By Angus Loten

The massive applications that have long defined enterprise

information technology are changing, and the process is gaining

momentum as more firms shift spending away from data centers,

servers and other hardware and into cloud-based software as a

service, says Oracle Chief Executive Mark Hurd.

That migration can be a challenge for software companies and

customers alike. But it also gives companies like Oracle the

opportunity to make changes that take advantage of certain

qualities of the cloud.

"At some point, I expect all customers will make the transition

to cloud, it's just too compelling not to," Mr. Hurd recently told

CIO Journal.

It's also an opportunity for Oracle to build more business

around the cloud. Despite its focus on cloud, Oracle continues to

rank well behind cloud-market front-runners Amazon.com Inc. and

Microsoft Corp., according to Gartner Inc. and other IT industry

analysts -- rankings Mr. Hurd says focus too narrowly on

infrastructure rather than applications software.

Software as a service, or SaaS, is the largest segment of the

global cloud market, forecast to grow 22.2% to $73.6 billion by the

end of the year, Gartner says. It expects the broader global public

cloud market to grow 21.4% this year to a total of $186.4 billion,

with infrastructure as the fastest-growing segment projected to hit

$40.8 billion, up 35.9%.

During its latest quarter ended Aug. 31, Oracle reported overall

revenue growth of 1% to $9.19 billion, including $6.61 billion in

revenue from a new segment called cloud services and license

support that combines cloud and licensing sales.

Looking for growth, Oracle is focusing on cloud-based software

for sales, marketing, services, human resources and other business

functions "that work together as a suite of applications," Mr. Hurd

said.

That strategy marks a shift in recent years for the Redwood

City, Calif., tech giant, which largely built its business on

developing database software that companies used within their own

data centers: "It's very different from the old world," said Mr.

Hurd, a former chairman and chief executive of Hewlett-Packard Co.

who shares the title of Oracle's CEO with Safra Catz.

Mr. Hurd said businesses moving to the cloud are effectively

shifting costs in their IT budgets for data centers, servers,

middleware and other tech components into a growing software

market, and saving money in the process. Oracle's goal, he said, is

to capture those savings by offering cloud services that

essentially combine software, hardware and labor spending into

SaaS.

He sees a number of benefits for enterprise customers running

software in the cloud. For one, cloud applications can be updated

with new features much faster and more often -- four times a year

on average, compared with once every three or four years, Oracle

said.

And since cloud applications are purchased with a renewable

subscription, rather than a one-time perpetual license fee, Oracle

says cloud app vendors are incentivized to continuously add new or

improved capabilities to retain customers.

More broadly, Oracle says cloud-delivered software allows a

company's IT resources to become more strategic, with staff

focusing on higher-value initiatives.

With SaaS, CIOs who have had to spend upward of 80% of their

budgets running and maintaining existing IT and only 20% on

business innovation can start to flip that ratio. Eliminating

legacy-style implementations and customizations gives them the

scope to ramp up innovation, Oracle says.

By bundling its cloud-delivered software into suites, it says,

enterprise users are able to move data seamlessly from application

to application -- since they are built on the same platform, using

the same programming language, and are designed to work

together.

In an on-premise setup, by contrast, CIOs have to deal with

added costs -- and headaches -- for customizations built by systems

integrators, on top of the expense of purchasing the applications,

Oracle says.

Mr. Hurd says in the cloud "their applications run faster and at

a lower cost, and they are always current on the most recent

innovations."

But he adds that cloud isn't a winner-take-all market. Many

customers are increasingly running workloads using a hybrid cloud

model, where some parts use on-premise technology and other parts

are in the cloud.

More CIOs also are relying on several competing cloud providers

for different tools and services.

"The fact that you've now got multiple applications providers,

you might have a Microsoft cloud and a Oracle cloud, or programs

running on someone else's infrastructure, all of that is materially

simpler than managing the environment that many of these customers

developed," Mr. Hurd said.

"This is an irresistible force," he added.

Write to Angus Loten at angus.loten@wsj.com

(END) Dow Jones Newswires

December 03, 2018 11:59 ET (16:59 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

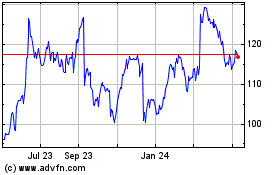

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

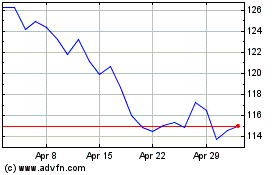

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024