Insperity, Inc. (NYSE: NSP), a leading provider of human

resources and business performance solutions for America’s best

businesses, today reported results for the first quarter ended Mar.

31, 2019:

- Q1 WSEE growth of 15% on strong sales

and client retention

- Q1 net income and EPS up 53% and 57%,

to $76 million and $1.85, respectively

- Q1 adjusted EPS up 40% to $1.98

- Q1 adjusted EBITDA up 21% to $101

million

First Quarter Results

First quarter 2019 net income and diluted earnings per share of

$76.3 million and $1.85 represented increases of 53% and 57%,

respectively, compared to the first quarter of 2018. Adjusted EPS

was $1.98, a 40% increase over the first quarter of 2018. Adjusted

EBITDA increased 21% over the first quarter of 2018 to $101.4

million.

“Our record first quarter results reflect the strength of our

business model and continued excellent execution of our strategic

plan,” said Paul J. Sarvadi, Insperity chairman and chief executive

officer. “These results further demonstrate the sustainability of

our rapid growth and profitability experienced over the last

several years into 2019.”

Revenues increased 14% over the first quarter of 2018 to

$1,153.0 million on a 15% increase in the average number of

worksite employees (“WSEEs”) paid per month. The continued

double-digit worksite employee growth was the result of the

enrollment of new clients coming off a successful 2018 fall sales

campaign and a high level of client retention during our heavy

first quarter client renewal period. Additionally, we experienced

net hiring in our client base during the first quarter of 2019,

although at lower levels than experienced during the first quarter

of 2018.

Gross profit increased 14% over the first quarter of 2018 to

$226.7 million, and included favorable workers’ compensation and

benefit cost trends and stronger pricing. Operating expenses

increased 5% over the first quarter of 2018, while adjusted

operating expenses increased 12% to $141.3 million, and included

continued investments in our growth, technology and product and

service offerings.

“Worksite employee growth in the mid-teens, combined with

effective management of pricing, direct cost programs and operating

costs, produced adjusted EBITDA and cash flow at record levels,”

said Douglas S. Sharp, senior vice president of finance, chief

financial officer and treasurer. “We ended the first quarter with

$141 million of adjusted cash, up from $129 million at December 31,

2018, after the repurchase of 230,000 shares at a cost of $29

million and the payment of our regular cash dividend totaling $12

million.”

2019 Guidance

The company also announced its updated guidance for 2019,

including the second quarter of 2019. Please refer to the

accompanying financial tables at the end of this press release for

the reconciliation of non-GAAP financial measures to the comparable

GAAP financial measures.

Q2

2019 Full Year 2019

Average WSEEs paid 232,500 — 234,500 238,400 —

242,600 Year-over-year increase 14.0% — 15.0% 14.0% — 16.0%

Adjusted EPS $0.81 — $0.86 $4.55 — $4.80 Year-over-year increase

19% — 26% 21% — 28% Adjusted EBITDA (in millions) $55 — $58

$276 — $289 Year-over-year increase 18% — 24% 15% — 21%

Definition of Key Metrics

Average WSEEs paid - Determined by calculating the company’s

cumulative worksite employees paid during the period divided by the

number of months in the period.

Adjusted EPS - Represents diluted net income per share computed

in accordance with GAAP, excluding the impact of non-cash

stock-based compensation and costs associated with a one-time tax

reform bonus paid to corporate employees.

Adjusted EBITDA - Represents net income computed in accordance

with GAAP, plus interest expense, income taxes, depreciation and

amortization expense, non-cash stock-based compensation and costs

associated with a one-time tax reform bonus paid to corporate

employees.

Insperity will be hosting a conference call today at 10 a.m. ET

to discuss these results, provide guidance for the second quarter

and an update to the full year guidance, and answer questions from

investment analysts. To listen in, call 877-651-0053 and use

conference i.d. number 2122429. The call will also be webcast at

http://ir.insperity.com. The conference call script will be

available at the same website later today. A replay of the

conference call will be available at 855-859-2056, conference i.d.

2122429. The webcast will be archived for one year.

About Insperity

Insperity, a trusted advisor to America’s best businesses for

more than 33 years, provides an array of human resources and

business solutions designed to help improve business performance.

Insperity® Business Performance Advisors offer the most

comprehensive suite of products and services available in the

marketplace. Insperity delivers administrative relief, better

benefits, reduced liabilities and a systematic way to improve

productivity through its premier Workforce Optimization® solution.

Additional company offerings include Traditional Payroll and Human

Capital Management, Time and Attendance, Performance Management,

Organizational Planning, Recruiting Services, Employment Screening,

Expense Management, Retirement Services and Insurance Services.

Insperity business performance solutions support more than 100,000

businesses with over 2 million employees. With 2018 revenues of

$3.8 billion, Insperity operates in 74 offices throughout the

United States. For more information, visit

http://www.insperity.com.

Forward-Looking Statements

The statements contained herein that are not historical facts

are forward-looking statements within the meaning of the federal

securities laws (Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934). You can

identify such forward-looking statements by the words “expects,”

“intends,” “plans,” “projects,” “believes,” “estimates,” “likely,”

“possibly,” “probably,” “goal,” “opportunity,” “objective,”

“target,” “assume,” “outlook,” “guidance,” “predicts,” “appears,”

“indicator” and similar expressions. Forward-looking statements

involve a number of risks and uncertainties. In the normal course

of business, Insperity, Inc., in an effort to help keep our

stockholders and the public informed about our operations, may from

time to time issue such forward-looking statements, either orally

or in writing. Generally, these statements relate to business plans

or strategies, projected or anticipated benefits or other

consequences of such plans or strategies, or projections involving

anticipated revenues, earnings, unit growth, profit per worksite

employee, pricing, operating expenses or other aspects of operating

results. We base the forward-looking statements on our

expectations, estimates and projections at the time such statements

are made. These statements are not guarantees of future performance

and involve risks and uncertainties that we cannot predict. In

addition, we have based many of these forward-looking statements on

assumptions about future events that may prove to be inaccurate.

Therefore, the actual results of the future events described in

such forward-looking statements could differ materially from those

stated in such forward-looking statements. Among the factors that

could cause actual results to differ materially are:

- adverse economic conditions;

- regulatory and tax developments and

possible adverse application of various federal, state and local

regulations;

- the ability to secure competitive

replacement contracts for health insurance and workers’

compensation insurance at expiration of current contracts;

- cancellation of client contracts on

short notice, or the inability to renew client contracts or attract

new clients;

- vulnerability to regional economic

factors because of our geographic market concentration;

- increases in health insurance costs and

workers’ compensation rates and underlying claims trends, health

care reform, financial solvency of workers’ compensation carriers,

other insurers or financial institutions, state unemployment tax

rates, liabilities for employee and client actions or

payroll-related claims;

- failure to manage growth of our

operations and the effectiveness of our sales and marketing

efforts;

- the impact of the competitive

environment and other developments in the human resources services

industry, including the PEO industry, on our growth and/or

profitability;

- our liability for worksite employee

payroll, payroll taxes and benefits costs;

- our liability for disclosure of

sensitive or private information;

- our ability to integrate or realize

expected returns on our acquisitions;

- failure of our information technology

systems;

- an adverse final judgment or settlement

of claims against Insperity; and

- disruptions to our business resulting

from the actions of certain stockholders.

These factors are discussed in further detail in Insperity’s

filings with the U.S. Securities and Exchange Commission. Any of

these factors, or a combination of such factors, could materially

affect the results of our operations and whether forward-looking

statements we make ultimately prove to be accurate.

Except to the extent otherwise required by federal securities

law, we do not undertake any obligation to update our

forward-looking statements to reflect events or circumstances after

the date they are made or to reflect the occurrence of

unanticipated events.

Insperity, Inc.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in thousands)

March 31, 2019

December 31, 2018 Assets Cash and cash

equivalents $ 398,936 $ 326,773 Restricted cash 44,705 42,227

Marketable securities 53,599 60,781 Accounts receivable, net

421,297 400,623 Prepaid insurance 24,928 8,411 Other current assets

36,616 27,721

Total

current assets 980,081 866,536 Property and

equipment, net 116,131 117,213 Right of use leased assets 50,259 —

Prepaid health insurance 9,000 9,000 Deposits 177,105 172,674

Goodwill and other intangible assets, net 12,723 12,726 Deferred

income taxes, net 145 8,816 Other assets 5,534

4,851

Total assets

$ 1,350,978 $

1,191,816 Liabilities and stockholders’

equity Accounts payable $ 7,854 $ 10,622 Payroll taxes and

other payroll deductions payable 308,062 261,166 Accrued worksite

employee payroll cost 363,862 329,979 Accrued health insurance

costs 45,832 35,153 Accrued workers’ compensation costs 47,973

45,818 Accrued corporate payroll and commissions 27,562 60,704

Other accrued liabilities 49,244

28,890

Total current liabilities 850,389

772,332 Accrued workers’ compensation cost, net of current

186,624 187,412 Long-term debt 144,400 144,400 Operating lease

liabilities, net of current 50,371 — Other accrued liabilities, net

of current — 9,996

Total noncurrent liabilities 381,395 341,808

Stockholders’ equity: Common stock 555 555 Additional paid-in

capital 33,833 36,752 Treasury stock, at cost (376,097 ) (357,569 )

Retained earnings 460,903

397,938

Total stockholders’ equity

119,194 77,676 Total

liabilities and stockholders’ equity $

1,350,978 $ 1,191,816

Insperity, Inc.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three Months Ended March 31, (in thousands,

except per share amounts)

2019

2018 Change Operating results:

Revenues(1) $ 1,153,010 $

1,014,372 13.7 % Payroll taxes, benefits and

workers’ compensation costs 926,293

814,652 13.7 %

Gross profit 226,717

199,720 13.5 % Salaries, wages and payroll

taxes 83,380 87,186 (4.4 )% Stock-based compensation 6,040 3,135

92.7 % Commissions 6,952 6,066 14.6 % Advertising 5,031 3,565 41.1

% General and administrative expenses 33,162 29,852 11.1 %

Depreciation and amortization 6,691

5,213 28.4 %

Total operating expenses

141,256 135,017

4.6 % Operating income 85,461

64,703 32.1 % Other income (expense): Interest

income 3,245 1,456 122.9 % Interest expense (1,681 )

(1,070 ) 57.1 %

Income before income tax

expense 87,025 65,089 33.7 % Income

tax expense 10,736 15,098

(28.9 )%

Net income $ 76,289

$ 49,991 52.6

% Less distributed and undistributed earnings allocated to

participating securities (1,031 ) (585 )

76.2 %

Net income allocated to common shares

$ 75,258 $ 49,406

52.3 % Net income per share

of common stock Basic $ 1.86 $ 1.20 55.0 % Diluted $ 1.85 $

1.18 56.8 % ____________________________________ (1)

Revenues are comprised of gross billings less WSEE payroll costs as

follows:

Three Months Ended

March 31, (in thousands)

2019 2018 Gross billings

$ 6,871,670 $ 5,923,356 Less: WSEE payroll cost

5,718,660 4,908,984

Revenues $

1,153,010 $ 1,014,372

Insperity, Inc.

KEY FINANCIAL AND STATISTICAL

DATA

(Unaudited)

Three Months Ended March 31,

2019 2018 Change

Average WSEEs paid 225,525 195,683 15.3

%

Statistical data (per WSEE per month): Revenues(1) $ 1,704

$ 1,728 (1.4 )% Gross profit 335 340 (1.5 )% Operating expenses 209

230 (9.1 )% Operating income 126 110 14.5 % Net income 113 85 32.9

% ____________________________________ (1) Revenues per WSEE

per month are comprised of gross billings per WSEE per month less

WSEE payroll costs per WSEE per month follows:

Three Months Ended March 31, (per WSEE per

month)

2019

2018 Gross billings $ 10,157 $ 10,090 Less:

WSEE payroll cost 8,453

8,362

Revenues

$ 1,704 $

1,728

Insperity, Inc.

Non-GAAP Financial Measures

(Unaudited)

Non-GAAP financial measures are not prepared in accordance

with GAAP and may be different from non-GAAP financial measures

used by other companies. Non-GAAP financial measures should not be

considered as a substitute for, or superior to, measures of

financial performance prepared in accordance with GAAP. Investors

are encouraged to review the reconciliation of the non-GAAP

financial measures used to their most directly comparable GAAP

financial measures as provided in the tables below.

Non-GAAP Measure

Definition Benefit of Non-GAAP Measure

Non-bonus payroll cost Non-bonus payroll cost is a

non-GAAP financial measure that excludes the impact of bonus

payrolls paid to our WSEEs.

Bonus payroll cost varies from period to

period, but has no direct impact to our ultimate workers’

compensation costs under the current program.

Our management refers to non-bonus payroll cost in

analyzing, reporting and forecasting our workers’ compensation

costs.

We include these non-GAAP financial

measures because we believe they are useful to investors in

allowing for greater transparency related to the costs incurred

under our current workers’ compensation program.

Adjusted cash, cash equivalents and marketable securities Excludes

funds associated with:

• federal and state income tax

withholdings,

• employment taxes,

• other payroll deductions, and

• client prepayments.

We believe that the exclusion of the identified items helps us

reflect the fundamentals of our underlying business model and

analyze results against our expectations, against prior period, and

to plan for future periods by focusing on our underlying

operations. We believe that the adjusted results provide relevant

and useful information for investors because they allow investors

to view performance in a manner similar to the method used by

management and improves their ability to understand and assess our

operating performance. Adjusted operating expense Represents

operating expenses excluding the impact of the following:

• costs associated with a one-time tax

reform bonus paid to corporate employees.

EBITDA Represents net income computed in accordance with GAAP,

plus:

• interest expense,

• income tax expense, and

• depreciation and amortization

expense.

Adjusted EBITDA Represents EBITDA plus:

• non-cash stock based compensation,

and

• costs associated with a one-time tax

reform bonus paid to corporate employees.

Adjusted Net Income Represents net income computed in accordance

with GAAP, excluding:

• non-cash stock based compensation,

and

• costs associated with a one-time tax

reform bonus paid to corporate employees.

Adjusted EPS Represents diluted net income per share

computed in accordance with GAAP, excluding:

• non-cash stock based compensation,

and

• costs associated with a one-time tax

reform bonus paid to corporate employees.

Following is a reconciliation of payroll cost (GAAP) to

non-bonus payroll costs (non-GAAP):

Three Months Ended March 31, (in thousands,

except per WSEE per month)

2019 2018

$ WSEE $

WSEE Payroll cost $ 5,718,660 $ 8,453 $

4,908,984 $ 8,362 Less: Bonus payroll cost 990,578

1,465 830,861

1,415

Non-bonus payroll cost $

4,728,082 $ 6,988

$ 4,078,123 $

6,947 % Change period over period 15.9

% 0.6 % 15.9 % 3.3

%

Following is a reconciliation of cash, cash equivalents and

marketable securities (GAAP) to adjusted cash, cash equivalents and

marketable securities (non-GAAP):

(in thousands)

March

31, 2019 December 31, 2018 Cash,

cash equivalents and marketable securities $ 452,535 $ 387,554

Less: Amounts payable for withheld federal and state income taxes,

employment taxes and other payroll deductions 279,641 224,487

Client prepayments 32,388 34,177

Adjusted cash, cash equivalents and marketable securities

$ 140,506 $

128,890

Following is a reconciliation of operating expenses (GAAP) to

adjusted operating expenses (non-GAAP):

Three Months Ended March 31, (in thousands,

except per WSEE per month)

2019 2018

$ WSEE $

WSEE Operating expenses $ 141,256 $ 209

$ 135,017 $ 230 Less: One-time tax reform bonus —

— 9,306 16

Adjusted operating expenses $

141,256 $ 209

$ 125,711 $ 214

% Change period over period 12.4 %

(2.3 )% 18.8 % 5.9 %

Following is a reconciliation of net income (GAAP) to EBITDA

(non-GAAP) and adjusted EBITDA (non-GAAP):

Three Months Ended March 31, (in thousands,

except per WSEE per month)

2019 2018

$ WSEE $

WSEE Net income $ 76,289 $ 113 $ 49,991

$ 85 Income tax expense 10,736 16 15,098 26 Interest expense 1,681

2 1,070 2 Depreciation and amortization 6,691

10 5,213 9

EBITDA 95,397 141 71,372 122

Stock-based compensation 6,040 9 3,135 5 One-time tax reform bonus

— — 9,306

16

Adjusted EBITDA $

101,437 $ 150

$ 83,813 $ 143

% Change period over period 21.0 %

4.9 % 33.6 % 19.2 %

Following reconciliation of net income (GAAP) to adjusted net

income (non-GAAP):

Three Months Ended March 31, (in thousands)

2019 2018

Net income $ 76,289 $ 49,991 Non-GAAP adjustments: Stock-based

compensation 6,040 3,135 One-time tax reform bonus —

9,306

Total non-GAAP adjustments

6,040 12,441 Tax effect (745 )

(2,886 )

Adjusted net income $

81,584 $ 59,546

% Change period over period 37.0 % 54.1

%

Following is a reconciliation of diluted EPS (GAAP) to adjusted

EPS (non-GAAP):

Three Months Ended March 31,

2019 2018 Diluted

EPS $ 1.85 $ 1.18 Non-GAAP adjustments: Stock-based compensation

0.15 0.07 One-time tax reform bonus —

0.22

Total non-GAAP adjustments 0.15

0.29 Tax effect (0.02 ) (0.06 )

Adjusted EPS $ 1.98

$ 1.41 % Change period over

period 40.4 % 53.3 %

The following is a reconciliation of GAAP to non-GAAP financial

measures for second quarter and full year 2019 guidance:

(in millions, except per share

amounts)

Q2 2019 Guidance

Full Year 2019 Guidance Net income $28

- $30 $167 - $178 Income tax expense 11 - 12 48 - 50 Interest

expense 2 7 Depreciation and amortization 7

28

EBITDA 48 - 51 250

- 263 Stock-based compensation 7

26

Adjusted EBITDA

$55 - $58 $276 - $289

Diluted net income per share of common stock $0.68 - $0.73

$4.06 - $4.31 Non-GAAP adjustments: Stock-based compensation

0.18 0.63

Total

non-GAAP adjustments 0.18 0.63 Tax effect

(0.05 ) (0.14 )

Adjusted EPS

$0.81 - $0.86

$4.55 - $4.80

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190429005128/en/

Investor Relations Contact:Douglas S. SharpSenior Vice

President of Finance,Chief Financial Officer and Treasurer(281)

348-3232Investor.Relations@Insperity.com

News Media Contact:Suzanne HaugenPublic Relations

Manager(281) 312-3543Media@Insperity.com

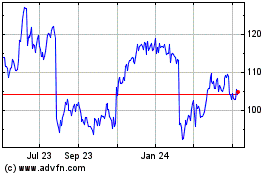

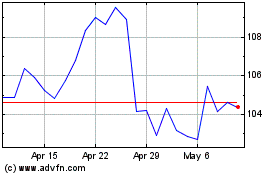

Insperity (NYSE:NSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Insperity (NYSE:NSP)

Historical Stock Chart

From Apr 2023 to Apr 2024