Home-Builder Stocks Are Sitting Pretty

October 02 2019 - 5:18PM

Dow Jones News

By Jessica Menton

Shares of home builders were a relative bright spot Wednesday in

a sea of red in the stock market.

Lennar Corp. was among the best performers in the S&P 500

after the company delivered stronger-than-expected third-quarter

earnings and reported an increase in orders and deliveries.

"We continue to believe the basic underlying housing market

fundamentals of low unemployment, higher wages and low inventory

levels remain favorable," Chairman Stuart Miller said in prepared

remarks.

Shares climbed 3.8% to $57.82 to notch a 52-week high. That

compares with the broader S&P 500's 1.9% decline.

Home-building companies have rebounded this year after concerns

about a weak housing market and a downturn in economic growth

weighed on those shares last year. NVR Inc. and PulteGroup Inc.,

which fell 2.3% and 0.6%, respectively, are up at least 39% this

year. Both are also hovering around 52-week highs.

Investors have taken a second look at the group after the

Federal Reserve lowered interest rates in July for the first time

in a decade. The move helped ease mortgage rates, which have given

home buyers an incentive.

A decline in rates has also helped the housing market remain

strong amid renewed worries about slowing global growth. Weak

readings this week on manufacturing activity and private-sector job

growth have revived concerns about the U.S. economy.

Still, some analysts expect that home builders will continue to

benefit from improving home sales and housing construction as home

buyers look to refinance. Recent housing data has pointed to a

firming housing market. Home building in the U.S. rose in August to

the highest level since June 2007, the Commerce Department said,

while pending home sales rebounded.

Mortgage rates are expected to remain low for the foreseeable

future, according to Freddie Mac. Last week, the average U.S. fixed

rate for a 30-year mortgage -- which dropped to a three-year low in

August -- fell to 3.64%, Freddie Mac said Thursday. That's down

from 4.7% a year ago.

The mortgage-finance company forecasts the 10-year U.S. Treasury

yield will average 1.8% in 2020, down from an annual average of

2.1% in 2019. The 10-year yield settled at 1.594% Wednesday.

Continued improvement in the sector could give home-builder

stocks more room to run, some analysts and investors say.

"The macro backdrop has rebounded, as starts are set to turn

positive, inventory growth has moderated and affordability has

improved, which in turn should allow the housing recovery to

resume," analysts at JPMorgan Chase & Co. said in a note.

Write to Jessica Menton at Jessica.Menton@wsj.com

(END) Dow Jones Newswires

October 02, 2019 17:03 ET (21:03 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

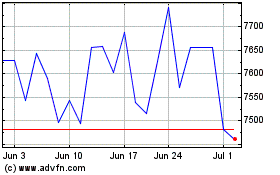

NVR (NYSE:NVR)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVR (NYSE:NVR)

Historical Stock Chart

From Apr 2023 to Apr 2024