By Michael C. Bender, Georgia Wells, Miriam Gottfried and Aaron Tilley

After months of maneuvering over the future of TikTok, it took a

pair of 11th-hour phone calls with two of America's most powerful

executives to persuade President Trump to agree to a tentative

deal.

Key to getting the president on board with the idea, which

involved Oracle Corp. and Walmart Inc. taking stakes in a new

TikTok based in the U.S., was a thinly sketched-out plan to create

a $5 billion education fund, described by people involved as a

gesture to placate Mr. Trump. The provision came so late that when

it was announced, TikTok and its Chinese parent company weren't

aware it was part of the plan.

The last-minute wrangling came at the end of a week in which a

small group of executives worked with officials led by Treasury

Secretary Steven Mnuchin to make sure a proposal would pass muster

with Mr. Trump. The president has threatened to ban the

Chinese-owned app as a national security risk, and the talks were

aimed, essentially, at Americanizing TikTok. The group was making

headway, but the outcome still wasn't clear.

On Friday Mr. Trump jumped on the phone with Oracle Chairman

Larry Ellison and Walmart Chief Executive Doug McMillon. Mr.

Ellison, a Trump supporter and one of the world's richest people,

spent most of the time getting the president comfortable with the

deal structure and Oracle's role in addressing his security

concerns, according to people familiar with the matter.

The executives talked with Mr. Trump again on Saturday, the

people said. Mr. Trump still wanted something additional, which led

to the education initiative, details of which remained unclear. The

president disclosed his support in principle for the tentative deal

within hours -- though it still needs final approval from all

parties.

Over two months of negotiations with little precedent in

American business history, a mix of powerful personalities,

corporate strategies and geopolitical machinations have intertwined

to decide the fate of an app that 100 million Americans use to

share short dance clips and amusing videos. At the center has been

the U.S. president and his desire to bring at least the U.S.

operations of China's most globally successful tech platform under

American control.

Little about the negotiations was routine, including the

outcome. Investment bankers normally enmeshed in corporate deal

making weren't involved, one person said. And if the U.S. succeeds

in wresting control of a big part of one of China's national

success stories, that would likely trigger further consequences in

the escalating U.S.-China battle for technological supremacy.

As in the days leading up to White House approval in principle,

much remains uncertain. Details still need to be hashed out and

approved by U.S. officials, including the ownership stakes and

TikTok's valuation, which could be as much as $60 billion. Mr.

Trump reiterated on Monday he expects the new company to be

U.S.-controlled. "If we find that they don't have total control,

then we're not going to approve the deal," he said on Fox News.

On Monday, participants were openly disagreeing over the

ownership structure of the proposed new company, TikTok Global. A

spokesman for TikTok parent ByteDance Ltd. said it would retain an

80% stake outright, while Oracle said on Monday morning the 80%

would be distributed proportionally to ByteDance's current

shareholders, which include U.S. investors, and "ByteDance will

have no ownership in TikTok Global."

China's government has yet to give its nod. Officials there

didn't respond to requests for comment. Hu Xijin, editor in chief

of the Global Times, a Communist Party-backed tabloid, said Monday

on Twitter he thought Beijing wouldn't approve the current

agreement. He said it "would endanger China's national security,

interests and dignity." Mr. Hu had earlier held up the U.S.'s

restructuring of the deal as a model that should be promoted

globally.

The arrangement announced over the weekend would transfer

TikTok's data to U.S. servers with enhanced security run by Oracle

and overseen by Oracle CEO Safra Catz, who was once considered for

Mr. Trump's national security adviser. Oracle has promised that

TikTok users' data would be secure.

The structure looks different from Mr. Trump's initial demands.

It could leave TikTok's Beijing-based parent, ByteDance, as a big

shareholder in the new U.S.-based company. The preliminary

agreement also doesn't call for the transfer of ownership of

TikTok's vaunted algorithms, the app's secret sauce and a prized

Chinese asset.

Mr. Trump put TikTok in his crosshairs in July when his

administration said it might ban the app for Americans because of

concerns its data could be accessed for ill purposes by the Chinese

government, something TikTok has said wouldn't happen. He later

issued an executive order setting a deadline for mid-September to

come up with a deal, and a separate 90-day deadline to make it

final.

For most of the ensuing weeks, Microsoft Corp. seemed to be in

pole position. It would have bought TikTok's operations in the U.S.

and three other countries. Microsoft CEO Satya Nadella spoke to Mr.

Trump on Aug. 2 and said the company would work toward a deal.

Walmart later teamed up with Microsoft in that effort. Walmart

started talking with the ByteDance chief executive after Mr. Trump

made his demands, working to forge a closer relationship with

ByteDance in the U.S. and globally, aiming to build its advertising

and e-commerce businesses through the platform, said a person

familiar with the situation. Mr. McMillon let ByteDance and Bill

Ford, CEO of ByteDance investor General Atlantic, know Walmart was

interested in being part of the deal regardless of the other

buyers, said this person.

As the deadline neared, Microsoft's prospects faded. China's

government in late August issued new restrictions on the export of

artificial-intelligence technology, signalling that TikTok's core

algorithms couldn't be included as part of a deal. Beijing

indicated to ByteDance that it didn't want a U.S. company to

control TikTok's technology and it didn't want a forced sale, one

person familiar with the situation said.

It also became increasingly clear that Zhang Yiming, founder and

chief executive of ByteDance, didn't want to give up control of

TikTok, which had enabled him to build a global hit unlike any

other Chinese tech entrepreneur, according to people familiar with

his thinking. ByteDance's U.S. investors, too, were unhappy that

their golden ticket might be snatched away and sold to other

American owners, one of the people said.

Instead, Oracle and ByteDance put together an offer they

believed would satisfy technical concerns from the Trump

administration, even if it fell short of a full sale. Whereas

Microsoft was really interested in control, Oracle was willing to

be a minority investor, and was primarily focused on winning a

marquee customer for its cloud business, according to people

familiar with the companies. Oracle had a history of working with

the U.S. government, so ByteDance and its investors saw the company

as being more aligned with its interests.

About 10 days ago, ByteDance brought the proposal to Mr.

Mnuchin, who had spent months trying to find a way to keep TikTok

from being banned in the U.S. while addressing security concerns

inside the administration. The fight had become a reprise of roles

during the China trade negotiations, as Mr. Mnuchin again jousted

with Peter Navarro, a White House trade adviser, in front of the

president.

Over the second weekend of September, ByteDance told Microsoft

it was out, and that Oracle was its pick. Walmart indicated it

still wanted to participate in a deal.

In the final week of jostling, the participants tried to

fine-tune an agreement they thought could win a green light from

Mr. Trump and China's leadership. The negotiations were conducted

by a tight-knit group that, according to a person familiar with

them, included Mr. Mnuchin, Oracle's Mr. Ellison and Ms. Catz,

Walmart's Mr. McMillon, Mr. Zhang of ByteDance and Mr. Ford of

ByteDance investor General Atlantic.

The initial proposal included many of the core elements of what

ended up being approved by the president, the people said: TikTok

Global as a U.S.-based entity, with Oracle vouching for its data

security, and a plan to take the new company public in the U.S.

that would give it majority non-Chinese ownership. Mr. Ford

proposed a requirement to fill the new company's board with U.S.

citizens except for Mr. Zhang, said people familiar with the

situation.

A term sheet went to the secretive government panel that had

been reviewing the security concerns about TikTok, the Committee on

Foreign Investment in the United States.

Cfius pushed the group to firm up a commitment that TikTok would

go public within 12 months, to settle on its board composition and

to describe the ownership of Oracle and Walmart and how that would

be structured.

Talks were jarred repeatedly by Mr. Trump's off-the-cuff

remarks. Early on, some participants were unsure about which

deadline they had to meet. Mr. Trump had said publicly the deadline

was Sept. 15, a Tuesday, but Mr. Mnuchin the day before clarified

they had until the following Sunday.

Mr. Mnuchin was initially skeptical of the Oracle deal, and

unsure the president would accept anything less than a sale of

TikTok's U.S. operations.

Company executives stressed to Mr. Mnuchin there were no other

options, apart from banning the company. Mr. Mnuchin came around,

and started pitching the president on a deal he believed would

address U.S. national security concerns and also satisfy the

Chinese government, and the Chinese investors.

Inside the administration, there was a growing realization that

China wouldn't let ByteDance sell all of TikTok or core assets such

as its algorithms. White House officials believed the president's

push to ban TikTok in the U.S. had embarrassed Beijing, which was

now determined to make ByteDance a global success story and oppose

a sale.

The group spent much of its time persuading U.S. officials that

ByteDance wasn't another Huawei Technologies Co., the Chinese

telecom giant Mr. Trump had put strict limites on, one of the

people said. Unlike Huawei, ByteDance always had major global

investors, and only two members of its five-person board are

Chinese nationals, including Mr. Zhang.

In the days before signing off, Mr. Trump sent mixed signals. He

told reporters on Wednesday he was skeptical of a deal that left

Chinese investors in control, and repeatedly said Microsoft was

still involved. People familiar with the matter said Microsoft

hadn't been involved since Sept. 13.

On Wednesday, Mr. Trump said his initial demand that the U.S.

Treasury receive a cut of the deal -- a payment he likened to

real-estate "key money" -- had been blocked by White House lawyers.

In private meetings, Mr. Trump continued to press people involved

in the talks about a payment to approve the deal, one of the people

said.

Secretary of State Mike Pompeo and Attorney General Bill Barr

reiterated objections to the deal, saying the national security

issues hadn't been fully addressed. National Security Council staff

in Mr. Trump's White House have continued to raise questions about

the current proposal.

Mr. Mnuchin and other U.S. officials sought to ensure that U.S.

investors would ultimately control a majority stake in the new

TikTok Global, according to people familiar with the matter. They

also went back to ByteDance with enhanced data-security and

data-management safeguards, which the Chinese company agreed to in

a late-night conference call with the secretary, according to one

of the people.

"I think his role here was, 'How can I have everyone save face

here and structure it in a way that China will sign off on it?' "

said Stephen Pavlick, a policy analyst at Renaissance Macro, and

former Treasury aide who worked on Cfius issues.

One person familiar with the talks said changes were made during

the week to all three major aspects of the deal: the size of

investments and corporate governance; parameters for cloud storage

of user data; and the security of the source code and artificial

intelligence. But those changes were described as incremental.

Cfius signed off on the revised proposal, which included a

five-person board for the new TikTok Global, with four Americans:

Messrs. Ford and McMillon along with leaders from two other U.S.

investors in ByteDance -- Doug Leone, global managing partner of

Sequoia Capital, and Arthur Dantchik of Susquehanna International

Group. Mr. Zhang would be the fifth member, according to the

proposal, which could still change.

Oracle would control the user data and guarantee its security,

and the companies pledged the deal would create 25,000 jobs in the

U.S. and lead to more than $5 billion in new tax dollars to the

U.S. Treasury.

It still wasn't clear whether Mr. Trump would give the deal his

blessing, the people said. Then, on Friday morning, the Commerce

Department issued its rules for implementing Mr. Trump's original

ban, saying Americans would be barred from downloading TikTok at

midnight Sunday, Sept. 20. It was a procedural move, but it

highlighted the peril facing TikTok if a deal wasn't completed.

TikTok responded by filing suit in federal court seeking to block

the order.

The phone calls with Messrs. McMillon and Ellison helped win Mr.

Trump's blessing for the preliminary deal. Mr. Ellison explained

the technical side of Oracle's security in a way that resonated for

Mr. Trump more clearly than similar conversations with his national

security team.

By Friday afternoon, the companies were hoping they would get an

announcement later that day. The death of Supreme Court Justice

Ruth Bader Ginsburg put everything on hold for a day.

After the subsequent calls on Saturday and the last-minute

education-fund pledge, Mr. Trump said he had blessed the deal in

principle, making sure to mention Mr. Ellison.

"TikTok is moving along," Mr. Trump said. "We're dealing with

Oracle, which you know of -- Larry Ellison. And we're dealing with,

as a combination, Walmart -- Walmart, a great company. A great

American company. The security will be 100 percent."

Executives at the companies involved were pleased, and relieved,

but not all on the same page. ByteDance issued a statement on its

Chinese social media site saying it hadn't heard of the $5 billion

education fund plan until seeing media reports about it. As of

Sunday, according to people familiar with the matter, ByteDance and

TikTok were still unclear about exactly what it is and how it would

be funded.

--Rolfe Winkler, Kate Davidson, Liza Lin and Sarah Nassauer

contributed to this article.s

Write to Michael C. Bender at Mike.Bender@wsj.com, Georgia Wells

at Georgia.Wells@wsj.com, Miriam Gottfried at

Miriam.Gottfried@wsj.com and Aaron Tilley at

aaron.tilley@wsj.com

(END) Dow Jones Newswires

September 21, 2020 19:01 ET (23:01 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

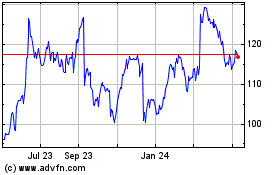

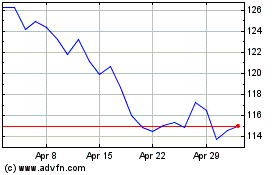

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024