Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

February 08 2021 - 3:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed

by the Registrant ☐ Filed by a Party other than the Registrant ☒

Check the appropriate box:

|

|

☐

|

Preliminary

Proxy Statement

|

|

|

☐

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

☐

|

Definitive

Proxy Statement

|

|

|

☐

|

Definitive

Additional Materials

|

|

|

☒

|

Soliciting

Material under §240.14a-12

|

Monmouth Real Estate Investment Corporation

(Name of Registrant as Specified In Its

Charter)

Blackwells Capital LLC

Jason Aintabi

Craig M. Hatkoff

Jennifer M. Hill

Todd S. Schuster

Allison Nagelberg

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

☐

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

☐

|

Fee

paid previously with preliminary materials.

|

|

|

☐

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its

filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Blackwells Capital LLC, together with the

other participants named herein, intends to file a preliminary proxy statement and accompanying proxy card with the Securities

and Exchange Commission to be used to solicit votes for the election of its slate of highly-qualified director candidates at the

2021 annual meeting of stockholders (including any other meeting of stockholders held in lieu thereof, and adjournments, postponements,

reschedulings or continuations thereof, the “Annual Meeting”) of Monmouth Real Estate Investment Corporation, a Maryland

corporation, and for the approval of six business proposals to be presented at the Annual Meeting.

On February 5, 2021, Blackwells Capital

LLC sent the following email to Jonathan Litt, the managing principal of Land and Buildings Investment Management, LLC:

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

BLACKWELLS CAPITAL LLC (“BLACKWELLS”) STRONGLY ADVISES

ALL SHAREHOLDERS OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT HTTP://WWW.SEC.GOV.

IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE,

UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO BLACKWELLS.

The participants in the proxy solicitation are Blackwells, Jason

Aintabi, Craig M. Hatkoff, Jennifer M. Hill, Allison Nagelberg, and Todd Schuster (collectively, the “Participants”).

As of the close of business on February 5, 2021, Blackwells

beneficially owns 150,100 shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”),

including 75,000 shares of Common Stock underlying call options exercisable within sixty (60) days of the close of business on

February 5, 2021. Additionally, Blackwells beneficially owns options that provide the holder the right to sell an underlying 25,000

shares of Common Stock which are exercisable within sixty (60) days of the close of business on February 5, 2021. As of the close

of business on February 5, 2021, Mr. Aintabi beneficially owns 3,545,134 shares of Common Stock, including (i) 150,100 shares of

Common Stock owned by Blackwells, of which Mr. Aintabi may be deemed the beneficial owner, as Managing Partner of Blackwells, (ii)

3,370,034 shares of Common Stock beneficially owned by BW Coinvest Management I LLC, which Mr. Aintabi, as the owner and President

& Secretary of Blackwells Asset Management LLC, the owner and sole member of BW Coinvest Management I LLC, may be deemed to

beneficially own and (iii) 25,000 shares of Common Stock underlying call options exercisable within sixty (60) days of the close

of business on February 5, 2021. Additionally, Mr. Aintabi may be deemed to beneficially own options that provide the holder the

right to sell an underlying 75,000 shares of Common Stock which are exercisable within sixty (60) days of the close of business

on February 5, 2021. As of the close of business on February 5, 2021, Ms. Nagelberg is the beneficial owner of 64,089.5767 shares

of Common Stock, and Mr. Schuster is the beneficial owner of 102,248 shares of Common Stock. Neither Ms. Hill nor Mr. Hatkoff owns

any shares of Common Stock as of the close of business on February 5, 2021. Collectively, the Participants beneficially own in

the aggregate approximately 3,711,471.5767 shares of Common Stock, including (i) 100,000 shares of Common Stock underlying call

options exercisable within sixty (60) days of the close of business on February 5, 2021, representing approximately 3.78% of the

outstanding shares of Common Stock.

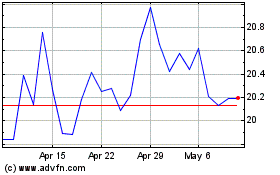

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

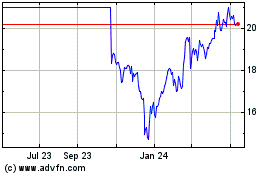

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Apr 2023 to Apr 2024