Ooma, Inc. (NYSE: OOMA), a smart communications platform for

businesses and consumers, today released financial results for the

fiscal third quarter ended October 31, 2022.

Third Quarter Fiscal 2023 Financial Highlights:

- Revenue: Total revenue was $56.7 million, up 15%

year-over-year. Subscription and services revenue increased to

$51.7 million from $44.7 million in the third quarter of fiscal

2022, and was 91% of total revenue, primarily driven by the growth

of Ooma Business.

- Net Income/Loss: GAAP net loss was $2.8 million, or

$0.11 per basic and diluted share, compared to GAAP net loss of

$0.3 million, or $0.01 per basic and diluted share, in the third

quarter of fiscal 2022. GAAP net loss for the third quarter

includes a $1.4 million charge for consolidation of facilities, as

well as $0.6 million in acquisition-related costs, both associated

with the acquisition of OnSIP in late July. Non-GAAP net income was

$3.5 million, or $0.14 per diluted share, compared to non-GAAP net

income of $3.3 million, or $0.13 per diluted share in the prior

year period.

- Adjusted EBITDA: Adjusted EBITDA was $4.5 million,

compared to $4.0 million in the third quarter of fiscal 2022.

For more information about non-GAAP net income and Adjusted

EBITDA, see the section below titled "Non-GAAP Financial Measures"

and the reconciliation provided in this release.

“Ooma executed well in Q3, increasing revenue 15% year-over-year

to $56.7 million and attaining its highest-ever quarterly non-GAAP

net income and adjusted EBITDA,” said Eric Stang, chief executive

officer of Ooma. “We introduced new features for our Ooma Office

Pro Plus tier of service, grew sales of Ooma Enterprise in select

verticals including hospitality, expanded our user base in Europe

in addition to North America, and added T-Mobile as a resale

partner for AirDial, our new solution to replace businesses’ aging

and expensive copper lines. We also continued the integration of

our recent acquisition OnSIP and are pleased to report that OnSIP

was adjusted EBITDA accretive in Q3, ahead of plan. Looking

forward, we continue to see significant opportunity and remain

focused on executing our strategy to drive profitable growth.”

Business Outlook:

For the fourth quarter of fiscal 2023, Ooma expects:

- Total revenue in the range of $56.3 million to $56.6

million.

- GAAP net loss in the range of $0.7 million to $1.0 million and

GAAP net loss per share in the range of $0.03 to $0.04.

- Non-GAAP net income in the range of $3.5 million to $3.8

million and non-GAAP net income per share in the range of $0.14 to

$0.15.

For the full fiscal year 2023, Ooma expects:

- Total revenue in the range of $216.0 million to $216.3

million.

- GAAP net loss in the range of $4.0 million to $4.3 million, and

GAAP net loss per share in the range of $0.16 to $0.18.

- Non-GAAP net income in the range of $13.0 million to $13.3

million, and non-GAAP net income per share in the range of $0.51 to

$0.53.

The following is a reconciliation of GAAP net loss to non-GAAP

net income and GAAP basic and diluted net loss per share to

non-GAAP diluted net income per share guidance for the fiscal

fourth quarter and fiscal year ending January 31, 2023 (in

millions, except per share data):

Projected range Three Months Ending Fiscal Year

Ending January 31, 2023 January 31, 2023

(unaudited) GAAP net loss

($0.7)-($1.0

)

($4.0)-($4.3

)

Stock-based compensation and related taxes

3.6

14.2

Amortization of intangible assets and acquisition-related costs

0.9

3.8

Facilities consolidation charges

—

1.4

Acquisition-related income tax benefit

—

(2.1

)

Non-GAAP net income

$3.5-$3.8

$13.0-$13.3

GAAP net loss per share

($0.03)-($0.04

)

($0.16)-($0.18

)

Stock-based compensation and related taxes

0.14

0.56

Amortization of intangible assets and acquisition-related costs

0.04

0.15

Facilities consolidation charges

—

0.06

Acquisition-related income tax benefit

—

(0.08

)

Non-GAAP net income per share

$0.14-$0.15

$0.51-$0.53

Weighted-average number of shares used in per share amounts:

Basic

24.9

24.5

Diluted

25.7

25.3

Conference Call Information:

Ooma will host a conference call and live webcast for analysts

and investors today at 5:00 p.m. Eastern time. The news release

with the financial results will be accessible from the company's

website prior to the conference call.

Parties in the United States and Canada can access the call by

dialing +1 (888) 550-5744, using conference ID 4726540.

International parties can access the call by dialing +1 (646)

960-0223, using conference ID 4726540.

The webcast will be accessible on the Events and Presentations

page of Ooma’s investor relations website,

https://investors.ooma.com, for a period of at least one year. A

telephonic replay of the conference call will be available from

approximately two hours after the call is completed or about 8:00

p.m. Eastern time on November 30, 2022 until 11:59 p.m. Eastern

time Wednesday, December 7, 2022. To access the replay, parties in

the United States and Canada should call +1 (800) 770-2030 and use

conference code 4726540. International parties should call +1 (647)

362-9199 and use conference code 4726540.

Non-GAAP Financial Measures

In addition to disclosing financial measures prepared in

accordance with U.S. generally accepted accounting principles

(“GAAP”), this press release and the accompanying tables contain

certain non-GAAP financial measures, including: non-GAAP net

income, non-GAAP net income per share, non-GAAP gross profit and

gross margin, non-GAAP operating income, and Adjusted EBITDA.

Adjusted EBITDA represents the net income before interest and other

income, income tax benefit, depreciation and amortization of

capital expenditures, amortization of intangible assets,

acquisition-related transaction costs, facilities consolidation

charges, and stock-based compensation expense and related

taxes.

Other non-GAAP financial measures exclude stock-based

compensation expense and related taxes, amortization of intangible

assets, acquisition-related transaction costs, facilities

consolidation charges and acquisition-related income tax benefit.

For the third quarter of fiscal 2023, facilities consolidation

charges included asset write-downs related to leased office space

assumed in connection with Ooma’s acquisition of OnSIP in July 2022

that the company determined were not needed to support the future

growth of its business. Non-GAAP weighted-average diluted shares

include the effect of potentially dilutive securities from the

company’s stock-based benefit plans.

These non-GAAP financial measures are presented to provide

investors with additional information regarding our financial

results and core business operations. Ooma considers these non-GAAP

financial measures to be useful measures of the operating

performance of the company, because they contain adjustments for

unusual events or factors that do not directly affect what

management considers to be Ooma's core operating performance and

are used by the company's management for that purpose. Management

also believes that these non-GAAP financial measures allow for a

better evaluation of the company's performance by facilitating a

meaningful comparison of the company's core operating results in a

given period to those in prior and future periods. In addition,

investors often use similar measures to evaluate the operating

performance of a company.

Non-GAAP financial measures are presented for supplemental

informational purposes only to aid an understanding of the

company's operating results. The non-GAAP financial measures should

not be considered a substitute for financial information presented

in accordance with GAAP and may be different from non-GAAP

financial measures presented by other companies. A limitation of

the non-GAAP financial measures presented is that the adjustments

relate to items that the company generally expects to continue to

recognize. The adjustment of these items should not be construed as

an inference that the adjusted gains or expenses are unusual,

infrequent or non-recurring. Therefore, both GAAP financial

measures of Ooma's financial performance and the respective

non-GAAP measures should be considered together. Please see the

reconciliation of non-GAAP financial measures to the most directly

comparable GAAP measure in the tables below.

Disclosure Information

Ooma uses the investor relations section on its website as a

means of complying with its disclosure obligations under Regulation

FD. Accordingly, investors should monitor Ooma's investor relations

website in addition to following Ooma's press releases, Securities

and Exchange Commission (“SEC”) filings, and public conference

calls and webcasts.

Legal Notice Regarding Forward-Looking Statements

This press release contains forward-looking statements under the

Private Securities Litigation Reform Act of 1995. In particular,

the financial projections under “Business Outlook” and the

statements contained in the quotations of our Chief Executive

Officer regarding expectations regarding the Company’s business

opportunities and strategies may constitute forward-looking

statements. Forward-looking statements can be identified by the

fact that they do not relate strictly to historical facts and

generally contain words such as "believes”, "expects”, "may”,

"will”, "should”, "seeks”, "approximately”, "intends”, "plans”,

"estimates”, "anticipates”, and other expressions that are

predictions of or indicate future events. Although the

forward-looking statements contained in this press release are

based upon information available at the time the statements are

made and reflect management's good faith beliefs, forward-looking

statements inherently involve known and unknown risks,

uncertainties and other factors, which may cause the actual

results, performance or achievements to differ materially from

anticipated future results. Important factors that could cause

actual results to differ materially from expectations include,

among others: our inability to attract new customers on a

cost-effective basis; our inability to retain customers; our

inability to realize expected returns from our investments made in

connection with our international expansion efforts and development

of new product features; failure to realize AirDial opportunities;

intense competition; loss of key retailers and reseller

partnerships; our reliance on vendors to manufacture the on-premise

appliances and end-point devices we sell; our reliance on third

parties for our network connectivity and co-location facilities;

our reliance on third parties for some of our software development,

quality assurance and operations; our reliance on third parties to

provide the majority of our customer service and support

representatives; and interruptions to our service. You should not

place undue reliance on these forward-looking statements, which

speak only as of the date hereof. We do not undertake to update or

revise any forward-looking statements after they are made, whether

as a result of new information, future events, or otherwise, except

as required by applicable law.

The forward-looking statements contained in this press release

are also subject to other risks and uncertainties, including those

more fully described in our filings which we make with the SEC from

time to time, including the risk factors contained in our Quarterly

Report on Form 10-Q for the quarter ended July 31, 2022, filed with

the SEC on September 8, 2022. The forward-looking statements in

this press release are based on information available to Ooma as of

the date hereof, and Ooma disclaims any obligation to update any

forward-looking statements, except as required by law.

About Ooma, Inc.

Ooma (NYSE: OOMA) creates powerful connected experiences for

businesses and consumers, delivered from its smart cloud-based SaaS

platform. For businesses of all sizes, Ooma provides advanced voice

and collaboration features including messaging, intelligent virtual

attendants, and video conferencing to help them run more

efficiently. For consumers, Ooma’s residential phone service

provides PureVoice HD voice quality, advanced functionality and

integration with mobile devices. Learn more at www.ooma.com or

www.ooma.ca in Canada.

OOMA, INC CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, amounts in thousands) October

31, January 31,

2022

2022

Assets Current assets: Cash and cash equivalents

$

20,037

$

19,667

Short-term investments

4,495

11,613

Accounts receivable, net

7,125

7,310

Inventories

22,021

13,841

Other current assets

14,550

13,598

Total current assets

68,228

66,029

Property and equipment, net

7,662

6,481

Operating lease right-of-use assets

12,782

14,396

Intangible assets, net

11,256

4,208

Goodwill

8,946

4,264

Other assets

15,640

13,875

Total assets

$

124,514

$

109,253

Liabilities and stockholders' equity Current

liabilities: Accounts payable

$

11,827

$

7,507

Accrued expenses and other current liabilities

24,805

22,823

Deferred revenue

17,476

16,600

Total current liabilities

54,108

46,930

Long-term operating lease liabilities

10,539

11,194

Other liabilities

39

73

Total liabilities

64,686

58,197

Stockholders' equity: Common stock

5

4

Additional paid-in capital

191,909

179,860

Accumulated other comprehensive loss

(60

)

(20

)

Accumulated deficit

(132,026

)

(128,788

)

Total stockholders' equity

59,828

51,056

Total liabilities and stockholders' equity

$

124,514

$

109,253

OOMA, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited, amounts in thousands, except share

and per share data) Three Months Ended Nine

Months Ended October 31,2022 October 31,2021

October 31,2022 October 31,2021 Revenue:

Subscription and services

$

51,749

$

44,659

$

146,467

$

130,161

Product and other

4,930

4,513

13,202

11,640

Total revenue

56,679

49,172

159,669

141,801

Cost of revenue: Subscription and services

14,070

12,274

39,954

36,939

Product and other

6,689

6,652

18,026

17,231

Total cost of revenue

20,759

18,926

57,980

54,170

Gross profit

35,920

30,246

101,689

87,631

Operating expenses: Sales and marketing

18,019

15,078

51,602

43,425

Research and development

12,498

9,467

34,115

28,190

General and administrative (1)

8,258

6,080

21,232

17,819

Total operating expenses

38,775

30,625

106,949

89,434

Loss from operations

(2,855

)

(379

)

(5,260

)

(1,803

)

Interest and other income, net

94

53

144

151

Loss before income taxes

(2,761

)

(326

)

(5,116

)

(1,652

)

Income tax (provision) benefit

(49

)

—

1,878

—

Net loss

$

(2,810

)

$

(326

)

$

(3,238

)

$

(1,652

)

Net loss per share of common stock: Basic and diluted

$

(0.11

)

$

(0.01

)

$

(0.13

)

$

(0.07

)

Weighted-average shares of common stock outstanding: Basic

and diluted

24,608,685

23,619,406

24,373,836

23,348,529

(1) Includes asset impairment related to facilities

consolidation as follows:

$

1,402

$

—

$

1,402

$

—

OOMA, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (Unaudited, amounts in thousands) Three

Months Ended Nine Months Ended October 31,2022

October 31,2021 October 31,2022 October

31,2021 Cash flows from operating activities: Net loss

$

(2,810

)

$

(326

)

$

(3,238

)

$

(1,652

)

Adjustments to reconcile net loss to net cash provided by operating

activities: Stock-based compensation expense

3,541

3,233

10,383

9,748

Depreciation and amortization of capital expenditures

998

780

2,737

2,328

Amortization of intangible assets

794

326

1,492

978

Amortization of operating lease right-of-use assets

799

699

2,248

2,230

Facilities consolidation charges

1,402

—

1,402

—

Deferred income tax benefit

(90

)

—

(2,133

)

—

Other

8

15

34

39

Changes in operating assets and liabilities: Accounts receivable,

net

(533

)

(1,457

)

440

(1,057

)

Inventories and deferred inventory costs

(977

)

(369

)

(8,135

)

(1,969

)

Prepaid expenses and other assets

1,022

(1,355

)

(1,304

)

(4,362

)

Accounts payable, accrued expenses and other liabilities

(1,446

)

389

1,244

(1,738

)

Deferred revenue

(219

)

(57

)

301

327

Net cash provided by operating activities

2,489

1,878

5,471

4,872

Cash flows from investing activities: Proceeds from

maturities and sales of short-term investments

1,775

4,330

10,900

14,230

Purchases of short-term investments

—

(6,007

)

(3,869

)

(14,866

)

Capital expenditures

(1,095

)

(1,308

)

(3,907

)

(3,050

)

Business acquisition

—

—

(9,771

)

—

Net cash provided by (used in) investing activities

680

(2,985

)

(6,647

)

(3,686

)

Cash flows from financing activities: Proceeds from

issuance of common stock

1,123

959

2,677

2,580

Shares repurchased for tax withholdings on vesting of restricted

stock units

(447

)

(479

)

(1,131

)

(1,624

)

Net cash provided by financing activities

676

480

1,546

956

Net increase (decrease) in cash and cash equivalents

3,845

(627

)

370

2,142

Cash and cash equivalents at beginning of period

16,192

20,067

19,667

17,298

Cash and cash equivalents at end of period

$

20,037

$

19,440

$

20,037

$

19,440

OOMA, INC. Reconciliation of Non-GAAP Financial

Measures (Unaudited, amounts in thousands, except

percentages, shares and per share data) Three Months

Ended Nine Months Ended October 31,2022

October 31,2021 October 31,2022 October

31,2021 Revenue

$

56,679

$

49,172

$

159,669

$

141,801

GAAP gross profit

$

35,920

$

30,246

$

101,689

$

87,631

Stock-based compensation and related taxes

242

210

738

795

Amortization of intangible assets

139

73

291

219

Non-GAAP gross profit

$

36,301

$

30,529

$

102,718

$

88,645

Gross margin on a GAAP basis

63

%

62

%

64

%

62

%

Gross margin on a Non-GAAP basis

64

%

62

%

64

%

63

%

GAAP operating loss

$

(2,855

)

$

(379

)

$

(5,260

)

$

(1,803

)

Stock-based compensation and related taxes

3,585

3,306

10,592

10,073

Amortization of intangible assets and acquisition-related costs

1,374

326

2,873

978

Facilities consolidation charges

1,402

—

1,402

—

Non-GAAP operating income

$

3,506

$

3,253

$

9,607

$

9,248

GAAP net loss

$

(2,810

)

$

(326

)

$

(3,238

)

$

(1,652

)

Stock-based compensation and related taxes

3,585

3,306

10,592

10,073

Amortization of intangible assets and acquisition-related costs

1,374

326

2,873

978

Facilities consolidation charges

1,402

—

1,402

—

Acquisition-related income tax benefit

(90

)

—

(2,133

)

—

Non-GAAP net income

$

3,461

$

3,306

$

9,496

$

9,399

GAAP basic and diluted net loss per share

$

(0.11

)

$

(0.01

)

$

(0.13

)

$

(0.07

)

Stock-based compensation and related taxes

0.14

0.14

0.43

0.43

Amortization of intangible assets and acquisition-related costs

0.05

0.01

0.12

0.04

Facilities consolidation charges

0.06

—

0.06

—

Acquisition-related income tax benefit

—

—

(0.09

)

—

Non-GAAP net income per basic share

$

0.14

$

0.14

$

0.39

$

0.40

Non-GAAP net income per diluted share

$

0.14

$

0.13

$

0.38

$

0.38

GAAP weighted-average basic and diluted shares

24,608,685

23,619,406

24,373,836

23,348,529

Non-GAAP weighted-average diluted shares

25,181,210

24,964,822

25,035,092

24,758,489

GAAP net loss

$

(2,810

)

$

(326

)

$

(3,238

)

$

(1,652

)

Reconciling items: Interest and other income, net

(94

)

(53

)

(144

)

(151

)

Income taxes

49

—

(1,878

)

—

Depreciation and amortization of capital expenditures

998

780

2,737

2,328

Facilities consolidation charges

1,402

—

1,402

—

Amortization of intangible assets and acquisition-related costs

1,374

326

2,873

978

Stock-based compensation and related taxes

3,585

3,306

10,592

10,073

Adjusted EBITDA

$

4,504

$

4,033

$

12,344

$

11,576

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221130005989/en/

INVESTOR CONTACT: Matthew S. Robison Director of IR and

Corporate Development Ooma, Inc. ir@ooma.com (650) 300-1480

MEDIA CONTACT: Mike Langberg Director of Corporate

Communications Ooma, Inc. press@ooma.com (650) 566-6693

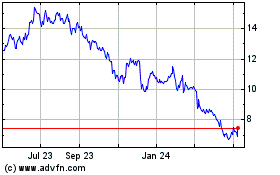

Ooma (NYSE:OOMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

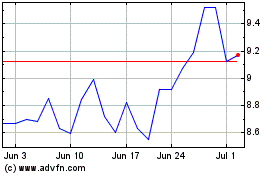

Ooma (NYSE:OOMA)

Historical Stock Chart

From Apr 2023 to Apr 2024