Additional Proxy Soliciting Materials (definitive) (defa14a)

April 28 2023 - 6:20AM

Edgar (US Regulatory)

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 27, 2023

Newmont Corporation

(Exact name of Registrant as Specified in Its

Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

001-31240

(Commission File Number)

84-1611629

(I.R.S. Employer Identification No.)

6900 E. Layton Avenue, Denver, CO 80237

(Address of principal executive offices) (zip code)

(303) 863-7414

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| x |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading

Symbol |

|

Name of Each Exchange on Which Registered |

| Common stock, par value $1.60 per share |

|

NEM |

|

New York Stock Exchange |

|

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

On April 27, 2023, Newmont Corporation, a

Delaware Corporation (the “Corporation”), posted on its website, www.newmont.com,

an earnings presentation that includes, among other matters, information related to the potential transaction to acquire all of the issued

share capital of Newcrest Mining Limited (“Newcrest”). Newmont held a related live webcast presentation on April 27,

2023 at 10:00 a.m. Eastern Time.

An excerpt from the earnings presentation is attached

hereto as Exhibit 99.1 and an excerpt from the transcript of the related live webcast presentation is attached hereto as Exhibit 99.2,

each of which is incorporated herein by reference.

No Offer or Solicitation

None of this current report on

Form 8-K, nor the exhibits hereto, is an offer to purchase or exchange nor a solicitation of an offer to sell securities of

Newmont or Newcrest. In furtherance of this proposed transaction and subject to future developments, Newmont may file one or more

proxy statements or other documents with the SEC. None of this current report on Form 8-K nor the exhibits hereto is a

substitute for any proxy statement, scheme booklet or other document Newmont or Newcrest may file with the SEC and Australian

regulators in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF NEWMONT AND NEWCREST ARE URGED TO READ THE

PROXY STATEMENT(S), SCHEME BOOKLET AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME

AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE POTENTIAL BUSINESS COMBINATION TRANSACTION. Investors and

securityholders may obtain a free copy of the disclosure documents (when they are available) and other documents filed by Newmont

with the SEC at the SEC's website at www.sec.gov. The disclosure documents and other documents that are filed with the SEC by

Newmont may also be obtained on Newmont’s website at www.newmont.com or obtained for free from the sources listed below.

Newmont and certain of its directors and executive officers may be deemed to be participants in any solicitation of proxies from

Newcrest stockholders in respect of the proposed transaction between Newmont and Newcrest. Information regarding Newmont’s

directors and executive officers is available in its proxy statement for its 2023 annual meeting of stockholders, which was filed

with the SEC on March 10, 2023. This document can be obtained free of charge from the sources indicated below. Additional

information regarding the interests of these participants in such proxy solicitation and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in any proxy statement and other relevant materials to be filed with

the SEC in connection with the proposed transaction if and when they become available.

Cautionary Regarding Forward-Looking Statements

This current report on Form 8-K, and the exhibits hereto, contain

“forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other

applicable laws. Where a forward-looking statement expresses or implies an expectation or belief as to future events or results, such

expectation or belief is expressed in good faith and believed to have a reasonable basis. However, such statements are subject to risks,

uncertainties and other factors, which could cause actual results to differ materially from future results expressed, projected or implied

by the forward-looking statements. Forward-looking statements often address our expected future business and financial performance and

financial condition; and often contain words such as “anticipate,” “intend,” “plan,” “will,”

“would,” “estimate,” “expect,” “believe,” “target,” “indicative,”

“preliminary,” “proposed” or “potential.” Forward-looking statements may include, without limitation,

statements relating to the proposed transaction to acquire the share capital of Newcrest, expectations regarding the potential value proposition,

a binding proposal and potential synergies from the proposed transaction, or similar statements. There is no certainty that any transaction

will occur on the proposed terms, within any particular timeframe, that further negotiations will take place, that any synergies will

be realized or that any transaction will occur at all. Risks include fluctuations in company stock price and results of operations; uncertainties

regarding the outcome of discussions between Newmont and Newcrest with respect to the proposed transaction, including the possibility

that the parties may not agree to pursue a business combination, or that it may be materially different from the terms of the proposal

described herein; uncertainties about the outcomes of the due diligence process and the ability to consummate the proposed business combination

or achieve the expected benefits; uncertainties with respect to shareholder approvals; potential regulatory or closing delays; the industry

and market reaction to Newmont’s proposed transaction; and changes in the overall economic conditions. The forward-looking statements

are also subject to other risks and uncertainties, including those more fully described in Newmont’s Annual Report on Form 10-K

for the year ended December 31, 2022 filed with the U.S. Securities and Exchange Commission (the “SEC”), under the heading

“Risk Factors”, available on the SEC website or www.newmont.com. Newmont does not undertake any obligation to communicate

publicly revisions to any “forward-looking statement” to reflect events or circumstances after the date of this current report

on Form 8-K or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. Investors

should not assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of

that statement. Continued reliance on “forward-looking statements” is at investors’ own risk.

| ITEM 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of

1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Newmont Corporation |

|

| |

|

|

| By: |

/s/ Logan Hennessey |

|

| Name: |

Logan Hennessey |

|

| Title: |

Vice President, Associate General Counsel and Corporate Secretary |

|

Dated: April 27, 2023

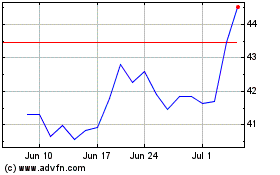

Newmont (NYSE:NEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

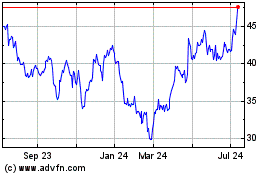

Newmont (NYSE:NEM)

Historical Stock Chart

From Apr 2023 to Apr 2024