UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

☒

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended

December 31, 2018

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to ________

Commission File Number 1-12378

|

|

|

|

|

|

|

NVR, Inc. Profit Sharing Plan

|

|

(Full name of the Plan)

|

|

|

|

NVR, Inc.

|

|

11700 Plaza America Drive, Suite 500

|

|

Reston, Virginia 20190

|

|

(703) 956-4000

|

|

(Name of issuer of securities held pursuant to the Plan and the address and phone number of its principal executive offices)

|

|

|

NVR, I

NC

.

PROFIT SHARING PLAN

|

|

|

|

|

|

|

|

Form 11-K

|

|

|

|

|

|

Table of Contents

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

|

|

Financial Statements:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Schedule:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Report of Independent Registered Public Accounting Firm

To the Plan Participants and

Audit Committee of N

VR,

I

nc.

NVR, Inc.

Profit Sharing Plan

:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for plan benefits of

the

N

VR, Inc.

Profit Sharing Plan

(the Plan) as of

December 31, 2018

and

2017

, the related

statement of changes in net assets available for plan benefits for the year ended

December 31, 2018

,

and the related notes (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for plan benefits of the Plan as of

December 31, 2018

and

2017

, and the changes in net assets available for plan benefits for the year ended

December 31, 2018

, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the

financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Accompanying Supplemental Information

The supplemental information in the accompanying schedule, Schedule H, line 4(i) - Schedule of Assets (Held at End of Year) as of

December 31, 2018

has been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the

financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ KPMG LLP

We have served as the Plan’s auditor since 1992.

McLean, Virginia

June 28, 2019

NVR, INC.

PROFIT SHARING PLAN

Statements of Net Assets Available for Plan Benefits

December 31, 2018

and

2017

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

|

|

2018

|

|

2017

|

|

ASSETS

|

|

|

|

|

|

Plan interest in master trust, at fair value

|

|

$

|

443,103

|

|

$

|

521,202

|

|

|

|

|

|

|

|

Receivables:

|

|

|

|

|

|

Loans to participants

|

|

8,816

|

|

8,391

|

|

Employee contributions

|

|

42

|

|

33

|

|

Employer contributions

|

|

3

|

|

5

|

|

Total receivables

|

|

8,861

|

|

8,429

|

|

|

|

|

|

|

|

Total assets

|

|

451,964

|

|

529,631

|

|

|

|

|

|

|

|

LIABILITIES

|

|

|

|

|

|

Due to participants

|

|

100

|

|

147

|

|

|

|

|

|

|

|

Net assets available for plan benefits

|

|

$

|

451,864

|

|

$

|

529,484

|

|

|

|

|

|

|

See accompanying notes to financial statements.

NVR, INC.

PROFIT SHARING PLAN

Statement of Changes in Net Assets Available for Plan Benefits

For the Year Ended

December 31, 2018

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

Additions to net assets attributable to:

|

|

|

|

Contributions:

|

|

|

|

Employee

|

|

30,594

|

|

Employer

|

|

4,032

|

|

Rollovers

|

|

2,813

|

|

Total contributions

|

|

37,439

|

|

|

|

|

|

Total additions

|

|

37,439

|

|

|

|

|

|

Deductions from net assets attributable to:

|

|

|

|

Participation in net investment loss of master trust:

|

|

|

|

Net depreciation in fair value of investments

|

|

$

|

(102,796)

|

|

Interest and dividends

|

|

25,216

|

|

Total investment loss, net

|

|

(77,580)

|

|

|

|

|

|

Benefits paid to participants

|

|

(37,411)

|

|

Administrative expenses

|

|

(68)

|

|

|

|

|

|

Total deductions

|

|

(115,059)

|

|

|

|

|

|

Decrease in net assets available for plan benefits

|

|

(77,620)

|

|

Net assets available for plan benefits at beginning of year

|

|

529,484

|

|

Net assets available for plan benefits at end of year

|

|

$

|

451,864

|

See accompanying notes to financial statements.

NVR, INC.

PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 201

8

and 201

7

(dollars in thousands)

1.

Description of Plan and Benefits

The following description of the

NVR, Inc.

Profit Sharing Plan

(the “Plan” or “PSP”) provides only general information. Participants should refer to the Plan

document

for a more complete description of the Plan's provisions.

General

The Plan is a defined contribution, profit-sharing retirement plan, and covers substantially all employees of NVR, Inc. and its affiliated companies ("NVR" or “the Company”).

The investments of the Plan are maintained in a master trust with the investments of the NVR, Inc. Employee Stock Ownership Plan (“ESOP”).

Fidelity Management Trust Company

("Fidelity") is the trustee and

provide

s

recordkeep

ing services

for the

Plan.

Additionally, Fidelity Investm

ents

Institutional Operating Company, I

nc., provides certain other reco

rdkeeping servi

c

e

s

for the

Plan.

F

idelity

maintains

a

separate

account reflecting the e

q

uitable share of ea

ch

plan

's investments

within the master trust

and reports

th

e Plan’s

share of

investments

to the Plan

.

The Plan is administered by a Profit Sharing Committee (the "Plan Administrator"), which is designated by the Board of Directors of NVR, Inc. (the “Board”). The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

The Plan Year begins each January 1

st

and ends each December 31

st

.

Employee Eligibility

All full-time and part-time employees are eligible to participate in the Plan immediately upon employment. The Plan excludes any employee covered by a collective bargaining agreement negotiated in good faith with the Company and leased employees.

Contributions

The Plan provides for eligible Plan participants to make voluntary salary deferral contributions (“VSDC”) from 1% to 50% of their current salary on a

combined

pre-tax

,

R

oth

and post-tax basis into the Plan for investment. All investment funds provided in the Plan are available for employee VSDC. A participant's

pre-tax

and

/or

Roth

deferral was limited to a maximum contribution of

$18

.5 and $18.0

during

2018

and

2017

, respec

tively

. Participants who reached age 50 or older before the close of the calendar year and have deferred the maximum amount allowed under the Plan have the option to make additional pre-tax

and

/or

Roth

salary deferrals. The maximum “catch-up” contribution was

$6.0

during both

2018

and

2017

. Participants may change their salary deferral percentages periodically, but participants generally cannot withdraw fund balances before termination, retirement, death or total permanent disability unless certain hardship conditions exist.

In accordance with the Plan, the Company may declare a program of matching contributions. In both

2018

and

2017

, the Company matched up to the first one thousand dollars of individual participants’

pre

-tax and

/or Roth salary

deferrals

.

The Company doe

s not

make matching contribution

s

on post-tax salary deferrals.

NVR contributed

$4,003

and

$3,700

in matching contributions during

2018

and

2017

, respectively. Matching contributions are invested in participant accounts in the Plan as directed by participants.

Vesting and Forfeitures

Employees vest in Company matching contributions at the rate of 20% per year beginning with the completion of the second year of service. Employees also become 100% vested upon reaching age 60 or upon an employee’s termination on account of death or total disability. Participants are fully vested at all times in their VSDC account balances. Forfeitures of unvested amounts relating to terminated employees are allocated annually, in the subsequent fiscal year, to all eligible participants in the Plan as of December 31, based upon the proportion that the participant’s compensation for that Plan Year bears to the total compensation received for such year by all participants sharing in the allocation, subject to the annual addition limitation and nondiscrimination requirement

NVR, INC.

PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 201

8

and 201

7

(dollars in thousands)

imposed under the Internal Revenue Code. Forfeitures of approximately

$682

and

$752

in

2018

and

2017

, respectively, were allocated to participant accounts in

2019

and

2018

, respectively.

Investment Options

The Plan Administrator selects the number and type of investment options available.

Fidelity

is responsible for maintaining an account balance for each participant. Each participant instructs

Fidelity

how to allocate their account balances.

Fidelity

values account balances daily. Each investment fund's income and expenses are allocated to participant accounts daily in relation to their respective account balances. Each account balance is based on the value of the underlying investments in each account. Generally, participants may elect to change how future contributions are allocated or may transfer current account balances among investment options.

Payments of Benefits

Depending on various provisions and restrictions of the Plan, the method of benefit payment can be in the form of a lump-sum distribution or based on a deferred payment schedule. Amounts remaining in the Plan as a result of deferred payments are subject to daily fluctuations in value based on the underlying investments in each account.

Participant Loans

Loans are made available to all participants on a nondiscriminatory basis in accordance with the specific provisions set forth in the Plan. The amount of a loan generally cannot exceed the lesser of $50 or one-half of a participant's total vested account balance as of the loan origination date. Generally, a loan bears interest at a fixed rate which is determined by the Plan Administrator. Such rate for all outstanding loans was prime plus 1% set at the date of loan origination. All loans are subject to specific repayment terms and are secured by the participant's non

-

forfeitable interest in his/her account equivalent to the principal amount of the loan. Participants must pay any outstanding loans in full upon termination of service with the Company. Loans not repaid within the time

-

frame specified by the Plan subsequent to termination are considered to be in default and treated as a distribution to the terminated participant. Participant loans are recorded at unpaid principal plus accrued interest. Interest income from loans to participants is included in “Interest and dividends” on the accompanying Statement of Changes in Net Assets Available for Plan Benefits.

Administrative Expenses

Loan origination fees and trustee fees are paid by the Plan. All other administrative expenses are paid directly by the Company.

2.

Summary of Significant Accounting Policies

Basis of Presentation

The accompanying financial statements have been prepared on the accrual basis of accounting.

Investment Income

Interest income from investments is recorded on the accrual basis of accounting. Dividend income is recorded on the ex-dividend date. Investment transactions are accounted for on a trade-date basis. Realized gains and losses on sales of investments are based on the change in market values from the investment transactions’ acquisition dates.

Investment Valuation and Transactions

All investments are carried at fair value.

Net unrealized appreciation and depreciation is measured and recognized in the Statement of Changes in Net Assets Available for Plan Benefits as the difference between the fair value of investments remeasured at the financial

NVR, INC.

PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 201

8

and 201

7

(dollars in thousands)

statement date and the fair value at the beginning of the Plan Year or the original measurement at the investment purchase date if purchased during the Plan Year. Purchase and sale transactions are recorded on a trade-date basis.

Fair Value Measurements

Accounting Standard Codification (“ASC”) Topic 820 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in the principal market for the asset or liability or, in the absence of a principal market, the most advantageous market for the asset or liability, in an orderly transaction between market participants at the measurement date. ASC Topic 820 establishes a fair value hierarchy for those instruments measured at fair value that distinguishes between assumptions based on market data (observable inputs) and the Plan’s assumptions (unobservable inputs). The hierarchy consists of three levels:

Level 1 – Quoted market prices in active markets for identical assets or liabilities.

Investments in registered investment companies, shares of the Company’s common stock, other common and preferred stock and cash are valued using quoted prices in active markets.

Level 2 – Inputs other than Level 1 inputs that are either directly or indirectly observable.

Investments in a common collective trust, the Fidelity Managed Income Portfolio CL2 (“MIP” or “the Fund”) are valued using net asset value. The Fund is a stable value fund which is intended to maintain a stable asset value of $1.00 per unit. The net asset value is quoted in a private market, and is based on the fair value of the underlying assets owned by the Fund, which are predominantly traded in an active market. These investments are redeemable with the Fund at contract value under the Fund’s terms of operations.

Par

ticipant

directed withdrawals

or exchanges may be made on a da

ily ba

sis. Plan directed withdrawals require notice to Fide

lity and could result in

the

redemption rights

be

ing

restricted by the Fund

for up to twelve months

.

As of December 31, 2018, the Plan ha

d not provided the MIP with advance notice to terminate the Plan's investment in the MIP.

Due to the nature of the investments held by the Fund, changes in market conditions and the economic environment may significantly impact the net asset value of the Fund, and the Plan’s interest in the Fund.

Level 3 – Unobservable inputs developed using estimates and assumptions developed by the Plan, which reflect those a market participant would use.

The Plan has no investments valued using Level 3 inputs.

The following table presents the financial instruments in the master trust (see footnote 3 for discussion of the master trust) measured at fair value on a recurring basis, based on the fair value hierarchy as of

December 31, 2018

:

NVR, INC.

PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 201

8

and 201

7

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basis of Fair Value Measurements

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Fair Value Measurements:

|

|

|

|

|

|

|

|

|

|

Investments in registered investment companies:

|

|

|

|

|

|

|

|

|

|

Domestic equities - small cap

|

|

$

|

16,447

|

|

$

|

—

|

|

$

|

—

|

|

$

|

16,447

|

|

Domestic equities - mid cap

|

|

32,251

|

|

—

|

|

—

|

|

32,251

|

|

Domestic equities - large cap

|

|

152,322

|

|

—

|

|

—

|

|

152,322

|

|

International equities

|

|

21,391

|

|

—

|

|

—

|

|

21,391

|

|

Life cycle/target date funds

|

|

127,929

|

|

—

|

|

—

|

|

127,929

|

|

Bond funds

|

|

15,078

|

|

—

|

|

—

|

|

15,078

|

|

Subtotal

|

|

365,418

|

|

—

|

|

—

|

|

365,418

|

|

NVR, Inc common stock

|

|

649,482

|

|

—

|

|

—

|

|

649,482

|

|

Investments in common/collective trusts

|

|

—

|

|

36,318

|

|

—

|

|

36,318

|

|

Self-directed brokerage accounts

|

|

7,400

|

|

—

|

|

—

|

|

7,400

|

|

Cash

|

|

36

|

|

—

|

|

—

|

|

36

|

|

Total

|

|

$

|

1,022,336

|

|

$

|

36,318

|

|

$

|

—

|

|

$

|

1,058,654

|

The following table presents the financial instruments in the master trust measured at fair value on a recurring basis, based on the fair value hierarchy as of

December 31, 2017

:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basis of Fair Value Measurements

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Fair Value Measurements:

|

|

|

|

|

|

|

|

|

|

Investments in registered investment companies:

|

|

|

|

|

|

|

|

|

|

Domestic equities - small cap

|

|

$

|

19,356

|

|

$

|

—

|

|

$

|

—

|

|

$

|

19,356

|

|

Domestic equities - mid cap

|

|

36,023

|

|

—

|

|

—

|

|

36,023

|

|

Domestic equities - large cap

|

|

158,065

|

|

—

|

|

—

|

|

158,065

|

|

International equities

|

|

24,659

|

|

—

|

|

—

|

|

24,659

|

|

Life cycle/target date funds

|

|

130,799

|

|

—

|

|

—

|

|

130,799

|

|

Bond funds

|

|

13,065

|

|

—

|

|

—

|

|

13,065

|

|

Subtotal

|

|

381,967

|

|

—

|

|

—

|

|

381,967

|

|

NVR, Inc common stock

|

|

1,008,742

|

|

—

|

|

—

|

|

1,008,742

|

|

Investments in common/collective trusts

|

|

—

|

|

27,752

|

|

—

|

|

27,752

|

|

Self-directed brokerage accounts

|

|

6,352

|

|

—

|

|

—

|

|

6,352

|

|

Cash

|

|

40

|

|

—

|

|

—

|

|

40

|

|

Total

|

|

$

|

1,397,101

|

|

$

|

27,752

|

|

$

|

—

|

|

$

|

1,424,853

|

Payments of Benefits

Benefits are recorded as deductions when paid. At

December 31, 2018

and

2017

, refunds of

$100

and

$147

, respectively, were due to participants for excess contributions made during the Plan Year and are reflected as a reduction of employee contributions in the Statement of Changes in Net Assets Available for Plan Benefits and in the “Due to participants” line item on the Statement of Net Assets Available for Plan Benefits.

NVR, INC.

PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 201

8

and 201

7

(dollars in thousands)

Use of Estimates in Preparation of Financial Statements

The preparation of financial statements in conformity with

U

.

S

.

g

enerally

a

ccepted

a

c

counting

p

rinciples

("GAAP

"

)

requires the Plan Administrator to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of Plan activity during the reporting period. Accordingly, actual results may differ from those estimates.

Recent Accounting Pronouncements

In February 2017, the

Financial Accounting Standards Board ("

FASB

")

issued A

ccounting

S

tan

dards

U

pdate (

"

ASU")

2017-06, Employee Benefit Plan Master Trust Reporting. The amendments in ASU 2017-06 will require the Plan to report its interest in a master trust and the change in the value of that interest as separate line items on the Statement of Net Assets Available for Plan Benefits and the Statement of Changes in Net Assets available for plan benefits, respectively. The Plan will also have to disclose the master trust’s investments and other assets and liabilities, as well as the dollar amount of its interest in those balances. Investments measured at fair value will have to be presented by general type of investment. ASU 2017-06 must be applied retrospectively

and

is effective for the Plan beginning on January 1, 2019

.

The Company

is currently evaluating the

impact of the adoption of this AS

U

on the Plan’s financial statements and related disclosures.

In August 2018, the FAS

B issue

d ASU 2018-

13 - Fair Value Measurement (Topic 820)

Disclosure Framework

-Change

s to the Disclosure Requirements for Fair Value M

easurement.

T

he

A

SU modifies the dis

closure requirements of fair value m

easurements in A

S

C

Topic 820.

T

he ASU is effecti

ve for

the Plan on January 1, 2020

, with early adoption permitted.

The Company is

currently

evaluating the impact of the adoption of this ASU on th

e

Plan

financial statements

and rel

ated disclo

sures

.

3.

Investments

The investments of the Plan are maintained in a master trust with the investments of the NVR, Inc. Employee Stock Ownership Plan (“ESOP”). The Plan’s share of changes in the master trust and the value of the master trust have been reported to the Plan by the trustee as having been determined through the use of fair values for all investments. The

divided interest of each Plan

in the master trust is increased or decreased (as the case may be):

(i)

for the entire amount of every contribution received on behalf of the Plan, every benefit payment, or other expense attributable solely to such Plan, and every other transaction relating only to such Plan; and

(ii)

for accrued income, gain or loss, and administrative expense attributable solely to such Plan.

The Plan’s interest in the master trust was approximately

42%

and

37%

as of

December 31, 2018

and

2017

, respectively.

The following table presents the investments in the master trust at fair value for all investments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31,

|

|

|

|

|

|

2018

|

|

2017

|

|

|

|

|

|

|

|

NVR, Inc. common stock

|

|

$

|

649,482

|

|

$

|

1,008,742

|

|

Investments in registered investment companies

|

|

365,418

|

|

381,967

|

|

Investments in common/collective trusts

|

|

36,318

|

|

27,752

|

|

Self-directed brokerage accounts

|

|

7,400

|

|

6,352

|

|

Cash

|

|

36

|

|

40

|

|

Total

|

|

$

|

1,058,654

|

|

$

|

1,424,853

|

NVR, INC.

PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 201

8

and 201

7

(dollars in thousands)

The interests of the PSP and ESOP participating in the master trust investments at

December 31, 2018

and

2017

were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31,

|

|

|

|

|

|

2018

|

|

2017

|

|

|

|

|

|

|

|

NVR, Inc. Employee Stock Ownership Plan

|

|

$

|

615,551

|

|

$

|

903,651

|

|

Profit Sharing Plan of NVR, Inc. and Affiliated Companies

|

|

443,103

|

|

521,202

|

|

Net investment assets in master trust

|

|

$

|

1,058,654

|

|

$

|

1,424,853

|

Net investment

loss

for the master trust for the year ended

December 31, 2018

was as follows:

|

|

|

|

|

|

|

|

|

|

|

Net investment loss:

|

|

|

|

Net depreciation in fair value of investments

|

|

$

|

(361,421)

|

|

Interest income

|

|

433

|

|

Dividend income

|

|

29,273

|

|

Net investment loss in master trust

|

|

$

|

(331,715)

|

The interests of the PSP and ESOP participating in the net investment

loss

in the master trust for the year ended

December 31, 2018

, were as follows:

|

|

|

|

|

|

|

|

|

|

|

NVR, Inc. Employee Stock Ownership Plan

|

|

$

|

(254,135)

|

|

Profit Sharing Plan of NVR, Inc. and Affiliated Companies

|

|

(77,580)

|

|

Net investment loss in master trust

|

|

$

|

(331,715)

|

The in

vestment loss

allocation variance between the PSP and ESOP is driven primarily by the investment mix within the respective plans. The ESOP requires holdings to be predominately invested in NVR, Inc. common stock; whereas the PSP has no similar requirements and thus holdings within the PSP are diversified among multiple investments.

4.

Tax Status

The Plan received its latest determination letter on September 7, 2017 which stated that the Plan is qualified under section 401(a) of the Internal Revenue Code (the “Code”) and its related Trust is exempt from tax under section 501(a) of the Code. The Plan has been amended since receiving the determination letter; however, in the opinion of the Plan Administrator, the Plan and its underlying trust have operated within the terms of the Plan and remain qualified under the applicable provisions of the Code.

GAAP requires plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the Internal Revenue Service. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of

December 31, 2018

, there are no uncertain positions taken or expected to be taken. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes it is no longer subject to income tax examinations for years prior to

2

01

5

.

NVR, INC.

PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 201

8

and 201

7

(dollars in thousands)

5.

Plan Termination

Although it has not expressed any intent to do so, the Plan Administrator has the right under the Plan to discontinue contributions at any time and terminate the Plan subject to the provisions of ERISA. In the event of a Plan termination, partial Plan termination or if the Sponsor suspends contributions indefinitely, affected participants will become fully vested in their accounts.

6.

Parties-In-Interest

At

December 31, 2018

and

2017

, Plan investments of

$313,293

and

$320,739

, respectively, are with parties-in-interest as they are investment funds of the trustee and recordkeeper, Fidelity Management Trust Company and Fidelity Investments Institutional Operations Company, Inc.

At

December 31, 2018

and

2017

, investments held by the Plan included

45,077

shares and

50,727

shares of NVR, Inc. common stock, with a fair value of approximately

$109,853

and

$177,962

, respectively. These qualify as exempt parties-in-interest transactions.

7.

Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the value of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statement of net assets available for benefits.

8.

Reconciliation of Financial Statements to Form 5500

The following is a reconciliation from the financial statements to the Form 5500 of net assets available for plan benefits:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31,

|

|

|

|

|

|

2018

|

|

2017

|

|

|

|

|

|

|

|

Net assets available as reported in the financial statements

|

|

$

|

451,864

|

|

$

|

529,484

|

|

Adjustment from fair value to current value for the MIP

|

|

—

|

|

(40)

|

|

Deemed distributions (a)

|

|

(92)

|

|

(207)

|

|

Net assets available as reported in the Form 5500

|

|

$

|

451,772

|

|

$

|

529,237

|

The following is a reconciliation from the financial statements to the Form 5500 of

the

decrease in

net

assets available for plan benefits

:

|

|

|

|

|

|

|

|

|

|

|

|

|

Year ended

|

|

|

|

December 31, 2018

|

|

|

|

|

|

Decrease in net assets as reported in the financial statements

|

|

$

|

(77,620)

|

|

Deemed distributions reported in 2018 Form 5500 (a)

|

|

(92)

|

|

Deemed distributions reported in 2017 Form 5500 (a)

|

|

207

|

|

Adjustment from fair value to current value for the MIP

|

|

40

|

|

Decrease in net assets as reported in the Form 5500

|

|

$

|

(77,465)

|

NVR, INC.

PROFIT SHARING PLAN

Notes to Financial Statements

December 31, 201

8

and 201

7

(dollars in thousands)

(a)

Deemed distributions represent defaulted loan balances for which there were no post-default

payment activity. These distributions are not included in the loan balance, and in turn, are not included in the net assets available for plan benefits, for reporting purposes in the Form 5500 but are reflected in the total loan balance for financial statement reporting purposes.

9.

Subsequent Events

The Company evaluated all subsequent events through

June 28, 2019

, the date the financial statements were available to be issued.

NVR, INC.

PROFIT SHARING PLAN

EIN: 54-1394360

Plan Number: 333

Schedule H, Line 4(i) - Schedule of Assets (Held at End of Year)

December 31, 201

8

(dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Column A

|

|

Column B

|

|

Column C

|

|

Column E

|

|

|

|

Identity of issue, borrower, lessor, or similar party

|

|

Description of investment

|

|

Current Value

|

|

*

|

|

Participant loans - other

|

|

Participant loans with various rates of interest from 4.25% to 9.25% and maturity dates through September 2033

|

|

$

|

8,724

|

|

|

|

|

|

|

|

|

|

*

|

|

Party-in-interest

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Exhibit Description

|

|

|

|

|

|

23.1

|

|

|

|

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Plan Administrator has duly caused this annual report to be signed on behalf of the Plan by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

NVR, Inc.

|

|

|

|

|

|

Date: June 28, 2019

|

By:

|

/s/ Kevin N. Reichard

|

|

|

|

Kevin N. Reichard

|

|

|

|

Profit Sharing Committee Chairman

|

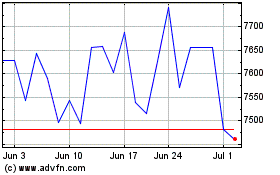

NVR (NYSE:NVR)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVR (NYSE:NVR)

Historical Stock Chart

From Apr 2023 to Apr 2024