Current Report Filing (8-k)

September 03 2019 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 28, 2019

NEXPOINT RESIDENTIAL TRUST, INC.

(Exact Name Of Registrant As Specified In Its Charter)

|

|

|

|

|

|

|

Maryland

|

|

001-36663

|

|

47-1881359

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

300 Crescent Court, Suite 700

Dallas, Texas 75201

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (972) 628-4100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.01 per share

|

|

NXRT

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 2.01.

|

Completion of Acquisition or Disposition of Assets.

|

NexPoint Residential Trust, Inc. (the “Company”) completed the previously disclosed sale of The Pointe at the Foothills, Belmont at Duck

Creek, The Ashlar, Heatherstone and Edgewater at Sandy Springs on August 28, 2019 and the previously disclosed sale of Abbington Heights on August 30, 2019 (together the “Portfolio”) to an unaffiliated third party for

approximately $289.9 million. For property level information regarding the Portfolio, see the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, which was filed

with the Securities and Exchange Commission (the “SEC”) on July 30, 2019, which information is incorporated by reference herein. The Company used the proceeds from the sale to fund a portion of the purchase price of the

previously disclosed acquisition of the Pembroke Apartments, which, as further discussed below, closed on August 30, 2019. The Company will also use the proceeds from the sale to fund a portion of the purchase price of the previously

disclosed acquisition of the Arbors of Brentwood.

The Company also completed the previously disclosed acquisition of the Pembroke Apartments on

August 30, 2019 from an unaffiliated third party for approximately $322.0 million. For property level information regarding the Pembroke Apartments, see the Company’s Current Report on Form 8-K,

which was filed with the SEC on August 13, 2019, which information is incorporated by reference herein.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(a) Financial Statements. The financial information relating to the Pembroke Apartments required under Rule

3-14 of Regulation S-X will be filed by an amendment to this report no later than November 18, 2019, which is the first business day that is 71 calendar days

from the date that the report relating to the Pembroke Apartments is required to be filed.

(b) Pro Forma Financial Information. The pro

forma financial information relating to the Pembroke Apartments required under Article 11 of Regulation S-X will be filed by an amendment to this report no later than November 18, 2019, which is the first

business day that is 71 calendar days from the date that the report relating to the Pembroke Apartments is required be filed.

The pro forma financial

information relating to the Portfolio required under Article 11 of Regulation S-X has been included in this Current Report on Form 8-K as set forth below.

|

|

|

|

|

|

|

Unaudited Pro Forma Consolidated Financial Information

|

|

|

3

|

|

|

|

|

|

Unaudited Pro Forma Consolidated Balance Sheet as of June 30, 2019

|

|

|

4

|

|

|

|

|

|

Unaudited Pro Forma Consolidated Statement of Operations for the six months ended June 30,

2019 and the year ended December 31, 2018

|

|

|

5

|

|

|

|

|

|

Notes to Unaudited Pro Forma Consolidated Financial Statements

|

|

|

7

|

|

(d) Exhibits. None.

Cautionary Notice Regarding Forward-Looking Statements

This report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on management’s

current expectations, assumptions and beliefs. Forward-looking statements can often be identified by words such as “will”, “expect,” “intend” and similar expressions, and variations or negatives of these words. These

forward-looking statements include, but are not limited to, statements regarding the expected use of proceeds from the property disposition and the acquisition of the Arbors of Brentwood. They are not guarantees of future results and are subject to

risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in any forward-looking statement. Readers should not place undue reliance on any forward-looking statements and are encouraged to review

the Company’s Annual Report on Form 10-K for the year ended December 31, 2018 and the Company’s other filings with the SEC for a more complete discussion of the risks and other factors that

could affect any forward-looking statements. Except as required by law, the Company does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changing

circumstances or any other reason after the date of this report.

2

NEXPOINT RESIDENTIAL TRUST, INC.

UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

The following unaudited pro forma information should be read in conjunction with the Company’s historical consolidated financial

statements and the notes thereto as filed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, which was filed with the SEC on February 19, 2019. In

addition, this unaudited pro forma information should be read in conjunction with the Company’s unaudited historical consolidated financial statements and the notes thereto as filed in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, which was filed with the SEC on July 30, 2019.

The

following unaudited pro forma consolidated balance sheet as of June 30, 2019 has been prepared to give effect to the disposition of the Portfolio as if the disposition occurred on June 30, 2019.

The following unaudited pro forma consolidated statement of operations for the year ended December 31, 2018 has been prepared to give

effect to the disposition of the Portfolio as if the disposition occurred on January 1, 2018.

The following unaudited pro forma

consolidated statement of operations for the six months ended June 30, 2019 has been prepared to give effect to the disposition of the Portfolio as if the disposition occurred on January 1, 2018.

These unaudited pro forma consolidated financial statements are prepared for informational purposes only and are not necessarily indicative of

future results or of actual results that would have been achieved had the disposition of the Portfolio been consummated on January 1, 2018 or June 30, 2019.

In the opinion of the Company’s management, all adjustments necessary to reflect the effect of the transaction described above have been

included in the pro forma consolidated financial statements.

3

NEXPOINT RESIDENTIAL TRUST, INC.

UNAUDITED PRO FORMA CONSOLIDATED BALANCE SHEET

AS OF JUNE 30, 2019

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NXRT, Inc.

(Historical)

(a)

|

|

|

Disposition of

Portfolio

(b)

|

|

|

Pro Forma

Total

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

Operating Real Estate Investments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Land

|

|

$

|

203,748

|

|

|

$

|

—

|

|

|

$

|

203,748

|

|

|

Buildings and improvements

|

|

|

914,771

|

|

|

|

—

|

|

|

|

914,771

|

|

|

Intangible lease assets

|

|

|

2,971

|

|

|

|

—

|

|

|

|

2,971

|

|

|

Construction in progress

|

|

|

612

|

|

|

|

—

|

|

|

|

612

|

|

|

Furniture, fixtures, and equipment

|

|

|

57,545

|

|

|

|

—

|

|

|

|

57,545

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Gross Operating Real Estate Investments

|

|

|

1,179,647

|

|

|

|

—

|

|

|

|

1,179,647

|

|

|

Accumulated depreciation and amortization

|

|

|

(127,118

|

)

|

|

|

—

|

|

|

|

(127,118

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Net Operating Real Estate Investments

|

|

|

1,052,529

|

|

|

|

—

|

|

|

|

1,052,529

|

|

|

Real estate held for sale, net of accumulated depreciation of $897 and $897, respectively

|

|

|

175,968

|

|

|

|

(158,499

|

)

|

|

|

17,469

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Net Real Estate Investments

|

|

|

1,228,497

|

|

|

|

(158,499

|

)

|

|

|

1,069,998

|

|

|

Cash and cash equivalents

|

|

|

16,892

|

|

|

|

139,048

|

(c)

|

|

|

155,940

|

|

|

Restricted cash

|

|

|

22,676

|

|

|

|

(1,724

|

)

|

|

|

20,952

|

|

|

Accounts receivable

|

|

|

2,667

|

|

|

|

(246

|

)

|

|

|

2,421

|

|

|

Prepaid and other assets

|

|

|

3,826

|

|

|

|

(328

|

)

|

|

|

3,498

|

|

|

Fair market value of interest rate swaps

|

|

|

2,363

|

|

|

|

—

|

|

|

|

2,363

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$

|

1,276,921

|

|

|

$

|

(21,749

|

)

|

|

$

|

1,255,172

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgages payable, net

|

|

$

|

769,973

|

|

|

$

|

—

|

|

|

$

|

769,973

|

|

|

Mortgages payable held for sale, net

|

|

|

156,636

|

|

|

|

(143,414

|

)

|

|

|

13,222

|

|

|

Credit facility, net

|

|

|

51,536

|

|

|

|

—

|

|

|

|

51,536

|

|

|

Accounts payable and other accrued liabilities

|

|

|

6,679

|

|

|

|

(411

|

)

|

|

|

6,268

|

|

|

Accrued real estate taxes payable

|

|

|

10,192

|

|

|

|

(1,358

|

)

|

|

|

8,834

|

|

|

Accrued interest payable

|

|

|

3,086

|

|

|

|

(483

|

)

|

|

|

2,603

|

|

|

Security deposit liability

|

|

|

2,032

|

|

|

|

(299

|

)

|

|

|

1,733

|

|

|

Prepaid rents

|

|

|

1,554

|

|

|

|

(291

|

)

|

|

|

1,263

|

|

|

Fair market value of interest rate swaps

|

|

|

853

|

|

|

|

—

|

|

|

|

853

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Liabilities

|

|

|

1,002,541

|

|

|

|

(146,256

|

)

|

|

|

856,285

|

|

|

|

|

|

|

|

Redeemable noncontrolling interests in the Operating Partnership

|

|

|

3,032

|

|

|

|

—

|

|

|

|

3,032

|

|

|

|

|

|

|

|

Stockholders’ Equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value: 100,000,000 shares authorized; 0 shares issued

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Common stock, $0.01 par value: 500,000,000 shares authorized; 23,895,442 and 23,499,635 shares

issued and outstanding, respectively

|

|

|

238

|

|

|

|

—

|

|

|

|

238

|

|

|

Additional paid-in capital

|

|

|

297,448

|

|

|

|

—

|

|

|

|

297,448

|

|

|

Accumulated earnings less dividends

|

|

|

(26,824

|

)

|

|

|

124,507

|

(d)

|

|

|

97,683

|

|

|

Accumulated other comprehensive income

|

|

|

486

|

|

|

|

—

|

|

|

|

486

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Stockholders’ Equity

|

|

|

271,348

|

|

|

|

124,507

|

|

|

|

395,855

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

$

|

1,276,921

|

|

|

$

|

(21,749

|

)

|

|

$

|

1,255,172

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the unaudited pro forma consolidated financial statements

4

NEXPOINT RESIDENTIAL TRUST, INC.

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED JUNE 30, 2019

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NXRT, Inc.

(Historical)

(a)

|

|

|

Disposition of

Portfolio

(b)

|

|

|

Pro Forma

Total

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income

|

|

$

|

74,033

|

|

|

$

|

(11,548

|

)

|

|

$

|

62,485

|

|

|

Other income

|

|

|

10,524

|

|

|

|

(2,041

|

)

|

|

|

8,483

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

84,557

|

|

|

|

(13,589

|

)

|

|

|

70,968

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating expenses

|

|

|

19,800

|

|

|

|

(3,466

|

)

|

|

|

16,334

|

|

|

Real estate taxes and insurance

|

|

|

11,322

|

|

|

|

(1,466

|

)

|

|

|

9,856

|

|

|

Property management fees

|

|

|

2,531

|

|

|

|

(408

|

)

|

|

|

2,123

|

|

|

Advisory and administrative fees

|

|

|

3,722

|

|

|

|

(321

|

)(c)

|

|

|

3,401

|

|

|

Corporate general and administrative expenses

|

|

|

4,974

|

|

|

|

—

|

|

|

|

4,974

|

|

|

Property general and administrative expenses

|

|

|

3,426

|

|

|

|

(595

|

)

|

|

|

2,831

|

|

|

Depreciation and amortization

|

|

|

28,464

|

|

|

|

(2,073

|

)

|

|

|

26,391

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total expenses

|

|

|

74,239

|

|

|

|

(8,329

|

)

|

|

|

65,910

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income before gain on sales of real estate

|

|

|

10,318

|

|

|

|

(5,260

|

)

|

|

|

5,058

|

|

|

Gain on sales of real estate

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

10,318

|

|

|

|

(5,260

|

)

|

|

|

5,058

|

|

|

Interest expense

|

|

|

(16,678

|

)

|

|

|

3,096

|

|

|

|

(13,582

|

)

|

|

Loss on extinguishment of debt and modification costs

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(6,360

|

)

|

|

|

(2,164

|

)

|

|

|

(8,524

|

)

|

|

Net loss attributable to redeemable noncontrolling interests in the Operating

Partnership

|

|

|

(19

|

)

|

|

|

(8

|

)

|

|

|

(27

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders

|

|

$

|

(6,341

|

)

|

|

$

|

(2,156

|

)

|

|

$

|

(8,497

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized losses on interest rate derivatives

|

|

|

(16,611

|

)

|

|

|

—

|

|

|

|

(16,611

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss

|

|

|

(22,971

|

)

|

|

|

(2,164

|

)

|

|

|

(25,135

|

)

|

|

Comprehensive loss attributable to redeemable noncontrolling interests in the Operating

Partnership

|

|

|

(69

|

)

|

|

|

(8

|

)

|

|

|

(77

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive loss attributable to common stockholders

|

|

$

|

(22,902

|

)

|

|

$

|

(2,156

|

)

|

|

$

|

(25,058

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding – basic

|

|

|

23,643

|

|

|

|

—

|

|

|

|

23,643

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding – diluted

|

|

|

24,139

|

|

|

|

—

|

|

|

|

24,139

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share – basic

|

|

$

|

(0.27

|

)

|

|

$

|

(0.09

|

)

|

|

$

|

(0.36

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share – diluted

|

|

$

|

(0.27

|

)

|

|

$

|

(0.09

|

)

|

|

$

|

(0.36

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the unaudited pro forma consolidated financial statements

5

NEXPOINT RESIDENTIAL TRUST, INC.

UNAUDITED PRO FORMA CONSOLIDATED STATEMENT OF OPERATIONS

FOR THE YEAR ENDED DECEMBER 31, 2018

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NXRT, Inc.

(Historical)

(d)

|

|

|

Disposition of

Portfolio

(e)

|

|

|

Pro Forma

Total

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rental income

|

|

$

|

127,964

|

|

|

$

|

(22,363

|

)

|

|

$

|

105,601

|

|

|

Other income

|

|

|

18,633

|

|

|

|

(3,798

|

)

|

|

|

14,835

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

146,597

|

|

|

|

(26,161

|

)

|

|

|

120,436

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property operating expenses

|

|

|

35,824

|

|

|

|

(7,226

|

)

|

|

|

28,598

|

|

|

Acquisition costs

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Real estate taxes and insurance

|

|

|

20,713

|

|

|

|

(2,897

|

)

|

|

|

17,816

|

|

|

Property management fees

|

|

|

4,382

|

|

|

|

(790

|

)

|

|

|

3,592

|

|

|

Advisory and administrative fees

|

|

|

7,474

|

|

|

|

(649

|

)(f)

|

|

|

6,825

|

|

|

Corporate general and administrative expenses

|

|

|

7,808

|

|

|

|

—

|

|

|

|

7,808

|

|

|

Property general and administrative expenses

|

|

|

6,134

|

|

|

|

(1,139

|

)

|

|

|

4,995

|

|

|

Depreciation and amortization

|

|

|

47,470

|

|

|

|

(8,535

|

)

|

|

|

38,935

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total expenses

|

|

|

129,805

|

|

|

|

(21,236

|

)

|

|

|

108,569

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

16,792

|

|

|

|

(4,925

|

)

|

|

|

11,867

|

|

|

Interest expense

|

|

|

(28,572

|

)

|

|

|

5,358

|

|

|

|

(23,214

|

)

|

|

Loss on extinguishment of debt and modification costs

|

|

|

(3,576

|

)

|

|

|

620

|

|

|

|

(2,956

|

)

|

|

Gain on sales of real estate

|

|

|

13,742

|

|

|

|

—

|

|

|

|

13,742

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

|

(1,614

|

)

|

|

|

1,053

|

|

|

|

(561

|

)

|

|

Net income attributable to noncontrolling interests

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Net income (loss) attributable to redeemable noncontrolling interests in the Operating

Partnership

|

|

|

(5

|

)

|

|

|

—

|

|

|

|

(4

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to common stockholders

|

|

$

|

(1,609

|

)

|

|

$

|

1,053

|

|

|

$

|

(557

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gains on interest rate derivatives

|

|

|

1,931

|

|

|

|

—

|

|

|

|

1,931

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income

|

|

|

317

|

|

|

|

1,053

|

|

|

|

1,370

|

|

|

Comprehensive income attributable to noncontrolling interests

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Comprehensive income attributable to redeemable noncontrolling interests in the Operating

Partnership

|

|

|

1

|

|

|

|

1

|

|

|

|

2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income attributable to common stockholders

|

|

$

|

316

|

|

|

$

|

1,052

|

|

|

$

|

1,368

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding – basic

|

|

|

21,189

|

|

|

|

—

|

|

|

|

21,189

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding – diluted

|

|

|

21,667

|

|

|

|

—

|

|

|

|

21,667

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share – basic

|

|

$

|

(0.08

|

)

|

|

$

|

0.05

|

|

|

$

|

(0.03

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share – diluted

|

|

$

|

(0.08

|

)

|

|

$

|

0.05

|

|

|

$

|

(0.03

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to the unaudited pro forma consolidated financial statements

6

NEXPOINT RESIDENTIAL TRUST, INC.

NOTES TO UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS

Balance sheet adjustments

|

|

(a)

|

Represents the unaudited historical consolidated balance sheet of NexPoint Residential Trust, Inc. and

subsidiaries (the “Company”) as of June 30, 2019. See the historical consolidated financial statements and notes thereto included in the Company’s Quarterly Report on Form 10-Q

for the six months ended June 30, 2019.

|

|

|

(b)

|

Reflects the disposition of the Portfolio as if it occurred on June 30, 2019.

|

|

|

(c)

|

Represents the proceeds from the sale of the Portfolio after adjustments for closing costs, repayment of

outstanding debt and other liabilities related to the Portfolio as of June 30, 2019.

|

|

|

(d)

|

Reflects the change in accumulated earnings arising from the disposition of the Portfolio, net of any estimated

gain on disposition. This change has not been reflected in the pro forma consolidated statement of operations because it is considered to be non-recurring in nature.

|

Income statement adjustments

|

|

(a)

|

Represents the unaudited historical consolidated operations of the Company for the six months ended

June 30, 2019. See the historical consolidated financial statements and notes thereto included in the Company’s Quarterly Report on Form 10-Q for the six months ended June 30, 2019.

|

|

|

(b)

|

Represents the pro forma change in operations that would result if the Portfolio had been disposed of by the

Company on January 1, 2018.

|

|

|

(c)

|

Represents the impact to advisory and administrative fees assuming the sale of the Portfolio occurred on

January 1, 2018.

|

|

|

(d)

|

Represents the audited historical consolidated operations of the Company for the year ended December 31,

2018. See the historical consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018.

|

|

|

(e)

|

Represents the pro forma change in operations that would result if the Portfolio had been disposed of by the

Company on January 1, 2018.

|

|

|

(f)

|

Represents the impact to advisory and administrative fees assuming the sale of the Portfolio occurred on

January 1, 2018.

|

7

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

NEXPOINT RESIDENTIAL TRUST, INC.

|

|

|

|

|

By:

|

|

/s/ Brian Mitts

|

|

|

|

Name: Brian Mitts

Title: Chief Financial

Officer, Executive

VP-Finance, Secretary and Treasurer

|

Date: September 3, 2019

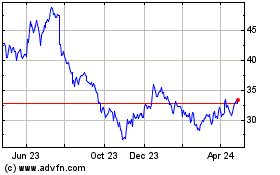

NexPoint Residential (NYSE:NXRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

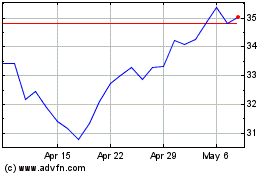

NexPoint Residential (NYSE:NXRT)

Historical Stock Chart

From Apr 2023 to Apr 2024