Filed Pursuant to Rule 424(b)(5)

File No. 333-261173

The information in this preliminary prospectus supplement is

not complete and may be changed. A registration statement relating to these securities was filed with the Securities and Exchange Commission and became effective. This preliminary prospectus supplement and the accompanying prospectus are not an

offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus Supplement dated November 18, 2021

PROSPECTUS SUPPLEMENT

(To Prospectus dated November

18, 2021)

$

Nuveen AMT-Free Municipal Credit Income Fund

SERIES C MUNIFUND

PREFERRED SHARES

VARIABLE RATE REMARKETED MODE

LIQUIDATION PREFERENCE $1,000 PER SHARE

Nuveen AMT-Free Municipal Credit Income Fund (the “Fund”), a diversified, closed-end management investment company, is offering

Series C MuniFund Preferred Shares (the “Series C MFP Shares”), liquidation preference $1,000 per share (the

“Liquidation Preference”), in the Variable Rate Remarketed Mode (the “VRR Mode,” and the Series C MFP Shares, while in the VRR Mode, the “VRRM-MFP Shares”). The VRRM-MFP Shares will be in the VRR Mode until December 1, 2031, subject to earlier redemption, repurchase or transition to a new Mode (as defined herein) by the Fund.

The dividend rate generally will be the “Regular Dividend Rate,” determined by BofA Securities, Inc., as remarketing agent (the

“Remarketing Agent”), on each Business Day (as defined herein), commencing on the issue date of , 2021; provided, that the initial dividend rate for the issue date

will be equal to % per annum, plus the Securities Industry and Financial Markets Association (“SIFMA”) Municipal Swap Index published at approximately 4:00 p.m., New York City time on

Wednesday, , 2021, or % per annum if the SIFMA Municipal Swap Index is not so published. The Regular Dividend Rate will be

determined by the Remarketing Agent as the minimum rate that would enable the Remarketing Agent to sell all of the outstanding VRRM-MFP Shares on the date of determination for settlement in seven days at a

price (without regard to accumulated but unpaid dividends) equal to the aggregate Liquidation Preference thereof. Dividends on the VRRM-MFP Shares generally will be paid monthly on the first Business Day of

each month, commencing . Dividends are expected to be exempt from regular U.S. federal income tax and the federal alternative

minimum tax applicable to individuals, with exceptions for certain portions that may represent capital gains, if any, from portfolio transactions.

The Remarketing Agent will use its best efforts to remarket in seven days any VRRM-MFP Shares duly

tendered by a beneficial owner. If any tendered VRRM-MFP Share is not successfully remarketed, the Fund will redeem all outstanding VRRM-MFP Shares 365 days after

the failed remarketing tender date, subject to a prior successful remarketing by the Remarketing Agent of all outstanding VRRM-MFP Shares, as described below.

(continued on next page)

The VRRM-MFP Shares will not be listed or traded on any securities exchange.

The VRRM-MFP Shares will be subject to mandatory redemption by the Fund on December 1, 2031 (the

“Term Redemption Date”), unless earlier redeemed or repurchased by the Fund.

Investing in

VRRM-MFP Shares involves risks. See “Risk Factors” beginning on page S-19 and on page 43 of the accompanying

prospectus. You should consider carefully these risks together with all of the other information in this prospectus supplement and the accompanying prospectus before making a decision to purchase any of the

VRRM-MFP Shares.

Neither the Securities and Exchange Commission (the “SEC”)

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price(1)

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to the Fund

|

|

$

|

|

|

|

$

|

|

|

|

(1)

|

Plus accumulated dividends, if any, from the Date of Original Issue (as defined herein).

|

It is expected that the VRRM-MFP Shares will be delivered to investors in book-entry form only,

through the facilities of The Depository Trust Company, on or about , 2021.

BofA

Securities

, 2021

(continued from previous page)

As described above, each beneficial owner of VRRM-MFP Shares will have the right on any Business Day

to tender VRRM-MFP Shares for remarketing at the Purchase Price on the seventh calendar day after delivery of a tender notice to the Remarketing Agent, or if such seventh calendar day is not a Business Day,

the next succeeding Business Day. The “Purchase Price” is equal to the Liquidation Preference, plus accumulated but unpaid dividends (whether or not earned or declared), if any, to, but excluding, the relevant purchase date. Except as

otherwise permitted by the Remarketing Agent, VRRM-MFP Shares may be optionally tendered for remarketing only in minimum amounts of twenty-five (25)

VRRM-MFP Shares and multiples of five (5) VRRM-MFP Shares in excess thereof. If any tendered

VRRM-MFP Share is not successfully remarketed, all tendered VRRM-MFP Shares shall be retained by their respective beneficial owners, no tendered VRRM-MFP Shares will be purchased, a “Failed Remarketing Period” will commence and all of the VRRM-MFP Shares will be subject to mandatory redemption on the first

Business Day falling on or after the 365th calendar day following the failed remarketing tender date (the “Failed Remarketing Mandatory Redemption Date”), unless, prior to such date, the Remarketing Agent successfully remarkets all of the

outstanding VRRM-MFP Shares or the Fund transitions the VRRM-MFP Shares to a new Mode or redeems or repurchases all of the outstanding

VRRM-MFP Shares. During the Failed Remarketing Period, the right to optionally tender VRRM-MFP Shares for remarketing will be suspended, dividends will be payable at the

Step-Up Dividend Rate (as defined herein), and the Remarketing Agent will use its best efforts to remarket all (but not less than all) of the outstanding VRRM-MFP Shares

at the Purchase Price. If the Remarketing Agent finds purchasers for all of the outstanding VRRM-MFP Shares, the VRRM-MFP Shares will be subject to mandatory tender for

remarketing by the Remarketing Agent at the Purchase Price. Upon a successful such remarketing, the Remarketing Agent will resume setting the Regular Dividend Rate, the right of beneficial owners to tender their

VRRM-MFP Shares for remarketing will resume and the failed remarketing mandatory redemption will be cancelled.

The Fund’s investment objectives are to provide current income exempt from regular federal income tax and federal alternative minimum tax

applicable to individuals, and to enhance portfolio value relative to the municipal bond market by investing in tax-exempt municipal bonds that the Fund’s investment adviser, Nuveen Fund Advisors, LLC,

believes are underrated or undervalued or that represent municipal market sectors that are undervalued. As a fundamental investment policy, under normal circumstances, the Fund will invest at least 80% of its Assets (as defined herein) in municipal

securities and other related investments, the income from which is exempt from regular federal income taxes. As non-fundamental investment policies, under normal circumstances, the Fund will invest 100% of its

Managed Assets (as defined herein) and at least 80% of its Assets in municipal securities and other related investments, the income from which is exempt from the federal alternative minimum tax applicable to individuals at the time of purchase. As a

non-fundamental investment policy, under normal circumstances, the Fund may invest up to 55% of its Managed Assets in securities that, at the time of investment, are rated below the three highest grades (Baa

or BBB or lower) by at least one nationally recognized statistical rating organization or are unrated but judged to be of comparable quality by the Fund’s sub-adviser, Nuveen Asset Management, LLC. There

can be no assurance that the Fund will achieve its investment objectives.

You should read this prospectus supplement, together with the

accompanying prospectus, which contains important information about the Fund, before deciding whether to invest in VRRM-MFP Shares and retain it for future reference. A statement of additional information,

dated November 18, 2021, and as it may be supplemented (the “SAI”), containing additional information about the Fund, has been filed with the SEC and is incorporated by reference in its entirety into this prospectus supplement and the

accompanying prospectus. You may request a free copy of the SAI, annual and semi-annual reports to shareholders, when available, and other information about the Fund, and make shareholder inquiries by calling (800) 257-8787 or by writing to the

Fund, or from the Fund’s website (www.nuveen.com). The information contained in, or that can be accessed through, the Fund’s website is not part of this prospectus supplement, the accompanying prospectus or the SAI, except to the extent

specifically incorporated by reference. You may also obtain a copy of the other information regarding the Fund from the SEC’s website (www.sec.gov).

VRRM-MFP Shares do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance

Corporation, the Federal Reserve Board or any other government agency.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

You should rely only on the information contained or incorporated by reference into this prospectus

supplement and the accompanying prospectus. The Fund has not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The Fund is not making an offer

of VRRM-MFP Shares in any state where the offer is not permitted. You should not assume that the information contained in this prospectus supplement and the accompanying prospectus is accurate as of any date

other than the respective dates on the front covers. The Fund’s business, financial condition and prospects may have changed since such dates.

iii

FORWARD-LOOKING STATEMENTS

Any projections, forecasts and estimates contained or incorporated by reference herein are forward looking statements and are based upon

certain assumptions. Projections, forecasts and estimates are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying any projections, forecasts or estimates will not materialize or will vary

significantly from actual results. Actual results may vary from any projections, forecasts and estimates and the variations may be material. Some important factors that could cause actual results to differ materially from those in any forward

looking statements include changes in interest rates, market, financial or legal uncertainties, including changes in tax law, and the timing and frequency of defaults on underlying investments. Consequently, the inclusion of any projections,

forecasts and estimates herein should not be regarded as a representation by the Fund or any of its affiliates or any other person or entity of the results that will actually be achieved by the Fund. Neither the Fund nor its affiliates has any

obligation to update or otherwise revise any projections, forecasts and estimates including any revisions to reflect changes in economic conditions or other circumstances arising after the date hereof or to reflect the occurrence of unanticipated

events, even if the underlying assumptions do not come to fruition. The Fund acknowledges that, notwithstanding the foregoing, the safe harbor for forward-looking statements under the Private Securities Litigation Reform Act of 1995 does not apply

to investment companies such as the Fund.

iv

PROSPECTUS SUPPLEMENT SUMMARY

This is only a summary. You should review the more detailed information contained elsewhere in this prospectus supplement, in the

accompanying prospectus and in the statement of additional information, dated November 18, 2021, and as it may be supplemented (the “SAI”), including the documents incorporated by reference, prior to making an investment in

the Fund, especially the information set forth under the heading “Risk Factors” beginning on page S-19 of this prospectus supplement and beginning on page 43 in the

accompanying prospectus.

|

The Fund

|

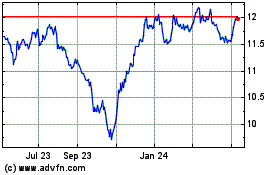

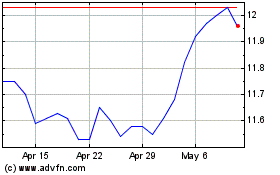

Nuveen AMT-Free Municipal Credit Income Fund (the “Fund”) is a diversified, closed-end management investment company. The Fund’s common shares, $.01

par value per share (“Common Shares”), are traded on the New York Stock Exchange under the symbol “NVG.” See “Description of Securities—Common Shares” in the prospectus. As of September 30, 2021, the Fund had

213,425,280 Common Shares outstanding, and net assets applicable to Common Shares of $3,707,300,733. The Fund commenced investment operations on March 25, 2002.

|

|

|

As of the date of this prospectus supplement, the Fund has outstanding two series of MuniFund Preferred Shares (“MFP Shares”), consisting of 2,054 Series A MFP Shares and 200,000 Series B MFP Shares; five

series of Variable Rate Demand Preferred Shares (“VRDP Shares”), consisting of 1,790 Series 1 VRDP Shares, 3,854 Series 2 VRDP Shares, 1,800 Series 4 VRDP Shares, 3,405 Series 5 VRDP Shares and 3,267 Series 6 VRDP Shares; and one

series of Adjustable Rate MuniFund Term Preferred (“AMTP Shares”), consisting of 1,120 Series 2028 AMTP Shares. See “Description of Securities—Preferred Shares” in the prospectus. MFP Shares, VRDP Shares, AMTP Shares and any

other preferred shares of the Fund as may be outstanding from time to time are collectively referred to as “Preferred Shares.”

|

|

Investment Objectives and Policies

|

The Fund’s investment objectives are to provide current income exempt from regular federal income tax and federal alternative minimum tax applicable to individuals, and to enhance portfolio value relative to the municipal bond market by

investing in tax-exempt municipal bonds that the Fund’s investment adviser, Nuveen Fund Advisors, LLC (“Nuveen Fund Advisors” or the “Investment Adviser”), believes are underrated or

undervalued or that represent municipal market sectors that are undervalued.

|

|

|

As a fundamental investment policy, under normal circumstances, the Fund will invest at least 80% of its Assets (as defined below) in municipal securities and other related investments, the income from which is exempt

from regular federal income taxes.

|

S-1

|

|

As a non-fundamental investment policy that may be changed by the Fund’s trustees without prior shareholder notice, under normal circumstances, the Fund will invest 100% of

its Managed Assets (as defined below) in municipal securities and other related investments, the income from which is exempt from the federal alternative minimum tax applicable to individuals at the time of purchase. As a non-fundamental investment policy subject to change by the Fund’s trustees upon 60 days’ notice to shareholders, under normal circumstances, the Fund will invest at least 80% of its Assets in municipal

securities and other related investments, the income from which is exempt from the federal alternative minimum tax applicable to individuals at the time of purchase.

|

|

|

“Assets” means net assets of the Fund plus the amount of any borrowings for investment purposes. “Managed Assets” means the total assets of the Fund, minus the sum of its accrued liabilities (other

than Fund liabilities incurred for the express purpose of creating leverage). Total assets for this purpose shall include assets attributable to the Fund’s use of leverage (whether or not those assets are reflected in the Fund’s financial

statements for purposes of generally accepted accounting principles), and derivatives will be valued at their market value.

|

|

|

As a non-fundamental investment policy that may be changed by the Fund’s trustees without prior shareholder notice, under normal circumstances, the Fund may invest up to 55%

of its Managed Assets in securities that, at the time of investment, are rated below the three highest grades (Baa or BBB or lower) by at least one nationally recognized statistical rating organization (“NRSRO”) or are unrated but judged

to be of comparable quality by the Fund’s sub-adviser, Nuveen Asset Management, LLC (“NAM” or the “Sub-Adviser”).

|

|

|

There can be no assurance that the Fund will achieve its investment objectives. See “Risk Factors” and “The Fund’s Investments—Investment Objectives and Policies” in the prospectus.

|

|

Investment Adviser

|

Nuveen Fund Advisors is the Fund’s investment adviser, responsible for overseeing the Fund’s overall investment strategy and its implementation.

|

|

Sub-Adviser

|

NAM serves as the Fund’s investment sub-adviser and is an affiliate of Nuveen Fund Advisors. NAM is a registered investment adviser. NAM oversees the day-to-day investment operations of the Fund.

|

S-2

|

The Offering

|

The Fund is offering up to 250,000 Series C MuniFund Preferred Shares (the “Series C MFP Shares”), liquidation preference $1,000 per share (the “Liquidation Preference”), in the Variable Rate Remarketed Mode (the Series C MFP

Shares, while in the Variable Rate Remarketed Mode, the “VRRM-MFP Shares”). See “Underwriting.” The first issuance date of the VRRM-MFP Shares upon

the closing of this offering is referred to herein as the “Date of Original Issue.”

|

|

Minimum Purchase Amount

|

The minimum purchase amount in this offering is twenty-five (25) VRRM-MFP Shares. Purchases in excess of the minimum purchase amount may be made only in multiples of five (5) VRRM-MFP Shares.

|

|

VRRM-MFP Shares

|

The VRRM-MFP Shares are Preferred Shares of the Fund, ranking on parity with each other and other Preferred Shares with respect to the payment of dividends and the distribution of assets upon dissolution,

liquidation or winding up of the affairs of the Fund. Each Preferred Share, including each VRRM-MFP Share, ranks and will rank senior in priority to the Common Shares as to the payment of dividends and as to

the distribution of assets upon dissolution, liquidation or winding up of the affairs of the Fund.

|

|

|

The VRRM-MFP Shares are being issued in the Variable Rate Remarketed Mode (the “VRR Mode”) designated pursuant to the Statement and the Statement Supplement (each as

defined below). So long as the VRRM-MFP Shares are outstanding, they will remain in the VRR Mode until December 1, 2031 (the “Term Redemption Date”), subject to the right of the Fund, at its option,

to terminate the VRR Mode and change the VRRM-MFP Shares to a new Mode (as defined below) with different terms. The VRRM-MFP Shares will be subject to mandatory tender

in connection with any Mode Change (as defined below), and holders of VRRM-MFP Shares will not have the right or obligation to retain their VRRM-MFP Shares in the new

Mode. See “Description of VRRM-MFP Shares—Mode Change” in this prospectus supplement and “Description of Securities—Preferred Shares—MuniFund Preferred Shares—Designation of

Modes” in the prospectus.

|

|

Variable Rate Remarketed Mode

|

The terms and conditions described in this prospectus supplement apply to the Series C MFP Shares during the VRR Mode. As described in this prospectus

supplement, during the VRR Mode, generally the regular dividend rate will be reset by the remarketing agent on each Business Day (as defined herein), and the remarketing agent will use its best efforts to

|

S-3

|

|

remarket VRRM-MFP Shares properly tendered by the beneficial owner thereof. See “Description of VRRM-MFP

Shares.” A complete description of the preferences, voting powers, restrictions, limitations as to dividends, qualification, and terms and conditions of redemption of the VRRM-MFP Shares during the VRR

Mode can be found in the Fund’s Declaration of Trust (the “Declaration of Trust”), the Statement Establishing and Fixing the Rights and Preferences of Series C MuniFund Preferred Shares (the “Statement”) and the

Supplement to the Statement Establishing and Fixing the Rights and Preferences of Series C MuniFund Preferred Shares (the “Statement Supplement”). These documents are filed with the SEC as exhibits to the Fund’s registration statement

of which the prospectus is a part. Copies may be obtained as described under “Where You Can Find More Information.”

|

|

|

“Mode” means the VRR Mode, or any subsequent Mode, including any extension thereof, for which terms and conditions of the Series C MFP Shares are designated pursuant to the Statement and the Statement

Supplement. See “Description of VRRM-MFP Shares—Mode Change.”

|

|

Remarketing Agent

|

BofA Securities, Inc., or any successor remarketing agent appointed by the Fund, will serve as the remarketing agent for the VRRM-MFP Shares (the “Remarketing Agent”) pursuant to a remarketing

agreement with the Fund and the Investment Adviser (the “Remarketing Agreement”).

|

|

|

The Remarketing Agent will agree to use its best efforts to remarket all VRRM-MFP Shares properly tendered in connection with an optional tender or mandatory tender of VRRM-MFP Shares, set the regular dividend rate and perform certain other duties. See “Description of VRRM-MFP Shares—Remarketing—Remarketing Agent.”

|

|

Dividend Provisions

|

General. Dividends on VRRM-MFP Shares with respect to any Dividend Period will be declared to the holders

as their names appear on the registration books of the Fund at the close of business on each day in such Dividend Period and will be paid on each Dividend Payment Date. During the VRR Mode, the “Dividend Period” will generally be a

calendar month, and the “Dividend Payment Date” will be the first Business Day of each month commencing . The Fund at

its discretion may establish Dividend Payment Dates more frequently than monthly. In connection with any transfer of VRRM-MFP Shares, the transferor as beneficial owner of

VRRM-MFP Shares will be deemed to have agreed pursuant to the terms of the VRRM-MFP Shares to transfer to the

|

S-4

|

|

transferee the right to receive from the Fund any dividends declared and unpaid for each day prior to the transferee becoming the beneficial owner of the

VRRM-MFP Shares in exchange for payment of the Purchase Price for such VRRM-MFP Shares by the transferee.

|

|

|

The amount of dividends per VRRM-MFP Share payable on any Dividend Payment Date will equal the sum of the dividends accumulated but not yet paid for the related Dividend Period.

The amount of dividends per VRRM-MFP Share accumulated for each such Dividend Period will be calculated by adding the “Dividend Factor” for each calendar day in such Dividend Period. The Dividend

Factor for each calendar day in a Dividend Period will be equal to: (x) the Dividend Rate in effect for such calendar day; (y) divided by the actual number of days in the year in which such day occurs (365 or 366); and (z) multiplied

by the Liquidation Preference.

|

|

|

Regular Dividend Rate. Subject to certain exceptions as described in this prospectus supplement, the Dividend Rate on the VRRM-MFP Shares will be the “Regular Dividend

Rate.”

|

|

|

The initial Regular Dividend Rate, for the Date of Original Issue of , 2021, will be equal to the sum of % per annum, plus

the Securities Industry and Financial Markets Association (“SIFMA”) Municipal Swap Index published at approximately 4:00 p.m., New York City time on Wednesday, , 2021

or % per annum if the SIFMA Municipal Swap Index is not so published. “SIFMA Municipal Swap Index” means the Securities Industry and Financial Markets Association Municipal Swap Index, a weekly, high-grade index

comprised of seven-day, tax-exempt variable rate demand notes produced by Bloomberg.

|

|

|

Thereafter, the Regular Dividend Rate generally will be determined by the Remarketing Agent on each Business Day, commencing on the Date of Original Issue, by 6:00 p.m., New York City time, for applicability on the

following day. The Regular Dividend Rate will be determined by the Remarketing Agent as the minimum rate that would enable the Remarketing Agent to sell all of the outstanding VRRM-MFP Shares on such Business

Day for settlement in seven (7) days at a price (without regard to accumulated but unpaid dividends) equal to the aggregate Liquidation Preference thereof.

|

|

|

In the event that the Remarketing Agent fails to determine the Regular Dividend Rate on any Business Day as set forth above,

then the Regular Dividend Rate applicable for the following day will be the same as the Regular Dividend Rate for the

|

S-5

|

|

immediately preceding Business Day and such rate will continue until the earlier of (A) the Business Day on which the Remarketing Agent determines a new Regular Dividend Rate or Step-Up Dividend Rate, as applicable, or (B) the fifth consecutive Business Day succeeding the first such Business Day on which such Dividend Rate is not determined by the Remarketing Agent. In the event that

the Remarketing Agent fails to determine a new Regular Dividend Rate for a period of five consecutive Business Days as described in clause (B) of the immediately preceding sentence, the Dividend Rate will be equal to the Step-Up Dividend Rate until a new Regular Dividend Rate is established by the Remarketing Agent.

|

|

|

“Business Day” means a day (a) other than a day on which commercial banks in The City of New York, New York are required or authorized by law or executive order to close and (b) on which the New York

Stock Exchange is not closed.

|

|

|

Step-Up Dividend Rate. In the event that the Remarketing Agent fails to determine a new Regular Dividend Rate for a period of five consecutive Business Days as described

above or commencing on the day following a Failed Remarketing Event and thereafter during a “Failed Remarketing Period,” except during an “Increased Rate Period,” the Dividend Rate on the

VRRM-MFP Shares will be the “Step-Up Dividend Rate.” The Step-Up Dividend Rate will mean a Dividend Rate, determined by

the Remarketing Agent, equal to the highest, as of the date of determination, of: (x) 5% per annum; (y) the Fed Funds Rate (as defined herein) plus 2.5% per annum; and (z) the One-Year AAA MMD Rate

(as defined herein) plus 2.5% per annum. In the event that the Fed Funds Rate (or a successor thereto) or the One-Year AAA MMD Rate (or a successor thereto) is no longer published or available for purposes of

determining the Step-Up Dividend Rate on any date, the Remarketing Agent, with the prior agreement of the Fund, will determine an equivalent rate in good faith on a commercially reasonable basis using a

formulation by reference to market practice at such date.

|

|

|

A “Failed Remarketing Period” is (i) in the case of a failed remarketing in connection with an optional tender

for remarketing, the period, if any, commencing on the Tender Notice Date (as defined below) relating to the Failed Remarketing Event with respect to the optional tender and ending upon the earliest to occur of (a) the redemption or repurchase

by the Fund of all of the outstanding VRRM-MFP Shares, (b) the date on which all (but not less than all) of the VRRM-MFP Shares are successfully remarketed pursuant

to a

|

S-6

|

|

mandatory tender for remarketing, and (c) the date on which the Fund completes a successful transition to a new Mode for all of the VRRM-MFP Shares;

and (ii) in the case of a failed transition to a new Mode, the period commencing on the date of the remarketing notice relating to the Failed Remarketing Event with respect to the failed transition and ending upon the earliest to occur of

(a) the redemption or repurchase by the Fund of all of the outstanding VRRM-MFP Shares, and (b) as applicable, (x) the date on which all (but not less than all) of the VRRM-MFP Shares are successfully remarketed pursuant to a mandatory tender for remarketing, or (y) the date on which the Fund completes a successful transition to a new Mode for all of the VRRM-MFP Shares. See “Remarketing—General” below.

|

|

|

An “Increased Rate Period” is the period, if any, commencing on (i) any Dividend Payment Date or Redemption Date for which the Fund fails to timely deposit with the Calculation and Paying Agent (as

defined herein) deposit securities sufficient to pay the applicable dividend or redemption price and ending on the Business Day on which the deposit is made by 12:00 noon, New York City time, in same-day funds

or (ii) the Business Day on which a court or other applicable governmental authority has made a final determination that for U.S. federal income tax purposes the VRRM-MFP Shares do not qualify as equity

in the Fund and such determination results from an act or failure to act on the part of the Fund. See “Description of VRRM-MFP Shares—Dividends—Increased Dividend Rate.”

|

|

|

Increased Rate. The Dividend Rate will be adjusted to the “Increased Rate” for each Increased Rate Period. The Increased Rate means, for any Increased Rate Period, the applicable Regular Dividend Rate

or Step-Up Dividend Rate as in effect from time to time plus 5% per annum.

|

|

|

Maximum Rate. The Maximum Rate for the VRRM-MFP Shares will be 15% per annum. Neither the Regular Dividend Rate, the Increased Rate nor the

Step-Up Dividend Rate may exceed the Maximum Rate.

|

|

|

The applicable dividend rate for the VRRM-MFP Shares is referred to in this prospectus supplement as the “Dividend Rate.”

|

|

|

See “Description of VRRM-MFP Shares—Dividends.”

|

|

Remarketing—General

|

Except during a Failed Remarketing Period, the VRRM-MFP Shares will be subject to optional tender by the

beneficial owners thereof, as described below under “Optional Tender for

|

S-7

|

|

Remarketing.” During a Failed Remarketing Period, all of the VRRM-MFP Shares will subject to mandatory tender for remarketing, subject to certain

retention rights, if the Remarketing Agent succeeds in identifying a purchaser or purchasers for all of the outstanding VRRM-MFP Shares, as described below under “Mandatory Tender for Remarketing

Following a Failed Remarketing Event.” All of the VRRM-MFP Shares will be subject to mandatory tender for remarketing, with no retention rights, in connection with a Mode Change, as described above under “VRRM-MFP Shares.”

|

|

|

If for any reason (other than a failure to timely deliver VRRM-MFP Shares by or on behalf of the tendering beneficial owner), any VRRM-MFP

Share subject to remarketing in connection with an optional tender or a mandatory tender is not successfully remarketed, a “Failed Remarketing Event” will occur. The consequences of a Failed Remarketing Event vary depending on whether it

occurs in connection with an optional tender for remarketing, a mandatory tender for remarketing following a Failed Remarketing Event or a mandatory tender for remarketing in connection with a Mode Change, as further described in this Summary and

under “Description of VRRM-MFP Shares.”

|

|

Minimum Remarketing Amount

|

Except as otherwise permitted by the Remarketing Agent, VRRM-MFP Shares may be optionally tendered for remarketing only in minimum amounts of twenty-five

(25) VRRM-MFP Shares and multiples of five (5) VRRM-MFP Shares in excess thereof.

|

|

Optional Tender for Remarketing

|

Each beneficial owner of VRRM-MFP Shares will have the right to tender such beneficial owner’s VRRM-MFP Shares (in whole shares only) for remarketing by

delivering an irrevocable written notice (a “Tender Notice”) by electronic means to the Remarketing Agent on any Business Day (the “Tender Notice Date”). The number of VRRM-MFP Shares so

tendered for remarketing is the “Designated Amount.” The giving of a Tender Notice will constitute the irrevocable tender for remarketing of the Designated Amount of such VRRM-MFP Shares on the

seventh calendar day following the Tender Notice Date or, if such seventh calendar day is not a Business Day, the next succeeding Business Day (the “Purchase Date”).

|

|

|

Upon receipt of a Tender Notice, the Remarketing Agent will offer for sale, and use its best efforts to sell, the Designated

Amount of VRRM-MFP Shares with respect to which a Tender

|

S-8

|

|

Notice has been received by the Remarketing Agent (the “Tendered VRRM-MFP Shares”) at a price equal to $1,000 per share plus any accumulated but

unpaid dividends (whether or not earned or declared), if any, to, but excluding, the relevant Purchase Date (the “Purchase Price”) for purchase on the Purchase Date.

|

|

|

If the Remarketing Agent successfully remarkets the Tendered VRRM-MFP Shares by identifying a purchaser for such Tendered VRRM-MFP Shares

during the period beginning on the Tender Notice Date for such Tendered VRRM-MFP Shares and ending on the Business Day immediately preceding the Purchase Date for such Tendered

VRRM-MFP Shares (a “Remarketing Window”), the Remarketing Agent will give written notice (a “Remarketing Notice”) by electronic means to the beneficial owner of such Tendered VRRM-MFP Shares, with a copy to the Fund and the Calculation and Paying Agent, that a purchaser has been identified for a purchase of such Tendered VRRM-MFP Shares on the

Purchase Date.

|

|

|

If the Remarketing Agent obtains a bid at the Purchase Price for any VRRM-MFP Shares being remarketed, which, if accepted, would be binding on the bidder for the consummation of

the sale of such VRRM-MFP Shares (an “actionable bid”), and the Remarketing Agent elects in its sole discretion to accept such actionable bid, the Remarketing Agent will (i) purchase the

tendered VRRM-MFP Shares, as a principal and not as an agent, from the beneficial owner or holder thereof on the Purchase Date at the Purchase Price, (ii) resell such

VRRM-MFP Shares, as a principal and not as an agent, to the person making such actionable bid at the Purchase Price, and (iii) record such purchase and resale on its books and records. Any such purchases

by the Remarketing Agent from the beneficial owner or holder will be made with the Remarketing Agent’s own funds.

|

|

|

For payment of the Purchase Price on the Purchase Date, Tendered VRRM-MFP Shares must

be delivered at or prior to 11:00 a.m., New York City time, on the Purchase Date to the Remarketing Agent by or for the account of the tendering beneficial owner through the Securities Depository, so long as the

VRRM-MFP Shares are in book-entry form, or at the principal office of the Remarketing Agent, accompanied by an instrument of transfer thereof, in a form satisfactory to the Remarketing Agent, executed in blank

by the holder thereof or by the holder’s duly-authorized attorney, with such signature guaranteed by a commercial bank, trust company or member firm of the New York Stock Exchange, if the VRRM-MFP

|

S-9

|

|

Shares are in certificated form. If Tendered VRRM-MFP Shares are delivered after that time on any Business Day, the Purchase Price will be paid on the next

succeeding Business Day.

|

|

|

See “Description of VRRM-MFP Shares—Remarketing—Optional Tender for Remarketing.”

|

|

Failed Remarketing Event in Connection with an Optional Tender

|

If for any reason (other than a failure to timely deliver Tendered VRRM-MFP Shares by or on behalf of the tendering beneficial owner) any Tendered VRRM-MFP Share is

not successfully remarketed during the related Remarketing Window, a “Failed Remarketing Event” will occur.

|

|

|

Upon the occurrence of a Failed Remarketing Event, (a) all Tendered VRRM-MFP Shares shall be retained by their respective beneficial owners, and no such Tendered VRRM-MFP Shares will be purchased on their respective Purchase Date, (b) the Remarketing Agent will provide written notice to the Calculation and Paying Agent, the Fund and the holders of the VRRM-MFP Shares by electronic means, (c) a Failed Remarketing Period will commence and (d) all outstanding VRRM-MFP Shares will become subject to mandatory

redemption on the Failed Remarketing Mandatory Redemption Date, which will be the first Business Day falling on or after the 365th calendar day following the Tender Notice Date relating to the Failed Remarketing Event.

|

|

|

Commencing on the date of the Failed Remarketing Event and thereafter during the Failed Remarketing Period, the Remarketing Agent will no longer determine the Regular Dividend Rate on a daily basis; commencing on the

day following the date of the Failed Remarketing Event, dividends on all VRRM-MFP Shares will be payable at the Step-Up Dividend Rate (as determined by the Remarketing

Agent commencing on the date of the Failed Remarketing Event); the right of beneficial owners to make optional tenders of their VRRM-MFP Shares for remarketing will be suspended; and all of the outstanding VRRM-MFP Shares will be subject to mandatory tender for remarketing as described below under “Mandatory Tender for Remarketing Following a Failed Remarketing Event.”

|

|

Mandatory Tender for Remarketing Following a Failed Remarketing Event

|

Commencing on the date of the Failed Remarketing Event and thereafter during a Failed Remarketing Period, the Remarketing Agent will offer for sale, and

use its best efforts to sell, all (but

|

S-10

|

|

not less than all) of the outstanding VRRM-MFP Shares at a price per share equal to the Purchase Price. Upon identifying a purchaser or purchasers for all

of the outstanding VRRM-MFP Shares (subject to the retention rights described in the immediately following paragraph) and establishing the Regular Dividend Rate to apply to the

VRRM-MFP Shares on the Remarketing Date, the Remarketing Agent will give a Remarketing Notice to the Calculation and Paying Agent, the Fund and the holders of the

VRRM-MFP Shares by electronic means stating (A) that a purchaser or purchasers have been identified for the purchase of all (but not less than all) of the VRRM-MFP

Shares on the date set forth in such Remarketing Notice (the “Remarketing Date”), which Remarketing Date will be the fifth Business Day following delivery of the Remarketing Notice, (B) the Regular Dividend Rate to be applicable to

the VRRM-MFP Shares on the Remarketing Date and (C) that all VRRM-MFP Shares will be subject to mandatory tender for purchase at a price equal to the Purchase Price

on the Remarketing Date.

|

|

|

Any beneficial owner of a VRRM-MFP Share that is not a Tendered VRRM-MFP Share that was part of the related Failed Remarketing Event, as

determined by the Remarketing Agent, may deliver written notice to the Remarketing Agent and the Calculation and Paying Agent by electronic means at least three Business Days prior to the related Remarketing Date that such beneficial owner wishes to

retain such beneficial owner’s VRRM-MFP Shares (each such beneficial owner, a “Retaining Beneficial Owner”). On the Remarketing Date, the VRRM-MFP Shares

held by such Retaining Beneficial Owner will be (a) subject to mandatory tender as set forth in the immediately preceding paragraph and (b) repurchased by the Retaining Beneficial Owner at a price equal to the Purchase Price on the

Remarketing Date.

|

|

|

If the Remarketing Agent obtains a bid at the Purchase Price for any VRRM-MFP Shares

being remarketed, which, if accepted, would be binding on the bidder for the consummation of the sale of such VRRM-MFP Shares (an “actionable bid”), and the Remarketing Agent elects in its sole

discretion to accept such actionable bid, the Remarketing Agent will (i) purchase the tendered VRRM-MFP Shares, as a principal and not as an agent, from the beneficial owner or holder thereof on the

Purchase Date at the Purchase Price, (ii) resell such VRRM-MFP Shares, as a principal and not as an agent, to the person making such actionable bid at the Purchase Price, and (iii) record such

purchase and resale on its books and records.

|

S-11

|

|

Any such purchases by the Remarketing Agent from the beneficial owner or holder will be made with the Remarketing Agent’s own funds.

|

|

|

In the event of a successful remarketing on the Remarketing Date, the Remarketing Agent will resume resetting the Regular Dividend Rate on the VRRM-MFP Shares, the Failed

Remarketing Mandatory Redemption Date with respect to the related Failed Remarketing Event shall be cancelled and the VRRM-MFP Shares will no longer be subject to mandatory redemption on such date.

|

|

|

See “Description of VRRM-MFP Shares—Remarketing—Mandatory Tender for Remarketing Following a Failed Remarketing Event.”

|

|

Failed Remarketing Event in Connection with a Mandatory Tender for Remarketing Following a Failed Remarketing Event

|

If for any reason (other than a failure to timely deliver VRRM-MFP Shares by or on behalf of a tendering beneficial owner) any VRRM-MFP Share is not successfully

remarketed pursuant to the related mandatory tender a “Failed Remarketing Event” will occur. Upon the occurrence of a Failed Remarketing Event, (a) all VRRM-MFP Shares will be retained by their

respective holders, and no VRRM-MFP Shares shall be purchased on the Remarketing Date, (b) the Remarketing Agent will provide a Failed Remarketing Notice in writing to the Calculation and Paying Agent,

the Fund and the holders of the VRRM-MFP Shares by electronic means, (c) the then-prevailing Failed Remarketing Period will continue and (d) all Outstanding

VRRM-MFP Shares will remain subject to mandatory redemption on the related Failed Remarketing Mandatory Redemption Date.

|

|

Coverage and Leverage Tests

|

The Fund will agree in the Statement Supplement to comply on an ongoing basis with asset coverage and effective leverage requirements. A failure to comply may result in the mandatory redemption of Preferred Shares, which may include some number

of VRRM-MFP Shares. See “Redemption Provisions—Asset Coverage Mandatory Redemption” and “—Effective Leverage Ratio Mandatory Redemption” below and “Description of VRRM-MFP Shares—Coverage and Leverage Tests” and “—Redemptions—Asset Coverage Mandatory Redemption” and “—Effective Leverage Ratio Mandatory Redemption.”

|

S-12

|

Redemption Provisions

|

Optional Redemption. Subject to certain conditions, VRRM-MFP Shares may be redeemed on any Business Day, at the option of the Fund (in whole or from time to time, in part), out of funds legally

available therefor, at the Redemption Price per share. The “Redemption Price” per share is equal to the Liquidation Preference per VRRM-MFP Share plus an amount equal to all unpaid dividends and

other distributions on such VRRM-MFP Share accumulated from and including the Date of Original Issue to (but excluding) the Term Redemption Date or any redemption dates for optional or mandatory redemption

otherwise provided in the Statement Supplement (the “Redemption Date”) (whether or not earned or declared by the Fund, but without interest thereon).

|

|

|

See “Description of VRRM-MFP Shares—Redemptions—Optional Redemption.”

|

|

|

Term Mandatory Redemption. The Fund will redeem all outstanding VRRM-MFP Shares on the Term Redemption Date at the aggregate Redemption Price.

|

|

|

See “Description of VRRM-MFP Shares—Redemptions—Term Mandatory Redemption.”

|

|

|

Failed Remarketing Mandatory Redemption. The Fund will redeem all outstanding VRRM-MFP Shares at the aggregate Redemption Price on the Failed Remarketing Mandatory

Redemption Date, if a Failed Remarketing Period shall have commenced and be continuing for 365 days, or, if earlier, on the Term Redemption Date.

|

|

|

See “Description of VRRM-MFP Shares—Redemptions—Failed Remarketing Mandatory Redemption.”

|

|

|

Asset Coverage Mandatory Redemption. If the Fund fails to have Asset Coverage of at least 225% as required under the Statement Supplement and such failure is not timely cured, the Fund will proceed to redeem

Preferred Shares (which may include at the sole option of the Fund any number or proportion of VRRM-MFP Shares) to restore compliance with the Asset Coverage requirement. In the event that any VRRM-MFP Shares then outstanding are to be redeemed, the Fund will redeem such VRRM-MFP Shares at a price per VRRM-MFP Share equal to

the Redemption Price on the Redemption Date therefor.

|

|

|

See “Description of VRRM-MFP Shares—Redemptions—Asset Coverage Mandatory Redemption.”

|

S-13

|

|

Effective Leverage Ratio Mandatory Redemption. If the Effective Leverage Ratio of the Fund exceeds 45% (or 46% solely by reason of fluctuations in the market value of the Fund’s portfolio securities) as of

the close of business on any Business Day on which such ratio is required to be calculated and such breach is not cured as of the close of business on the date that is seven Business Days following the Business Day on which such non-compliance is first determined, the Fund will cause the Effective Leverage Ratio to not exceed 45% by (x) engaging in transactions involving or relating to the floating rate securities not owned by the Fund

and/or the inverse floating rate securities owned by the Fund, including the purchase, sale or retirement thereof, (y) proceeding with redeeming a sufficient number of Preferred Shares, which at the Fund’s sole option may include any

number or proportion of VRRM-MFP Shares, in accordance with the terms of such series, or (z) engaging in any combination of the actions contemplated by (x) and (y) above. In the event that any VRRM-MFP Shares then outstanding are to be redeemed, the Fund will redeem such VRRM-MFP Shares at a price per VRRM-MFP Share equal to

the Redemption Price on the Redemption Date thereof.

|

|

|

See “Description of VRRM-MFP Shares—Redemptions—Effective Leverage Ratio Mandatory Redemption.”

|

|

|

Any optional or mandatory redemption of VRRM-MFP Shares by the Fund shall be done in accordance with the requirements of the Statement and Statement Supplement and the provisions

of the 1940 Act and rules thereunder, including Rule 23c-2. The Statement Supplement requires that notice of redemption be provided not more than 45 calendar days and not less than five Business Days prior to

the date fixed for redemption.

|

|

Tax Exemption

|

The dividend rate for VRRM-MFP Shares assumes that each month’s distribution is comprised solely of dividends exempt from regular U.S. federal income tax and the federal alternative minimum tax. From

time to time, the Fund may be required to allocate capital gains and/or ordinary income to a given month’s distribution on VRRM-MFP Shares. To the extent that it does so, the Fund will provide notice

thereof and make Additional Amount Payments (as defined herein) at the times and in accordance with, and to the extent required in, the provisions relating thereto as described under “Description of

VRRM-MFP Shares—Taxable Allocations.” Investors should consult with their own tax advisors before making an investment in the VRRM-MFP Shares. See “Tax

Matters.”

|

S-14

|

Ratings

|

The Fund expects that at the Date of Original Issue, the VRRM-MFP Shares will have a long-term rating from Fitch Ratings, Inc. (“Fitch”) and a long-term credit rating from Moody’s Investors

Service, Inc. (“Moody’s”). Each NRSRO rating the VRRM-MFP Shares at the request of the Fund is referred to in this prospectus supplement as a “Rating Agency.”

|

|

|

There can be no assurance that the Fund will maintain any ratings of the VRRM-MFP Shares or, if at any time the VRRM-MFP Shares have one or

more ratings, that any particular ratings will be maintained. See “Risk Factors—Ratings Risk” and “Description of VRRM-MFP Shares—Ratings.”

|

|

Voting Rights

|

Except as otherwise provided in the Declaration of Trust or as otherwise required by law, (i) each holder of VRRM-MFP Shares will be entitled to one vote for each

VRRM-MFP Share held by such holder on each matter submitted to a vote of shareholders of the Fund, and (ii) the holders of outstanding Preferred Shares, including each

VRRM-MFP Share, and of Common Shares will vote together as a single class; provided, however, that the holders of outstanding Preferred Shares, including VRRM-MFP

Shares, voting as a class, to the exclusion of the holders of all other securities and classes of shares of beneficial interest of the Fund, will be entitled to elect two trustees of the Fund at all times, each Preferred Share, including each VRRM-MFP Share, entitling the holder thereof to one vote. The holders of outstanding Common Shares and Preferred Shares, including VRRM-MFP Shares, voting together as a single

class, will elect the balance of the trustees. See “Description of VRRM-MFP Shares—Voting Rights.”

|

|

Liquidation Preference

|

In the event of any liquidation, dissolution or winding up of the affairs of the Fund, whether voluntary or involuntary, the holders of VRRM-MFP Shares will be entitled to receive a liquidation

distribution per share equal to the Liquidation Preference plus an amount equal to all unpaid dividends and other distributions accumulated to (but excluding) the date fixed for distribution or payment (whether or not earned or declared by the Fund,

but without interest thereon). See “Description of VRRM-MFP Shares—Priority of Payment and Liquidation Preference.”

|

|

Trading Market

|

The VRRM-MFP Shares are a new issue of securities and there is currently no established trading market for such

shares. The Fund does not intend to apply for a listing of the VRRM-MFP Shares on a securities exchange or an automated dealer quotation system. Accordingly, there can be no assurance as to

|

S-15

|

|

the development or liquidity of any market for the VRRM-MFP Shares, including in a remarketing by the Remarketing Agent.

|

|

Further Issuance

|

The Fund may issue additional Preferred Shares on parity with VRRM-MFP Shares, including additional VRRM-MFP Shares. The Fund may not issue additional classes of

shares that are senior to VRRM-MFP Shares or that are senior to other outstanding Preferred Shares of the Fund as to payments of dividends or as to distribution of assets upon dissolution, liquidation or

winding up of the affairs of the Fund.

|

|

Calculation and Paying Agent

|

The Fund will enter into a Tender and Paying Agent Agreement with The Bank of New York Mellon (the “Calculation and Paying Agent”), effective as of the Date of Original Issue in connection with the initial issuance of VRRM-MFP Shares. In connection with the VRR Mode, the Calculation and Paying Agent will serve as the Fund’s calculation agent, transfer agent and registrar, dividend disbursing agent, and paying agent and

redemption price disbursing agent with respect to the VRRM-MFP Shares. See “Custodian, Transfer Agent, Calculation and Paying Agent.”

|

|

Use of Proceeds

|

The Fund estimates that the total net proceeds from this offering after deducting the underwriting discounts and commissions and estimated offering expenses payable by the Fund will be approximately

$ . The Fund intends to use all or part of the net proceeds from the sale of VRRM-MFP Shares, which may be supplemented with cash already held by the Fund, to

redeem up to 2,500 outstanding Variable Rate Demand Preferred Shares of the Fund in the aggregate from one or more series and maintain the Fund’s leveraged capital structure. Any net proceeds not applied to such redemptions will increase the

Fund’s leverage accordingly and be used by the Fund for investment purposes in accordance with the Fund’s investment objectives and policies. See “Use of Proceeds.”

|

|

Book-Entry

|

It is expected that the VRRM-MFP Shares will be delivered to investors in book-entry form only, through the facilities of The Depository Trust Company (“DTC”). See “Book-Entry Procedures and

Settlement.”

|

|

Governing Law

|

The Declaration of Trust, the Statement and the Statement Supplement are governed by the laws of the Commonwealth of Massachusetts. The Remarketing Agreement is governed by the laws of the State of New York.

|

|

Risk Factors

|

See “Risk Factors” in this prospectus supplement, as well as “Risks Factors” and other information included in the accompanying prospectus, for a discussion of the principal risks you should carefully consider before deciding

to invest in VRRM-MFP Shares.

|

S-16

Overview of the Variable Rate Remarketed Structure

This overview highlights certain features of the VRRM-MFP Shares. You should read it in the context

of the more detailed information in this summary and contained elsewhere in this prospectus supplement, including under the heading “Description of VRRM-MFP Shares,” as well as in the accompanying

prospectus and SAI, including the documents incorporated by reference, prior to making an investment in the VRRM-MFP Shares. You should pay particular attention to the information set forth under the heading

“Risk Factors” beginning on page S-19 of this prospectus supplement and beginning on page 9 in the accompanying prospectus.

Dividends and Remarketing Features

|

|

∎

|

|

earn dividends at the rate reset each Business Day at the lowest market-clearing rate that is determined by the

Remarketing Agent to value the shares at their Liquidation Preference;

|

|

|

∎

|

|

may be tendered by VRRM-MFP shareholders to the Remarketing Agent for

remarketing; and

|

|

|

∎

|

|

are redeemable by the Fund at any time on not more than 45 calendar days and not less than five Business

Days’ notice.

|

|

|

∎

|

|

VRRM-MFP shareholders have the option to tender their shares to the

Remarketing Agent for sale and purchase via a best efforts remarketing in seven days, or if such seventh day is not a Business Day, the next succeeding Business Day (the “Purchase Date”) at Liquidation Preference plus accumulated

dividends.

|

|

|

∎

|

|

If, by the Business Day immediately preceding the Purchase Date, the Remarketing Agent is unable to find

investors for the tendered VRRM-MFP Shares, a “Failed Remarketing Event” shall occur, and, starting on the following day:

|

|

|

∎

|

|

all outstanding VRRM-MFP Shares, including those not tendered, will begin

to accumulate dividends at the Step-Up Dividend Rate equal to the highest of:

|

|

|

∎

|

|

(x) 5% per annum; (y) the Fed Funds Rate plus 2.5% per annum; (z) the

One-Year AAA MMD Rate plus 2.5% per annum;

|

|

|

∎

|

|

any VRRM-MFP Shares tendered will NOT be purchased and will

remain held by existing holders;

|

|

|

∎

|

|

the right of VRRM-MFP shareholders to make optional tenders of their VRRM-MFP Shares for remarketing will be

suspended;

|

|

|

∎

|

|

all VRRM-MFP Shares will be subject to mandatory redemption on the Failed

Remarketing Mandatory Redemption Date, occurring on the first Business Day falling on or after the 365th calendar day following the Tender Notice Date relating to the Failed Remarketing Event;

|

|

|

∎

|

|

the Remarketing Agent will continuously attempt to remarket all of the outstanding

VRRM-MFP Shares on a best efforts basis:

|

|

|

∎

|

|

if the Remarketing Agent can successfully remarket the shares to investors:

|

|

|

∎

|

|

the Remarketing Agent will initiate a mandatory tender for remarketing (with five Business Days’ notice) of

all the VRRM-MFP Shares and remarket the shares to investors for purchase on the fifth Business Day, the “Remarketing Date;” and

|

S-17

|

|

∎

|

|

upon settlement of the mandatory remarketing of the VRRM-MFP Shares, the

Failed Remarketing Mandatory Redemption Date is cancelled and the VRRM-MFP Shares resume their normal rate reset/tender mechanisms; provided, however,

|

|

|

∎

|

|

if the Remarketing Agent cannot successfully remarket the shares:

|

|

|

∎

|

|

the Fund is obligated to redeem all of the VRRM-MFP Shares on the Failed

Remarketing Mandatory Redemption Date; and

|

|

|

∎

|

|

VRRM-MFP Shares will receive the

Step-Up Dividend Rate until all of the VRRM-MFP Shares are remarketed or redeemed, or the Fund completes a successful transition to a new Mode for all of the VRRM-MFP Shares.

|

Structural Features Relating to Asset Coverage, Effective

Leverage and Failed Remarketing

|

|

∎

|

|

Asset Coverage Mandatory Redemption

|

|

|

∎

|

|

If the Fund fails to have Asset Coverage of at least 225% as of any Business Day close and the failure goes

uncured for 30 calendar days, the Fund will redeem such number of Preferred Shares (which may at the sole option of the Fund include any number or proportion of VRRM-MFP Shares) that would result in Asset

Coverage of at least 225%.

|

|

|

∎

|

|

Effective Leverage Ratio Mandatory Redemption

|

|

|

∎

|

|

If the Effective Leverage Ratio of the Fund exceeds 45% (or 46% solely by reason of fluctuations in the market

value of the Fund’s portfolio securities) as of any Business Day close and the breach goes uncured for seven Business Days, the Fund will reduce leverage by (a) reducing exposure incurred through tender option bond trusts or similar

structures or (b) redeeming such number of Preferred Shares (which may at the sole option of the Fund include any number or proportion of VRRM-MFP Shares), or any combination of (a) and (b), to

reduce the Effective Leverage Ratio to no more than 45%.

|

|

|

∎

|

|

Failed Remarketing Mandatory Redemption

|

|

|

∎

|

|

At least six months prior to the Failed Remarketing Mandatory Redemption Date, the Fund will earmark assets rated

at least A- or the equivalent with a market value equal to at least 110% of the Liquidation Preference of all outstanding VRRM-MFP Shares until the redemption of all

outstanding VRRM-MFP Shares. The earmarked assets must include highly liquid deposit securities, in an amount equal to 20% of the Liquidation Preference of all outstanding

VRRM-MFP Shares, with 135 days remaining to the redemption date, increasing to 100% with 15 days remaining:

|

|

|

|

|

|

Number of Days

Preceding the Failed

Remarketing

Mandatory

Redemption Date:

|

|

Value of Deposit

Securities as

Percentage of

Liquidation Preference

|

|

|

|

|

135

|

|

20%

|

|

|

|

|

105

|

|

40%

|

|

|

|

|

75

|

|

60%

|

|

|

|

|

45

|

|

80%

|

|

|

|

|

15

|

|

100%

|

S-18

RISK FACTORS

Investing in the VRRM-MFP Shares involves risk, including the risk that you may receive little or

no return on your investment or that you may lose part or all of your investment. Therefore, before investing in the VRRM-MFP Shares you should consider carefully the following risks, as well as the risk

factors set forth under “Risk Factors” beginning on page 43 of the accompanying prospectus.

Remarketing Risk

VRRM-MFP Shares do not have a put option allowing the holder to sell

VRRM-MFP Shares back to the Fund at any time. No party, including, but not limited to, the Remarketing Agent and the Fund, is under any obligation to purchase VRRM-MFP

Shares on an optional tender. Accordingly, VRRM-MFP Shares are not, and should not be considered by any investors to be, cash equivalents.

Due to the lack of a guaranteed purchaser for VRRM-MFP Shares, liquidity in VRRM-MFP Shares depends upon a successful remarketing. The Purchase Price of a Tendered VRRM-MFP Share will only be paid upon a successful remarketing, and the Purchase Price

of the VRRM-MFP Shares is payable exclusively from remarketing proceeds. A remarketing may be unsuccessful for various reasons, including, but not limited to, general market conditions, market disruptions,

credit events relating to the Fund, concerns about future liquidity, and participation by the Remarketing Agent as a buyer or seller of VRRM-MFP Shares. Additionally, a successful remarketing does not

guarantee any successful remarketing in the future.

In the event that any Tendered VRRM-MFP

Shares are not successfully remarketed, all beneficial owners of the VRRM-MFP Shares, regardless of whether they have tendered their VRRM-MFP Shares, may be required to

hold their VRRM-MFP Shares until the Failed Remarketing Mandatory Redemption Date. The requirement of the Fund to redeem the VRRM-MFP Shares on a Failed Remarketing

Mandatory Redemption Date may increase the financial stress on the Fund, which could have a negative impact on the Fund’s ratings. Upon a failed remarketing, all of the VRRM-MFP Shares will pay dividends

at the Step-Up Dividend Rate, and optional tenders for remarketing will be suspended. The Step-Up Dividend Rate may be lower than the rate on comparable securities

issued by the Fund or on similar securities in the market. Although holders of VRRM-MFP Shares may seek to sell their VRRM-MFP Shares in the secondary market, they may

only be able to do so at a discount from the Purchase Price if the Step-Up Dividend Rate is not high enough in relation to the level of liquidity or the Fund’s credit.

The Remarketing Agent, in its sole discretion, may purchase VRRM-MFP Shares for its own account in

order to achieve a successful remarketing (i.e., because there are otherwise not enough buyers to purchase the VRRM-MFP Shares) or for other reasons. If the Remarketing Agent does purchase Tendered VRRM-MFP Shares for its own account, it may cease doing so at any time without notice, in its sole discretion. The Remarketing Agent may choose to tender for remarketing any

VRRM-MFP Shares it holds at any time. Any decision by the Remarketing Agent to purchase VRRM-MFP Shares may be constrained in amount and holding period by internal

limits that may be set and changed from time to time.

As described above, the Remarketing Agent has no obligation to purchase VRRM-MFP Shares. The Remarketing Agent has agreed to act as principal in remarketings in the circumstances where the Remarketing Agent has obtained an “actionable bid” and the Remarketing Agent elects in

its sole

S-19

discretion to accept such actionable bid, as described below under “Description of VRRM-MFP Shares—Remarketing—Optional Tender for

Remarketing” and “—Mandatory Tender for Remarketing Following a Failed Remarketing Event.”

The Remarketing Agent also

may make a market by purchasing and selling VRRM-MFP Shares other than in connection with a tender and remarketing, although it is under no obligation to do so and may discontinue any such activities at any

time without notice. Such purchases and sales may be made at prices that may be at, above or below the Purchase Price. No notice is required for such purchases or sales. Purchases and sales of VRRM-MFP Shares

by the Remarketing Agent may negatively impact the price and/or demand for VRRM-MFP Shares sold into the secondary market by other holders of VRRM-MFP Shares.

The purchase of VRRM-MFP Shares by the Remarketing Agent may create the appearance that there is

greater third-party demand for the VRRM-MFP Shares in the market than is actually the case. The practices described above also may result in fewer VRRM-MFP Shares being

tendered in a remarketing.

The Ability to Sell the VRRM-MFP Shares Other Than Through a Remarketing May Be

Limited

The Remarketing Agent may buy and sell VRRM-MFP Shares other than through a

remarketing. However, it is not obligated to do so and may cease doing so at any time without notice and may require holders that wish to sell their VRRM-MFP Shares to instead tender their VRRM-MFP Shares for remarketing with appropriate notice. Further, investors who purchase VRRM-MFP Shares should not assume that they will be able to sell their VRRM-MFP Shares other than by tendering the VRRM-MFP Shares in accordance with the remarketing process.

Under Certain Circumstances, the Remarketing Agent May Be Removed, Resign or Cease Remarketing the VRRM-MFP Shares,

Without a Successor Being Named.

Under certain circumstances, the Remarketing Agent may be removed or have the ability to resign or

cease its remarketing efforts, without a successor having been named, subject to the terms of the Remarketing Agreement.

No Public Trading Market

The VRRM-MFP Shares will be a new issue of securities and there is currently no established

trading market for the VRRM-MFP Shares. The Fund does not intend to apply for a listing of the VRRM-MFP Shares on a securities exchange or an automated dealer quotation

system. Thus, an investment in VRRM-MFP Shares may be illiquid and there may be no active trading market.

Risk

of Mandatory and Optional Redemptions or Mode Change

The Fund may be forced to redeem

VRRM-MFP Shares to meet requirements in the Statement Supplement or regulatory or Rating Agency requirements, or may voluntarily redeem VRRM-MFP Shares at any time, or

may elect to make a Mode Change, including in circumstances that are unfavorable to VRRM-MFP shareholders, at times when attractive alternative investment opportunities for reinvestment of the proceeds are not

available. See “Description of VRRM-MFP Shares—Redemptions” and “—Mode Change.”

S-20

Dividend Rate Risk

The VRRM-MFP Shares are variable dividend rate securities. Such securities generally are less

sensitive to interest and dividend rate changes but may decline in value if their dividend rate does not rise as much, or as quickly, as interest and dividend rates in general. Conversely, variable dividend rate securities will not generally

increase in value if interest and dividend rates decline.

Interest Rate and Income Shortfall Risk

VRRM-MFP Shares generally pay dividends based on short-term interest rates, and the proceeds from the

issuance of the Fund’s Preferred Shares are used to buy municipal bonds, which pay interest based on long-term yields. Long-term municipal bond yields are typically, although not always, higher than short-term interest rates. Long-term,

intermediate-term and short-term interest rates may fluctuate. If short-term interest rates rise, VRRM-MFP Share rates may rise so that the amount of dividends paid to the

VRRM-MFP shareholders exceeds the income from the portfolio securities purchased with the proceeds from the sale of VRRM-MFP Shares. Because income from the Fund’s

entire investment portfolio (not just the portion of the portfolio attributable to the proceeds from the issuance of Preferred Shares) is available to pay dividends on the Fund’s outstanding Preferred Shares, however, dividend rates on the

Preferred Shares would need to greatly exceed the Fund’s net portfolio income before the Fund’s ability to pay dividends on the Preferred Shares, including the VRRM-MFP Shares, would be jeopardized.

If long-term rates rise, the value of the Fund’s investment portfolio will decline, reducing the amount of assets serving as the Asset Coverage for the VRRM-MFP Shares.

Additionally, in certain market environments, short-term market interest rates may be higher than the Maximum Rate allowable for the dividend

reset for VRRM-MFP Shares. In such extreme circumstances, this scenario may adversely affect the valuation of VRRM-MFP Shares and the liquidity of VRRM-MFP Shares.

Subordination Risk

While VRRM-MFP shareholders will have equal liquidation and distribution rights to any other Preferred

Shares issued or that might be issued by the Fund, they will be subordinated to the rights of holders of indebtedness and the claims of other creditors of the Fund. Therefore, dividends, distributions and other payments to VRRM-MFP shareholders in liquidation or otherwise will be subject to prior payments due, if any, to the holders of indebtedness or other creditors of the Fund. Creditors of the Fund may include lenders and

counterparties in connection with any borrowings, delayed delivery purchases and/or forward delivery contracts or derivatives, including interest rate swaps or caps, entered into by the Fund.

Ratings Risk

The Fund expects that, at

the Date of Original Issue, the VRRM-MFP Shares will have a long-term rating from Fitch and a long-term credit rating from Moody’s.

There can be no assurance that any particular rating will be maintained at the level currently assigned to the

VRRM-MFP Shares. Ratings do not eliminate or mitigate the risks of investing in VRRM-MFP Shares. A rating issued by a Rating Agency (including Fitch and Moody’s) is

only the opinion of the entity issuing the rating at that time, and is not a guarantee as to quality, or an assurance of the future performance, of the rated security (in this case, VRRM-MFP Shares). In

addition, the

S-21

manner in which the Rating Agency obtains and processes information about a particular security may affect the Rating Agency’s ability to react in a timely manner to changes in an

issuer’s circumstances (in this case, the Fund) that could influence a particular rating. A Rating Agency downgrade of the VRRM-MFP Shares that results in an increase in the Dividend Rate may make VRRM-MFP Shares less liquid in the secondary market.

Additionally, so long as the VRRM-MFP Shares or other Preferred Shares of the Fund have long-term ratings, the Fund will be required to meet certain asset coverage or other criteria in order to maintain such rating. The Fund’s failure to

meet such criteria may cause the Fund to sell portfolio positions or to redeem VRRM-MFP Shares at inopportune times in an amount necessary to restore compliance with such criteria, or may result in a downgrade

of ratings. The ratings do not eliminate or necessarily mitigate the risks of investing in VRRM-MFP Shares. A rating issued by a Rating Agency is only the opinion of the entity issuing the rating at that time

and is not a guarantee as to quality, or an assurance of the future performance, of the rated security. In addition, the manner in which the Rating Agency obtains and processes information about a particular security may affect the Rating

Agency’s ability to timely react to changes in an issuer’s (in this case, the Fund’s) circumstances that could influence a particular rating. A Rating Agency could downgrade VRRM-MFP Shares,

which may make VRRM-MFP Shares less liquid in the secondary market, although the downgrade would probably result in higher dividend rates.

A rating on the VRRM-MFP Shares is not a recommendation to purchase, hold, or sell those shares,

inasmuch as the rating does not comment as to market price or suitability for a particular investor. A Rating Agency could downgrade VRRM-MFP Shares.

Tax Risks

The Fund is relying on an

opinion of counsel that the VRRM-MFP Shares will qualify as stock in the Fund for U.S. federal income tax purposes. Because there is no direct legal authority on the classification of instruments similar to

the VRRM-MFP Shares, investors should be aware that the Internal Revenue Service and other governmental taxing authorities could assert a contrary position. See “Tax Matters.”

Multiple Series Risk

Following the

issuance of the VRRM-MFP Shares, the Fund will have three series of MFP Shares, five series of VRDP Shares and one series of AMTP Shares outstanding. All Preferred Shares of the Fund have equal priority as to

the payment of dividends and the distribution of assets upon dissolution, liquidation or winding up of the affairs of the Fund, but, to the extent that the terms of the various series or types of Preferred Shares differ, there is a risk that market

or other events may impact one series of Preferred Shares differently from other series. If market or other events cause the Fund to breach covenants applicable to one series or type of Preferred Shares but not others, the Fund may nevertheless be

granted discretion to redeem shares of any series of Preferred Shares, including the affected series, in order to restore compliance, subject to the redemption terms of each series. In addition, the voting power of certain series of Preferred Shares

may be more concentrated than others. The Fund, without the consent of VRRM-MFP shareholders, may from time to time issue additional Preferred Shares of a new or existing series in connection with new

financings, refinancing or reorganizations. The issuance by the Fund of additional Preferred Shares may require the consent of liquidity providers or other Fund counterparties.

S-22

Dividend Risk

The Fund may be unable to pay dividends on VRRM-MFP Shares in extraordinary circumstances.

The Remarketing Agent is Paid by the Fund

The Remarketing Agent’s responsibilities include determining the Regular Dividend Rate and

Step-up Dividend Rate from time to time and remarketing VRRM-MFP Shares that are optionally or mandatorily tendered by the owners thereof (subject, in each case, to the

terms of the Remarketing Agreement), all as further described in this prospectus supplement. The Remarketing Agent is appointed by the Fund and is paid by the Fund for its services. As a result, the interests of the Remarketing Agent may differ from

those of existing holders and potential purchasers of VRRM-MFP Shares.

S-23

CAPITALIZATION

The following table sets forth the capitalization of the Fund as of October 31, 2021 and as adjusted to give effect to the partial redemption

of Variable Rate Demand Preferred Shares and the estimated expenses incurred in connection with the offering of the VRRM-MFP Shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

Actual

October 31, 2021

(Unaudited)

|

|

|

As Adjusted

October 31,

2021

(Unaudited)

|

|

|

VRDP Shares, $100,000 stated value per share, at liquidation value; unlimited Preferred Shares

authorized, of which 14,116 are designated as VRDP (14,116 VRDP Shares outstanding and VRDP Shares outstanding, as adjusted, respectively)*

|

|

$

|

1,411,600,000

|

|

|

$

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFP Shares, $100,000 and $1,000 stated value per share, respectively, at liquidation value;