Current Report Filing (8-k)

April 06 2020 - 5:15PM

Edgar (US Regulatory)

0000029989

false

0000029989

2020-04-03

2020-04-03

0000029989

omc:CommonStockParValue0.15PerShareMember

2020-04-03

2020-04-03

0000029989

omc:Sec0.800SeniorNotesDue2027Member

2020-04-03

2020-04-03

0000029989

omc:Sec1.400SeniorNotesDue2031Member

2020-04-03

2020-04-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13

OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of

earliest event reported): April 3, 2020

OMNICOM GROUP INC.

(Exact Name of Registrant as

Specified in its Charter)

|

New York

|

1-10551

|

13-1514814

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

437 Madison Avenue, New York, NY

|

10022

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone

number, including area code: (212) 415-3600

Not Applicable

(Former name or former address,

if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol

|

Name of each exchange on

which registered

|

|

Common Stock, par value $0.15 per share

|

OMC

|

New York Stock Exchange

|

|

0.800% Senior Notes due 2027

|

OMC/27

|

New York Stock Exchange

|

|

1.400% Senior Notes due 2031

|

OMC/31

|

New York Stock Exchange

|

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

On April 3,

2020, Omnicom Group Inc. (“Omnicom Group”) and its wholly owned subsidiary Omnicom Capital Inc. (the “Borrower”

and, together with Omnicom Group, the “Loan Parties”) entered into a 364-Day Credit Agreement (the “Credit Agreement”)

with the lenders named therein (the “Lenders”), Citibank, N.A., BofA Securities, Inc., Mizuho Bank, Ltd. and U.S. Bank

National Association, as joint lead arrangers and joint book managers, Bank of America, N.A., Mizuho Bank, Ltd. and U.S. Bank National

Association, as syndication agents, and Citibank, N.A., as administrative agent for the Lenders (the “Agent”). The

Credit Agreement has a maturity date of April 2, 2021. Under the Credit Agreement, the Lenders committed to provide advances in

an aggregate amount of up to US$400,000,000. Interest on the borrowings under the Credit Agreement is payable at a base rate or

Eurocurrency rate, in either case plus an applicable margin and fees. Borrowings under the Credit Agreement may be used for general

corporate purposes of the Borrower and its subsidiaries, including, without limitation, to fund acquisitions not prohibited under

the Credit Agreement.

The terms of

the Credit Agreement include representations and warranties, affirmative and negative covenants (including certain financial covenants)

and events of default that are customary for credit facilities of this nature. Upon the occurrence, and during the continuance,

of an event of default, including but not limited to nonpayment of principal when due, nonpayment of interest within five business

days after it becomes due, failure to perform or observe certain terms, covenants or agreements under the Credit Agreement, and

certain defaults of other indebtedness, the Agent may terminate the obligation of the Lenders under the Credit Agreement to make

advances and declare any outstanding obligations under the Credit Agreement immediately due and payable. In addition, in the event

of an actual or deemed entry of an order for relief with respect to either of the Loan Parties under the Federal Bankruptcy Code,

the obligation of the Lenders to make advances shall automatically terminate and any outstanding obligations under the Credit Agreement

shall immediately become due and payable.

The obligations

of the Borrower under the Credit Agreement are guaranteed by Omnicom Group.

The foregoing

description of the Credit Agreement does not purport to be a complete statement of the parties’ rights and obligations under

the Credit Agreement and the transactions contemplated by the Credit Agreement. The foregoing description of the Credit Agreement

is qualified in its entirety by reference to the Credit Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated

herein by reference.

Item 2.03. Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information

contained in Item 1.01 is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

Number

|

Description

|

|

10.1

|

364-Day

Credit Agreement, dated as of April 3, 2020, by and among Omnicom Capital Inc., a Connecticut corporation, Omnicom Group Inc.,

a New York corporation, the banks, financial institutions and other institutional lenders and initial issuing banks listed

on the signature pages thereof, Citibank, N.A., BofA Securities, Inc., Mizuho Bank, Ltd. and U.S. Bank National Association,

as joint lead arrangers and joint book managers, Bank of America, N.A., Mizuho Bank, Ltd. and U.S. Bank National Association,

as syndication agents, and Citibank, N.A., as administrative agent for the lenders.

|

|

104

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

OMNICOM GROUP INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Michael J. O’Brien

|

|

|

|

Name: Michael J. O’Brien

|

|

|

|

Title: Executive Vice President,

|

|

|

|

General Counsel and Secretary

|

|

|

|

|

|

Date: April 6, 2020

|

|

|

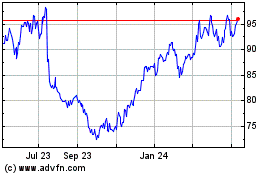

Omnicom (NYSE:OMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

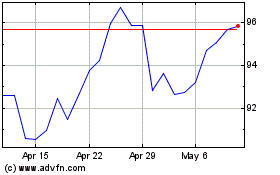

Omnicom (NYSE:OMC)

Historical Stock Chart

From Apr 2023 to Apr 2024