Nike Down 4% After Earnings

March 19 2021 - 11:22AM

Dow Jones News

By Michael Dabaie

Nike Inc. shares fell 4% to $137.08 Friday in morning

trading.

The athletic footwear, apparel, equipment and accessories

company Thursday reported third quarter revenue rose 2.5% to $10.36

billion, missing the FactSet consensus for $11 billion.

Per-share earnings were 90 cents, up from 53 cents the same

period last year.

North America reported revenue fell 10% on supply chain

challenges, including global container shortages and U.S. port

congestion, impacting the flow of inventory and timing of wholesale

shipments, the company said.

Europe, Middle East and Africa physical retail sales declined,

with 45% of Nike-owned stores experienced mandatory Covid-19

related closures for the last two months of the quarter, partially

offset by a 60% bump in digital sales.

The company said that about 65% of stores in EMEA are open or

operating on reduced hours.

Greater China revenue increased 42% on a currency-neutral basis,

reflecting double-digit growth versus the year-earlier quarter,

Nike said.

"We can see the near-term operating environment with increasing

clarity, yet we remain focused on what's required to win for the

long term. With that in mind, we are now more confident in our full

year outlook for revenue and expect low- to mid-teens growth versus

the prior year," Chief Financial Officer Matt Friend said on the

company's conference call. "Specifically for Q4, in our least

comparable quarter of this fiscal year, we expect revenue growth of

roughly 75% versus the prior year. This reflects

government-mandated restrictions in Europe starting to ease in

April and inventory transit times slowly improving in North

America."

"Looking ahead to fiscal 2022...we are already exceeding our

pre-pandemic levels of business, and I expect the momentum we are

seeing to translate into continued strong revenue growth," Mr.

Friend said.

Bank of America Global Research said in an analyst note it

expects Nike "to recapture demand in [the fourth quarter] given

transit times are slowly improving in N. America and we believe

Nike should have sufficient supply to meet the potential surge in

demand from fiscal stimulus."

Bank of America said it believes Nike continues to benefit from

a strong product led by classic footwear franchises including Air

Force 1 and Air Jordan 1 and more recently Nike Blazer and Nike

Dunk. "We believe Nike's current product momentum is supported by

its return to a dominant position in the resale market," Bank of

America said. The firm reiterated its Buy rating on the stock.

"We encourage investors to focus on indicators of a strong pull

market...and look through transient supply-side challenges," Stifel

said in a note. Stifel said it sees the third-quarter revenue miss

as a push to the fourth quarter and expects product flow to be

normalized by fiscal year-end.

Stifel rates the stock as Buy.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

March 19, 2021 11:07 ET (15:07 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

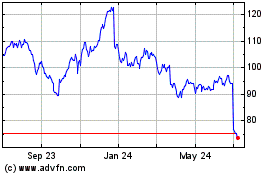

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

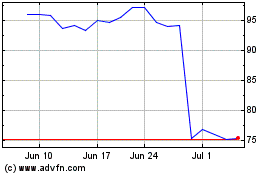

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024