Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

January 11 2022 - 8:07AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a -16 or 15d -16 of

the Securities Exchange Act of 1934

Report on Form 6-K dated January 11, 2022

(Commission File No. 1-13202)

Nokia Corporation

Karakaari 7A

FI-02610 Espoo

Finland

(Name and address of registrant’s principal executive office)

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

|

|

|

|

|

|

Form 20-F: x

|

|

Form 40-F: ¨

|

|

|

|

|

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

|

|

|

|

Yes: ¨

|

|

No: x

|

|

|

|

|

|

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

|

|

|

|

Yes: ¨

|

|

No: x

|

|

|

|

|

|

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

|

|

|

|

|

|

Yes: ¨

|

|

No: x

|

Enclosures:

|

|

•

|

Stock

Exchange Release: Nokia expects to exceed 2021 financial guidance and provides operating margin guidance for 2022

|

|

STOCK EXCHANGE RELEASE 1

(3)

|

|

|

|

|

|

11 January 2022

|

Nokia Corporation

Inside information

11 January 2022 at 09:00 EET

Nokia expects to exceed 2021 financial

guidance and provides operating margin guidance for 2022

Espoo, Finland – Nokia is today providing an update to its financial

guidance for 2021 and a comparable operating margin guidance for 2022.

In Q4 2021 Nokia’s underlying business performed largely as expected.

However, other operating income was higher than expected including further benefits from venture fund investments, leading to a stronger

comparable operating margin exceeding the 2021 guidance.

Based on preliminary and unaudited financial results for 2021 Nokia

now estimates net sales of approximately €22.2bn within its previous guidance of €21.7 to 22.7bn and a comparable operating

margin of 12.4 to 12.6% above its previous guidance of 10 to 12%. The company estimates it has benefited from approximately 150bps of

one-offs in financial year 2021 to its comparable operating margin (up from 100bps expected at our Q3 earnings) related to venture fund

investments, a one-off software contract in Q2, bad debt provision reversals and some other one-time benefits.

Updated 2021 guidance based on preliminary and unaudited 2021 financials:

|

|

Previous (28 Oct ’21)

|

Updated

|

|

Net sales

|

€21.7bn to €22.7bn1

|

Approx. €22.2bn

|

|

Comparable operating margin

|

10 to 12%

|

12.4 to 12.6%

|

|

Free cash flow

|

Clearly positive

|

Clearly positive

|

|

Comparable ROIC

|

17 to 21%

|

17 to 21%

|

1 Assuming actual

currency rates until Sept 2021 and end of Sept EUR/USD rate of 1.16 continues in the remainder of 2021.

|

STOCK EXCHANGE RELEASE 2

(3)

|

|

|

|

|

|

11 January 2022

|

2022 outlook:

Nokia is also introducing a new comparable operating margin

guidance for financial year 2022 of 11% to 13.5%. This new guidance considers estimated continued improvements in the underlying

business, supply constraints and cost inflation, with the year-on-year progression also impacted by the significant one-offs seen in

2021.

The company will release its fourth quarter and full year 2021 financial

results on Thursday 3 February 2022 when it will also revisit its longer-term outlook.

Nokia will conduct a conference call with analysts and investors to

discuss its fourth quarter performance and business outlook on 3 February 2022 at 11:30am EET / 9:30am BST / 4:30am US EST.

About Nokia

At Nokia, we create technology

that helps the world act together.

As a trusted partner for critical

networks, we are committed to innovation and technology leadership across mobile, fixed and cloud networks. We create value with intellectual

property and long-term research, led by the award-winning Nokia Bell Labs.

Adhering to the highest standards

of integrity and security, we help build the capabilities needed for a more productive, sustainable and inclusive world.

Inquiries:

Nokia

Communications

Phone: +358 10 448 4900

Email: press.services@nokia.com

Katja Antila, Head of Corporate Communications

Nokia

Investor Relations

Phone: +358 40 803 4080

Email: investor.relations@nokia.com

|

STOCK EXCHANGE RELEASE 3

(3)

|

|

|

|

|

|

11 January 2022

|

Forward-looking statements

Nokia and its business are exposed to a number of risks and

uncertainties which include but are not limited to (i) competitive intensity, which is particularly impacting Mobile Networks and is

expected to continue at a high level; (ii) our ability to accelerate our product roadmaps and cost competitiveness through

additional 5G investments; (iii) some customers are reassessing their vendors in light of security concerns, creating near-term

pressure to invest in order to secure long-term benefits; (iv) the scope and duration of the COVID-19 impact, and the pace and shape

of the economic recovery following the pandemic; (v) our ability to procure certain standard components and the costs thereof, such

as semiconductors; and the disturbance in the global supply chain, including shortage of individual components, including

semiconductors, which will continue to pose a risk for impact on sales; (vi) the timing of completions and acceptances of certain

projects; (vii) our product and regional mix; (viii) macroeconomic, industry and competitive dynamics; (ix) the timing and value of

new and existing patent licensing agreements with smartphone vendors, automotive companies and consumer electronics companies; (x)

our ability to meet our sustainability targets, including with respect to changes to our greenhouse gas emission; (xi) results in

brand and technology licensing; costs to protect and enforce our intellectual property rights; and the regulatory landscape for

patent licensing; as well as the risk factors specified under Forward-looking Statements of this report, and our 2020 annual report

on Form 20-F published on March 4, 2021 under Operating and financial review and prospects-Risk factors.

Certain statements herein that are not historical facts are forward-looking

statements. These forward-looking statements reflect Nokia's current expectations and views of future developments and include statements

regarding: A) our expectations, plans, benefits or outlook related to our strategies, product launches, growth management and operational

key performance indicators and B) preliminary and unaudited 2021 financial results. These forward-looking statements are subject to a

number of risks and uncertainties, many of which are beyond our control, which could cause our actual results to differ materially from

such statements. These statements are based on management’s best assumptions and beliefs in light of the information currently available

to them. These forward-looking statements are only predictions based upon our current expectations and views of future events and developments

and are subject to risks and uncertainties that are difficult to predict because they relate to events and depend on circumstances that

will occur in the future. Factors, including risks and uncertainties that could cause these differences, include those risks and uncertainties

identified in the preceding risk factors above.

SIGNATURE

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant, Nokia Corporation, has duly caused this report to be signed

on its behalf by the undersigned, thereunto duly authorized.

|

Date: January 11, 2022

|

Nokia Corporation

|

|

|

|

|

|

By:

|

/s/ Esa Niinimäki

|

|

|

Name:

|

Esa Niinimäki

|

|

|

Title:

|

Deputy Chief Legal Officer, Corporate

|

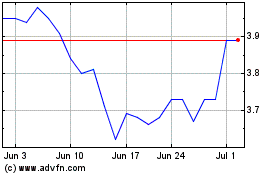

Nokia (NYSE:NOK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nokia (NYSE:NOK)

Historical Stock Chart

From Apr 2023 to Apr 2024