Moody’s to Acquire Class, Expanding Presence in Peru’s Domestic Credit Market

April 19 2022 - 8:00AM

Business Wire

Moody’s Corporation (NYSE:MCO) today announced that it has

agreed to acquire Class y Asociados S.A. Clasificadora de Riesgo

(S.A.) (Class), a leading credit rating agency serving Peru’s

domestic bond market. The acquisition will extend Moody’s growing

presence across Latin America and expand its Moody’s Local platform

while reaffirming its support for the growth of capital markets in

the region. Moody’s intends to integrate Class into Moody’s Local

Peru.

“Peru’s dynamic domestic capital market is a priority for

Moody’s as we continue to grow our presence across Latin America,”

said Renzo Barbieri O’Hara, General Manager of Moody’s Local Peru.

“With Class, we are excited by the opportunity to deepen our

analytical capabilities to help further develop the Peruvian

capital markets.”

Based in Lima, Class covers Peruvian corporates, municipalities,

banks, insurance companies, and other financial institutions. Its

team of analysts draws on years of experience working in Peru’s

capital markets to provide market participants with valuable

insights on credit risk.

Prior to the merger, Class will maintain separate operations,

analytical staff, and credit rating processes. Once the integration

is complete, Class’s ratings portfolio and its team of rating

analysts will become part of Moody’s Local Peru.

Moody’s Local is a domestic credit ratings platform launched in

2019 to provide ratings and research to capital markets across

Latin America. The platform combines tailored methodologies with

experienced teams of local analysts to provide valuable insight. In

addition to Peru, Moody’s Local operates in Argentina, Bolivia,

Brazil, Panama, and Uruguay. For more information, visit

https://www.moodyslocal.com.

The acquisition was approved by the Peruvian Superintendence of

the Securities Market (Supertintendencia del Mercado de Valores -

SMV). The acquisition will be funded with cash on hand and is not

expected to have a material impact on Moody’s 2022 financial

results.

ABOUT MOODY’S

CORPORATION

Moody’s (NYSE: MCO) is a global integrated risk assessment firm

that empowers organizations to make better decisions. Its data,

analytical solutions, and insights help decision-makers identify

opportunities and manage the risks of doing business with others.

We believe that greater transparency, more informed decisions, and

fair access to information open the door to shared progress. With

over 13,000 employees in more than 40 countries, Moody’s combines

international presence with local expertise and over a century of

experience in financial markets. Learn more at

moodys.com/about.

“SAFE HARBOR” STATEMENT UNDER THE

PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

Certain statements contained in this document are

forward-looking statements and are based on future expectations,

plans and prospects for Moody’s business and operations that

involve a number of risks and uncertainties. The forward-looking

statements in this document are made as of the date hereof, and

Moody’s disclaims any duty to supplement, update or revise such

statements on a going-forward basis, whether as a result of

subsequent developments, changed expectations or otherwise. In

connection with the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, Moody’s is identifying

certain factors that could cause actual results to differ, perhaps

materially, from those indicated by these forward-looking

statements. Those factors, risks and uncertainties include, but are

not limited to the global impact of the crisis in Ukraine on

volatility in the U.S. and world financial markets, on general

economic conditions and GDP in the U.S. and worldwide, and its

potential for further worldwide credit market disruptions and

economic slowdowns; the impact of COVID-19 on world financial

markets, on general economic conditions and on Moody’s own

operations and personnel; future worldwide credit market

disruptions or economic slowdowns, which could affect the volume of

debt and other securities issued in domestic and/or global capital

markets; other matters that could affect the volume of debt and

other securities issued in domestic and/or global capital markets,

including regulation, credit quality concerns, changes in interest

rates, inflation and other volatility in the financial markets such

as that due to Brexit and uncertainty as companies transition away

from LIBOR; the level of merger and acquisition activity in the

U.S. and abroad; the uncertain effectiveness and possible

collateral consequences of U.S. and foreign government actions

affecting credit markets, international trade and economic policy,

including those related to tariffs, tax agreements and trade

barriers; concerns in the marketplace affecting our credibility or

otherwise affecting market perceptions of the integrity or utility

of independent credit agency ratings; the introduction of competing

products or technologies by other companies; pricing pressure from

competitors and/or customers; the level of success of new product

development and global expansion; the impact of regulation as an

NRSRO, the potential for new U.S., state and local legislation and

regulations; the potential for increased competition and regulation

in the EU and other foreign jurisdictions; exposure to litigation

related to our rating opinions, as well as any other litigation,

government and regulatory proceedings, investigations and inquiries

to which Moody’s may be subject from time to time; provisions in

U.S. legislation modifying the pleading standards and EU

regulations modifying the liability standards, applicable to credit

rating agencies in a manner adverse to credit rating agencies;

provisions of EU regulations imposing additional procedural and

substantive requirements on the pricing of services and the

expansion of supervisory remit to include non-EU ratings used for

regulatory purposes; the possible loss of key employees; failures

or malfunctions of our operations and infrastructure; any

vulnerabilities to cyber threats or other cybersecurity concerns;

the outcome of any review by controlling tax authorities of Moody’s

global tax planning initiatives; exposure to potential criminal

sanctions or civil remedies if Moody’s fails to comply with foreign

and U.S. laws and regulations that are applicable in the

jurisdictions in which Moody’s operates, including data protection

and privacy laws, sanctions laws, anti-corruption laws, and local

laws prohibiting corrupt payments to government officials; the

impact of mergers, acquisitions, such as our acquisition of RMS, or

other business combinations and the ability of Moody’s to

successfully integrate acquired businesses; currency and foreign

exchange volatility; the level of future cash flows; the levels of

capital investments; and a decline in the demand for credit risk

management tools by financial institutions. These factors, risks

and uncertainties as well as other risks and uncertainties that

could cause Moody’s actual results to differ materially from those

contemplated, expressed, projected, anticipated or implied in the

forward-looking statements are described in greater detail under

“Risk Factors” in Part I, Item 1A of Moody’s annual report on Form

10-K for the year ended December 31, 2021, and in other filings

made by Moody’s from time to time with the SEC or in materials

incorporated herein or therein. Stockholders and investors are

cautioned that the occurrence of any of these factors, risks and

uncertainties may cause Moody’s actual results to differ materially

from those contemplated, expressed, projected, anticipated or

implied in the forward-looking statements, which could have a

material and adverse effect on Moody’s business, results of

operations and financial condition. New factors may emerge from

time to time, and it is not possible for Moody’s to predict new

factors, nor can Moody’s assess the potential effect of any new

factors on it..

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220418005581/en/

For Moody’s: SHIVANI KAK Investor Relations +1

212-553-0298 Shivani.kak@moodys.com

OR

JOE MIELENHAUSEN Communications +1 212-553-1461

joe.mielenhausen@moodys.com

OR

EDUARDO BARKER Communications (Latin America) +1 212-553-7717

Eduardo.Barker@moodys.com

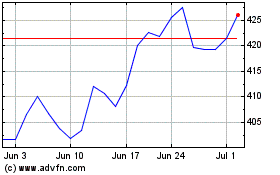

Moodys (NYSE:MCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Moodys (NYSE:MCO)

Historical Stock Chart

From Apr 2023 to Apr 2024