By Saabira Chaudhuri

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 4, 2019).

Falling alcohol consumption is often attributed to

health-conscious millennials. But some of the fastest-growing

alcoholic drinks in America are "alcopops," or strong, sugary

alcoholic sodas, aimed at younger drinkers.

To tap the trend, Guinness maker Diageo PLC last year launched

Smirnoff Ice Smash, a fruit-flavored, 8% alcohol-by-volume version

of its longstanding lower-alcohol Smirnoff Ice alcopop. Sales of

Smash have grown 400% over the past six months, according to the

company. The canned drink is Diageo's most successful product

launch in U.S. convenience stores, despite the shift toward

healthier drinks.

"We debate this ourselves on a daily basis," said Nuno Teles,

Diageo's head of U.S. beer, reflecting on the popularity of Smash

beverages at a time when Americans are increasingly reaching for

healthy options. "We see two different consumers."

Miller Lite owner Molson Coors Brewing Co. in January launched a

sixth flavor of its 8% alcohol-content Steel Reserve Alloy alcopop

called "Spiked Tropic Storm" after taste tests showed it appealed

to 21-to-27-year-old consumers. It said that sales of the brand are

up 11% so far this year and that its data indicates millennials of

both genders are driving Steel Reserve Alloy sales growth. The

brewer also sells 24-ounce cans of its Redd's Wicked alcopop at gas

stations, pharmacies and delis. A new seasonal flavor, sour apple,

sold so well that the company recently turned it into a full-time

offering.

Sales of alcopops with 6% or higher alcohol content grew 4.7% to

$1.14 billion last year in grocery, convenience and liquor stores,

according to research firm Nielsen. That compares with a decline of

3.6% for similar alcopops under 6% ABV and a 0.2% drop in beer

sales. Wine sales climbed 2.1% and spirits 3.1%.

The alcopop figures include traditional flavored malt beverages

like Smirnoff Ice, as well as hard sodas, teas and coffees, but

exclude spiked seltzers. Alcopops generally contain less booze than

wine and spirits, but have levels comparable to or higher than most

beers. While exact numbers aren't available, industry executives

and analysts say that millennial-age drinkers are among the largest

buyers of alcopops.

"Health and wellness is not a trend for all consumers," said

Anheuser-Busch InBev SA Chief Executive Carlos Brito in an

interview. "For some, when they go to some occasions, they want

higher [alcohol] products, they don't care about the calories."

The Budweiser brewer in January rolled out Ritas Spritz, a

series of canned, sparkling margarita and sangria drinks containing

6% alcohol in flavors like cherry lime and strawberry blueberry. It

also sells a higher-alcohol line of flavored Ritas alcopops in

regular and large cans.

Made from a base of malt that is flavored to resemble a premixed

cocktail, alcopops are attracting drinkers seeking strong flavors.

Widely found in 7-Eleven and similar chains, they offer a

relatively cheap and convenient option for drinkers seeking a buzz.

The drinks are generally taxed like beer -- less than spirits or

wine -- despite often being stronger and containing spirits.

Alcopops, which exploded in popularity in the 1990s, have grown

at 2.5% a year from 1990 to 2018 in the U.S., according to industry

tracker IWSR. It says the category has doubled in size over that

time, from 45 million nine-liter cases to over 90 million

nine-liter cases.

These sugary, flavored drinks have drawn fire for targeting

young people, who are often attracted by their resemblance to soft

drinks. Companies say they seek to appeal to legal-age drinkers,

although they acknowledge the demographic for these ready-to-drink

beverages skews young.

Smirnoff Ice Smash reminds Mary Cochran of a pink Popsicle.

"It's pretty decent," said the 26-year-old from Charlotte, N.C.,

who posts video reviews of drinks in her free time. "But I still

feel like it's just so full of sugar that it can't be a good

decision."

AB InBev's Natty Rush brand is aimed at young drinkers who don't

have lots of disposable income and haven't taken to beer, says

Chelsea Phillips, vice president of marketing for AB InBev's

"Beyond Beer" unit. The drink, which has an alcohol content of 8%,

is sold in flavors including "Watermelon Smash" and "Hurricane

Punch."

The growing popularity of alcopops is a boon for brewers, who

typically include the drinks in their beer-volume figures, helping

offset slowing demand for some of their biggest lager brands and

lure back consumers defecting to wine and spirits.

Executives say sugary alcopops aren't being hurt by the

popularity of so-called spiked seltzers. This smaller, newer

category of drinks, which includes brands like White Claw and

Smirnoff Seltzer, is aimed at more health-conscious consumers.

Sales of spiked seltzers -- which typically contain less alcohol

than traditional alcopops -- are sugar-free and have fewer

calories, soared 169% last year to $488 million, according to

Nielsen.

High-calorie alcopops and spiked seltzers are often drunk by the

same consumers, just on different occasions, said Ms. Phillips. She

reflected on this seeming inconsistency in her own life, saying she

eats a lot more salad now but still keeps cookie dough in the

fridge for when she wants to indulge.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

April 04, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

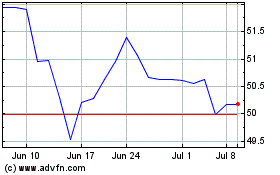

Molson Coors Beverage (NYSE:TAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

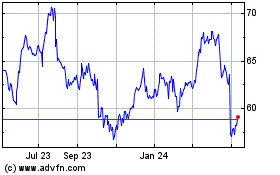

Molson Coors Beverage (NYSE:TAP)

Historical Stock Chart

From Apr 2023 to Apr 2024