Additional Proxy Soliciting Materials (definitive) (defa14a)

May 22 2023 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 19, 2023

Newmont Corporation

(Exact name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

001-31240

(Commission File Number)

84-1611629

(I.R.S. Employer Identification No.)

6900

E. Layton Avenue, Denver, CO 80237

(Address of principal executive offices) (zip code)

(303) 863-7414

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| x |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

| Common stock, par value $1.60 per share |

|

NEM |

|

New York Stock Exchange |

| |

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01. Other Events.

On May 19,

2023, Newmont Corporation, a Delaware corporation (“Newmont” or the “Company”), posted on

its website, www.newmont.com, an investor presentation that includes, among other matters, information related to the pending

transaction whereby Newmont Overseas Holdings Pty Ltd, an Australian proprietary company limited by shares and an indirect wholly

owned subsidiary of Newmont (“Newmont Sub”), will acquire all of the issued and outstanding ordinary shares of

Newcrest Mining Limited (“Newcrest”) pursuant to a court-approved scheme of arrangement under Part 5.1 of

Australia’s Corporations Act 2001 (Cth) (the “Scheme” and such acquisition, the

“Transaction”). Upon completion of the Transaction, subject to the satisfaction or waiver (where permitted) of

the conditions precedent to such closing, Newcrest will be an indirect wholly owned subsidiary of Newmont.

An excerpt from the investor

presentation is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Additional Information

about the Transaction and Where to Find It

None of this current

report on Form 8-K, nor the exhibits hereto, is an offer to purchase or exchange nor a solicitation of an offer to sell securities

of Newmont or Newcrest nor the solicitation of any vote or approval in any jurisdiction nor shall there be any such issuance or transfer

of securities of Newmont or Newcrest in any jurisdiction in contravention of applicable law. This current report on Form 8-K is being

made in respect of the Transaction involving Newmont and Newcrest pursuant to the terms of a scheme implementation deed dated May 15,

2023 (the “Scheme Implementation Deed”) by and among Newmont, Newmont Sub and Newcrest and may be deemed to be soliciting

material relating to the Transaction. In furtherance of the pending Transaction and subject to future developments, Newmont will file

one or more proxy statements or other documents with the SEC. None of this current report on Form 8-K nor the exhibits hereto is

a substitute for any proxy statement, the Scheme Booklet or other document Newmont or Newcrest may file with the SEC and Australian regulators

in connection with the pending Transaction. INVESTORS AND SECURITY HOLDERS OF NEWMONT AND NEWCREST ARE URGED TO READ THE PROXY STATEMENT(S),

SCHEME BOOKLET AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY

VOTING OR INVESTMENT DECISION WITH RESPECT TO THE TRANSACTION AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PENDING TRANSACTION

AND THE PARTIES TO THE TRANSACTION. The definitive proxy statement will be mailed to Newmont stockholders. Investors and security holders

may obtain a free copy of the proxy statements, the filings with the SEC that will be incorporated by reference into the proxy statement,

the Scheme Booklet and other documents containing important information about the Transaction and the parties to the Transaction, filed

by Newmont with the SEC at the SEC's website at www.sec.gov. The disclosure documents and other documents that are filed with the SEC

by Newmont may also be obtained on www.newmont.com/investor-relations/default.aspx or by contacting Newmont’s Investor Relations

department at Daniel.Horton@newmont.com or by calling 303-837-5484.

Participants in the

Transaction Solicitation

Newmont, Newcrest and

certain of their respective directors and executive officers and other employees may be deemed to be participants in any solicitation

of proxies from Newmont shareholders in respect of the pending Transaction between Newmont and Newcrest. Information regarding Newmont’s

directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2022 filed with

the SEC on February 23, 2023 and its proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on

March 10, 2023. Information about Newcrest’s directors and executive officers is set forth in Newcrest’s latest annual

report dated August 19, 2022 as updated from time to time via announcements made by Newcrest on the the Australian Securities Exchange

(“ASX”). Additional information regarding the interests of these participants in such proxy solicitation and a description

of their direct and indirect interests, by security holdings or otherwise, will be contained in any proxy statement and other relevant

materials to be filed with the SEC in connection with the pending Transaction if and when they become available.

Cautionary Statement Regarding Forward-Looking Statements

This current report

on Form 8-K, and the exhibits hereto, contain “forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are

intended to be covered by the safe harbor created by such sections and other applicable laws and “forward-looking

information” within the meaning of applicable Australian securities laws. Where a forward-looking statement expresses or

implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed

to have a reasonable basis. However, such statements are subject to risks, uncertainties and other factors, which could cause actual

results to differ materially from future results expressed, projected or implied by the forward-looking statements. Forward-looking

statements often address our expected future business and financial performance and financial condition; and often contain words

such as “anticipate,” “intend,” “plan,” “will,” “would,”

“estimate,” “expect,” “believe,” “target,” “indicative,”

“pending,” “preliminary,” “proposed” or “potential.” Forward-looking statements may

include, without limitation, statements relating to (i) the pending Transaction to acquire the share capital of Newcrest, the

expected terms, timing and closing of the pending Transaction, including receipt of required approvals and satisfaction of other

customary closing conditions; (ii) estimates of future production, including expected annual production; (iii) estimates

of future costs applicable to sales and all-in sustaining costs; (iv) estimates of future capital expenditures;

(v) estimates of future cost reductions, synergies, including pre-tax synergies, savings and efficiencies, and future cash flow

enhancements through portfolio optimization; (vi) expectations regarding future exploration and the development, growth and

potential of Newmont’s and Newcrest’s operations, project pipeline and investments; (vii) expectations regarding

future optimization; (viii) expectations of future dividends and returns to shareholders; (ix) expectations of future

balance sheet strength and credit ratings; (x) expectations of future equity and enterprise value; (xi) expected listing

of common stock on the New York Stock Exchange, the Toronto Stock Exchange and the ASX; (xii) expectations of future plans and

benefits; (xiii) expectations from the integration of Newcrest, including the combined company’s production capacity,

asset quality and geographic spread. Estimates or expectations of future events or results are based upon certain assumptions, which

may prove to be incorrect. Such assumptions, include, but are not limited to: (i) there being no significant change to current

geotechnical, metallurgical, hydrological and other physical conditions; (ii) permitting, development, operations and expansion

of Newmont’s and Newcrest’s operations and projects being consistent with current expectations and mine plans, including

without limitation receipt of export approvals; (iii) political developments in any jurisdiction in which Newmont and Newcrest

operate being consistent with its current expectations; (iv) certain exchange rate assumptions for the Australian dollar to the

U.S. dollar, as well as other the exchange rates being approximately consistent with current levels; (v) certain price

assumptions for gold, copper, silver, lead and oil; (vi) prices for key supplies being approximately consistent with current

levels; (vii) the accuracy of current mineral reserve, mineral resource and mineralized material estimates; and

(viii) other planning assumptions. Risks relating to forward looking statements in regard to Newmont’s business and

future performance may include, but are not limited to, gold and other metals price volatility, currency fluctuations, operational

risks, increased production costs and variances in ore grade or recovery rates from those assumed in mining plans, political risk,

community relations, conflict resolution governmental regulation and judicial outcomes and other risks. In addition, material risks

that could cause actual results to differ from forward-looking statements include: the inherent uncertainty associated with

financial or other projections; the prompt and effective integration of Newmont’s and Newcrest’s businesses and the

ability to achieve the anticipated synergies and value-creation contemplated by the pending Transaction; the risk associated with

Newmont’s and Newcrest’s ability to obtain the approval of the pending Transaction by their shareholders required to

consummate the pending Transaction and the timing of the closing of the pending Transaction, including the risk that the conditions

to the pending Transaction are not satisfied on a timely basis or at all and the failure of the pending Transaction to close for any

other reason; the risk that a consent or authorization that may be required for the pending Transaction is not obtained or is

obtained subject to conditions that are not anticipated; the outcome of any legal proceedings that may be instituted against the

parties and others related to the Scheme Implementation Deed; unanticipated difficulties or expenditures relating to the pending

Transaction, the response of business partners and retention as a result of the announcement and pendency of the Transaction; risks

relating to the value of the Scheme Consideration to be issued in connection with the pending Transaction; the anticipated size of

the markets and continued demand for Newmont’s and Newcrest’s resources and the impact of competitive responses to the

announcement of the Transaction; and the diversion of management time on pending Transaction-related issues. For a more

detailed discussion of such risks and other factors, see Newmont’s Annual Report on Form 10-K for the year ended

December 31, 2022, filed with the SEC as well as Newmont’s other SEC filings, available on the SEC website or

www.newmont.com. Newcrest’s most recent annual report for the fiscal year ended June 30, 2022 as well as Newcrest’s

other filings made with Australian securities regulatory authorities are available on ASX (www.asx.com.au) or www.newcrest.com.

Newmont is not affirming or adopting any statements or reports attributed to Newcrest (including prior mineral reserve and resource

declaration) in this current report on Form 8-K or made by Newcrest outside of this current report on Form 8-K.

Newcrest is not affirming or adopting any statements or reports attributed to Newmont (including prior mineral reserve and resource

declaration) in this Current Report on Form 8-K or made by Newmont outside of this current report on Form 8-K. Newmont and

Newcrest do not undertake any obligation to release publicly revisions to any “forward-looking statement,” including,

without limitation, outlook, to reflect events or circumstances after the date of this current report on Form 8-K, or to

reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. Investors should not

assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of that

statement. Continued reliance on “forward-looking statements” is at investors’ own risk.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Newmont Corporation |

| |

|

|

| Date: May 19, 2023 |

By: |

/s/ Logan Hennessey |

| |

|

Logan Hennessey |

| |

|

Vice President, Associate General Counsel and Corporate Secretary |

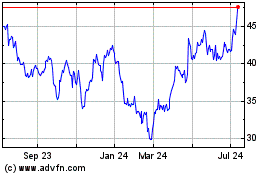

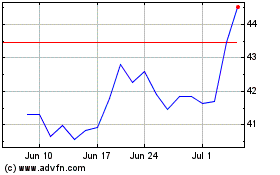

Newmont (NYSE:NEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Newmont (NYSE:NEM)

Historical Stock Chart

From Apr 2023 to Apr 2024