MONMOUTH REAL ESTATE ANNOUNCES TAX TREATMENT FOR 2020 DISTRIBUTIONS

January 26 2021 - 4:15PM

Monmouth Real Estate Investment Corporation (NYSE:MNR) today

announced the tax treatment of its 2020 distributions. The

following tables summarize, for income tax purposes, the nature of

cash distributions paid to stockholders of Monmouth’s common and

preferred shares during the calendar year ended December 31, 2020.

Common - CUSIP 609720107

|

Shown as Dollars ($) |

|

|

Payment Date |

Distributions Paid Per Share |

Non-Qualifying Ord. Income (1a) |

Total Long-Term Capital Gain (2a) |

Unrecap Sec 1250 Gain(2b) |

Return of Capital (3) |

Section 199A Dividends (5) |

|

3/16/2020 |

$0.170000 |

$0.061898 |

$0.000000 |

$0.000000 |

$0.108102 |

$0.061898 |

|

6/15/2020 |

$0.170000 |

$0.061898 |

$0.000000 |

$0.000000 |

$0.108102 |

$0.061898 |

|

9/15/2020 |

$0.170000 |

$0.061898 |

$0.000000 |

$0.000000 |

$0.108102 |

$0.061898 |

|

12/15/2020 |

$0.170000 |

$0.061898 |

$0.000000 |

$0.000000 |

$0.108102 |

$0.061898 |

|

TOTAL |

$0.680000 |

$0.247592 |

$0.000000 |

$0.000000 |

$0.432408 |

$0.247592 |

|

Shown as a Percentage (%) |

|

|

Payment Date |

Distributions Paid Per Share |

Non-Qualifying Ord. Income (1a) |

Total Long-Term Capital Gain (2a) |

Unrecap Sec 1250 Gain(2b) |

Return of Capital (3) |

Section 199A Dividends (5) |

|

3/16/2020 |

$0.170000 |

36.410671% |

0.000000% |

0.000000% |

63.589329% |

36.410671% |

|

6/15/2020 |

$0.170000 |

36.410671% |

0.000000% |

0.000000% |

63.589329% |

36.410671% |

|

9/15/2020 |

$0.170000 |

36.410671% |

0.000000% |

0.000000% |

63.589329% |

36.410671% |

|

12/15/2020 |

$0.170000 |

36.410671% |

0.000000% |

0.000000% |

63.589329% |

36.410671% |

|

TOTAL |

$0.680000 |

36.410671% |

0.000000% |

0.000000% |

63.589329% |

36.410671% |

6.125% Series C Cumulative Redeemable

Preferred - CUSIP 609720404

|

Shown as Dollars ($) |

|

|

Payment Date |

Distributions Paid Per Share |

Non-Qualifying Ord. Income (1a) |

Total Long-Term Capital Gain (2a) |

Unrecap Sec 1250 Gain(2b) |

Return of Capital (3) |

Section 199A Dividends (5) |

|

3/16/2020 |

$0.382813 |

$0.382813 |

$0.000000 |

$0.000000 |

$0.000000 |

$0.382813 |

|

6/15/2020 |

$0.382813 |

$0.382813 |

$0.000000 |

$0.000000 |

$0.000000 |

$0.382813 |

|

9/15/2020 |

$0.382813 |

$0.382813 |

$0.000000 |

$0.000000 |

$0.000000 |

$0.382813 |

|

12/15/2020 |

$0.382813 |

$0.382813 |

$0.000000 |

$0.000000 |

$0.000000 |

$0.382813 |

|

TOTAL |

$1.531252 |

$1.531252 |

$0.000000 |

$0.000000 |

$0.000000 |

$1.531252 |

|

Shown as a Percentage (%) |

|

|

Payment Date |

Distributions Paid Per Share |

Non-Qualifying Ord. Income (1a) |

Total Long-Term Capital Gain (2a) |

Unrecap Sec 1250 Gain(2b) |

Return of Capital (3) |

Section 199A Dividends (5) |

|

3/16/2020 |

$0.382813 |

100.000000% |

0.000000% |

0.000000% |

0.000000% |

100.000000% |

|

6/15/2020 |

$0.382813 |

100.000000% |

0.000000% |

0.000000% |

0.000000% |

100.000000% |

|

9/15/2020 |

$0.382813 |

100.000000% |

0.000000% |

0.000000% |

0.000000% |

100.000000% |

|

12/15/2020 |

$0.382813 |

100.000000% |

0.000000% |

0.000000% |

0.000000% |

100.000000% |

|

TOTAL |

$1.531252 |

100.000000% |

0.000000% |

0.000000% |

0.000000% |

100.000000% |

NOTE: Unrecaptured Section 1250 Gain (Box

2b) is a subset of, and is included in, the Total Capital Gain

Distributions reported in Box 2a.Section 199A Dividends (Box 5) is

a subset of, and is included in, the Total Ordinary Dividends

reported in Box 1a.

DIVIDEND REINVESTMENT PLAN

DISCOUNTS - Common – CUSIP 609720107

|

Payment Date |

Fair Market Value |

Discount Price |

Discount on D/R |

|

1/15/2020 |

$ 14.57 |

$ 13.84 |

$ 0.73 |

|

2/18/2020 |

$ 14.97 |

$ 14.25 |

$ 0.72 |

|

3/16/2020 |

$ 11.20 |

$ 11.20 |

$ 0.00 |

|

4/15/2020 |

$ 12.22 |

$ 11.81 |

$ 0.41 |

|

5/15/2020 |

$ 11.48 |

$ 11.12 |

$ 0.36 |

|

6/15/2020 |

$ 13.73 |

$ 13.04 |

$ 0.69 |

|

7/15/2020 |

$ 14.20 |

$ 13.49 |

$ 0.71 |

|

8/17/2020 |

$ 14.60 |

$ 14.08 |

$ 0.52 |

|

9/15/2020 |

$ 14.33 |

$ 13.62 |

$ 0.71 |

|

10/15/2020 |

$ 14.34 |

$ 13.70 |

$ 0.64 |

|

11/16/2020 |

$ 14.78 |

$ 14.04 |

$ 0.74 |

|

12/15/2020 |

$ 16.50 |

$ 15.68 |

$ 0.82 |

Shareholders are encouraged to consult with

their tax advisors as to the specific tax treatment of the

distributions they received from the Company.

Monmouth Real Estate Investment Corporation,

founded in 1968, is one of the oldest public equity REITs in the

world. The Company specializes in single tenant, net-leased

industrial properties, subject to long-term leases, primarily to

investment-grade tenants. Monmouth Real Estate Investment

Corporation is a fully integrated and self-managed real estate

company, whose property portfolio consists of 121 properties

containing a total of approximately 24.5 million rentable square

feet, geographically diversified across 31 states. The Company’s

occupancy rate as of this date is 99.7%.

Contact: Becky

Coleridge732-577-9996

#####

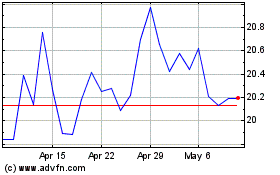

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

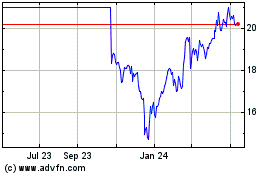

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Apr 2023 to Apr 2024