Current Report Filing (8-k)

May 22 2019 - 7:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of report

(Date of earliest event reported):

May 22, 2019

____________________

MURPHY

OIL CORPORATION

(Exact Name

of Registrant as Specified in Its Charter)

____________________

|

Delaware

|

1-8590

|

71-0361522

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

300 Peach Street

P.O. Box 7000

El Dorado, Arkansas

|

71730-7000

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s

telephone number, including area code:

870-862-6411

Not applicable

(Former Name

or Former Address, if Changed Since Last Report)

____________________

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

o

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common

Stock, $1.00 Par Value

|

MUR

|

New

York Stock Exchange

|

|

|

Item 7.01.

|

Regulation FD Disclosure.

|

On May 22,

2019, Roger Jenkins, President and Chief Executive Officer of Murphy Oil Corporation (the “Company”), will present

at the UBS Global Oil & Gas Conference. Attached hereto as Exhibit 99.1 is a copy of the presentation prepared by the Company

in connection therewith.

The information

in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the

liabilities of that Section, and shall not be incorporated by reference into any registration statement or other document pursuant

to the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

This Current

Report on Form 8-K, including the information furnished pursuant to Item 7.01 and the related Item 9.01 hereto, contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally

identified through the inclusion of words such as “aim”, “anticipate”, “believe”, “drive”,

“estimate”, “expect”, “expressed confidence”, “forecast”, “future”,

“goal”, “guidance”, “intend”, “may”, “objective”, “outlook”,

“plan”, “position”, “potential”, “project”, “seek”, “should”,

“strategy”, “target”, “will” or variations of such words and other similar expressions. These

statements, which express management’s current views concerning future events or results, are subject to inherent risks

and uncertainties. Factors that could cause one or more of these future events or results not to occur as implied by any forward-looking

statement include, but are not limited to: the Company’s ability to complete the previously announced acquisition of the

Gulf of Mexico assets or the previously announced Malaysia divestiture due to the failure to obtain regulatory approvals, the

failure of the respective counterparties to perform their obligations under the relevant transaction agreements, the failure to

satisfy all closing conditions, or otherwise; increased volatility or deterioration in the success rate of the Company’s

exploration programs or in the Company’s ability to maintain production rates and replace reserves; reduced customer demand

for the Company’s products due to environmental, regulatory, technological or other reasons; adverse foreign exchange movements;

political and regulatory instability in the markets where the Company does business; natural hazards impacting the Company’s

operations; any other deterioration in the Company’s business, markets or prospects; any failure to obtain necessary regulatory

approvals; any inability to service or refinance the Company’s outstanding debt or to access debt markets at acceptable

prices; and adverse developments in the U.S. or global capital markets, credit markets or economies in general. For further discussion

of factors that could cause one or more of these future events or results not to occur as implied by any forward-looking statement,

see “Risk Factors” in the Company’s most recent Annual Report on Form 10-K filed with the U.S. Securities and

Exchange Commission (“SEC”) and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K that the

Company files, available from the SEC’s website and from the Company’s website at http://ir.murphyoilcorp.com. The

Company undertakes no duty to publicly update or revise any forward-looking statements.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

99.1

|

UBS Global Oil & Gas Conference

Presentation dated May 22, 2019.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date: May 22, 2019

|

MURPHY OIL CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Christopher D. Hulse

|

|

|

|

|

Name:

|

Christopher D. Hulse

|

|

|

|

|

Title:

|

Vice President and Controller

|

|

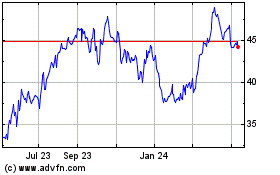

Murphy Oil (NYSE:MUR)

Historical Stock Chart

From Mar 2024 to Apr 2024

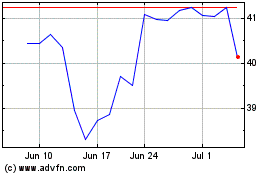

Murphy Oil (NYSE:MUR)

Historical Stock Chart

From Apr 2023 to Apr 2024