Nike Says Shipping Problems Constrained Revenue Growth -- Update

March 18 2021 - 5:40PM

Dow Jones News

By Kimberly Chin

Nike Inc. posted lower-than-expected sales in its latest

quarter, with the sneaker giant citing shipping challenges amid the

Covid-19 pandemic for denting sales.

Nike's revenue was $10.36 billion, a 2.5% increase from the

year-earlier period but the figure fell lower than analysts were

targeting. On a constant-currency basis, North American revenue

declined 11%, the company said.

"Our third-quarter revenue performance was impacted by

disruption related to the Covid-19 pandemic, particularly in North

America and EMEA, " the company said in prepared remarks. It added

that a global container shortage and U.S. port congestion delayed

the flow of inventory in the quarter by more than three weeks.

Nike is not alone. Supply chain issues have hit makers of

everything from cars and clothing to fitness equipment and medical

needle containers, as port backlogs and weather disruptions have

tempered strong consumer demand driven by the pandemic.

Nike's direct sales, which rose 20% to $4 billion, somewhat

offset the shipping problems, the company said. Meanwhile, digital

revenue increased 59% in the February quarter.

Before the pandemic hit, the sportswear giant had been beefing

up its direct-to-consumer business through its own website and

stores. In 2019, it parted ways with Amazon.com Inc. and cut back

on the number of stores that could sell its goods. It also had been

investing in apps for shopping, selling sneakers and guided

workouts.

For the fiscal third quarter, Nike had earnings of $1.45

billion, or 90 cents a share, compared with $847 million, or 53

cents a share, a year ago.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

March 18, 2021 17:25 ET (21:25 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

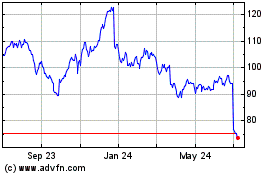

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

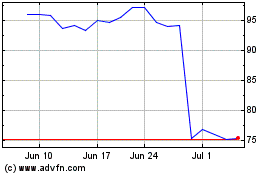

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024