By Kristin Broughton

Finance chiefs are selling a new type of bond designed to

attract socially minded investors that costs less and offers more

leeway for companies than other types of sustainable debt.

These instruments, known as sustainability-linked bonds, are

similar to traditional debt sales -- with one major exception: They

are usually structured such that companies pay a higher interest

rate to investors if they fail to achieve a set of environmental

and other goals before the maturity date. Also, the proceeds from

these bonds can be used for general purposes, such as paying down

existing debt, which sets it apart from other types of green,

social and sustainability bonds.

Luxury fashion brand Chanel, pharmaceutical company Novartis AG

and Brazilian paper maker Suzano SA all issued

sustainability-linked bonds in September, according to the Climate

Bonds Initiative, a nonprofit that tracks such debt sales. Italian

utility Enel SpA was the first company to issue this type of debt

last fall.

The four companies together raised roughly $8 billion, according

to Climate Bonds Initiative. There haven't been any issuances by an

American company.

This new type of debt is gaining popularity as companies take

advantage of historically low interest rates to shore up cash as

they weather the pandemic. Chief financial officers, whose job it

is to review their company's funding tools on a regular basis, are

increasingly using new types of debt to demonstrate their social

consciousness credentials to investors, and to attract new types of

investors.

Corporate green-bond issuance has increased by about eightfold

over the past five years, to $77.4 billion, according to data

provider Dealogic. In comparison, investment-grade companies issued

$2.3 trillion in traditional bonds through Oct. 1, a 9% increase

compared with the whole year of 2019, Dealogic said.

Generally, proceeds from green bonds must be spent on a

designated ESG project -- such as construction of a

renewable-energy facility -- and companies have to track and report

to investors how they spent the money. Before issuing a green bond,

companies also adopt a formal ESG financing framework, which is

reviewed by an external firm such an ESG ratings agency.

Sustainability-linked bonds appeal to companies that want to

offer ESG bonds with fewer financial restrictions, executives said.

Companies issuing sustainability-linked bonds expect lower staffing

and administrative costs compared with other types of

environmental, social or governance bonds.

More companies, including U.S. firms, are expected to sell these

bonds in the coming months, said Heather Lang, an executive

director of sustainable finance solutions at the ESG ratings firm

Sustainalytics. That is in part due to new guidelines for this type

of issuance by the International Capital Market Association, an

industry organization, a move that provided additional credibility

to companies issuing these bonds.

Novartis's sustainability-linked bond sale in September totaling

1.85 billion euros -- equivalent to $2.2 billion--was the company's

first trip into the ESG-bond market. The company set itself targets

for increasing patients' access to treatment for malaria and other

illnesses in certain countries by 2025. If an external verifier

determines that Novartis failed to meet those targets by the 2025

deadline, then the coupon rate on the bonds, which is set at zero,

will increase to 0.25% for the following three annual coupon

payments until the bond matures in September 2028, a spokesman

said.

Investors are able to get more clarity on Novartis's social

commitments through such a bond sale, and the company doesn't have

to expend extra resources to isolate ESG projects, a company

spokesman said.

"It is...not practical for us to separate out specific ESG

projects from our so-called 'regular' business activities," the

spokesman said. "And if we could identify and monitor a discrete

project, it wouldn't be of a size to justify a multibillion-dollar

bond issuance in the capital markets."

Novartis said it plans to use the proceeds of the bond offering

for general purposes, and didn't provide any more details. The last

time it issued in euros was two years ago, when it sold bonds with

coupon rates ranging from 0.5% to 1.7%, according to Dealogic.

Enel switched from selling green bonds to sustainability-linked

bonds last fall because of the financial benefits, including lower

administrative costs, said Alberto De Paoli, the company's CFO.

Among those were lower staffing needs, fewer third-party

assessments and less rigid rules on spending the money, Mr. De

Paoli said.

Enel in September 2019 issued a five-year $1.5 billion

sustainability-linked bond carrying a coupon rate of 2.65%, and a

month later sold another 2.5 billion euros, equivalent to $2.9

billion, through the same type of debt offering. The proceeds are

being used to fund sustainability efforts such as network

digitization and renewable-energy projects, a spokeswoman said. As

part of the offerings, Enel pledged to generate 55% of its

installed energy capacity with renewable sources by the end of 2021

and cut its greenhouse-gas emissions. Its interest rates will go up

by 25 basis points annually if it doesn't meet its goals.

Mr. De Paoli said that the financial benefits of

sustainability-linked bonds could push more companies to issue the

debt -- and set targets for improving the environment. "Not because

they want to be sustainable and want to go to heaven, but because

they are pursuing some economical reason," he said.

Write to Kristin Broughton at Kristin.Broughton@wsj.com

(END) Dow Jones Newswires

October 05, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

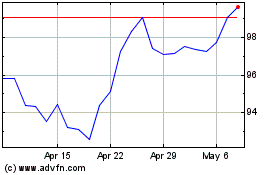

Novartis (NYSE:NVS)

Historical Stock Chart

From Mar 2024 to Apr 2024

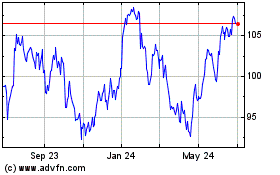

Novartis (NYSE:NVS)

Historical Stock Chart

From Apr 2023 to Apr 2024