Offshore-Rig Operator Noble Files for Bankruptcy

July 31 2020 - 2:04PM

Dow Jones News

By Patrick Fitzgerald

Noble Corp., an operator of offshore oil-and-gas drilling rigs,

filed for bankruptcy Friday, the latest victim of falling oil

demand as the coronavirus pandemic ravages the global economy.

London-based Noble and more than three dozen affiliates sought

chapter 11 protection in U.S. Bankruptcy Court in Houston after

reaching a deal with bondholders on a debt-for-equity swap that

wipes out $3.4 billion in debt.

Noble has carried a heavy debt load for years, but business has

dried up since the Covid-19 pandemic led to collapsing demand for

oil and gas. Earlier this month, the company missed a $15 million

payment on bonds that mature in 2024, starting a 30-day grace

period to cover the amount, according to the company's public

filings.

"Along with many other businesses in our industry, Noble has

been affected by the severe downturn in commodity prices which has

been compounded by the Covid-19 pandemic," said Robert Eifler,

Noble's chief executive.

The company, which has a fleet of 24 offshore drilling rigs,

will continue operating during the chapter 11 case.

The coronavirus pandemic has hurt the global economy, oil demand

has fallen and there is a supply glut. Those factors have combined

to drive down crude-oil prices, making customers think twice about

drilling for more oil.

Although oil prices have rebounded some, there remains

significant uncertainty about whether the trend will be

sustained.

Other major offshore-drilling companies have filed for

bankruptcy or are working on restructuring their debts.

London-based Valaris PLC, with some $7 billion in debt, recently

warned a bankruptcy filing could be imminent. Diamond Offshore

Drilling Inc. filed for bankruptcy in April.

In May, Noble warned it might not be able to continue as a going

concern because the pandemic was likely to cause it to burn through

cash faster than projected.

The company said major bondholders will pump $200 million of new

capital -- in the form of second-lien notes -- into the reorganized

business. A lending syndicate, led by JPMorgan Chase & Co, is

expected to lend $675 million to the new Noble. The company listed

assets of $7.3 billion against debts of $4.7 billion in court

filings.

An army of lawyers and bankers are advising Noble and its

creditors. Among Noble's bankruptcy advisers are Skadden, Arps,

Slate, Meagher & Flom LLP; Evercore Inc. and AlixPartners

LLP.

Kramer Levin Naftalis & Frankel LLP, Akin Gump Strauss Hauer

& Feld LLP and Ducera Partners LLC are advising an ad hoc group

of Noble's s priority guaranteed noteholders. Milbank LLP and

Houlihan Lokey Capital Inc. are advising senior noteholders. And

Simpson Thacher & Bartlett LLP and PJT Partners Inc. are

advising JPMorgan.

Write to Patrick Fitzgerald at patrick.fitzgerald@wsj.com

(END) Dow Jones Newswires

July 31, 2020 13:49 ET (17:49 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

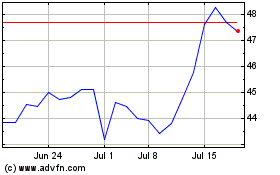

Noble (NYSE:NE)

Historical Stock Chart

From Mar 2024 to Apr 2024

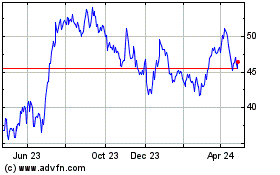

Noble (NYSE:NE)

Historical Stock Chart

From Apr 2023 to Apr 2024