Current Report Filing (8-k)

July 26 2019 - 8:51AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on July 26, 2019

___________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 26, 2019

OPPENHEIMER HOLDINGS INC.

(Exact name of registrant as specified in its charter)

Commission File Number 1-12043

|

|

|

|

|

|

|

Delaware

|

|

98-0080034

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

85 Broad Street

New York, New York 10004

(Address of principal executive offices) (Zip Code)

(212) 668-8000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CRF 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock

|

OPY

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 2 – FINANCIAL INFORMATION

ITEM 2.02. Results of Operations and Financial Condition.

(a)

On July 26, 2019, Oppenheimer Holdings Inc. (the “Company”) issued a press release announcing its second quarter 2019 earnings. A copy of the July 26, 2019 press release is furnished as Exhibit 99.1 to this Report and is incorporated herein by reference.

The information contained in this Item 2.02 and the related exhibit attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information or such exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth in this Item 2.02 or any exhibit related to this Item 2.02 on this Form 8-K shall not be deemed an admission as to the materiality of any information in the referenced items.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01. Financial Statements and Exhibits.

(d)

Exhibits:

The following exhibit is furnished (not filed) with this Current Report on Form 8-K:

99.1 Oppenheimer Holdings Inc.'s Press Release dated July 26, 2019

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Oppenheimer Holdings Inc.

|

|

|

|

|

Date: July 26, 2019

By: /s/ Jeffrey J. Alfano

---------------------------------

Jeffrey J. Alfano

Chief Financial Officer

(Duly Authorized Officer)

|

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit

Number

|

Description

|

|

|

|

Exhibit 99.1

Oppenheimer Holdings Inc. Reports Second Quarter 2019 Earnings and

Announces Increase of Quarterly Dividend and Intent to Redeem $50 million

of 6.75% Senior Secured Notes Due 2022

New York, July 26, 2019

– Oppenheimer Holdings Inc. (NYSE: OPY)(the "Company") today reported net income of

$12.4 million

or

$0.95

basic net income per share for the second quarter of 2019 compared with net income of

$8.9 million

or

$0.67

basic net income per share for the second quarter of 2018. Income before income taxes was

$17.4 million

for the second quarter of 2019 compared with income before income taxes of

$12.5 million

for the second quarter of 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary Operating Results (Unaudited)

|

|

('000s, except Per Share Amounts)

|

|

|

For the Three Months Ended

|

|

For the Six Months Ended

|

|

|

6/30/2019

|

|

6/30/2018

|

|

% Change

|

|

6/30/2019

|

|

6/30/2018

|

|

% Change

|

|

Revenue

|

$

|

250,935

|

|

|

$

|

242,556

|

|

|

3.5

|

|

|

$

|

502,705

|

|

|

$

|

477,086

|

|

|

5.4

|

|

|

Expenses

|

233,544

|

|

|

230,039

|

|

|

1.5

|

|

|

469,262

|

|

|

454,948

|

|

|

3.1

|

|

|

Income Before Income Taxes

|

17,391

|

|

|

12,517

|

|

|

38.9

|

|

|

33,443

|

|

|

22,138

|

|

|

51.1

|

|

|

Income Taxes

|

5,016

|

|

|

3,662

|

|

|

37.0

|

|

|

9,874

|

|

|

6,578

|

|

|

50.1

|

|

|

Net Income

|

$

|

12,375

|

|

|

$

|

8,855

|

|

|

39.8

|

|

|

$

|

23,569

|

|

|

$

|

15,560

|

|

|

51.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

$

|

0.95

|

|

|

$

|

0.67

|

|

|

41.8

|

|

|

$

|

1.81

|

|

|

$

|

1.17

|

|

|

54.7

|

|

|

Diluted

|

$

|

0.89

|

|

|

$

|

0.63

|

|

|

41.3

|

|

|

$

|

1.70

|

|

|

$

|

1.11

|

|

|

53.2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of

|

|

As of

|

|

|

6/30/2019

|

|

6/30/2018

|

|

% Change

|

|

6/30/2019

|

|

12/31/2018

|

|

% Change

|

|

Book Value Per Share

|

$

|

43.84

|

|

|

$

|

40.61

|

|

|

8.0

|

|

|

$

|

43.84

|

|

|

$

|

41.81

|

|

|

4.9

|

|

|

Tangible Book Value Per Share

(1)

|

$

|

30.62

|

|

|

$

|

27.78

|

|

|

10.2

|

|

|

$

|

30.62

|

|

|

$

|

28.78

|

|

|

6.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Represents book value less goodwill and intangible assets divided by number of shares outstanding.

|

|

|

|

|

|

|

Dividend Announcement

The Company announced an increase in its quarterly dividend from $0.11 to $0.12 per share, a 9.1% increase, effective for the second quarter of 2019 and payable on August 23, 2019 to holders of Class A non-voting and Class B voting common stock of record on August 9, 2019.

Senior Secured Note Redemption Announcement

The Company also announced that it will be redeeming a total of $50 million (25%) of its 6.75% Senior Secured Notes due 2022 (the “Notes”). The Company has delivered to the Trustee for the holders of the Notes a notice of partial redemption, notifying the Trustee of the Company’s intent to redeem on August 25, 2019 (the “Redemption Date”) $50 million aggregate principal amount of the outstanding Notes at a redemption price equal to 103.375% (“Call Premium”) of the principal amount of the Notes to be redeemed, plus accrued and unpaid interest thereon to the Redemption Date. The Company will incur $1.7 million in costs associated with paying the Call Premium on the Notes during the third quarter of 2019. Upon completion of the redemption, $150 million aggregate principal amount of the Notes will remain outstanding. The redemption of 25% of the Notes will reduce the Company’s interest costs by $3.8 million annually.

Second Quarter 2019 Highlights

|

|

|

|

•

|

Quarterly revenues in excess of $250 million

|

|

|

|

|

•

|

Profit margin in Private Client Division of 26.8%

|

|

|

|

|

•

|

Assets under management increased 5.2% to $30.2 billion at June 30, 2019, a record high, when compared to $28.7 billion at June 30, 2018

|

|

|

|

|

•

|

Auction rate securities ("ARS") tender offer due to take place in July 2019 will result in an additional $20 million in liquidity in the third quarter of 2019. As a result of the intent to participate in the tender offer, the Company marked the relevant ARS positions at their tender price at June 30, 2019 which resulted in:

|

|

|

|

|

◦

|

an unrealized loss of $2.4 million in the second quarter of 2019; and

|

|

|

|

|

◦

|

a reduction in "Level 3" securities to zero at June 30, 2019 for the first time in over a decade

|

|

|

|

|

•

|

Legal and regulatory costs declined by approximately 70% in the second quarter of 2019 compared with the second quarter of 2018

|

|

|

|

|

•

|

Book value per share of $43.84, a record high

|

|

|

|

|

•

|

The Company purchased 167,209 shares of OPY Class A non-voting common stock under its share purchase program during the second quarter of 2019 for $4.3 million at an average share price of $25.82

|

During the second quarter of 2019, the major stock indices in the U.S. increased 3.8% adding on to the 13.1% gains in the first quarter of 2019. The equities markets had their best June in decades while all three major indices closed near all-time highs. The markets benefited from expectations that the U.S. Federal Reserve will decrease short-term interest rates in the near term. A continued strong U.S. economy, record low unemployment, and optimism around trade negotiations between the U.S. and China helped fuel the rally in the equities markets. The 10-year Treasury yield was 2.41% at the end of the first quarter of 2019 and fell to 2.00% at the end of the second quarter of 2019 due to expectations around the Fed's loosening of monetary policy.

Albert G. Lowenthal, Chairman and CEO commented, "We are pleased with the performance of the business during the second quarter of 2019. Although our results were aided by a strong equities market, the firm's core businesses performed well and we believe that the strong underlying economic landscape will continue to provide support for the growth objectives of the firm. After the significant increases in the equities markets during the first quarter of 2019, our asset management fees for the second quarter increased 4.4%. Our investment banking business performed well as a result of increased fees from advisory assignments and equity underwritings and we are optimistic about our business pipeline for the second half of 2019.

Our institutional equities commission business showed improvement during the second quarter of 2019 as a result of strong execution-driven commission growth in block trading and better recognition and monetization of our high value research content. Our operating results continue to benefit from the present level of short-term interest rates as we continue to realize the effect of interest rate hikes in 2018. However, our transaction-based business in our Private Client Division declined during the period reflecting an ongoing secular reduction in portfolio turnover as clients continue to move to more passive investment strategies through investments in exchange traded funds ("ETFs") and other index related securities. We continue to be encouraged by the significant decline in legal and regulatory costs during the period as many of the investments in our compliance efforts continue to be realized.

The strong operating results of the business and increased liquidity from recent tenders for ARS help facilitate a reduction of high cost outstanding debt by 25% and also give us the ability to return additional capital to our shareholders through an increase of our dividend. Our reduced leverage and continued high level of liquidity will be advantageous as we look to expand our business.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Segment Results (Unaudited)

|

|

('000s)

|

|

|

|

For the Three Months Ended

|

|

For the Six Months Ended

|

|

|

|

6/30/2019

|

|

6/30/2018

|

|

% Change

|

|

6/30/2019

|

|

6/30/2018

|

|

% Change

|

|

Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Private Client

|

$

|

161,928

|

|

|

$

|

156,553

|

|

|

3.4

|

|

|

$

|

325,455

|

|

|

$

|

310,647

|

|

|

4.8

|

|

|

|

Asset Management

|

18,622

|

|

|

17,706

|

|

|

5.2

|

|

|

35,208

|

|

|

35,350

|

|

|

(0.4

|

)

|

|

|

Capital Markets

|

71,819

|

|

|

68,206

|

|

|

5.3

|

|

|

142,780

|

|

|

129,735

|

|

|

10.1

|

|

|

|

Corporate/Other

|

(1,434

|

)

|

|

91

|

|

|

*

|

|

|

(738

|

)

|

|

1,354

|

|

|

*

|

|

|

|

Total

|

$

|

250,935

|

|

|

$

|

242,556

|

|

|

3.5

|

|

|

$

|

502,705

|

|

|

$

|

477,086

|

|

|

5.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (Loss) Before Income Taxes

|

|

|

|

|

|

|

|

|

|

|

Private Client

|

43,416

|

|

|

33,513

|

|

|

29.5

|

|

|

86,250

|

|

|

73,675

|

|

|

17.1

|

|

|

|

Asset Management

|

5,318

|

|

|

3,958

|

|

|

34.4

|

|

|

7,560

|

|

|

7,676

|

|

|

(1.5

|

)

|

|

|

Capital Markets

|

(1,801

|

)

|

|

(199

|

)

|

|

(805.0

|

)

|

|

(4,448

|

)

|

|

(6,256

|

)

|

|

28.9

|

|

|

|

Corporate/Other

|

(29,542

|

)

|

|

(24,755

|

)

|

|

(19.3

|

)

|

|

(55,919

|

)

|

|

(52,957

|

)

|

|

(5.6

|

)

|

|

|

Total

|

$

|

17,391

|

|

|

$

|

12,517

|

|

|

38.9

|

|

|

$

|

33,443

|

|

|

$

|

22,138

|

|

|

51.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Percentage not meaningful.

Private Client

Private Client reported revenue of

$161.9 million

for the second quarter of 2019,

3.4

% higher than the second quarter of 2018 due to higher asset management fees, bank deposit sweep income, and an increase in the cash surrender value of Company-owned life insurance partially offset by lower retail commissions during the second quarter of 2019. Income before income taxes was

$43.4 million

for the second quarter of 2019, an increase of

29.5

% compared with the second quarter of 2018 due to the aforementioned items and lower legal and regulatory costs partially offset by higher interest costs during the second quarter of 2019.

|

|

|

|

•

|

Client assets under administration were $87.3 billion at June 30, 2019 compared with $80.1 billion at December 31, 2018, an increase of 9.0%.

|

|

|

|

|

•

|

Financial adviser headcount was 1,036 at the end of the second quarter of 2019, down from 1,083 at the end of the second quarter of 2018. The decline in financial adviser headcount since the second quarter of 2018 has resulted from the Company's emphasis on adviser productivity as well as retirements and attrition.

|

|

|

|

|

•

|

Retail commissions were $47.1 million for the second quarter of 2019, a decrease of 4.8% from the second quarter of 2018.

|

|

|

|

|

•

|

Advisory fee revenue on traditional and alternative managed products was $62.1 million for the second quarter of 2019, an increase of 3.8% from the second quarter of 2018 (see Asset Management below for further information). The increase in advisory fees was due to an increase in assets under management ("AUM") at March 31, 2019 as a result of the increase in the equities markets and net new assets during the first quarter of 2019.

|

|

|

|

|

•

|

Bank deposit sweep income was

$31.8 million

for the second quarter of 2019, an increase of

10.3

% compared with

$28.9 million

for the second quarter of 2018 due to higher short-term interest rates during the second quarter of 2019.

|

Asset Management

Asset Management reported revenue of

$18.6 million

for the second quarter of 2019,

5.2

% higher than the second quarter of 2018 due to higher AUM at March 31, 2019, which is the basis for advisory fees earned during the second quarter of 2019, as a result of the increase in the equities markets and net new assets during the first quarter of 2019. Income before income taxes was

$5.3 million

for the second quarter of 2019, an increase of

34.4

% compared with the second quarter of 2018 due to higher AUM at March 31, 2019.

|

|

|

|

•

|

Advisory fee revenue on traditional and alternative managed products was $18.6 million for the second quarter of 2019, an increase of 6.3% from the second quarter of 2018 primarily due to higher AUM at March 31, 2019.

|

|

|

|

|

◦

|

Advisory fees are calculated based on the value of client AUM at the end of the prior quarter which totaled $29.5 billion at March 31, 2019 ($28.2 billion at March 31, 2018) and are allocated between the Private Client and Asset Management business segments.

|

|

|

|

|

•

|

AUM increased 5.2% to $30.2 billion at June 30, 2019, a record high, compared with $28.7 billion at June 30, 2018, which is the basis for advisory fee billings for the third quarter of 2019. The increase in AUM was comprised of asset appreciation of $0.6 billion and a positive net contribution of assets of $0.9 billion.

|

Capital Markets

Capital Markets reported revenue of

$71.8 million

for the second quarter of 2019,

5.3

% higher than the second quarter of 2018 primarily due to higher investment banking fees. Loss before income taxes was

$1.8 million

for the second quarter of 2019 compared with loss before income taxes of

$0.2 million

for the second quarter of 2018.

|

|

|

|

•

|

Institutional equities commissions increased 6.9% to $24.8 million for the second quarter of 2019 compared with the second quarter of 2018 due to strong execution-driven commission growth in block trading and better recognition and monetization of our high value research content.

|

|

|

|

|

•

|

Advisory fees earned from investment banking activities increased 62.5% to $13.0 million for the second quarter of 2019 compared with $8.0 million for the second quarter of 2018 due to an increase in mergers and acquisitions transactions during the second quarter of 2019.

|

|

|

|

|

•

|

Equities underwriting fees increased modestly to $15.3 million for the second quarter of 2019 compared with $15.2 million for the second quarter of 2018 as the Company participated in more transactions with lower economics due to a decrease in the number of lead managed deals during the second quarter of 2019.

|

|

|

|

|

•

|

Revenue from taxable fixed income decreased marginally to $15.2 million during the second quarter of 2019 from $15.3 million during the second quarter of 2018 due to lower trading income in taxable fixed income products partially offset by higher institutional fixed income commissions.

|

|

|

|

|

•

|

Revenue from public finance and municipal trading decreased to $4.7 million during the second quarter of 2019 from $5.7 million during the second quarter of 2018 due to lower commission income partially offset by higher municipal trading income during the second quarter of 2019.

|

Compensation and Related Expenses

Compensation and related expenses totaled

$155.8 million

during the second quarter of 2019, an increase of

2.6

% compared with the second quarter of 2018. The increase was due to higher salaries, production, and incentive compensation costs partially offset by lower share-based and traders' compensation costs during the second quarter of 2019. Compensation and related expenses as a percentage of revenue was

62.1%

during the second quarter of 2019 compared with

62.6%

during the second quarter of 2018.

Non-Compensation Expenses

Non-compensation expenses were

$77.8 million

during the second quarter of 2019, a decrease of

0.5

% compared with

$78.2 million

during the second quarter of 2018 due primarily to higher interest costs and communication and technology costs partially offset by lower legal and regulatory costs during the second quarter of 2019.

Provision for Income Taxes

The effective income tax rate from continuing operations for the second quarter of 2019 was

28.8

%, slightly lower when compared with

29.3

% for the second quarter of 2018. The effective rate reflects the Company's estimate of the annual effective tax rate adjusted for certain discrete items.

Balance Sheet and Liquidity

|

|

|

|

•

|

At June 30, 2019, total equity was $563.6 million, a record high,

compared with $545.3 million

at December 31, 2018.

|

|

|

|

|

•

|

At June 30, 2019, book value per share was

$43.84

(compared with

$41.81

at December 31, 2018) and tangible book value per share was

$30.62

(compared with

$28.78

at December 31, 2018), both at record highs.

|

|

|

|

|

•

|

As discussed above, on August 25, 2019, the Company will be redeeming a total of $50 million (25%) of its Notes.

|

|

|

|

|

•

|

The Company's level 3 assets were $nil at June 30, 2019 (compared with $21.8 million at December 31, 2018). The decline in level 3 assets was the result of ARS issuer tender offer announcements and the resulting marking of the ARS positions held by the Company to the tender price during the three months ended June 30, 2019.

|

Company Information

Oppenheimer Holdings Inc., through its operating subsidiaries, is a leading middle market investment bank and full service broker-dealer that provides a wide range of financial services including retail securities brokerage, institutional sales and trading, investment banking (both corporate and public finance), research, market-making, trust, and investment management. With roots tracing back to 1881, the firm is headquartered in New York and has 94 retail branch offices in the United States and has institutional businesses located in London, Tel Aviv, and Hong Kong.

Forward-Looking Statements

This press release includes certain "forward-looking statements" relating to anticipated future performance. For a discussion of the factors that could cause future performance to be different than anticipated, reference is made to Factors Affecting "Forward-Looking Statements" and Part 1A – Risk Factors in the Company's Annual Report on Form 10-K for the year ended December 31, 2018.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oppenheimer Holdings Inc.

|

|

|

Consolidated Income Statement (Unaudited)

|

|

('000s, except number of shares and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

|

|

For the Six Months Ended

|

|

|

|

6/30/2019

|

|

6/30/2018

|

|

% Change

|

|

6/30/2019

|

|

6/30/2018

|

|

% Change

|

|

REVENUE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commissions

|

$

|

80,896

|

|

|

$

|

82,850

|

|

|

(2.4

|

)

|

|

$

|

160,305

|

|

|

$

|

166,257

|

|

|

(3.6

|

)

|

|

|

Advisory fees

|

80,707

|

|

|

77,270

|

|

|

4.4

|

|

|

154,354

|

|

|

154,818

|

|

|

(0.3

|

)

|

|

|

Investment banking

|

32,006

|

|

|

27,904

|

|

|

14.7

|

|

|

60,049

|

|

|

56,114

|

|

|

7.0

|

|

|

|

Bank deposit sweep income

|

31,830

|

|

|

28,853

|

|

|

10.3

|

|

|

65,798

|

|

|

54,150

|

|

|

21.5

|

|

|

|

Interest

|

13,550

|

|

|

13,056

|

|

|

3.8

|

|

|

26,277

|

|

|

25,283

|

|

|

3.9

|

|

|

|

Principal transactions, net

|

3,045

|

|

|

6,400

|

|

|

(52.4

|

)

|

|

14,483

|

|

|

9,126

|

|

|

58.7

|

|

|

|

Other

|

8,901

|

|

|

6,223

|

|

|

43.0

|

|

|

21,439

|

|

|

11,338

|

|

|

89.1

|

|

|

|

Total revenue

|

250,935

|

|

|

242,556

|

|

|

3.5

|

|

|

502,705

|

|

|

477,086

|

|

|

5.4

|

|

|

EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and related expenses

|

155,783

|

|

|

151,871

|

|

|

2.6

|

|

|

316,138

|

|

|

304,975

|

|

|

3.7

|

|

|

|

Communications and technology

|

20,499

|

|

|

17,997

|

|

|

13.9

|

|

|

40,585

|

|

|

36,685

|

|

|

10.6

|

|

|

|

Occupancy and equipment costs

|

15,573

|

|

|

14,901

|

|

|

4.5

|

|

|

30,846

|

|

|

30,329

|

|

|

1.7

|

|

|

|

Clearing and exchange fees

|

5,678

|

|

|

5,780

|

|

|

(1.8

|

)

|

|

11,010

|

|

|

11,876

|

|

|

(7.3

|

)

|

|

|

Interest

|

13,192

|

|

|

10,909

|

|

|

20.9

|

|

|

26,178

|

|

|

19,872

|

|

|

31.7

|

|

|

|

Other

|

22,819

|

|

|

28,581

|

|

|

(20.2

|

)

|

|

44,505

|

|

|

51,211

|

|

|

(13.1

|

)

|

|

|

Total expenses

|

233,544

|

|

|

230,039

|

|

|

1.5

|

|

|

469,262

|

|

|

454,948

|

|

|

3.1

|

|

|

Income before income taxes

|

17,391

|

|

|

12,517

|

|

|

38.9

|

|

|

33,443

|

|

|

22,138

|

|

|

51.1

|

|

|

Income taxes

|

5,016

|

|

|

3,662

|

|

|

37.0

|

|

|

9,874

|

|

|

6,578

|

|

|

50.1

|

|

|

Net income

|

$

|

12,375

|

|

|

$

|

8,855

|

|

|

39.8

|

|

|

$

|

23,569

|

|

|

$

|

15,560

|

|

|

51.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per share

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

$

|

0.95

|

|

|

$

|

0.67

|

|

|

41.8

|

|

|

$

|

1.81

|

|

|

$

|

1.17

|

|

|

54.7

|

|

|

Diluted

|

$

|

0.89

|

|

|

$

|

0.63

|

|

|

41.3

|

|

|

$

|

1.70

|

|

|

$

|

1.11

|

|

|

53.2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares outstanding

|

|

|

|

|

|

|

|

|

|

|

Basic

|

12,976,235

|

|

|

13,248,812

|

|

|

(2.1

|

)

|

|

12,998,168

|

|

|

13,244,245

|

|

|

(1.9

|

)

|

|

|

Diluted

|

13,861,753

|

|

|

14,050,573

|

|

|

(1.3

|

)

|

|

13,857,616

|

|

|

14,005,556

|

|

|

(1.1

|

)

|

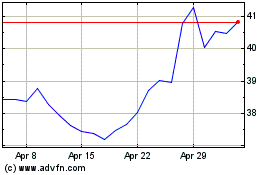

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Apr 2023 to Apr 2024