Ocwen Financial Corporation (NYSE: OCN) (“Ocwen” or the “Company”),

a leading non-bank mortgage servicer and originator, today

announced that its subsidiary PHH Corporation (“PHH”) has given

notice of its intention to redeem on March 4, 2021 (the “Redemption

Date”) all of its outstanding 6.375% Senior Notes due 2021 (the

“2021 Notes”) and also that its subsidiary PHH Mortgage Corporation

(“PMC” and together with PHH, the “Issuers” and each, an “Issuer”)

has given notice of its intention to redeem on the Redemption Date

all of its outstanding 8.375% Senior Secured Second Lien Notes due

2022 (the “2022 Notes”).

The 2021 Notes will be redeemed at a price of 100% of the

principal amount thereof, plus accrued and unpaid interest to, but

not including, the Redemption Date (equal to $1,003.36 per $1,000

principal amount). The Bank of New York Mellon Trust Company, N.A.,

the trustee for the 2021 Notes, has distributed a Notice of

Redemption on behalf of PHH to all registered holders of the 2021

Notes. Copies of such Notice of Redemption and additional

information related to the redemption of the 2021 Notes may be

obtained from the Company.

The 2022 Notes will be redeemed at a price of 102.094% of the

principal amount thereof, plus accrued and unpaid interest to, but

not including, the Redemption Date (equal to $1,046.30 per $1,000

principal amount). Wilmington Trust, National Association, the

trustee for the 2022 Notes, has distributed a Notice of Redemption

on behalf of PMC to all registered holders of the 2022 Notes.

Copies of such Notice of Redemption and additional information

related to the redemption of the 2022 Notes may be obtained from

the Company.

The obligation of each Issuer to redeem the respective series of

notes is subject to such Issuer or its affiliates completing a debt

financing that will provide funds sufficient to pay the redemption

price in full for the respective series of notes (the “Financing

Condition”). Accordingly, the Redemption Date for each series of

notes may be extended until the Financing Condition is satisfied or

waived by the respective Issuer in its sole discretion. If the

Financing Condition is not satisfied for any series of notes, the

respective Issuer may elect to rescind the Notice of Redemption for

such series of notes, terminate the redemption, and return any

tendered notes of such series to the holders thereof. If the

Redemption Date for any series of notes is extended or the

redemption is terminated, the respective Issuer will provide notice

to noteholders of such series of notes no later than 5:00 p.m. New

York time on the business day immediately preceding the Redemption

Date.

Unless an Issuer defaults in paying the redemption price in full

for the respective series of notes on the Redemption Date and

assuming the applicable Redemption Notice is not rescinded,

interest on such series of notes shall cease to accrue on and after

the Redemption Date, and the only remaining right of the

noteholders of such series of notes will be to receive payment of

the applicable redemption price upon surrender of their notes.

This press release is for information purposes only and shall

not constitute the official Notice of Redemption required under the

indentures governing the 2021 Notes and the 2022 Notes.

About Ocwen Financial Corporation

Ocwen Financial Corporation (NYSE: OCN) is a leading non-bank

mortgage servicer and originator providing solutions through its

primary brands, PHH Mortgage and Liberty Reverse Mortgage. PHH

Mortgage is one of the largest servicers in the country, focused on

delivering a variety of servicing and lending programs. Liberty is

one of the nation’s largest reverse mortgage lenders dedicated to

education and providing loans that help customers meet their

personal and financial needs. We are headquartered in West Palm

Beach, Florida, with offices in the United States and the U.S.

Virgin Islands and operations in India and the Philippines, and

have been serving our customers since 1988. For additional

information, please visit our website (www.ocwen.com).

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements may be identified by a

reference to a future period or by the use of forward-looking

terminology. Forward-looking statements are typically identified by

words such as “expect”, “believe”, “foresee”, “anticipate”,

“intend”, “estimate”, “goal”, “strategy”, “plan” “target” and

“project” or conditional verbs such as “will”, “may”, “should”,

“could” or “would” or the negative of these terms, although not all

forward-looking statements contain these words. Forward-looking

statements by their nature address matters that are, to different

degrees, uncertain. We are in the midst of a period of capital

markets volatility and experiencing significant changes within the

mortgage lending and servicing ecosystem which have magnified such

uncertainties. Readers should bear these factors in mind when

considering such statements and should not place undue reliance on

such statements.

Forward-looking statements involve a number of assumptions,

risks and uncertainties that could cause actual results to differ

materially. In the past, actual results have differed from those

suggested by forward looking statements and this may happen again.

Important factors that could cause actual results to differ

materially from those suggested by the forward-looking statements

include, but are not limited to, uncertainty relating to the future

impacts of the COVID-19 pandemic, including with respect to the

response of the U.S. government, state governments, the Federal

National Mortgage Association (Fannie Mae), the Federal Home Loan

Mortgage Corporation (Freddie Mac, and together with Fannie Mae,

the GSEs), the Government National Mortgage Association (Ginnie

Mae) and regulators, as well as the potential for ongoing

disruption in the financial markets and in commercial activity

generally, increased unemployment, and other financial difficulties

facing our borrowers; impacts on our operations resulting from

employee illness, social distancing measures and our shift to

greater utilization of remote work arrangements; the adequacy of

our financial resources, including our sources of liquidity and

ability to sell, fund and recover servicing advances, forward and

reverse whole loans, and HECM and forward loan buyouts and put

backs, as well as repay, renew and extend borrowings, borrow

additional amounts as and when required, meet our MSR or other

asset investment objectives and comply with our debt agreements,

including the financial and other covenants contained in them;

increased servicing costs based on increased borrower delinquency

levels or other factors; our ability to collect anticipated tax

refunds, including on the timeframe expected; the future of our

long-term relationship and remaining servicing agreements with New

Residential Investment Corp. (NRZ), our ability to execute an

orderly and timely transfer of responsibilities in connection with

the previously disclosed termination by NRZ of the PMC subservicing

agreement, including our ability to respond to any concerns raised

by regulators, lenders and other contractual counterparties in

connection with such transfer; our ability to timely adjust our

cost structure and operations as the loan transfer process is being

completed in response to the previously disclosed termination by

NRZ of the PMC subservicing agreement; our ability to continue to

improve our financial performance through cost re-engineering

efforts and other actions; our ability to continue to grow our

origination business and increase our origination volumes in a

competitive market and uncertain interest rate environment;

uncertainty related to claims, litigation, cease and desist orders

and investigations brought by government agencies and private

parties regarding our servicing, foreclosure, modification,

origination and other practices, including uncertainty related to

past, present or future investigations, litigation, cease and

desist orders and settlements with state regulators, the Consumer

Financial Protection Bureau (CFPB), State Attorneys General, the

Securities and Exchange Commission (SEC), the Department of Justice

or the Department of Housing and Urban Development (HUD) and

actions brought under the False Claims Act regarding incentive and

other payments made by governmental entities; adverse effects on

our business as a result of regulatory investigations, litigation,

cease and desist orders or settlements and related responses by key

counterparties, including lenders, the GSEs and Ginnie Mae; our

ability to comply with the terms of our settlements with regulatory

agencies, as well as general regulatory requirements, and the costs

of doing so; increased regulatory scrutiny and media attention; any

adverse developments in existing legal proceedings or the

initiation of new legal proceedings; our ability to interpret

correctly and comply with liquidity, net worth and other financial

and other requirements of regulators, the GSEs and Ginnie Mae, as

well as those set forth in our debt and other agreements; our

ability to comply with our servicing agreements, including our

ability to comply with our agreements with, and the requirements

of, the GSEs and Ginnie Mae and maintain our seller/servicer and

other statuses with them; our ability to fund future draws on

existing loans in our reverse mortgage portfolio; our servicer and

credit ratings as well as other actions from various rating

agencies, including the impact of prior or future downgrades of our

servicer and credit ratings; as well as other risks and

uncertainties detailed in Ocwen’s reports and filings with the SEC,

including its annual report on Form 10-K for the year ended

December 31, 2019 and its current and quarterly reports since such

date. Anyone wishing to understand Ocwen’s business should review

its SEC filings. Our forward-looking statements speak only as of

the date they are made and, we disclaim any obligation to update or

revise forward-looking statements whether as a result of new

information, future events or otherwise.

FOR FURTHER INFORMATION CONTACT:

|

Investors: |

Media: |

| June Campbell |

Dico Akseraylian |

| T: (856) 917-3190 |

T: (856) 917-0066 |

| E:

shareholderrelations@ocwen.com |

E: mediarelations@ocwen.com |

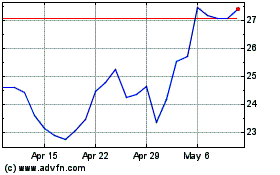

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

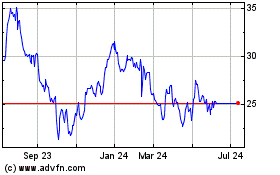

Ocwen Financial (NYSE:OCN)

Historical Stock Chart

From Apr 2023 to Apr 2024