Big-Bank Chiefs, Democrats Spar at House Hearing

April 10 2019 - 5:27PM

Dow Jones News

By Andrew Ackerman and Lalita Clozel

WASHINGTON -- The heads of seven of the largest U.S. banks

sparred with House Democrats on Wednesday, arguing the financial

system is now much safer than during the last joint testimony a

decade ago in the depths of the crisis.

Bank chiefs including JPMorgan Chase & Co.'s James Dimon,

Citigroup Inc.'s Michael Corbat, Morgan Stanley's James Gorman and

Goldman Sachs Group Inc.'s David Solomon told lawmakers that their

firms were more tightly overseen and less risky, with some using

the opportunity to press for eased regulation. Lawmakers peppered

the executives with questions about possible new threats to the

financial system and pressed them on issues such as economic

inequality and guns.

"There's trillions of dollars locked up to hold liquidity, in

perpetuity, " Mr. Dimon said. "You can actually change the capital

in a way that makes the system safer" and spurs more lending, he

added. With the CEOs lined up alphabetically, Messrs. Corbat, Dimon

and Gorman were often called on first to answer questions during

around six hours of questioning.

House Financial Services Committee Chairwoman Maxine Waters (D.,

Calif.) showed little patience for the banks, saying they are

"simply too big to manage their own operations." She also

criticized a series of settlements between the banks and their

regulators, saying the firms were "chronic" lawbreakers and "too

big to care about the harm they have caused."

Some Republicans criticized Democrats for holding the hearing,

saying there was no clear purpose behind it other than to attack

the nation's biggest lenders. "This is a hearing in search of a

headline," said Rep. Patrick McHenry (R., N.C.), the ranking GOP

member on the panel.

Asked about potential risks to the financial system, some of the

executives pointed to leveraged lending, or banks' lending to

highly indebted companies. While corporate credit is large by

historical standards, Morgan Stanley's Mr. Gorman said, "I don't

think it's dangerous." Several financial regulators, including

Securities and Exchange Commission chief Jay Clayton, have raised

concerns about growth in leveraged loans.

Wednesday's hearing marks the first time since February 2009

that chief executives of the major banks have appeared together at

a congressional panel. The hearing is part of an opening salvo in

House Democrats' plans to examine the industry's activities, though

split control of Congress means it is unlikely to lead to any new

legislation becoming law.

In an echo of the 2009 hearing, several of the chief executives

skipped executive perks and traveled commercially to Washington.

Mr. Corbat flew commercially while Messrs. Solomon and Bank of

America's Brian Moynihan took Amtrak from New York.

Several Democrats sought to point to the CEOs as illustrations

of growing U.S. income inequality. Rep. Nydia Velazquez (D., N.Y.)

questioned Mr. Corbat over the ratio between his salary, $24

million in 2018, and the median pay of employees at his firm.

"Believe me, it doesn't look good," she said.

Mr. Corbat said if he were to work under a boss with a much

higher pay grade than his, "I would be hopeful that there's

opportunities to continue to advance within the firm."

The CEOs of the five big Wall Street Banks -- Goldman Sachs,

Citigroup, JPMorgan, Bank of America and Morgan Stanley -- w ere

paid a combined $126 million in 2017, hitting the highest level

since before the crisis. Tim Sloan, who resigned from his role as

head of Wells Fargo after appearing before the same panel in March,

was awarded $18.4 million in compensation for 2018.

Some of Ms. Waters's questioning fell flat, including whether

the lenders had uncovered accounts tied to illicit Russian

businesses. Most of the chief executives said their firms had no

such connections. Mr. Corbat said he couldn't comment on internal

investigations.

Democrats and Republicans pushed the CEOs to detail their

relationships with gun companies. In one exchange, Rep. Carolyn

Maloney (D., N.Y.) asked Mr. Dimon to adopt a policy on

"responsible business" with the gun industry, and the JPMorgan

chief said he would consider it.

Mr. Solomon said Goldman Sachs doesn't do business with

companies that manufacture assault weapons, bump stocks or

high-capacity magazines. Mr. Gorman said Morgan Stanley has

"restricted our activities" with retailers of automatic and

semiautomatic weapons. Both Citi and Bank of America announced last

year after the Parkland, Fla., high school shooting that they were

restricting ties to certain gun retailers and manufacturers.

Under questioning from Republicans, the executives said more

risks lie in parts of the financial sector that are not as tightly

regulated as banks, or "shadow banking."

The Federal Reserve and other financial regulators are

overseeing a gradual rollback of controls put in place after the

financial crisis in attempts to boost lending and the economy.

On Monday, the Fed moved to ease a rule requiring big banks to

plan for their own demise in a plan that would allow them to file

so-called living-will plans every four years rather than annually.

Regulators also have proposed simplifying compliance with the

Volcker rule, a Dodd-Frank provision that curbed risky trading by

banks.

Write to Andrew Ackerman at andrew.ackerman@wsj.com and Lalita

Clozel at lalita.clozel.@wsj.com

(END) Dow Jones Newswires

April 10, 2019 17:12 ET (21:12 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

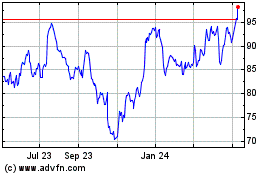

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Mar 2024 to Apr 2024

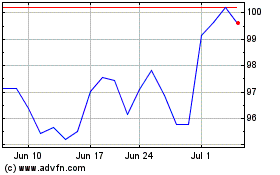

Morgan Stanley (NYSE:MS)

Historical Stock Chart

From Apr 2023 to Apr 2024