Current Report Filing (8-k)

November 27 2019 - 8:32AM

Edgar (US Regulatory)

false0000075488000100498000010049802019-11-252019-11-250001004980pcg:PACIFICGASANDELECTRICCOMPANYMember2019-11-252019-11-250001004980pcg:FirstPreferredStockCumulativeParValue25PerShare5NonredeemableMemberpcg:NYSEAmericanLLCMember2019-11-252019-11-250001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare6NonredeemableMember2019-11-252019-11-250001004980pcg:FirstPreferredStockCumulativeParValue25PerShare480RedeemableMemberpcg:NYSEAmericanLLCMember2019-11-252019-11-250001004980pcg:TheNewYorkStockExchangeMemberpcg:CommonStockNoParValueMember2019-11-252019-11-250001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare5SeriesARedeemableMember2019-11-252019-11-250001004980pcg:FirstPreferredStockCumulativeParValue25PerShare550NonredeemableMemberpcg:NYSEAmericanLLCMember2019-11-252019-11-250001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare5RedeemableMember2019-11-252019-11-250001004980pcg:FirstPreferredStockCumulativeParValue25PerShare436SeriesARedeemableMemberpcg:NYSEAmericanLLCMember2019-11-252019-11-250001004980pcg:FirstPreferredStockCumulativeParValue25PerShare450RedeemableMemberpcg:NYSEAmericanLLCMember2019-11-252019-11-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: November 25, 2019

(Date of earliest event reported)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

Securities registered pursuant to Section 12(b) of the Act:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this

chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01 Other Events.

2020 Cost of Capital Application

On November 25, 2019, the assigned administrative law judge of the California Public Utilities Commission (the “CPUC”) issued a

proposed decision (the “PD”) in the 2020 Cost of Capital proceeding of Pacific Gas and Electric Company (the “Utility”), a subsidiary of PG&E Corporation. If adopted, the PD would maintain the Utility’s return on common equity (“ROE”) for the

three-year period beginning January 1, 2020 at 10.25%, as compared to 12% requested by the Utility. The PD finds that “the passage of AB 1054 and other investor supportive policies in California have mitigated wildfire exposure faced by

California’s utilities” and, as a result, “the Commission will not authorize a specific wildfire risk premium in the adopted ROE.” The Utility’s annual cost of capital adjustment mechanism, that would start in 2021, would also remain unchanged. If

adopted, the PD would maintain the common equity component of the Utility’s capital structure at 52% in 2020, as requested by the Utility, and reduce its preferred stock component from 1% to 0.5%, also as requested by the Utility.

The following table compares the cost of capital currently authorized in the Utility’s 2019 Gas Transmission and Storage rate case and

the 2017 General Rate Case, with those proposed in the PD:

If the PD is adopted, the Utility estimates that the Utility’s 2020 revenue requirement associated with the authorized cost of capital

would be approximately $30 million more than the currently authorized revenue requirement.

The PD does not take a position or establish any orders pertaining to whether the Utility should be required to submit a new cost of

capital application following its emergence from Chapter 11 bankruptcy. The PD defers that issue to the CPUC’s separate order instituting investigation into issues relating to the Utility’s bankruptcy.

Comments on the PD must be filed by December 13, 2019, and reply comments are due on December 17, 2019. If the CPUC issues a final

decision at its meeting scheduled to be held on December 19, 2019, as currently indicated in the procedural schedule for this proceeding, changes to the Utility’s revenue requirement would become effective on January 1, 2020.

For more information about the 2020 Cost of Capital proceeding, see PG&E Corporation and the Utility’s joint Quarterly Report on

Form 10-Q for the quarterly period ended September 30, 2019.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned

thereunto duly authorized.

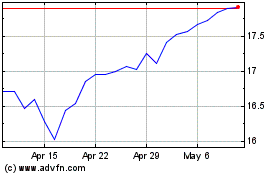

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

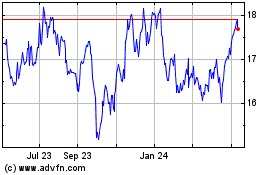

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024