UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 14, 2023

Newmont Corporation

(Exact name of Registrant as Specified in Its

Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

001-31240

(Commission File Number)

84-1611629

(I.R.S. Employer Identification No.)

6900 E. Layton Avenue, Denver, CO 80237

(Address of principal executive offices) (zip code)

(303) 863-7414

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading

Symbol |

|

Name of Each Exchange on Which Registered |

| Common stock, par value $1.60 per share |

|

NEM |

|

New York Stock Exchange |

|

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

On May 14, 2023 (Mountain Daylight Time) / May 15, 2023 (Australian

Eastern Standard Time), Newmont Corporation, a Delaware corporation (“Newmont” or the “Company”), entered into

a scheme implementation deed (the “Scheme Implementation Deed”) with Newmont Overseas Holdings Pty Ltd, an Australian proprietary

company limited by shares and an indirect wholly owned subsidiary of Newmont (“Newmont Sub”) and Newcrest Mining Limited,

an Australian public company limited by shares (“Newcrest”), pursuant to which, on the terms and subject to the conditions

set forth therein, Newmont Sub will acquire all of the issued and outstanding ordinary shares of Newcrest pursuant to a court-approved

scheme of arrangement under Part 5.1 of Australia’s Corporations Act 2001 (Cth) (“Corporations Act”) (the

“Scheme” and such acquisition, the “Transaction”). Upon completion of the Transaction, Newcrest will be

a wholly owned subsidiary of Newmont Sub and an indirect wholly owned subsidiary of Newmont. The

closing of the Transaction is expected to occur in the fourth quarter of calendar year 2023, subject to the satisfaction or waiver (where

permitted) of the conditions precedent to such closing.

On the terms and subject to the conditions of the Scheme Implementation

Deed and the Scheme, when the Scheme becomes effective (the “Effective Time”), all issued and outstanding Newcrest ordinary

shares as of the record date for the Scheme will be transferred to Newmont Sub and the holders of such Newcrest ordinary shares (other

than Ineligible Foreign Shareholders, as defined in the Scheme Implementation Deed) will have the right to receive, for each such share,

either (1) 0.400 of a share (“New Newmont Shares”) of Newmont common stock, par value $1.60 per share (“Newmont

common stock”) or (2) 0.400 CHESS Depositary Interests (“New Newmont CDIs” and together with the New Newmont Shares,

the “Scheme Consideration”) each representing a unit of beneficial ownership interest in a share of Newmont common stock to

be issued by Newmont pursuant to a Deed Poll to be executed by Newmont and Newmont Sub in favor of all Newcrest shareholders (“Deed

Poll”). The form of consideration received by each shareholder depends on their country of residence and shareholder preferences.

Conditions to the Transaction

The respective obligations of

Newmont and Newcrest to consummate the Transaction are subject to the satisfaction or waiver (if applicable) of a number of customary

conditions, including, but not limited to: (1) approval by a majority in number of Newcrest’s shareholders voting

and 75% of the votes cast for the Scheme in accordance with the Corporations Act (the “Newcrest Shareholder Approval”); (2) approval

by a majority of votes cast by Newmont stockholders with respect to the issuance of the Newmont common stock comprising the Scheme Consideration

(“Newmont Stockholder Approval”); (3) certain regulatory approvals, including, but not limited to, approval, non-objection or

clearance by Australia’s Foreign Investment Review Board, Canadian Competition Bureau and the Independent Consumer and Competition

Commission of Papua New Guinea; (4) non-occurrence of a Newmont Prescribed Occurrence (as defined in the Scheme Implementation

Deed) or a Newcrest Prescribed Occurrence (as defined in the Scheme Implementation Deed); (5) non-occurrence of a Newmont

Material Adverse Change (as defined in the Scheme Implementation Deed) or a Newcrest Material Adverse Change (as defined in the Scheme

Implementation Deed); (6) approval of the Scheme by the Federal Court of Australia, or another court of competent jurisdiction under

the Corporations Act agreed by Newmont and Newcrest (the “Court”); (7) the absence of any governmental order, injunction,

decree or ruling prohibiting consummation of the Transaction; (8) issuance of a customary independent expert report concluding and

continuing to conclude that the Scheme is in the best interests of the Newcrest shareholders; (9) the Scheme Consideration issuable

in the Transaction having been approved for listing on the NYSE and Australian Securities Exchange (“ASX”), respectively;

(10) receipt by Newcrest of confirmation from the Australian Taxation Office that it is prepared to issue a Class Ruling (as

defined in the Scheme Implementation Deed) confirming the eligibility for scrip-for-scrip roll-over relief in connection with the issuance

of the Scheme Consideration; (11) Newcrest having taken all necessary steps to ensure that the ordinary shares issued under the Newcrest

employee incentive arrangements have lapsed or vested; and (12) the Scheme Consideration being exempt from the registration requirements

of the Securities Act of 1933, as amended (the “Securities Act”).

Representations and Warranties; Covenants;

Board Recommendations

The Scheme Implementation Deed contains customary

representations and warranties given by Newmont, Newmont Sub and Newcrest. The Scheme Implementation Deed also contains pre-closing covenants

as is customary for transactions of this nature, including, but not limited to, the obligation of each of Newcrest and Newmont, to the

extent within its power to do so, to conduct its business and operations in the ordinary and usual course and use its best endeavors to

maintain its business and assets in the ordinary course and preserve its relationships with government agencies and other material business

relationships. Additionally, the Scheme Implementation Deed includes customary covenants by each of Newmont and Newcrest to refrain from

taking specified actions without the consent of the other party. Newmont, Newmont Sub and Newcrest have agreed to take all necessary steps

to implement the Scheme in a timely manner.

Newmont’s board of directors has unanimously

agreed to recommend that Newmont’s stockholders vote in favor of Newmont Stockholder Approval and Newcrest’s board of directors

has unanimously agreed to recommend that Newcrest’s shareholders vote in favor of the Scheme, with such recommendation in each case

subject to customary exceptions, including the absence of a Newmont Superior Proposal (as defined in the Scheme Implementation Deed) or

a Newcrest Superior Proposal (as defined in the Scheme Implementation Deed), as applicable.

The Scheme Implementation Deed provides that,

during the Exclusivity Period (as defined in the Scheme Implementation Deed), Newmont and

Newcrest are subject to certain restrictions on their ability to solicit alternative acquisition proposals from third parties, to provide

information to third parties and to engage in discussions with third parties regarding alternative acquisition proposals, subject to customary

exceptions. Notwithstanding these restrictions, Newmont and Newcrest are permitted to provide information to, and engage in discussions

with, a party which has made an unsolicited acquisition proposal that the Newmont board of directors or the Newcrest board of directors

(as applicable) has determined, among other things, after receiving the advice of financial and legal advisors, is or could reasonably

be considered to become a Newcrest Superior Proposal or Newmont Superior Proposal (each, as defined in the Scheme Implementation Deed),

as applicable. Before (1) the board of directors of Newcrest changes its recommendation, or (2) Newcrest enters into an agreement

to effect a Newcrest Superior Proposal, Newmont must be presented with a five business day “match right”.

Treatment of Equity Awards

Newmont and Newcrest have agreed in the Scheme

Implementation Deed that any option, restricted share or right to Newcrest ordinary shares issued under the employee incentive arrangements

of Newcrest will have either lapsed or vested and converted into Newcrest ordinary shares prior to the Scheme record date and will participate

in the Scheme on the same basis as other Newcrest ordinary shares. As at the Scheme record date, no outstanding such option, restricted

share or right will remain outstanding.

Termination

The Scheme Implementation Deed contains certain

customary termination rights for both Newmont and Newcrest, including, among others, if there is or may be a failure of a condition precedent

to be satisfied in accordance with its terms and Newmont and Newcrest are unable to agree on

a revision to the terms of the Scheme after such failure of the conditions precedent or the

Scheme has not become effective by 11:59pm (Melbourne, Australia time) on February 15, 2024 (the “End Date”).

Each of Newmont and Newcrest may terminate the Scheme Implementation Deed if, among other

things, (1) the other party’s board of directors fails to recommend the Transaction or has made an adverse change in recommendation

or (2) the other party materially breaches certain terms of the Scheme Implementation Deed, subject to certain cure periods. Newcrest

may also terminate the Scheme Implementation Deed if its board of directors has determined that a Newcrest Competing Proposal (as defined

in the Scheme Implementation Deed) constitutes a Newcrest Superior Proposal (as defined in

the Scheme Implementation Deed) that Newmont does not match within the prescribed timeframe.

Break Fee and Reverse Break Fee

Under the Scheme Implementation Deed, Newcrest

will be required to make a payment of US$178,515,206 to Newmont if (1) there is an adverse change in recommendation by a member

of Newcrest’s board of directors (unless the independent expert concludes that the Scheme is not in the best interest of the Newcrest

shareholders or Newcrest is entitled to terminate on the basis of a material breach of certain terms of the Scheme Implementation Deed

by Newmont), (2) a competing transaction for Newcrest is announced, and such a competing transaction is completed within 18 months

of the date of such announcement, or (3) Newmont validly terminates the Scheme Implementation Deed on the basis of a material breach

of certain terms of the Scheme Implementation Deed by Newcrest.

Under the Scheme Implementation Deed, Newmont

will be required to make a payment of U.S.$374,766,240 to Newcrest if (1) there is an adverse change in recommendation by a member

of Newmont’s board of directors (unless Newmont is entitled to terminate the Scheme Implementation Deed on the basis of a material

breach of certain terms of the Scheme Implementation Deed by Newcrest), (2) a competing transaction for Newmont is announced, and

such a competing transaction is completed within 18 months of the date of such announcement, (3) Newcrest validly terminates the

Scheme Implementation Deed on the basis of a material breach of certain terms of the Scheme Implementation Deed by Newmont or (4) the

Scheme becomes effective but Newmont does not pay the Scheme Consideration. Additionally, Newmont must pay an amount equal to Newcrest’s

actual third-party costs if Newcrest terminates the Scheme Implementation Deed due to a failure to obtain the Newmont stockholder approval

(whether or not a competing proposal for Newmont has been announced prior to the Newmont stockholder meeting).

In the event the Scheme becomes Effective

(as defined in the Scheme Implementation Deed), no termination fee will be payable by either

Newmont or Newcrest.

Special Meeting

The

Newmont stockholder meeting (the “Special Meeting”) to consider the Scheme and the share issuance necessary to complete the

Scheme is expected to be held within 48 hours before the Newcrest shareholder meeting is convened to vote on the Transaction. At the Special

Meeting, the stockholders of Newmont will be asked to vote on two separate proposals: (i) the issuance of the Newmont common

stock comprising the Scheme Consideration, which is a condition to consummate the Transaction, and (ii) an increase in Newmont’s

authorized share capital in Newmont’s Restated Certificate of Incorporation (the “Authorized Share Capital Proposal”),

which is not a condition to consummate the transaction. The increase that Newmont expects to propose would be from 1,280,000,000 shares

currently, to an amount to be specified, up to 2,550,000,000 million shares. The approval of the issuance of the Newmont common stock

comprising the Scheme Consideration requires the favorable vote of a majority of votes cast by Newmont stockholders for adoption. The

approval of the Authorized Share Capital Proposal requires the favorable vote of a majority of the outstanding Newmont Shares for adoption.

Special Dividend

The

Scheme Implementation Deed provides that Newcrest may, subject to complying with applicable law, declare and pay to Newcrest shareholders

a special dividend of up to $1.10 per share, subject to the Scheme becoming Effective (as

defined in the Scheme Implementation Deed).

Voting Confirmations

In accordance with, and as at the date of,

the Scheme Implementation Deed, each member of Newmont’s board and of Newcrest’s board has confirmed such director’s

recommendation, and such director’s intention to vote any shares of Newmont common stock or Newcrest ordinary shares, respectively

they own, in favor of the Newmont Stockholder Approval and Newcrest Shareholder Approval, respectively,

in the absence of a superior competing proposal.

Additional Information

Newmont has agreed to invite two of Newcrest’s

existing directors to join the board of directors of Newmont, on or before the implementation of the Scheme, conditional on the Scheme

becoming Effective (as defined in the Scheme Implementation Deed).

The foregoing description of the Transaction,

the Scheme and the Scheme Implementation Deed does not purport to be a complete description of all

the parties’ rights and obligations under the Scheme Implementation Deed and is qualified in its entirety by reference to

the full text of the Scheme Implementation Deed, which is filed as Exhibit 2.1 to this Current Report on Form 8-K, and

is incorporated herein by reference. A copy of the Scheme Implementation Deed has been included solely to provide investors with information

regarding its terms and is not intended to provide any factual information about Newmont, Newcrest or their respective subsidiaries or

affiliates.

The Scheme Implementation Deed contains representations,

warranties, covenants and agreements, which were made only for purposes of such agreement and as of specified dates. The representations

and warranties in the Scheme Implementation Deed reflect negotiations between the parties to the Scheme Implementation Deed and are not

intended as statements of fact to be relied upon by Newmont’s stockholders or Newcrest’s shareholders or any other person.

In particular, the representations, warranties, covenants and agreements in the Scheme Implementation Deed may be subject to limitations

agreed by the parties, including having been modified or qualified by certain confidential disclosures that were made between the parties

in connection with the negotiation of the Scheme Implementation Deed, and having been made for purposes of allocating contractual risk

among the parties rather than establishing matters of fact. In addition, the parties may apply standards of materiality in a way that

is different from what may be viewed as material by investors. As such, the representations, warranties and covenants in the Scheme Implementation

Deed or any descriptions thereof may not describe the actual state of affairs at the date they were made or at any other time and you

should not rely on them. Moreover, information concerning the subject matter of the representations and warranties may change after the

date of the Scheme Implementation Deed, and should be read in conjunction with other information regarding Newmont and Newcrest that is

or will be contained in or incorporated by reference into the documents that Newmont files or has filed with the SEC and unless required

by applicable law, Newmont undertakes no obligation to update such information.

Item 3.02. Unregistered Sales of Equity Securities.

The information set forth under Item 1.01 of this Current Report on

Form 8-K is hereby incorporated into this Item 3.02.

As described in Item 1.01 of this Current Report on Form 8-K,

Newmont has agreed in the Scheme Implementation Deed that, if the Scheme is approved, Newmont will acquire all of the issued and outstanding

ordinary shares of Newcrest and Newmont will issue 0.400 New Newmont Shares or New Newmont CDIs for each Newcrest ordinary share, or approximately

358 million shares of Newmont common stock. If issued, and after the consummation of the Transaction, such shares will represent approximately

31% of the total number of outstanding shares of Newmont common stock.

Section 3(a)(10) of the Securities Act exempts from the registration

requirements under the Securities Act the issuance of securities which have been approved, after a hearing upon the substantive and procedural

fairness of the terms and conditions of the relevant transaction, at which all persons to whom it is proposed the securities will be issued

shall have the right to appear, by any court expressly authorized by law to grant such approval. Under the Scheme Implementation Deed,

Newcrest will propose the Scheme to the Court for orders (i) that the Newcrest meeting be convened to consider and vote upon the

Scheme and (ii) approving the Scheme as agreed by the Newcrest shareholders.

Item 8.01. Other Events.

On May 14, 2023, Newmont issued a press release announcing the

entry into the Scheme Implementation Deed. A copy of the press release is filed as Exhibit 99.1 and is incorporated into this Item

8.01 by reference.

Additional Information

about the Transaction and Where to Find It

None of this current report on Form 8-K,

nor the exhibits hereto, is an offer to purchase or exchange nor a solicitation of an offer to sell securities of Newmont or Newcrest

nor the solicitation of any vote or approval in any jurisdiction nor shall there be any such issuance or transfer of securities of Newmont

or Newcrest in any jurisdiction in contravention of applicable law. This current report on Form 8-K is being made in respect of the

Transaction involving Newmont and Newcrest pursuant to the terms of the Scheme Implementation Deed by and among Newmont, Newmont Sub and

Newcrest and may be deemed to be soliciting material relating to the Transaction. In furtherance of the pending Transaction and subject

to future developments, Newmont will file one or more proxy statements or other documents with the SEC. None of this current report on

Form 8-K nor the exhibits hereto is a substitute for any proxy statement, the Scheme Booklet or other document Newmont or Newcrest

may file with the SEC and Australian regulators in connection with the pending Transaction. INVESTORS AND SECURITY HOLDERS OF NEWMONT

AND NEWCREST ARE URGED TO READ THE PROXY STATEMENT(S), SCHEME BOOKLET AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY

IF AND WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE TRANSACTION AS THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PENDING TRANSACTION AND THE PARTIES TO THE TRANSACTION. The definitive proxy statement will be mailed

to Newmont stockholders. Investors and security holders may obtain a free copy of the proxy statements, the filings with the SEC that

will be incorporated by reference into the proxy statement, the Scheme Booklet and other documents containing important information about

the Transaction and the parties to the Transaction, filed by Newmont with the SEC at the SEC’s website at www.sec.gov. The disclosure

documents and other documents that are filed with the SEC by Newmont may also be obtained on www.newmont.com/investor-relations/default.aspx

or by contacting Newmont’s Investor Relations department at Daniel.Horton@newmont.com or by calling 303-837-5484.

Participants in the

Transaction Solicitation

Newmont, Newcrest and

certain of their respective directors and executive officers and other employees may be deemed to be participants in any solicitation

of proxies from Newmont shareholders in respect of the pending Transaction between Newmont and Newcrest. Information regarding Newmont’s

directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2022 filed with

the SEC on February 23, 2023 and its proxy statement for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on

March 10, 2023. Information about Newcrest’s directors and executive officers is set forth in Newcrest’s latest annual

report dated August 19, 2022 as updated from time to time via announcements made by Newcrest on the ASX. Additional information regarding

the interests of these participants in such proxy solicitation and a description of their direct and indirect interests, by security holdings

or otherwise, will be contained in any proxy statement and other relevant materials to be filed with the SEC in connection with the pending

Transaction if and when they become available.

Cautionary Statement Regarding Forward-Looking Statements

This

current report on Form 8-K, and the exhibits hereto, contain “forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended

to be covered by the safe harbor created by such sections and other applicable laws and “forward-looking information” within

the meaning of applicable Australian securities laws. Where a forward-looking statement expresses or implies an expectation or belief

as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However,

such statements are subject to risks, uncertainties and other factors, which could cause actual results to differ materially from future

results expressed, projected or implied by the forward-looking statements. Forward-looking statements often address our expected future

business and financial performance and financial condition; and often contain words such as “anticipate,” “intend,”

“plan,” “will,” “would,” “estimate,” “expect,” “believe,” “target,”

“indicative,” “pending,” “preliminary,” “proposed” or “potential.” Forward-looking

statements may include, without limitation, statements relating to (i) the pending Transaction to acquire the share capital of Newcrest,

the expected terms, timing and closing of the pending Transaction, including receipt of required approvals and satisfaction of

other customary closing conditions; (ii) estimates of future production, including expected annual production; (iii) estimates

of future costs applicable to sales and all-in sustaining costs; (iv) estimates of future capital expenditures; (v) estimates

of future cost reductions, synergies, including pre-tax synergies, savings and efficiencies, and future cash flow enhancements through

portfolio optimization; (vi) expectations regarding future exploration and the development, growth and potential of Newmont’s

and Newcrest’s operations, project pipeline and investments; (vii) expectations regarding future optimization; (viii) expectations

of future dividends and returns to shareholders; (ix) expectations of future balance sheet strength and credit ratings; (x) expectations

of future equity and enterprise value; (xi) expected listing of common stock on the New York Stock Exchange, the Toronto Stock Exchange

and the ASX; (xii) expectations of future plans and benefits, and (xiii) expectations from the integration of Newcrest, including

the combined company’s production capacity, asset quality and geographic spread. Estimates or expectations of future events or results

are based upon certain assumptions, which may prove to be incorrect. Such assumptions, include, but are not limited to: (i) there

being no significant change to current geotechnical, metallurgical, hydrological and other physical conditions; (ii) permitting,

development, operations and expansion of Newmont’s and Newcrest’s operations and projects being consistent with current expectations

and mine plans, including without limitation receipt of export approvals; (iii) political developments in any jurisdiction in which

Newmont and Newcrest operate being consistent with its current expectations; (iv) certain exchange rate assumptions for the Australian

dollar to the U.S. dollar, as well as other the exchange rates being approximately consistent with current levels; (v) certain price

assumptions for gold, copper, silver, lead and oil; (vi) prices for key supplies being approximately consistent with current levels;

(vii) the accuracy of current mineral reserve, mineral resource and mineralized material estimates; and (viii) other planning

assumptions. Risks relating to forward looking statements in regard to Newmont’s business and future performance may include, but

are not limited to, gold and other metals price volatility, currency fluctuations, operational risks, increased production costs and variances

in ore grade or recovery rates from those assumed in mining plans, political risk, community relations, conflict resolution governmental

regulation and judicial outcomes and other risks. In addition, material risks that could cause actual results to differ from forward-looking

statements include: the inherent uncertainty associated with financial or other projections; the prompt and effective integration of Newmont’s

and Newcrest’s businesses and the ability to achieve the anticipated synergies and value-creation contemplated by the pending Transaction;

the risk associated with Newmont’s and Newcrest’s ability to obtain the approval of the pending Transaction by their shareholders

required to consummate the pending Transaction and the timing of the closing of the pending Transaction, including the risk that the conditions

to the pending Transaction are not satisfied on a timely basis or at all and the failure of the pending Transaction to close for any other

reason; the risk that a consent or authorization that may be required for the pending Transaction is not obtained or is obtained subject

to conditions that are not anticipated; the outcome of any legal proceedings that may be instituted against the parties and others related

to the Scheme Implementation Deed; unanticipated difficulties or expenditures relating to the pending Transaction, the response of business

partners and retention as a result of the announcement and pendency of the Transaction; risks relating to the value of the Scheme Consideration

to be issued in connection with the pending Transaction; the anticipated size of the markets and continued demand for Newmont’s

and Newcrest’s resources and the impact of competitive responses to the announcement of the Transaction; and the diversion of management

time on pending Transaction-related issues. For a more detailed discussion of such risks and other factors, see Newmont’s Annual

Report on Form 10-K for the year ended December 31, 2022, filed with the SEC as well as Newmont’s other SEC filings, available

on the SEC website or www.newmont.com. Newcrest’s most recent annual report for the fiscal year ended June 30, 2022 as well

as Newcrest’s other filings made with Australian securities regulatory authorities are available on ASX (www.asx.com.au) or www.newcrest.com.

Newmont is not affirming or adopting any statements or reports attributed to Newcrest (including prior mineral reserve and resource declaration)

in this current report on Form 8-K or made by Newcrest outside of this current report on Form 8-K. Newcrest is not affirming

or adopting any statements or reports attributed to Newmont (including prior mineral reserve and resource declaration) in this Current

Report on Form 8-K or made by Newmont outside of this current report on Form 8-K. Newmont and Newcrest do not undertake any

obligation to release publicly revisions to any “forward-looking statement,” including, without limitation, outlook, to reflect

events or circumstances after the date of this current report on Form 8-K, or to reflect the occurrence of unanticipated events,

except as may be required under applicable securities laws. Investors should not assume that any lack of update to a previously issued

“forward-looking statement” constitutes a reaffirmation of that statement. Continued reliance on “forward-looking statements”

is at investors’ own risk.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

* Certain schedules are omitted pursuant

to item 601(b)(2) of Regulation S-K. Company agrees to furnish supplementally any omitted schedules to the SEC upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Newmont Corporation |

| |

|

|

| Date: May 15, 2023 |

By: |

/s/ Logan Hennessey |

| |

|

Logan Hennessey |

| |

|

Vice President, Associate General Counsel and Corporate Secretary |

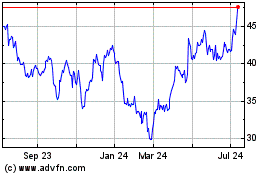

Newmont (NYSE:NEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

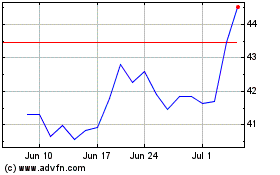

Newmont (NYSE:NEM)

Historical Stock Chart

From Apr 2023 to Apr 2024