the

utility's license to operate if necessary.

The company is seeking regulatory approval to issue $7.5 billion

in low-interest bonds to replace pricier short-term loans included

in its reorganization plan. As part of the deal with the governor,

shareholders would have to foot the repayment of those bonds.

PG&E also agreed not to reinstate dividend payments to

shareholders for about three years. Those payments have been

suspended since the end of 2017, after a series of deadly wildfires

in California's wine country.

A U.S. district judge overseeing PG&E's federal probation

tied to a 2010 natural-gas pipeline explosion has also restricted

the company from reinstating dividend payments until it

dramatically reduces the risk of its equipment sparking more

wildfires.

State fire investigators have tied PG&E's equipment to 18

wildfires in 2017 and 2018 that collectively killed more than 100

people and destroyed roughly 15,700 homes. The company has agreed

to settle claims from insurers, individual fire victims, cities and

public agencies for more than $25 billion.

Write to Katherine Blunt at Katherine.Blunt@wsj.com

(END) Dow Jones Newswires

March 20, 2020 18:57 ET (22:57 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

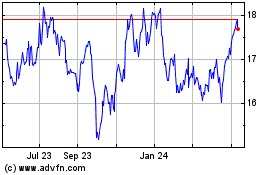

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

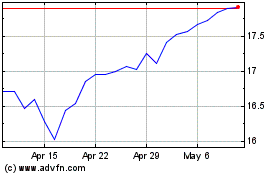

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024