Amended Current Report Filing (8-k/a)

September 12 2019 - 7:01AM

Edgar (US Regulatory)

0001164727

true

0001164727

2019-09-04

2019-09-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment

No. 1)

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

September 5, 2019

Newmont Goldcorp Corporation

(Exact name of Registrant as Specified in

Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

001-31240

(Commission File Number)

84-1611629

(I.R.S. Employer Identification No.)

6363 South Fiddlers Green Circle, Greenwood Village, Colorado 80111

(Address of principal executive offices)

(zip code)

(303) 863-7414

(Registrant’s telephone number, including

area code)

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instructions A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered or to be registered pursuant to Section 12(b) of

the Act.

|

Title of each class

|

|

Trading

Symbol

|

|

Name of each exchange on which registered

|

|

Common stock, par value $1.60 per share

|

|

NEM

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

EXPLANATORY NOTE

The sole purpose of this amendment to the Current Report on Form 8-K filed with the Securities and Exchange Commission on September 11, 2019 (this "Form 8-K/A") is to add Inline eXtensible Business Reporting Language ("XBRL") tagging to the cover page of this Form 8-K/A and to furnish Exhibit 104 to this Form 8-K/A relating to the same.

Item 8.01 Other Events.

As previously announced, on September 5,

2019 Newmont Goldcorp Corporation, a Delaware corporation (the “Company”), launched and priced its public offering

of 2.800% Senior Notes due 2029 (the “Notes”) in the principal amount of $700 million.

The sale of the Notes was registered under

the Securities Act of 1933, as amended (the “Act”), pursuant to a registration statement on Form S-3ASR (File No. 333-227483)

previously filed with the Securities and Exchange Commission.

The aggregate net proceeds expected to

be received by the Company from the sale of the Notes are estimated to be approximately $688 million, after deducting the underwriting

discount and estimated offering expenses. The Company intends to use the net proceeds of this offering for the repayment of the

$626 million outstanding under the Company’s 5.125% senior notes due October 1, 2019 at maturity, and any remaining portion

for general corporate purposes. The offering is expected to close on or about September 16, 2019 (the “Closing Date”),

subject to the customary closing conditions.

The Notes will be issued pursuant to an

Indenture, dated as of September 18, 2009 (the “Base Indenture”), among the Company, Newmont USA Limited (the “Guarantor”)

and The Bank of New York Mellon Trust Company, N.A., as Trustee (the “Trustee”), as supplemented by a Third Supplemental

Indenture, to be dated as of the Closing Date (the “Third Supplemental Indenture” and, together with the Base Indenture,

the “Indenture”), among the Company, the Guarantor and the Trustee.

The Notes are the Company’s unsecured

obligations and will rank equally with the Company’s existing and future unsecured senior debt and senior to the Company’s

future subordinated debt. The Notes will be guaranteed on a senior unsecured basis by the Guarantor. The guarantees for the Notes

are unsecured and unsubordinated obligations of the Guarantor and rank equally with other unsecured and unsubordinated indebtedness

of the Guarantor that is currently outstanding or that it may issue in the future. The guarantees will be released if the Guarantor

ceases to guarantee more than $75 million of other debt of the Company.

In connection with the offering, on September

5, 2019, the Company and the Guarantor entered into an underwriting agreement with Goldman Sachs & Co. LLC and J.P. Morgan

Securities LLC, as representatives of the several underwriters named therein, relating to the sale of the Notes (the “Underwriting

Agreement”). A copy of the Underwriting Agreement is attached hereto as Exhibit 1.1, and incorporated herein by reference.

Important Legal Information

This Form 8-K does not constitute an offer

to sell or a solicitation of an offer to buy, nor shall there be any sale of any of the Notes in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

The Notes being offered have not been approved or disapproved by any regulatory authority, nor has any such authority passed upon

the accuracy or adequacy of the prospectus supplement forming part of the registration statement, the Registration Statement or

the base prospectus thereof.

An electronic copy of the prospectus supplement

and accompanying base prospectus for the offering may be obtained at www.sec.gov.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

NEWMONT GOLDCORP CORPORATION

|

|

|

|

|

|

Dated: September 11, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Logan Hennessey

|

|

|

|

Logan Hennessey

|

|

|

|

Vice President, Associate General Counsel and Corporate Secretary

|

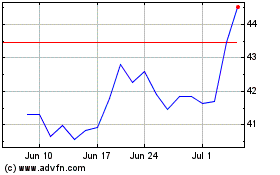

Newmont (NYSE:NEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

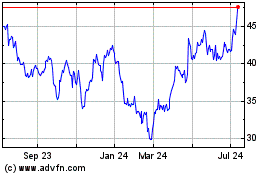

Newmont (NYSE:NEM)

Historical Stock Chart

From Apr 2023 to Apr 2024