Auditions for Morgan Stanley's No. 2 Job Start With Wealth-Management, Banking Shuffle--2nd Update

April 23 2019 - 6:09PM

Dow Jones News

By Liz Hoffman

A change atop Morgan Stanley's giant retail brokerage holds

clues for the race for succeed Chief Executive James Gorman and

shows the firm leaning into the type of plain-vanilla banking

activities it once avoided.

Shelley O'Connor, who co-heads the firm's wealth-management

division, will give up that role and become CEO of its two

regulated bank entities, where it is pushing mortgages, deposit

accounts and other Main Street products, Mr. Gorman said in a memo

to staff Tuesday reviewed by The Wall Street Journal.

Her move will leave Andy Saperstein as sole head of the

division, which generates about half of Morgan Stanley's revenue

and is increasingly valuable for its stability and growth.

A handful of executives are seen as possible successors to Mr.

Gorman, 60 years old, who has said in the past he likes to shift

people around to assess their abilities. He also has said he is in

no hurry to name a successor.

The race heated up last month when Morgan Stanley No. 2

executive, Colm Kelleher, retired.

Ms. O'Connor started her career right out of college at a Morgan

Stanley retail branch in California. Since 2014, she has overseen

wealth management's field operation, managing 15,700 brokers across

600 offices selling hundreds of products. She is the only woman

atop a major business line at the firm.

Morgan Stanley is making a concerted push into plain-vanilla

banking a decade after it, along with rival investment bank Goldman

Sachs Group Inc., was forced to convert into a bank holding company

during the financial crisis. It has slowly grown traditional

banking services like loans and deposits and has about $225 billion

in assets in its two regulated banking entities.

Unlike rival Goldman Sachs, which has hung out a shingle online

and partnered with third parties such as Fidelity Investments to

find customers, Morgan Stanley is focused on rolling out bank

products to existing brokerage clients. The firm manages $2.5

trillion in client assets and estimates there is at least another

$2 trillion that those same clients keep at other commercial

banks.

Morgan Stanley recently built an in-house mortgage origination

business and aims to lift the percentage of its wealth clients who

take out mortgages from the bank, currently around 2%. It has a $45

billion portfolio of loans backed by its clients' investment

portfolios, and a smaller book secured by art, boats, jewelry and

other valuables.

"Given the criticality of the banks to the future growth of our

business, I have asked Shelley to dedicate her full-time efforts to

leading them," Mr. Gorman said in the memo.

Write to Liz Hoffman at liz.hoffman@wsj.com

(END) Dow Jones Newswires

April 23, 2019 17:54 ET (21:54 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

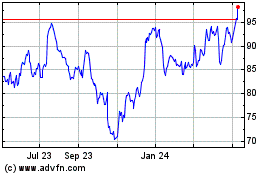

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Mar 2024 to Apr 2024

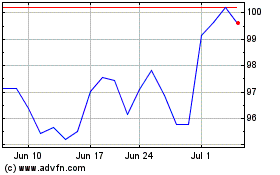

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Apr 2023 to Apr 2024