Current Report Filing (8-k)

August 25 2021 - 4:01PM

Edgar (US Regulatory)

0000702165

false

0000702165

2021-08-25

2021-08-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 25,

2021 (August 25, 2021)

________________________________

NORFOLK

SOUTHERN CORPORATION

(Exact name of registrant as specified in its

charter)

______________________________________

|

Virginia

|

1-8339

|

52-1188014

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(IRS

Employer Identification Number)

|

|

Three

Commercial Place

|

|

|

Norfolk, Virginia

23510-2191

|

757-629-2680

|

|

(Address of principal

executive offices, including zip code)

|

(Registrant’s telephone

number, including area code)

|

No Change

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange

on which registered

|

Norfolk Southern Corporation

Common Stock (Par Value $1.00)

|

|

NSC

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

See description under Item 2.03.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant.

On August 25, 2021, Norfolk Southern Corporation (the “Registrant”)

completed its offering of $600,000,000 aggregate principal amount of its 2.900% Senior Notes due 2051 (the “Notes”) pursuant

to an Underwriting Agreement, dated August 16, 2021 (the “Agreement”), by and among the Registrant and Citigroup Global Markets

Inc., Goldman Sachs & Co. LLC and U.S. Bancorp Investments, Inc., as representatives of the several underwriters named therein. The

Notes were sold pursuant to the Registrant’s Automatic Shelf Registration Statement on Form S-3 (File No. 333-252723). The Agreement

was initially filed as Exhibit 1.1 to the Registrant’s Current Report on Form 8-K filed on August 18, 2021. The description of the

Agreement contained herein is qualified by reference thereto.

The Notes were issued pursuant to an indenture, dated as of February 28, 2018,

as supplemented by a seventh supplemental indenture, dated as of August 25, 2021 (the “Seventh Supplemental Indenture”), each

between the Registrant and U.S. Bank National Association, as trustee. The Notes will pay interest semi-annually in arrears at a rate

of 2.900% per annum.

The Notes may be redeemed in whole at any time or in part from time to

time, at the Registrant’s option, as described below.

If the Notes are redeemed prior to the date that is six months prior to

the maturity date for the Notes, the redemption price for the Notes to be redeemed will be equal to the greater of (1) 100% of their principal

amount or (2) the sum of the present value of the remaining scheduled payments of principal and interest on the Notes to be redeemed,

to and including the date that is six months prior to the maturity date of the Notes (exclusive of interest accrued to, but not including,

the date of redemption), discounted to the date of redemption on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day

months) at a specified rate, plus accrued and unpaid interest on the principal amount being redeemed to, but not including, the redemption

date.

If the Notes are redeemed on or after the date that is six months prior

to the maturity date for the Notes, the redemption price for the Notes to be redeemed will equal 100% of the principal amount of such

Notes, plus accrued and unpaid interest to, but not including, the redemption date.

The Seventh Supplemental Indenture is filed herewith as Exhibit 4.1. The

description of the Seventh Supplemental Indenture contained herein is qualified by reference thereto.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are filed as part of this Current Report on Form

8-K:

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated August 16, 2021, among the Registrant and Citigroup Global Markets Inc., Goldman Sachs & Co. LLC and U.S. Bancorp Investments, Inc., is incorporated by reference to Exhibit 1.1 of the Registrant’s Current Report on Form 8-K filed on August 18, 2021.

|

|

|

|

|

|

4.1

|

|

Seventh Supplemental Indenture, dated as of August 25, 2021, between the Registrant and U.S. Bank National Association, as trustee.

|

|

|

|

|

|

5.1

|

|

Opinion Letter of Vanessa Allen Sutherland, Executive Vice President and Chief Legal Officer of the Registrant regarding the validity of the Notes.

|

|

|

|

|

|

5.2

|

|

Opinion Letter of Skadden, Arps, Slate, Meagher & Flom LLP regarding the validity of the Notes.

|

|

|

|

|

|

23.1

|

|

Consent of Vanessa Allen Sutherland (included in Exhibit 5.1).

|

|

|

|

|

|

23.2

|

|

Consent of Skadden, Arps, Slate, Meagher & Flom LLP (included in Exhibit 5.2).

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

NORFOLK SOUTHERN CORPORATION

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

/s/ Denise W. Hutson

|

|

|

Name: Denise W. Hutson

|

|

|

Title: Corporate Secretary

|

Date: August 25, 2021

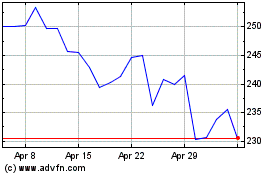

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

From Apr 2023 to Apr 2024