By Inti Pacheco and Bob Tita

Steel importers are winning most of their requests for tariff

exclusions for products they say they can't find in the U.S., but

the process is riddled with inconsistencies and frequent procedural

changes, according to manufacturers and importers.

The Commerce Department as of Dec. 17 granted about 75% of the

19,000 requests it processed to exclude products from tariffs on

foreign steel that took effect in March, according to a Wall Street

Journal analysis of those applications. Exclusions issued so far

cover 3.8 million tons of steel, or about 16% of the finished

foreign steel entering the U.S. through 11 months of 2018.

In cases the department rejected, a U.S. metal producer often

objected. More than 15,000 objections also have been filed on some

9,000 still-pending exclusion requests. Most of these objections

were filed by five steel companies: Nucor Corp., United States

Steel Corp., AK Steel Holding Corp., TimkenSteel Corp. and Webco

Industries Inc.

In many cases, those producers say, the Commerce Department

should reject the request because their company makes products

analogous or identical to those an importer wants to buy

abroad.

"We are willing and able to support substantial proportions of

increased domestic demand for many steel products," U.S. Steel said

in a statement. The company restarted steelmaking furnaces at an

Illinois mill earlier this year and is refurbishing equipment at

other plants as a result of rising steel demand and higher steel

prices caused by the tariff.

The Commerce Department said it is revising its

exclusion-request process to reach decisions more quickly. The

department's Bureau of Industry and Security introduced a rebuttal

period in September for companies that said some rejections seemed

arbitrary.

"The department has been treating each exclusion request and

objection in a fair and equitable way," the bureau said. The

Commerce Department didn't respond to specific comments from

companies that have filed exclusion requests or objections.

Manufacturers and other importers say some of their exclusion

requests are still being rejected for reasons that aren't fully

explained to them.

Primrose Alloys Inc., a California-based importer of

stainless-steel pipe, has had about half of its 474 exclusion

requests denied. In some of those cases, Primrose President Bob

Wren said, a competitor was granted an exclusion to import products

nearly identical to those that his company had sought to buy

tariff-free.

"None of it makes any sense," Mr. Wren said.

U.S. Metals, a pipe-and-fitting supplier, said its exclusion

requests faced resistance from the U.S. Customs and Border

Protection. The agency advised the Commerce Department to exclude

requests for products that officials said didn't match up properly

with the complex system of codes the government uses to categorize

imports.

Steve Tralie, vice president of the Houston-based company, said

competitors have been granted exclusions for similar products.

"We're just saying make it fair," Mr. Tralie said.

Amanda Pitts, who is managing the exclusion process for U.S.

Metals, has secured just seven of the 355 applications she has

filed. She said the Commerce Department hasn't explained in detail

why most of her requests were rejected.

"The whole process is a nightmare," she said.

The Commerce Department has reversed some decisions. It reversed

518 denials in December, including some of the U.S. Metals requests

that U.S. Customs and Border Protection had opposed.

Tin-coated sheet steel, used to make food cans, is one product

where some companies have won exclusions for their imports while

others have been rejected. U.S. production of tin has been falling

for years. Can makers say foreign tin is often better quality.

But domestic steel producers, led by ArcelorMittal NV and U.S.

Steel, still account for about 60% of the nation's tin market. They

accounted for nearly all the objections to the tariff exclusion

requests from U.S. can makers since the tariff took effect.

U.S. Steel wouldn't comment on its tin business. ArcelorMittal

has committed $20.2 million to improve the quality and efficiency

of its tin coating operations at its Weirton, W.V., mill, a company

spokeswoman, Mary Beth Holdford, said.

Two can makers, Independent Can Co. in Maryland and

Colorado-based Ball Corp., have received exclusions for nearly all

of their requests that have been processed so far. Meanwhile, Can

Corp. of America Inc. in Pennsylvania and Silgan Holdings Inc. in

Connecticut had almost all their tin exclusion requests denied.

Independent Can Chief Executive Richard Huether said he and his

competitors have shifted tin purchases to foreign suppliers because

of declining quality and service from domestic steel mills. He said

the unpredictable nature of the exclusion process was further

undermining his confidence in U.S. tin producers.

"The industry is being damaged by doubt and uncertainty," he

said.

Write to Inti Pacheco at inti.pacheco@wsj.com and Bob Tita at

robert.tita@wsj.com

(END) Dow Jones Newswires

January 02, 2019 09:33 ET (14:33 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

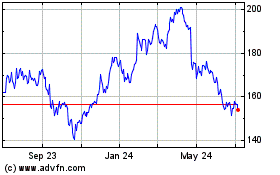

Nucor (NYSE:NUE)

Historical Stock Chart

From Mar 2024 to Apr 2024

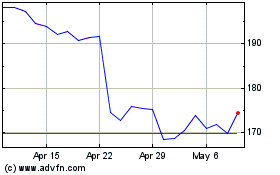

Nucor (NYSE:NUE)

Historical Stock Chart

From Apr 2023 to Apr 2024